South Korean Won (KRW) Vs. US Dollar (USD): The Fallout From Trump's Remarks

Table of Contents

Trump's Remarks and Their Immediate Impact on the KRW/USD Exchange Rate

Specific comments made by Donald Trump regarding trade with South Korea, often criticizing trade imbalances, directly impacted the KRW/USD exchange rate. For instance, his tweets or public statements expressing dissatisfaction with the trade deal often triggered immediate market reactions. These reactions were often characterized by increased volatility and a weakening of the South Korean Won against the US Dollar.

- Mechanism: The immediate impact stemmed from shifts in investor sentiment and speculation. Negative remarks often led to a sell-off of the Won, as investors anticipated potential negative economic consequences for South Korea.

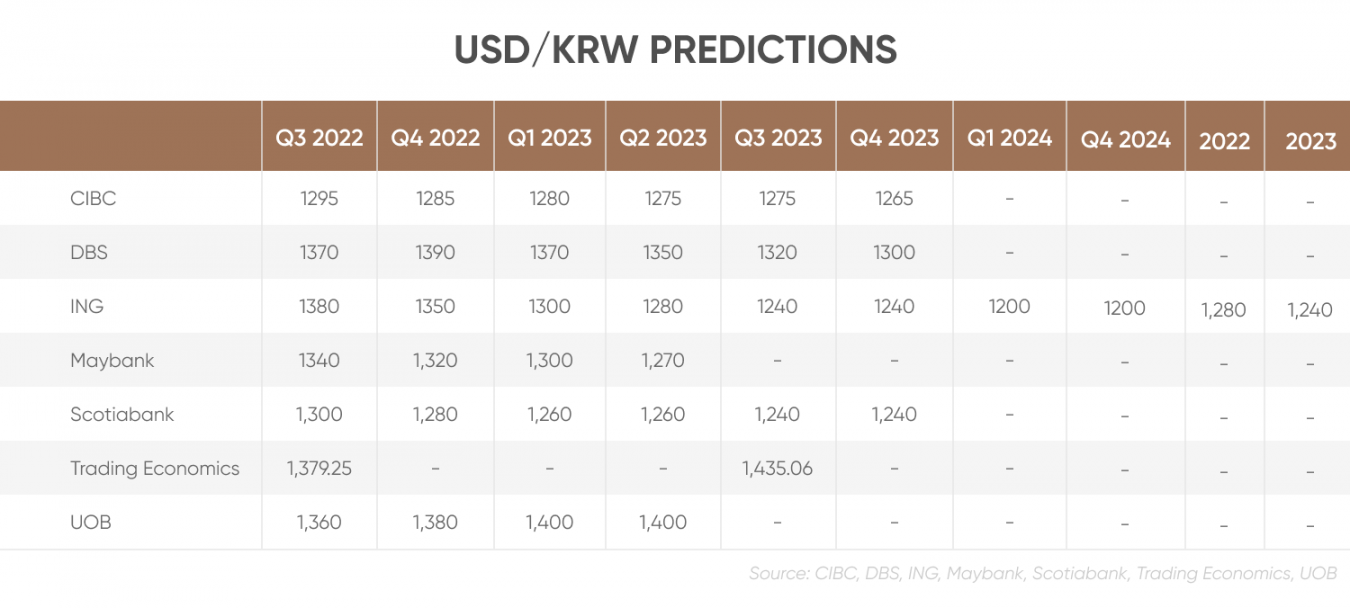

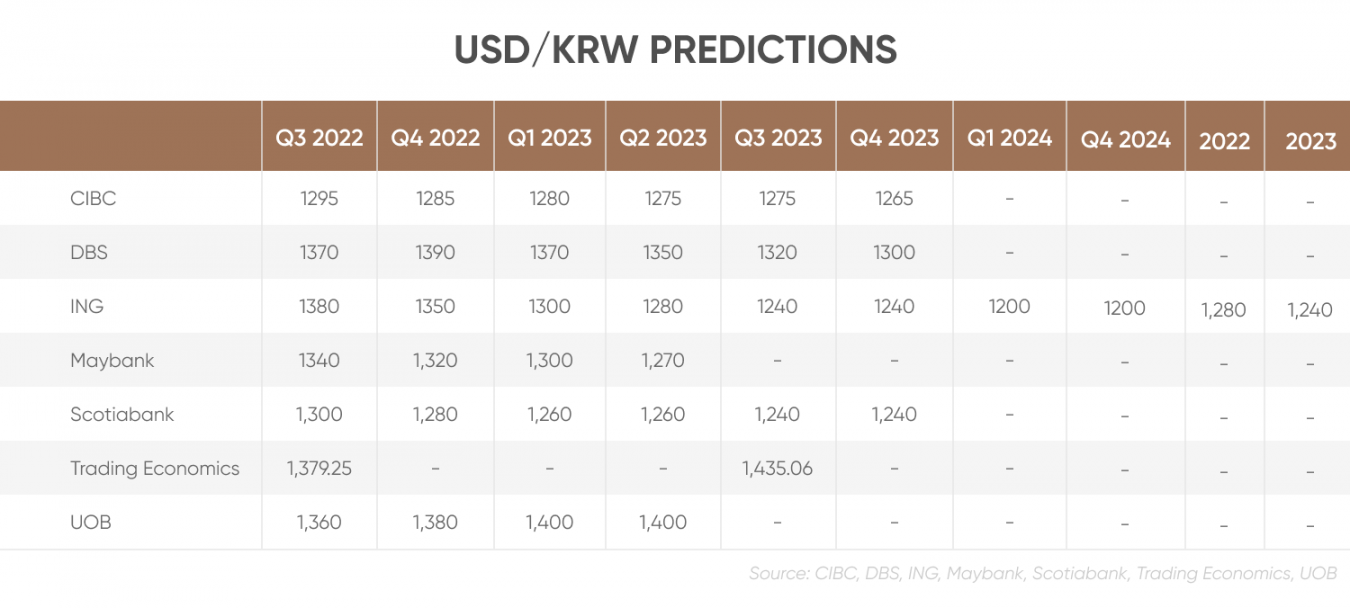

- Market Reaction: [Insert chart or graph showing KRW/USD exchange rate fluctuations around the time of specific Trump remarks]. The chart should visually demonstrate the immediate depreciation of the KRW following such statements.

- Specific Examples: For example, [mention a specific date and time of a Trump statement] led to a [percentage]% drop in the KRW/USD exchange rate within [timeframe]. Similarly, [mention another instance with date and time] saw a [percentage]% fluctuation.

The speed and magnitude of these reactions highlight the significant influence of political rhetoric on currency markets. Understanding these mechanisms is crucial for navigating KRW/USD volatility.

Long-Term Implications of Trump's Statements on the KRW/USD

While the immediate impact was dramatic, Trump's statements also had potential long-term effects on the KRW/USD relationship.

- Trade Relations: His comments fueled uncertainty about the future of US-South Korea trade relations, potentially impacting export-oriented South Korean businesses reliant on the US market.

- Foreign Investment: Negative sentiment could deter foreign investment in South Korea, hindering economic growth and putting downward pressure on the Won.

- Economic Growth: The uncertainty surrounding trade and investment could negatively impact South Korea's overall economic growth, further weakening the KRW relative to the USD.

- Expert Opinions: [Include quotes or summaries of expert opinions on the long-term effects of Trump's statements on the KRW/USD exchange rate and the South Korean economy]. This adds credibility and depth to the analysis.

Factors Beyond Trump's Remarks Affecting the KRW/USD Exchange Rate

While Trump's pronouncements played a role, other factors influenced the KRW/USD exchange rate.

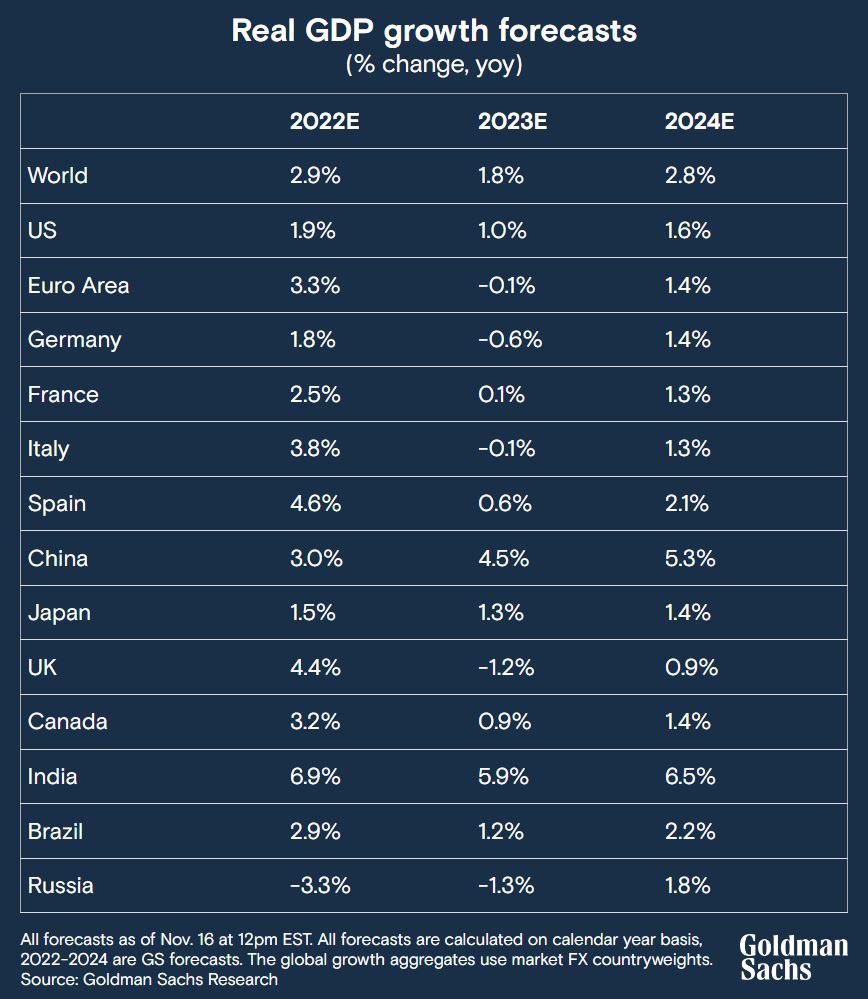

- Global Economic Conditions: Global interest rate changes, inflation rates in both countries, and overall global economic growth all impact the relative value of both currencies.

- Geopolitical Factors: Tensions on the Korean peninsula and broader geopolitical events impacted investor sentiment towards the Won.

- Domestic Economic Policies: Monetary policy decisions by the Bank of Korea and the Federal Reserve, as well as fiscal policies in both countries, influenced the KRW/USD exchange rate.

- Market Speculation: Purely speculative trading and investor behavior, unrelated to Trump's remarks, also played a role in the fluctuations.

Strategies for Navigating KRW/USD Volatility

Navigating the volatility requires proactive strategies:

- Businesses: Hedging strategies, such as forward contracts or options, can help mitigate exchange rate risk for businesses engaged in international trade involving the KRW and USD.

- Investors: Diversifying investments across different asset classes and currencies can reduce overall portfolio risk exposure to KRW/USD fluctuations.

- Individuals: Monitoring the exchange rate and adjusting personal financial plans accordingly is essential for those with financial dealings in both currencies. Consider using currency exchange services that offer competitive rates and transparency.

- Resources: Staying informed through reputable financial news sources and utilizing currency conversion tools are crucial.

Conclusion: Understanding the KRW/USD Relationship in the Post-Trump Era

Donald Trump's remarks created significant volatility in the South Korean Won (KRW) vs. US Dollar (USD) exchange rate, with both immediate and long-term consequences. However, understanding the interplay of multiple factors – including global economic conditions, geopolitical events, and domestic policies – is vital for navigating this complex relationship. The KRW/USD exchange rate is not solely determined by political rhetoric; it's a reflection of broader economic and geopolitical forces. To make informed decisions regarding your finances, it's crucial to stay informed about the KRW/USD exchange rate and utilize the resources mentioned. Further research into currency exchange and risk management strategies is recommended. Understanding the dynamics of the South Korean Won (KRW) versus US Dollar (USD) exchange rate remains crucial in today's interconnected global economy.

Featured Posts

-

Elon Musks Self Driving Taxi Ambitions Progress And Setbacks

Apr 25, 2025

Elon Musks Self Driving Taxi Ambitions Progress And Setbacks

Apr 25, 2025 -

Arsenal Eye Bundesliga Duo Journalist Provides Key Update

Apr 25, 2025

Arsenal Eye Bundesliga Duo Journalist Provides Key Update

Apr 25, 2025 -

Landlord Price Gouging Allegations Surface After La Fires Selling Sunsets Take

Apr 25, 2025

Landlord Price Gouging Allegations Surface After La Fires Selling Sunsets Take

Apr 25, 2025 -

Australias Next Government Goldman Sachs Fiscal Policy Outlook

Apr 25, 2025

Australias Next Government Goldman Sachs Fiscal Policy Outlook

Apr 25, 2025 -

The China Factor Automotive Brands Facing Headwinds In The Chinese Market

Apr 25, 2025

The China Factor Automotive Brands Facing Headwinds In The Chinese Market

Apr 25, 2025