Foreign Investment And Japan's Bond Market: A Swap-Driven Yield Rebound

Table of Contents

The Role of Currency Swaps in Foreign Investment

Currency swaps are pivotal in enabling foreign participation in Japan's bond market. These financial instruments allow investors to exchange principal and interest payments in one currency for those in another. For international investors targeting JGBs, currency swaps offer a crucial hedge against fluctuations in the yen (JPY) exchange rate. By effectively locking in an exchange rate, investors mitigate the risk of currency losses that could erode their returns.

The advantages for foreign investors are manifold:

- Reduced currency risk for foreign investors: Swaps neutralize the uncertainty associated with exchange rate volatility.

- Increased accessibility to JGBs for international players: Swaps make it significantly easier for non-Japanese entities to invest in JGBs.

- Impact of swap rates on overall investment attractiveness: Favorable swap rates enhance the appeal of JGBs to international investors.

Data from the Ministry of Finance indicates a substantial increase in JGB transactions facilitated by currency swaps over the past year, signifying the growing importance of this mechanism in shaping the market. Precise figures are often confidential, but anecdotal evidence from major financial institutions suggests a dramatic uptick.

Increased Foreign Demand and its Impact on JGB Yields

The influx of foreign capital, channeled largely through currency swaps, has exerted upward pressure on JGB yields. This dynamic follows basic supply and demand principles:

- Increased demand pushes prices down, leading to higher yields: As foreign investors acquire more JGBs, the increased demand drives down prices, inversely leading to higher yields.

- The impact of central bank policies (BOJ) on JGB yields: The BOJ's monetary policies, particularly its yield curve control (YCC) adjustments, significantly influence JGB yields and, consequently, investor behavior.

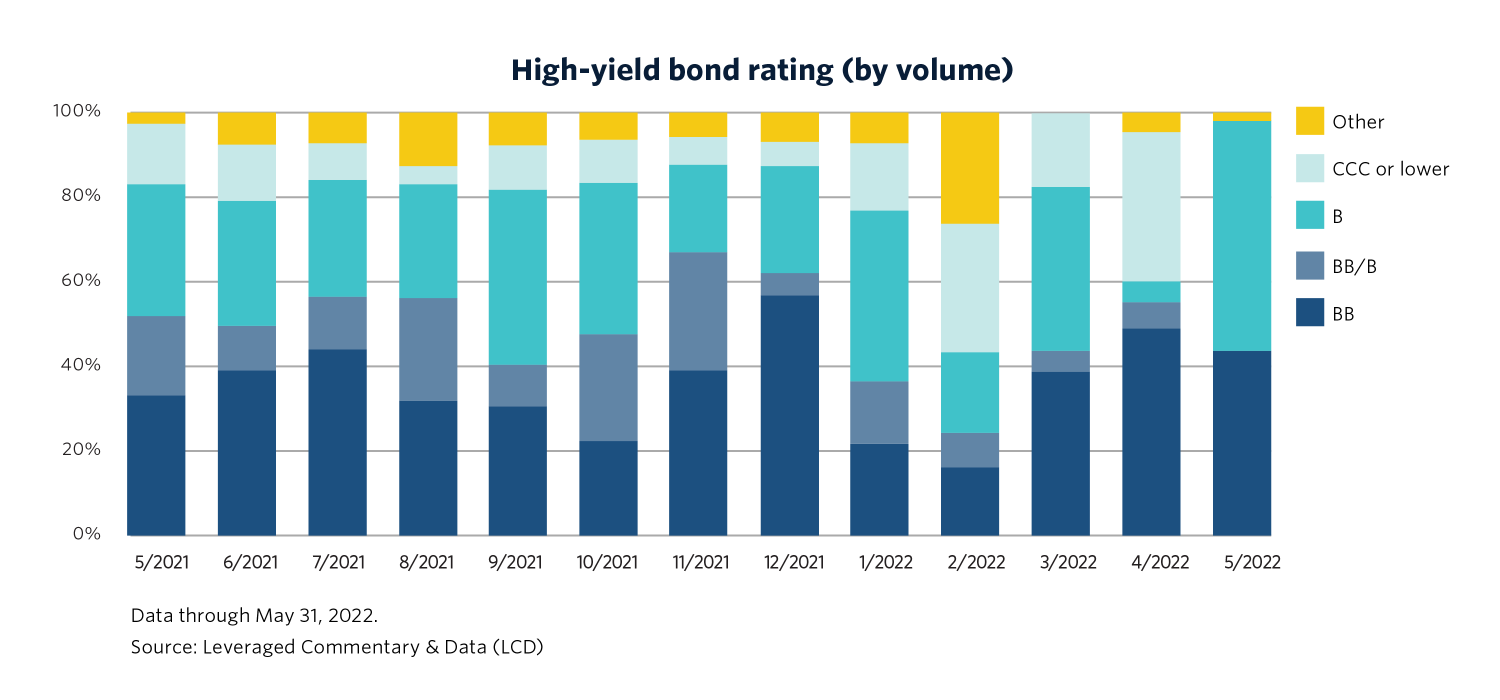

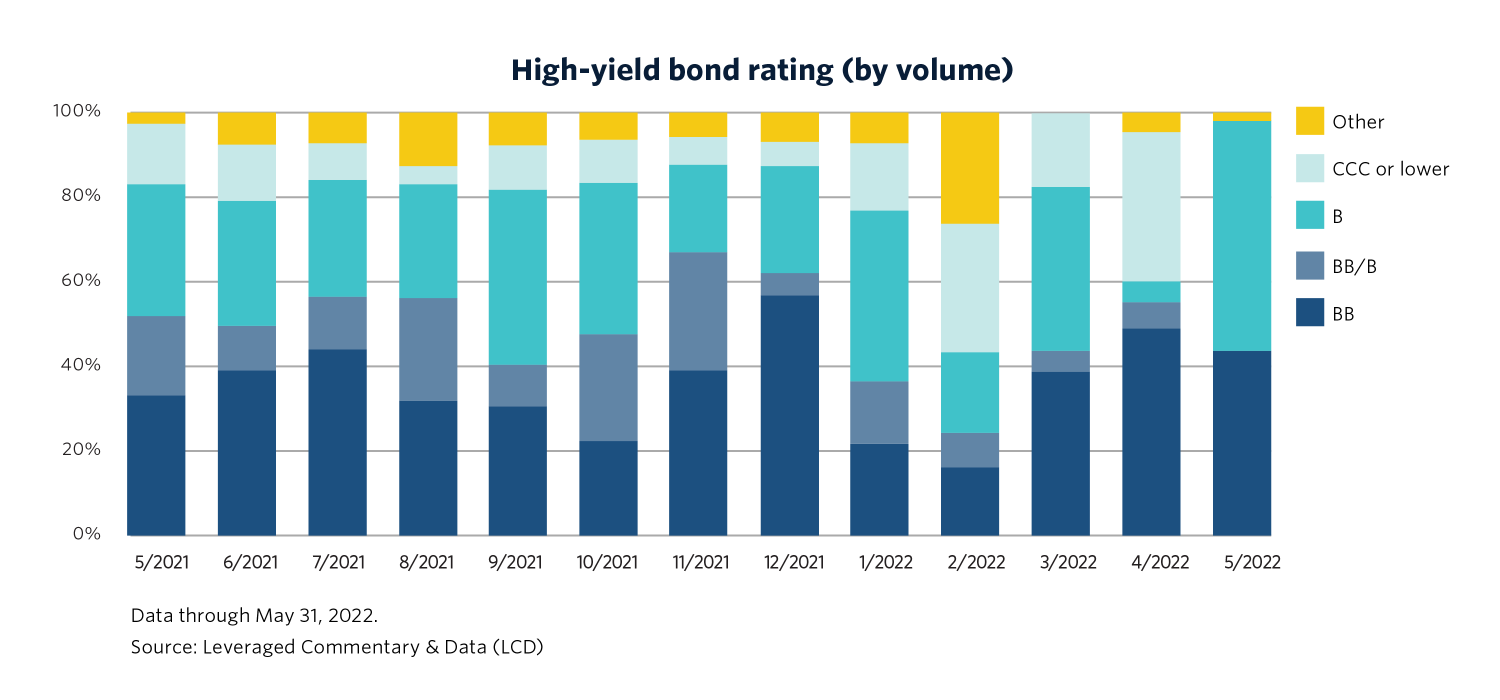

- Analysis of yield curve movements: Recent data showcases a steepening yield curve, reflecting the growing appetite for JGBs and the consequent yield increase. [Insert chart illustrating yield curve changes here]

The BOJ's Policy and its Influence

The BOJ's monetary policy plays a significant role in shaping the JGB market and influencing foreign investor decisions. The BOJ's recent adjustments to its yield curve control (YCC) policy, while subtle, have created opportunities for increased yield and attracted foreign investment.

- BOJ's recent policy shifts and their implications: Slight adjustments to the YCC have allowed for increased flexibility in the bond market.

- The interaction between BOJ actions and foreign investor decisions: These changes have signaled a potential shift towards a less interventionist approach, encouraging more foreign involvement.

- Potential future adjustments to BOJ policy: Further adjustments to the YCC or other monetary policies could significantly impact foreign investment flows and JGB yields.

Geopolitical Factors and their Influence on Foreign Investment in Japan's Bond Market

Global economic and geopolitical conditions significantly influence foreign investor sentiment towards JGBs. Japan's political stability and its strong economy have made JGBs a safe-haven asset, particularly during periods of global uncertainty.

- Safe-haven demand for JGBs during times of global uncertainty: During periods of economic turmoil, JGBs become more attractive to foreign investors seeking stability.

- Competition from other bond markets globally: The attractiveness of JGBs is also relative to the performance and yields of other government bonds globally. Rising interest rates in other major economies, such as the US, can impact investment flows towards JGBs.

- Impact of US interest rates on JGB investment: Higher US interest rates can draw investment away from JGBs, while lower rates can increase their appeal.

Conclusion

In summary, the recent yield rebound in Japan's bond market is significantly influenced by the influx of foreign investment, facilitated largely by currency swaps. This increased demand has pushed prices down and yields up. The BOJ's policies, particularly adjustments to its YCC, along with global economic and geopolitical factors, are instrumental in shaping investor sentiment.

For investors seeking opportunities in stable, yet dynamic markets, understanding the interplay between foreign investment, currency swaps, and Japan's bond market is crucial. Stay informed about the latest developments in Japan's bond market and the nuanced implications of currency swaps to make informed investment decisions. Further research into the dynamics of Japan's bond market is essential for successful navigation of this significant financial sector.

Featured Posts

-

Iconic Pepsi Ad Recreated Cindy Crawford At 58 In Daisy Dukes

Apr 25, 2025

Iconic Pepsi Ad Recreated Cindy Crawford At 58 In Daisy Dukes

Apr 25, 2025 -

Los Angeles Wildfires A Societal Commentary Through The Lens Of Gambling

Apr 25, 2025

Los Angeles Wildfires A Societal Commentary Through The Lens Of Gambling

Apr 25, 2025 -

New Crime Drama The Most Stressful Tv Show Viewers Are Obsessed With

Apr 25, 2025

New Crime Drama The Most Stressful Tv Show Viewers Are Obsessed With

Apr 25, 2025 -

Bbvas Investment Banking Push A Sustainable Strategy

Apr 25, 2025

Bbvas Investment Banking Push A Sustainable Strategy

Apr 25, 2025 -

Eurovision 2025 Who Are The Favourites Just Weeks Before The Contest

Apr 25, 2025

Eurovision 2025 Who Are The Favourites Just Weeks Before The Contest

Apr 25, 2025