BBVA's Investment Banking Push: A Sustainable Strategy?

Table of Contents

BBVA, a major global financial institution, is aggressively expanding its investment banking division. This ambitious undertaking raises a critical question: is this investment banking push a truly sustainable strategy, capable of delivering long-term value and navigating the ever-shifting financial landscape? This article delves into the key factors determining the success and sustainability of BBVA's strategic move.

BBVA's Investment Banking Expansion: Current State & Objectives

BBVA's current investment banking operations span a significant geographical footprint, with a strong presence in Europe, Latin America, and the United States. Their service offerings encompass a range of traditional investment banking activities, including mergers and acquisitions advisory, equity and debt underwriting, and financing solutions for corporations and governments.

- Recent Initiatives: BBVA has recently been involved in several high-profile transactions, such as advising on major mergers in the renewable energy sector and underwriting significant debt issuances for multinational corporations. Specific details about these deals are often confidential due to client agreements but publicly available information can be tracked through financial news outlets and regulatory filings.

- Strategic Goals: BBVA aims to significantly increase its market share in key investment banking segments, targeting substantial revenue growth within the next five years. Precise figures are generally not publicly released due to competitive reasons but increased activity suggests a drive to expand its market presence.

- Mergers & Acquisitions: While not publicly announcing large-scale mergers or acquisitions specifically for its investment banking arm, BBVA's overall strategy often involves strategic partnerships and acquisitions to bolster its capabilities and expand into new markets. These actions, even if not directly within the investment banking sector, support the broader strategic aims.

In summary, BBVA's current investment banking ambition is characterized by a significant drive to expand its services, increase market share, and boost revenue, all within a carefully considered global strategy.

Analyzing the Sustainability of BBVA's Approach: Strengths & Challenges

BBVA's investment banking push rests on several key strengths, but also faces considerable challenges in a competitive environment.

Strengths:

- Strong Brand Reputation: BBVA enjoys a robust brand reputation, built on years of operating in various markets, providing a solid foundation for attracting clients and talent.

- Sector Expertise: BBVA has demonstrated particular expertise in sectors experiencing significant growth, notably renewable energy and sustainable finance. This focus aligns with broader market trends and investor preferences.

- Geographic Diversification: The bank's presence in multiple key markets offers resilience against regional economic downturns and access to diverse investment opportunities.

- Technological Investments: BBVA has invested heavily in digital banking and fintech, providing a competitive edge in efficiency and client service.

Challenges:

- Intense Competition: The investment banking sector is fiercely competitive, with established global players vying for market share and top talent.

- Regulatory Hurdles: Navigating complex and evolving regulations, particularly in areas such as compliance and risk management, is a significant undertaking.

- Economic Uncertainty: Global economic uncertainties and potential market downturns pose a major threat to investment banking revenues.

- ESG Commitment: Maintaining a strong commitment to ESG principles while aggressively pursuing growth necessitates a careful balancing act.

- Talent Acquisition: Attracting and retaining top talent in a competitive employment market presents a substantial challenge.

Weighing the strengths and challenges, BBVA’s success hinges on its ability to navigate the competitive landscape while effectively managing risks associated with economic volatility and regulatory changes. Their strong brand and focus on sustainable finance may provide crucial advantages.

The Role of ESG and Sustainable Finance in BBVA's Strategy

BBVA has publicly demonstrated a strong commitment to ESG principles, viewing them not as a constraint but as a core element of their long-term growth strategy.

- Sustainable Finance Initiatives: BBVA has actively invested in various sustainable finance initiatives, including financing renewable energy projects and providing advisory services for green bonds.

- ESG-Driven Decisions: ESG factors are explicitly integrated into their investment banking decisions, influencing project selection, due diligence, and risk assessment.

- Alignment with Growth: The bank aims to align its sustainability goals with its aggressive investment banking expansion, recognizing the increasing demand for ESG-compliant investments.

- Growth in ESG Market: The global market for ESG investments is rapidly expanding, presenting a substantial opportunity for BBVA to capture significant market share by leveraging its early commitment to this sector.

ESG considerations are not merely a public relations exercise for BBVA, but a critical element of their investment banking strategy, reflecting a belief that sustainable practices contribute directly to long-term profitability and resilience.

Future Outlook and Potential for Success

BBVA's long-term prospects in investment banking depend on several factors.

- Potential Risks: Geopolitical instability, significant regulatory changes, and protracted economic downturns represent significant risks to the bank's investment banking ambitions.

- Opportunities: The burgeoning ESG investment market, coupled with increasing demand for digital financial services, offers substantial growth opportunities.

- Success Factors: The success of BBVA's strategy will depend heavily on its ability to maintain a strong brand reputation, attract and retain top talent, and effectively manage risks. Maintaining competitiveness in a rapidly evolving digital landscape is equally crucial.

- Growth Projections: While precise projections are difficult, the current trajectory suggests a potential for significant growth in market share and revenue if BBVA can navigate the challenges effectively.

A balanced view suggests a significant potential for success, yet hinges on adept management of market risks and regulatory considerations.

Conclusion

BBVA's ambitious investment banking push presents both opportunities and risks. While the bank possesses considerable strengths, including a strong brand, geographical diversification, and commitment to ESG, it also faces intense competition and the inherent uncertainties of the global financial landscape. Whether this represents a truly sustainable strategy remains to be seen. Further research and monitoring of BBVA's progress are necessary for a comprehensive assessment. Continued observation of BBVA's investment banking activities is vital for investors and stakeholders seeking to understand the long-term implications of this pivotal strategic shift. Understanding BBVA's approach to sustainable investment banking is crucial for navigating the future of the financial world.

Featured Posts

-

Is Betting On The Los Angeles Wildfires A Sign Of Societal Shift A Critical Examination

Apr 25, 2025

Is Betting On The Los Angeles Wildfires A Sign Of Societal Shift A Critical Examination

Apr 25, 2025 -

Indias Ultra Rich New Avenues For Global Stock And Bond Investments

Apr 25, 2025

Indias Ultra Rich New Avenues For Global Stock And Bond Investments

Apr 25, 2025 -

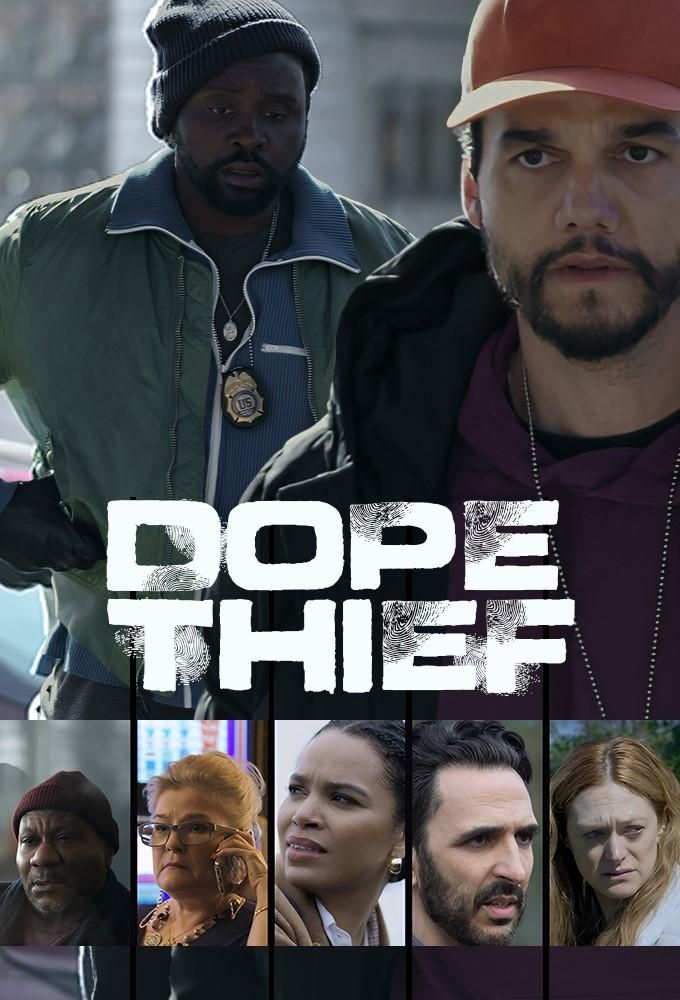

Dope Thief Episode 6 Review A Worrying Dip In Quality

Apr 25, 2025

Dope Thief Episode 6 Review A Worrying Dip In Quality

Apr 25, 2025 -

The Power Of A Friends Words One Mans 30 Stone Weight Loss

Apr 25, 2025

The Power Of A Friends Words One Mans 30 Stone Weight Loss

Apr 25, 2025 -

Warriors Hand Hornets Seventh Consecutive Defeat

Apr 25, 2025

Warriors Hand Hornets Seventh Consecutive Defeat

Apr 25, 2025