Preparing Your Portfolio For Significant Stock Market Swings

Table of Contents

Diversification: Spreading Your Risk Across Asset Classes

The Importance of Diversification

Diversification is a cornerstone of sound investment strategy. It involves spreading your investments across different asset classes to reduce the impact of any single investment's poor performance. During market swings, a diversified portfolio is less likely to suffer catastrophic losses because losses in one area may be offset by gains in another. Different asset classes include stocks (equities), bonds (fixed income), real estate, commodities (like gold or oil), and alternative investments. Each asset class reacts differently to market conditions, offering a buffer against overall portfolio decline.

- Diversify across sectors: Investing solely in technology stocks, for instance, exposes you to significant risk if the tech sector underperforms. Spreading your investments across various sectors (technology, healthcare, energy, consumer staples, etc.) reduces this sector-specific risk.

- Include international stocks: Don't limit yourself to your home country's market. International diversification provides exposure to different economic cycles and reduces dependence on a single region's economic performance.

- Consider alternative investments: Bonds typically offer lower returns than stocks but are less volatile. Real estate can be another stabilizing element in a portfolio, providing a hedge against inflation and market fluctuations.

- Regularly review and rebalance your portfolio: Market conditions change constantly. Regularly reviewing and rebalancing your portfolio ensures your asset allocation remains aligned with your risk tolerance and investment goals. This process of portfolio rebalancing involves adjusting your holdings to return to your target asset allocation.

Understanding Your Risk Tolerance and Time Horizon

Assessing Your Risk Profile

Before making any investment decisions, honestly assess your risk tolerance and investment time horizon. Your risk tolerance reflects your comfort level with the possibility of losing money. Are you an aggressive investor comfortable with higher risk for potentially higher returns, a moderate investor seeking a balance between risk and return, or a conservative investor prioritizing capital preservation?

- Consider your age, financial goals, and comfort level with potential losses: Younger investors with longer time horizons can typically tolerate more risk than older investors nearing retirement. Your financial goals (e.g., retirement, buying a house) also influence your risk tolerance.

- Long-term investors can generally withstand greater volatility: The longer your investment timeframe, the more time you have to recover from market downturns. Long-term investment strategies often focus on growth rather than short-term gains.

- Short-term investors should prioritize capital preservation: If you need access to your funds soon, preserving capital should be your primary concern. Conservative investment strategies are generally more appropriate for shorter time horizons.

- Adjust your portfolio strategy based on your risk profile and time horizon: Your risk profile and time horizon should be the guiding principles in determining your asset allocation and investment choices.

Strategic Asset Allocation for Market Swings

Defensive vs. Offensive Strategies

Investment strategies can be broadly categorized as defensive or offensive. Defensive strategies prioritize capital preservation during market downturns, while offensive strategies focus on maximizing growth potential, even if it means accepting higher risk.

- Defensive strategies focus on preserving capital during market downturns: This might involve increasing your holdings in lower-risk assets like government bonds or high-quality corporate bonds. Reducing exposure to equities is a common defensive measure.

- Offensive strategies aim for higher growth potential: Offensive strategies generally involve a larger allocation to stocks, particularly those with high growth potential. This approach is suitable for investors with a higher risk tolerance and a longer time horizon.

- Consider shifting your allocation based on market predictions and economic indicators: While impossible to perfectly predict the market, monitoring economic indicators and market trends can inform strategic allocation shifts. However, avoid making impulsive decisions based on short-term market fluctuations.

- Don't panic sell during market corrections: Market corrections are a normal part of the market cycle. Panic selling during these periods often leads to significant losses. Sticking to your long-term investment strategy is crucial.

Employing Defensive Investment Strategies

Safe Haven Assets

During times of market uncertainty, investors often turn to "safe haven" assets. These are assets perceived as relatively stable and less susceptible to market volatility.

- Gold often acts as a hedge against inflation and market volatility: Gold's value tends to rise during periods of economic uncertainty, making it a valuable addition to a diversified portfolio.

- Government bonds offer stability and relatively lower risk: Government bonds, particularly those issued by developed countries, are generally considered low-risk investments.

- Diversify your portfolio with these assets to reduce overall risk: Including a small percentage of safe haven assets can help mitigate losses during market downturns.

Monitoring and Adapting Your Portfolio

Regular Review and Adjustments

Regularly reviewing and adjusting your portfolio is critical for long-term success. Market conditions are dynamic, and your investment strategy should adapt accordingly.

- Monitor market trends and economic news: Stay informed about economic developments and market trends to identify potential opportunities and risks.

- Rebalance your portfolio periodically to maintain your target asset allocation: Market fluctuations can cause your asset allocation to drift from your target. Rebalancing brings it back in line.

- Consider seeking professional financial advice if needed: A financial advisor can provide personalized guidance based on your individual circumstances and investment goals.

Conclusion

Preparing your portfolio for significant stock market swings is crucial for long-term investment success. By diversifying your investments, understanding your risk tolerance, employing strategic asset allocation, and regularly monitoring your portfolio, you can navigate market volatility more effectively and protect your financial future. Don’t hesitate to seek professional guidance in preparing your portfolio for significant stock market swings. Remember, proactive planning and adaptation are key to weathering market storms and achieving your financial goals. Start preparing your portfolio today for future market fluctuations and build a resilient investment strategy.

Featured Posts

-

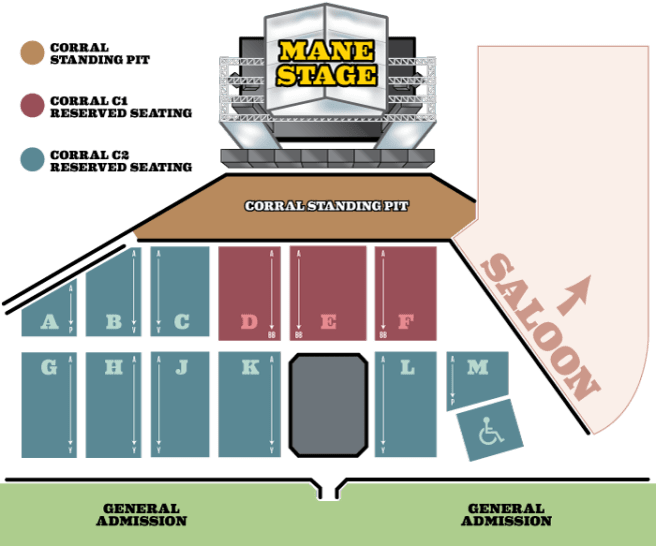

Stagecoach 2025 Where And How To Stream The Festival Live

Apr 25, 2025

Stagecoach 2025 Where And How To Stream The Festival Live

Apr 25, 2025 -

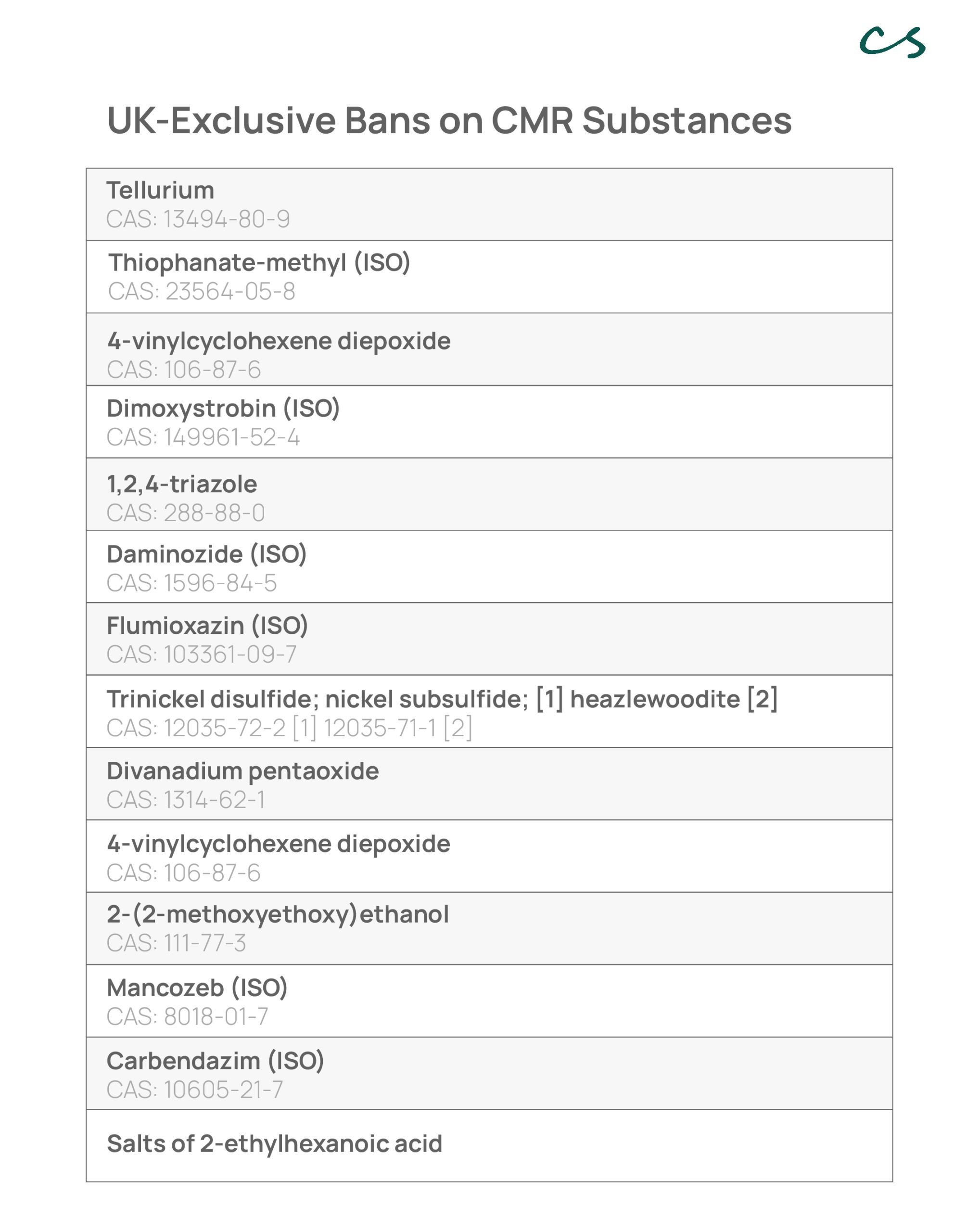

E Bay Listings For Banned Chemicals Section 230 Protection Challenged

Apr 25, 2025

E Bay Listings For Banned Chemicals Section 230 Protection Challenged

Apr 25, 2025 -

Boeing To Halt China Jet Production Amid Delivery Disputes

Apr 25, 2025

Boeing To Halt China Jet Production Amid Delivery Disputes

Apr 25, 2025 -

Tendencias De Maquiagem Conheca O Charme Da Aquarela

Apr 25, 2025

Tendencias De Maquiagem Conheca O Charme Da Aquarela

Apr 25, 2025 -

Analyzing The China Problem Case Studies Of Bmw Porsche And Others

Apr 25, 2025

Analyzing The China Problem Case Studies Of Bmw Porsche And Others

Apr 25, 2025