Land Your Dream Private Credit Role: 5 Do's And Don'ts

Table of Contents

5 Do's to Land Your Dream Private Credit Role

Do 1: Network Strategically (Keyword: Private Credit Networking)

Building a strong network is paramount in the competitive private credit industry. Don't underestimate the power of personal connections. Effective private credit networking can open doors that job postings never will.

- Build relationships with professionals in private credit: Attend industry events, connect with people on LinkedIn, and reach out to individuals whose careers you admire. Genuine connection is key.

- Attend industry conferences and events: These events provide excellent opportunities to meet potential employers and learn about the latest trends in private credit. Look for smaller, niche conferences alongside larger, well-known events.

- Leverage LinkedIn effectively: Optimize your profile, join relevant groups, and engage in discussions. LinkedIn is a powerful tool for private credit networking.

- Informational interviews are invaluable: Reach out to professionals in private credit for informational interviews. These conversations can provide valuable insights and help you build relationships.

- Join relevant professional organizations: Membership in organizations like the Association for Corporate Growth (ACG) or industry-specific groups can connect you with like-minded individuals and potential employers.

Do 2: Tailor Your Resume and Cover Letter (Keywords: Private Credit Resume, Private Credit Cover Letter)

Your resume and cover letter are your first impression. Make them count. A generic application will likely end up in the reject pile. Tailoring your application materials to each specific job shows genuine interest and initiative.

- Highlight relevant skills and experience: Quantify your achievements whenever possible. Instead of "Managed a portfolio," try "Managed a $50 million portfolio, increasing returns by 15%."

- Use keywords relevant to private credit job descriptions: Scan job postings to identify frequently used keywords and incorporate them naturally into your resume and cover letter.

- Tailor your resume and cover letter to each specific job application: Generic applications are a major turn-off. Show you understand the specific firm and role.

- Showcase your understanding of private credit markets and investment strategies: Demonstrate your knowledge of different private credit strategies, market trends, and relevant regulations.

- Proofread meticulously for errors: Typos and grammatical errors are unprofessional and can disqualify you from consideration.

Do 3: Ace the Private Credit Interview (Keywords: Private Credit Interview Questions, Private Credit Interview Tips)

The interview is your opportunity to shine. Thorough preparation is essential. Practice your answers, research the firm, and showcase your personality and passion.

- Research the firm and the interviewers thoroughly: Understand their investment strategy, recent deals, and the interviewers' backgrounds.

- Prepare for behavioral questions, technical questions, and case studies: Practice answering common interview questions using the STAR method (Situation, Task, Action, Result). Be ready for technical questions about financial modeling and private credit principles.

- Practice your answers and refine your storytelling: Your answers should be concise, clear, and compelling. Use the STAR method to structure your responses and tell a coherent story.

- Demonstrate your passion for private credit and your understanding of the industry: Show genuine enthusiasm for the field and your knowledge of relevant market trends.

- Ask insightful questions to show your interest and engagement: Asking thoughtful questions demonstrates your engagement and initiative.

Do 4: Showcase Your Financial Modeling Skills (Keyword: Private Credit Financial Modeling)

Proficiency in financial modeling is crucial for success in private credit. Mastering relevant software and showcasing your expertise is a must.

- Master Excel and financial modeling software (e.g., ARGUS, DCF modeling): Develop strong skills in building and interpreting financial models.

- Be prepared to demonstrate your proficiency through case studies or technical assessments: Practice building models and be prepared to walk interviewers through your process.

- Highlight your experience with relevant financial statements and analyses: Demonstrate your ability to analyze financial data and draw meaningful insights.

- Understand key valuation metrics used in private credit: Be familiar with metrics like IRR, MOIC, and LTV.

Do 5: Follow Up Professionally (Keyword: Private Credit Job Search)

Following up demonstrates your interest and professionalism. Don't let your application get lost in the shuffle.

- Send a thank-you note after each interview: Express your gratitude and reiterate your interest in the position.

- Maintain consistent communication, but avoid being overly persistent: Follow up periodically, but don't bombard the hiring manager with emails.

- Keep track of your applications and follow-up timelines: Use a spreadsheet or CRM system to organize your job search.

- Use a CRM system to manage your job search: A CRM system can help you track your applications, contacts, and follow-up efforts.

5 Don'ts to Avoid When Seeking a Private Credit Role

Don't 1: Submit Generic Applications (Keyword: Private Credit Job Application)

Submitting generic applications shows a lack of effort and interest. Take the time to personalize each application to demonstrate genuine interest in the specific role and firm.

- Avoid sending the same resume and cover letter to multiple firms without tailoring them: Each application should be unique and tailored to the specific job description.

- Generic applications show a lack of interest and preparation: Employers can easily spot generic applications, and they'll likely be discarded.

- Tailor your application materials to demonstrate specific interest in each role: Research the firm and highlight relevant skills and experience.

Don't 2: Overlook Networking (Keyword: Private Credit Job Search)

Networking is not just about making connections; it's about building relationships. Active networking significantly increases your chances of landing a private credit role.

- Don't underestimate the power of networking: Networking can lead to unadvertised job opportunities and valuable insights into the industry.

- Networking is crucial for gaining insights and making connections: Attend industry events, connect with professionals on LinkedIn, and seek out informational interviews.

- Engage actively with the industry's professionals: Participate in industry discussions, share your knowledge, and build genuine relationships.

Don't 3: Neglect Due Diligence (Keyword: Private Credit Research)

Thorough research is critical. Going into an interview unprepared shows a lack of seriousness and interest.

- Don't go into interviews unprepared: Research the firm, its investment strategy, and recent deals.

- Research the firm, its investment strategy, and recent deals: Understand their investment focus, recent transactions, and the team's experience.

- Demonstrate your thorough understanding of the market: Show you're knowledgeable about current market trends and challenges.

Don't 4: Underestimate Technical Skills (Keyword: Private Credit Skills)

Technical skills are fundamental in private credit. Mastering financial modeling and data analysis is crucial for success.

- Don't downplay the importance of technical skills in private credit: Financial modeling, data analysis, and valuation skills are essential.

- Master financial modeling and data analysis skills: Practice building financial models and analyzing data using relevant software.

- Showcase your expertise during interviews and assessments: Be prepared to demonstrate your technical skills through case studies or technical assessments.

Don't 5: Forget to Follow Up (Keyword: Private Credit Career)

Following up shows initiative and keeps your application top-of-mind. Don't assume silence means rejection.

- Don't assume your application will speak for itself: Following up demonstrates your continued interest and professionalism.

- Follow up with recruiters and hiring managers: Send thank-you notes after interviews and follow up periodically to express your continued interest.

- Express your continued interest in the position: Reiterate your enthusiasm for the role and the firm.

Conclusion

Securing your dream role in private credit requires dedication, preparation, and a strategic approach. By following these five "Do's" and avoiding the five "Don'ts," you'll significantly improve your chances of success. Remember to network strategically, tailor your application materials, ace the interview, showcase your financial modeling skills, and follow up professionally. Don't delay – start working towards landing your dream private credit role today!

Featured Posts

-

Ella Bleu Travolta 24 And Dazzling In Her New Magazine Cover

Apr 24, 2025

Ella Bleu Travolta 24 And Dazzling In Her New Magazine Cover

Apr 24, 2025 -

Instagrams Bold Move A Dedicated Video Editing App To Attract Tik Tok Users

Apr 24, 2025

Instagrams Bold Move A Dedicated Video Editing App To Attract Tik Tok Users

Apr 24, 2025 -

Anchor Brewing Company To Shutter A Legacy Concludes After 127 Years

Apr 24, 2025

Anchor Brewing Company To Shutter A Legacy Concludes After 127 Years

Apr 24, 2025 -

Liberal Party Platform A Voters Guide By William Watson

Apr 24, 2025

Liberal Party Platform A Voters Guide By William Watson

Apr 24, 2025 -

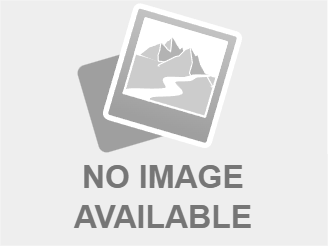

Teslas Q1 Earnings Report Political Fallout And Financial Implications

Apr 24, 2025

Teslas Q1 Earnings Report Political Fallout And Financial Implications

Apr 24, 2025