Australia's Next Government: Goldman Sachs' Fiscal Policy Outlook

Table of Contents

Goldman Sachs' Predictions Under a Coalition Government

Projected Spending and Revenue

Goldman Sachs' projections for a Coalition government suggest a focus on fiscal responsibility and targeted spending. Their forecast includes:

- Healthcare: Increased funding for aged care and targeted improvements to the public hospital system, but potentially slower growth in overall health spending compared to Labor's proposals.

- Education: Continued investment in school infrastructure and targeted programs, with a potential emphasis on vocational training and skills development. Funding increases may be more modest than under a Labor government.

- Infrastructure: Significant investment in infrastructure projects, particularly in transport and digital connectivity, aiming to stimulate economic growth. Specific project allocations and funding levels would need to be detailed in the Coalition's formal budget.

- Taxation: Potential for targeted tax cuts for middle-income earners and businesses, potentially offset by adjustments to other tax measures to maintain fiscal balance. Revenue is projected to increase moderately based on economic growth forecasts.

Goldman Sachs predicts a budget surplus within a specific timeframe, though the exact figures depend on economic conditions and the specifics of the Coalition’s policy implementation. This surplus, if realized, could lead to positive economic impacts, such as increased investor confidence and reduced government borrowing costs. However, potential risks include reliance on strong economic growth and the successful implementation of complex policy initiatives.

Key Policy Initiatives and Their Fiscal Implications

Goldman Sachs identifies several key Coalition policies and their fiscal ramifications:

- Tax cuts: The projected fiscal impact of tax cuts depends on the specific details. Targeted tax cuts for middle-income earners would stimulate consumption, but larger cuts could impact government revenue significantly.

- Infrastructure projects: Major infrastructure projects will create jobs and boost economic activity in the short term. However, the long-term fiscal impact depends on project success, efficiency and cost overruns.

- Regulatory reforms: Streamlining regulations may boost business investment and employment, leading to increased tax revenue. However, the precise effect is difficult to quantify precisely.

The uncertainties associated with the Coalition's fiscal plan involve the precise details of their policies and potential unforeseen economic shocks. Goldman Sachs emphasizes the need to closely monitor the global economic climate and commodity prices, given their impact on Australia's budget.

Goldman Sachs' Predictions Under a Labor Government

Projected Spending and Revenue

Goldman Sachs' forecast for a Labor government indicates a greater focus on social welfare and climate change initiatives. This translates into:

- Healthcare: Significant increases in funding for public hospitals, aged care, and Medicare, potentially leading to improved health outcomes but also increased government spending.

- Education: Substantial investment in public education, including early childhood education and higher education. This could improve human capital but also increase government expenditure significantly.

- Climate Change: Large investments in renewable energy infrastructure and climate change mitigation programs, while potentially beneficial for the environment, present considerable budgetary challenges.

- Taxation: Potential for increased taxes on higher-income earners and corporations to fund increased government spending programs. This could slow economic growth if not carefully managed.

Goldman Sachs projects a smaller budget surplus (or possibly a deficit) compared to the Coalition scenario. The potential economic consequences could include higher inflation and increased government debt, though the magnitude would depend on various factors.

Key Policy Initiatives and Their Fiscal Implications

Labor's policy initiatives, as analyzed by Goldman Sachs, have substantial fiscal implications:

- Climate change policies: Investments in renewable energy and emissions reduction programs are costly but could provide long-term economic benefits such as new jobs in green industries.

- Social welfare programs: Expanding social welfare programs may reduce inequality and improve social outcomes, but this increases government spending and may affect economic growth.

- Wage increases for public sector workers: Raising wages for public sector workers would boost consumer spending, but potentially increase the wage bill for the government.

The risks and uncertainties associated with Labor's fiscal plan largely stem from the significant increase in government spending and potential revenue shortfalls. Careful economic management and accurate revenue forecasting will be crucial to mitigating risks.

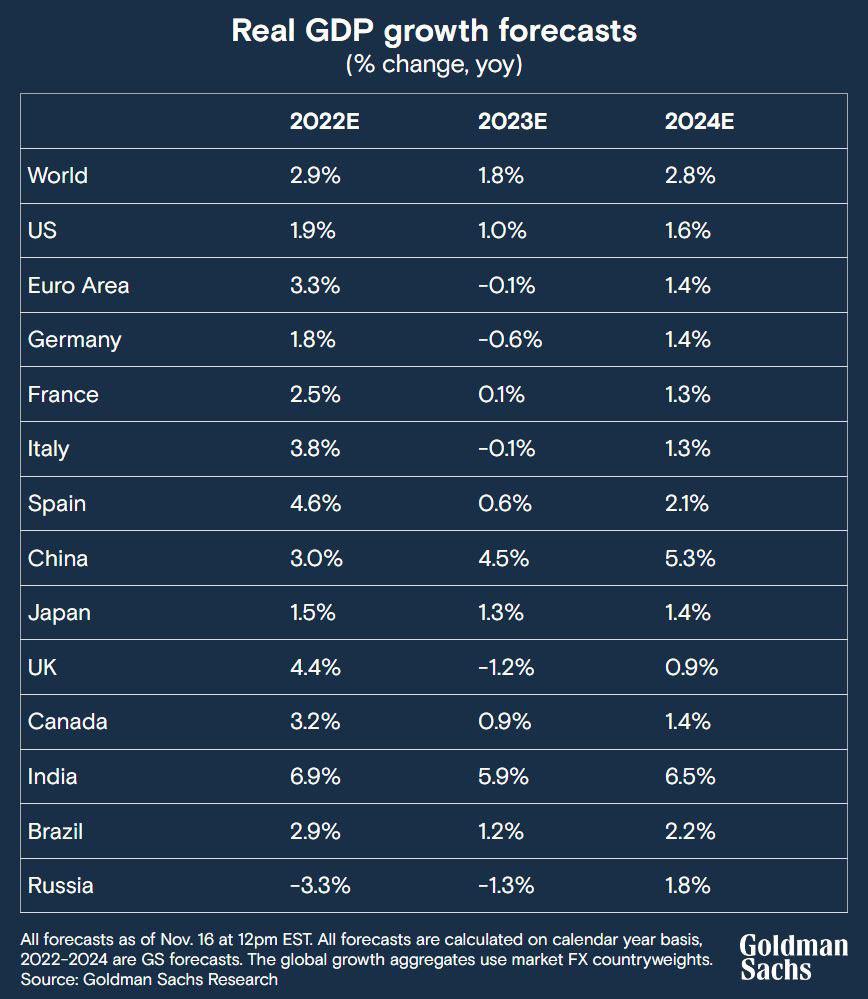

Comparison and Analysis of Both Scenarios

Goldman Sachs' analysis highlights key differences between the Coalition and Labor approaches: the Coalition prioritizes fiscal conservatism and targeted spending, while Labor focuses on increased social spending and addressing climate change. Both scenarios, however, acknowledge the importance of infrastructure investment. The long-term impacts depend significantly on economic growth, global conditions, and the success of policy implementation. Goldman Sachs considers global economic conditions and commodity prices as major external factors influencing both scenarios.

Implications for Investors and the Australian Economy

Goldman Sachs' projections have significant implications for investors and the broader Australian economy:

- Bond yields: Higher government debt under a Labor government could lead to higher bond yields.

- Equity markets: Increased government spending could positively affect certain sectors, while others might be negatively impacted by tax changes.

- Real estate: Infrastructure spending could boost the construction sector and property values, while increased interest rates could impact the market.

- Consumer confidence: Different fiscal policies would impact consumer confidence and spending patterns.

- Unemployment and wage growth: The impact on unemployment and wage growth depends on the effectiveness of each government's economic policies.

Understanding Australia's next government fiscal policy is critical for making informed investment decisions and navigating the evolving economic landscape.

Conclusion

Goldman Sachs' outlook on Australia's next government's fiscal policy provides crucial insights into potential economic trajectories under different leadership. Understanding the projected spending, revenue streams, and policy implications of both the Coalition and Labor parties is essential for informed decision-making by investors, businesses, and citizens alike. By analyzing these differing fiscal policy approaches, we can better prepare for the economic landscape shaped by Australia's next government. To stay abreast of the evolving fiscal policy debate and its ramifications, continue to monitor expert analyses like Goldman Sachs’ Australia's next government fiscal policy reports.

Featured Posts

-

Reviewing The Nintendo Switch 2 Preorder Experience A Critical Look

Apr 25, 2025

Reviewing The Nintendo Switch 2 Preorder Experience A Critical Look

Apr 25, 2025 -

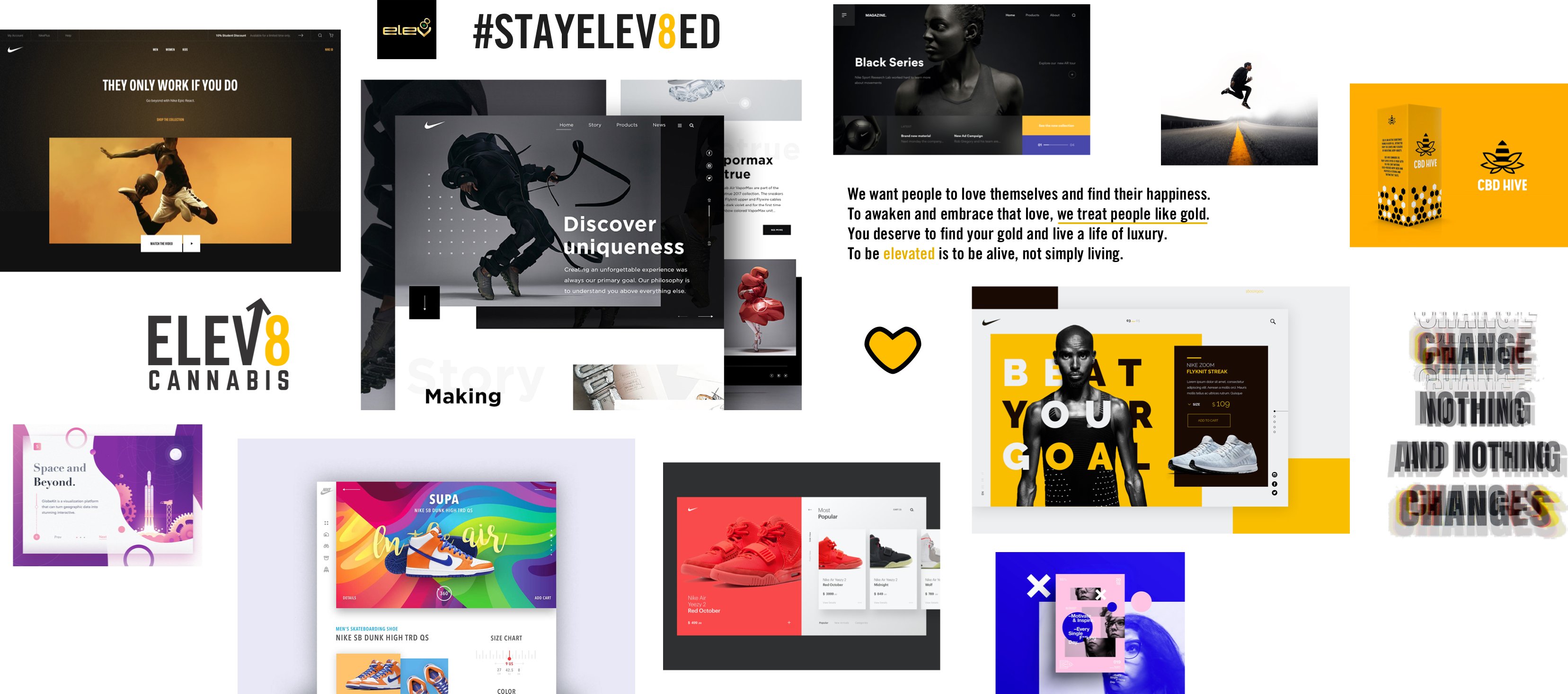

Alterya Acquired By Blockchain Analytics Giant Chainalysis

Apr 25, 2025

Alterya Acquired By Blockchain Analytics Giant Chainalysis

Apr 25, 2025 -

Actor Jack O Connell A Passion For The Jlc Reverso Watch

Apr 25, 2025

Actor Jack O Connell A Passion For The Jlc Reverso Watch

Apr 25, 2025 -

Scho Tramp Govorit Pro Viynu V Ukrayini

Apr 25, 2025

Scho Tramp Govorit Pro Viynu V Ukrayini

Apr 25, 2025 -

Preparing Your Portfolio For Significant Stock Market Swings

Apr 25, 2025

Preparing Your Portfolio For Significant Stock Market Swings

Apr 25, 2025