Meta's Future Under A Trump Administration: Zuckerberg's Challenges

Table of Contents

Increased Regulatory Scrutiny and Antitrust Concerns

A second Trump administration is likely to continue, and potentially intensify, its scrutiny of large tech companies like Meta. This could manifest in stricter antitrust enforcement and increased regulation of data privacy and content moderation. The implications of "Meta antitrust" concerns under a Trump presidency are significant.

-

Renewed antitrust lawsuits targeting Meta's market dominance: We could see a resurgence of lawsuits challenging Meta's acquisitions of Instagram and WhatsApp, arguing they stifle competition. The Department of Justice might pursue further investigations into Meta's market power in social networking and online advertising.

-

Increased pressure to divest from acquired companies like Instagram and WhatsApp: A Trump administration might push for Meta to divest itself of these key acquisitions, arguing they create an unfair monopoly. This would be a massive undertaking with potentially far-reaching consequences for Meta's business.

-

Heightened regulatory oversight of data collection and advertising practices: Expect stricter regulations concerning how Meta collects and uses user data for targeted advertising. This could lead to limitations on the company's lucrative advertising business model and necessitate significant changes to its data privacy policies. The impact of "data privacy regulation" on Meta's operations would be substantial.

-

Potential for stricter fines and penalties for non-compliance: Non-compliance with new or stricter regulations could lead to hefty fines and penalties, impacting Meta's profitability and potentially damaging its reputation. The threat of "Meta regulation" under a more assertive administration would be very real.

Content Moderation and Political Polarization

Trump's return and his followers' continued presence on Meta's platforms will likely reignite debates about content moderation and the spread of misinformation. Balancing free speech with the need to prevent the spread of harmful content will remain a critical challenge, impacting Meta’s approach to "content moderation."

-

Pressure to reinstate Trump's accounts and potentially other accounts previously banned for violating community standards: This would place Meta in a difficult position, potentially alienating users who value a safer online environment while facing accusations of censorship from others. The balancing act between "free speech" and responsibility will be under intense scrutiny.

-

Increased scrutiny of algorithms promoting political extremism or misinformation: Meta's algorithms could face intense scrutiny for potentially amplifying extremist views or misinformation, leading to calls for greater transparency and accountability. The debate over "political polarization" and its connection to online platforms will be re-ignited.

-

Potential for legislative action mandating specific content moderation policies: Congress might introduce legislation dictating how social media platforms should moderate content, potentially limiting Meta's flexibility and autonomy. This could lead to a significant shift in the "Meta content moderation" landscape.

-

Balancing user trust with the risk of censorship accusations: Meta will need to carefully navigate the delicate balance between maintaining user trust and avoiding accusations of censorship, a particularly challenging task in a highly polarized political environment.

Impact on International Expansion and Global Operations

A Trump administration's foreign policy approach could significantly impact Meta's global operations, especially in areas where the company faces regulatory challenges or political instability. The impact of "global tech regulation" will be a major consideration for Meta's international expansion.

-

Potential changes in international trade relations impacting Meta's business in specific countries: Changes in trade policies could create barriers to entry or increase operating costs for Meta in certain countries.

-

Increased difficulties navigating differing data privacy regulations globally: Compliance with various data privacy regulations across the globe will become even more complex and costly.

-

Potential for strained relationships with foreign governments impacting Meta's access to markets: A more protectionist foreign policy could damage relationships with foreign governments, potentially hindering Meta's expansion into new markets.

-

Challenges in maintaining consistent content moderation policies across diverse jurisdictions: Navigating different cultural norms and legal frameworks concerning content moderation will present a significant logistical and ethical challenge.

The Impact on Investor Confidence and Stock Price

The uncertainty surrounding Meta's future under a Trump administration will significantly impact investor sentiment and stock performance.

-

Potential for stock price volatility in response to regulatory news or policy changes: Any news regarding new regulations or lawsuits could trigger significant volatility in Meta's stock price.

-

Increased investor scrutiny of Meta's risk profile related to political uncertainty: Investors will carefully assess the political risks associated with Meta, potentially impacting investment decisions.

-

Potential for decreased investment in Meta due to perceived political risk: Investors may reduce their investments in Meta due to perceived heightened political risk and uncertainty.

Conclusion

Meta's future under a Trump administration presents a complex and challenging landscape for Zuckerberg. Navigating increased regulatory scrutiny, content moderation dilemmas, and the potential for international disruption will require strategic planning and effective political engagement. The impact on Meta's business model, investor confidence, and user trust will be profound. Understanding these potential challenges is crucial for investors, policymakers, and users alike. To stay informed on the latest developments in this evolving situation, keep following the news and analysis surrounding Meta's future under Trump.

Featured Posts

-

Lingering Effects Of Ohio Train Derailment Toxic Chemicals In Buildings Months Later

Apr 22, 2025

Lingering Effects Of Ohio Train Derailment Toxic Chemicals In Buildings Months Later

Apr 22, 2025 -

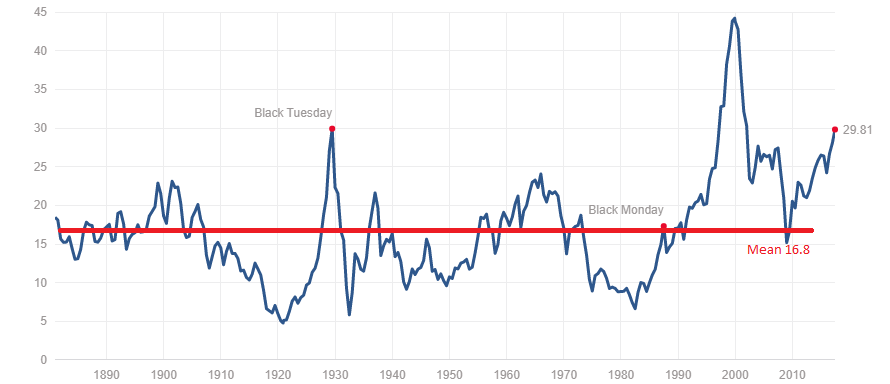

Understanding High Stock Market Valuations Insights From Bof A

Apr 22, 2025

Understanding High Stock Market Valuations Insights From Bof A

Apr 22, 2025 -

Fsus Post Shooting Plan A Controversial Return To Campus

Apr 22, 2025

Fsus Post Shooting Plan A Controversial Return To Campus

Apr 22, 2025 -

Crack The Code 5 Dos And Don Ts For Private Credit Job Seekers

Apr 22, 2025

Crack The Code 5 Dos And Don Ts For Private Credit Job Seekers

Apr 22, 2025 -

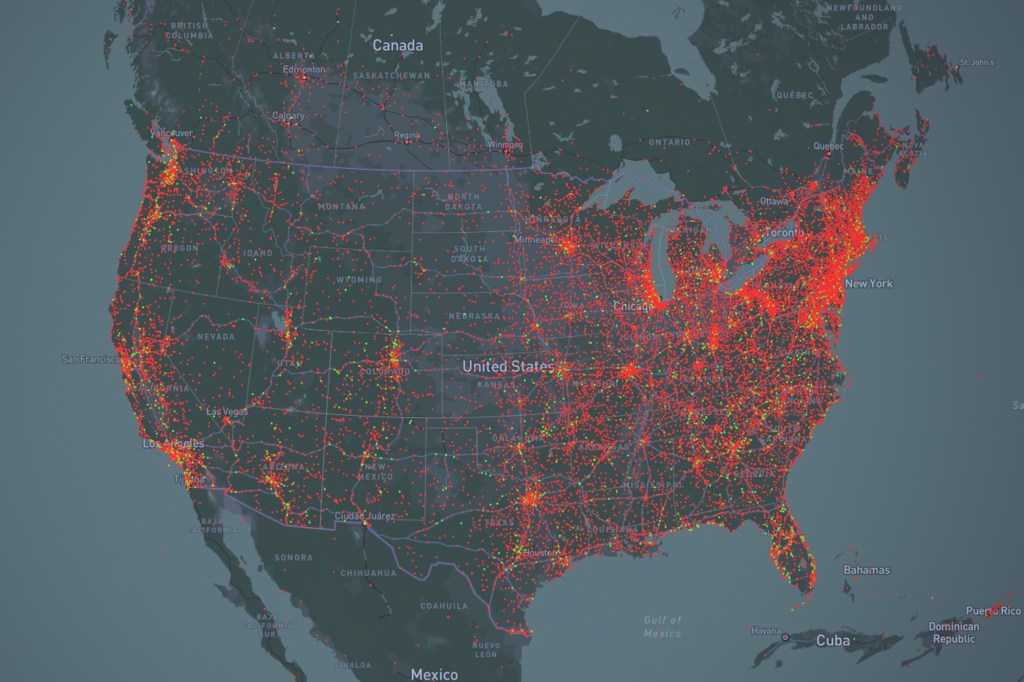

New Business Hotspots Across The Nation An Interactive Map

Apr 22, 2025

New Business Hotspots Across The Nation An Interactive Map

Apr 22, 2025