Private Credit Jobs: 5 Key Dos And Don'ts To Get Hired

Table of Contents

Do Your Research: Understanding the Private Credit Landscape

Before even applying for Private Credit jobs, thorough research is paramount. This involves understanding the nuances of the industry and the specific firms you're targeting.

Researching Private Credit Firms

Understanding the diverse types of private credit firms is crucial. These range from direct lenders focusing on specific sectors to large fund managers with diversified portfolios.

- Company Websites: Explore company websites for details on their investment strategies, recent transactions, and team members.

- LinkedIn: Use LinkedIn to research individual professionals, understand team structures, and gain insights into company culture.

- Industry Publications: Stay informed through industry publications like PEI Media and Private Debt Investor for market trends and firm updates.

- News Articles: Read news articles to understand recent deals, firm performance, and any significant industry developments.

Understanding a firm’s investment strategy, target sectors (e.g., real estate, healthcare, technology), and recent transactions demonstrates your genuine interest and preparedness.

Networking Within the Private Credit Industry

Networking is invaluable in the private credit world. It's not just about collecting business cards; it's about building genuine relationships.

- Networking Events & Conferences: Attend industry conferences and networking events to meet professionals and learn about new opportunities.

- Online Platforms (LinkedIn): Actively engage on LinkedIn, join relevant groups, and connect with individuals working in private credit.

- Informational Interviews: Reach out to professionals for informational interviews to learn about their career paths and gain valuable insights. These conversations can lead to unexpected opportunities.

- Prepare Talking Points: Before attending any networking event, prepare concise and engaging talking points highlighting your skills and career goals.

- Ask Insightful Questions: Show genuine interest by asking insightful questions about the industry, the firm, and the person's career path.

- Follow Up: Always follow up with individuals you meet, expressing your gratitude and reiterating your interest.

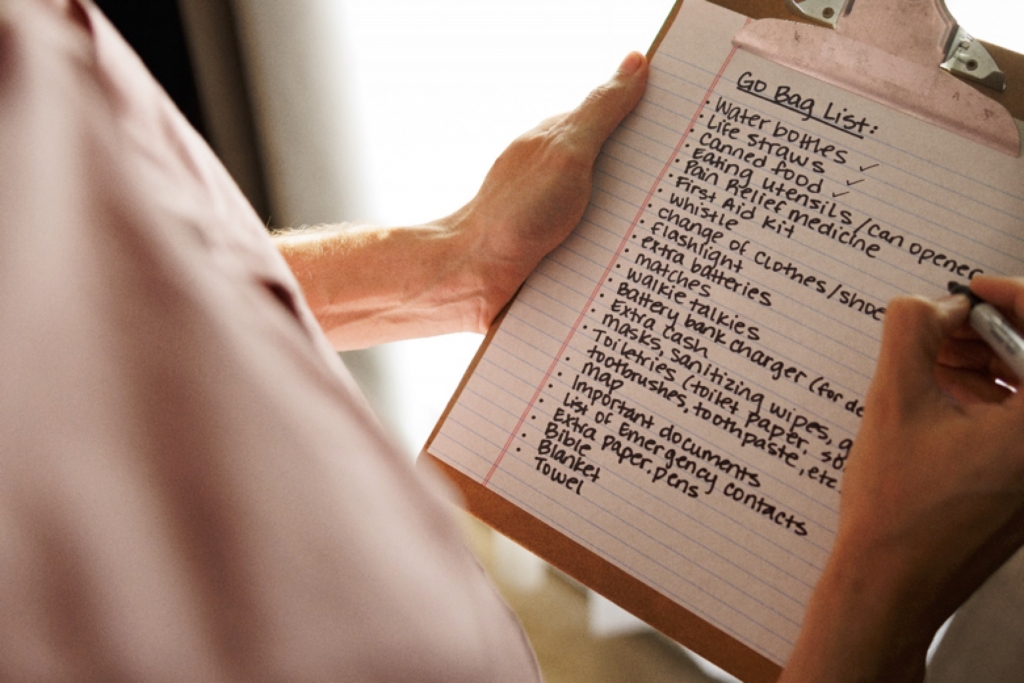

Tailor Your Resume and Cover Letter for Private Credit Jobs

Your resume and cover letter are your first impression. They must effectively communicate your qualifications and demonstrate your understanding of private credit.

Highlight Relevant Skills and Experience

Highlight skills directly relevant to Private Credit roles. Quantify your achievements whenever possible.

- Keywords: Use keywords from job descriptions, such as financial modeling, credit analysis, underwriting, due diligence, leveraged buyouts, and portfolio management.

- Quantifiable Achievements: Instead of simply stating responsibilities, quantify your achievements using metrics and numbers (e.g., "Increased portfolio yield by 15%").

- Tailored Approach: Customize your resume and cover letter for each application, emphasizing the skills and experience most relevant to the specific job requirements.

Showcase Your Understanding of Private Credit

Demonstrate your knowledge of the industry beyond just listing skills.

- Industry-Specific Keywords: Incorporate relevant financial terms like "senior secured debt," "mezzanine financing," "covenant lite," and "distressed debt" naturally within your application materials.

- Certifications: Mention any relevant certifications or coursework such as CFA, CAIA, or relevant MBA specializations.

- Market Trends: Demonstrate awareness of current market trends and challenges within the private credit industry.

Ace the Private Credit Interview: Preparation is Key

The interview process is crucial. Thorough preparation is essential for success.

Practice Behavioral Interview Questions

Prepare for behavioral questions using the STAR method (Situation, Task, Action, Result).

- Example Questions: "Tell me about a time you failed," "Describe a situation where you had to work under pressure," "Give an example of a time you had to deal with a difficult colleague."

- STAR Method: Practice structuring your answers using the STAR method to clearly illustrate your skills and experiences.

- Prepare Questions to Ask: Prepare thoughtful questions to ask the interviewer to demonstrate your genuine interest and engagement.

Technical Skills Assessment

Expect technical questions assessing your financial modeling, valuation, and credit analysis skills.

- Practice Problems: Work through practice problems in financial modeling, valuation, and credit analysis to sharpen your skills.

- Software Proficiency: Highlight your proficiency in relevant software like Excel, Bloomberg Terminal, and Argus.

- Case Studies: Be prepared to analyze case studies, demonstrating your analytical and problem-solving abilities.

Don't Neglect the Importance of Networking

Networking isn't a one-time event; it's an ongoing process.

Expand Your Professional Network

Actively participate in industry events, join relevant professional organizations, and leverage LinkedIn for networking opportunities.

- Recruiters: Build relationships with recruiters specializing in private credit placements.

- Industry Events: Attend industry conferences and workshops to expand your network and learn about new opportunities.

Don't Underestimate the Power of Referrals

Referrals significantly increase your chances of getting noticed.

- Leveraging Your Network: Inform your network of your job search and actively seek referrals from those with connections in the private credit industry.

- Maintaining Relationships: Maintain professional relationships even after securing a position; these relationships can lead to future opportunities.

Don't Make These Common Mistakes

Avoid these pitfalls to maximize your chances of landing a Private Credit job.

Failing to Research the Firm

Thoroughly research the firm before applying.

- Consequences: Not researching can lead to poorly prepared interviews and a lack of understanding of the firm's culture and investment strategy.

- Demonstrating Understanding: During interviews, demonstrate your understanding of the firm's investment thesis, portfolio companies, and recent activities.

Lack of Preparation for Technical Interviews

Technical interviews are common; neglecting preparation is a critical mistake.

- Common Questions: Prepare for questions on financial statement analysis, valuation methodologies, and credit risk assessment.

- Analytical Skills: Showcase your strong analytical and problem-solving skills through clear and concise answers.

Conclusion: Securing Your Ideal Private Credit Job

Landing a Private Credit job requires dedication and a strategic approach. By diligently researching firms, tailoring your application materials, acing interviews, and actively networking, you can significantly increase your chances of success. Remember to avoid common pitfalls such as neglecting research and underestimating the importance of technical skills. Start applying these tips today to land your dream Private Credit job, and build a thriving Private Credit career!

Featured Posts

-

Wildfire Betting Examining The Ethics Of Wagering On Natural Disasters In Los Angeles

Apr 24, 2025

Wildfire Betting Examining The Ethics Of Wagering On Natural Disasters In Los Angeles

Apr 24, 2025 -

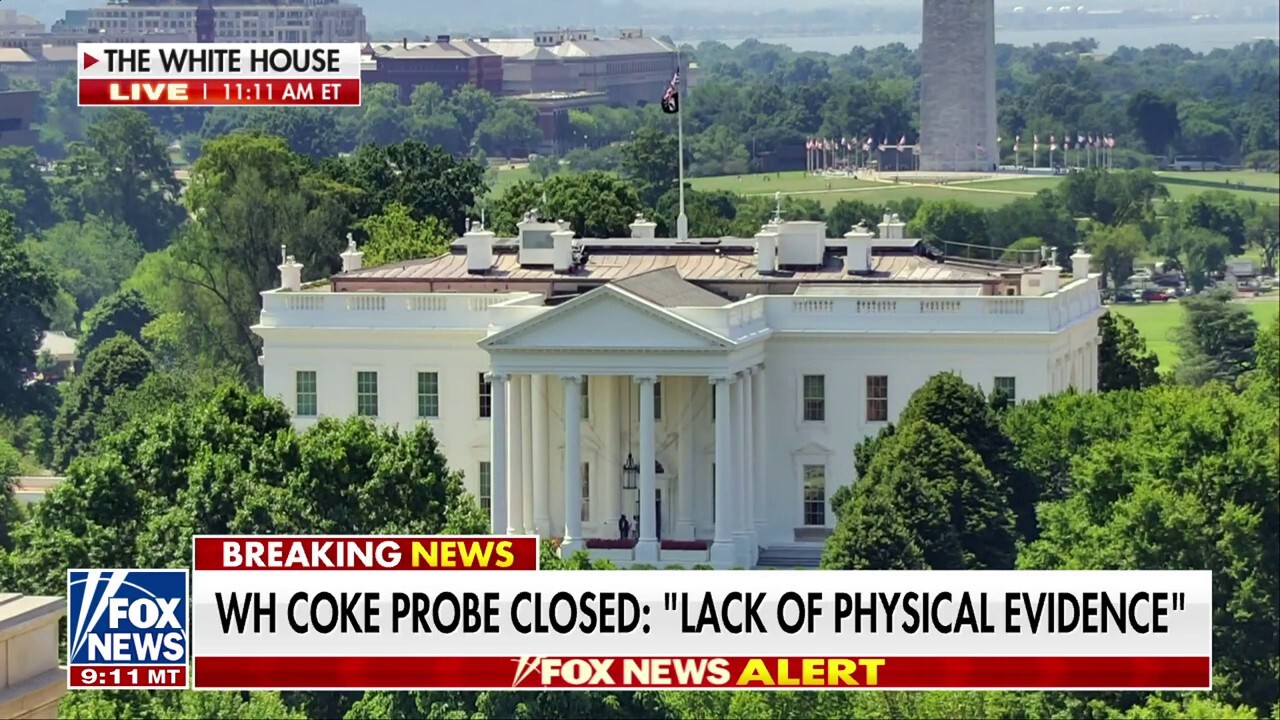

White House Cocaine Incident Secret Service Wraps Up Investigation

Apr 24, 2025

White House Cocaine Incident Secret Service Wraps Up Investigation

Apr 24, 2025 -

Is Canadas Fiscal Health Sustainable Examining Liberal Spending

Apr 24, 2025

Is Canadas Fiscal Health Sustainable Examining Liberal Spending

Apr 24, 2025 -

Remembering Jett Travolta A Photo Shared By His Father On His Birthday

Apr 24, 2025

Remembering Jett Travolta A Photo Shared By His Father On His Birthday

Apr 24, 2025 -

Why Is The Canadian Dollar Falling Against Major Currencies

Apr 24, 2025

Why Is The Canadian Dollar Falling Against Major Currencies

Apr 24, 2025