Emerging Market Stocks: Outperforming US Markets In 2024

Table of Contents

Stronger Economic Growth Prospects in Emerging Markets

Many emerging economies are projected to experience faster GDP growth rates than developed nations like the US in 2024. This robust economic expansion is fueled by several key factors:

- Rising Consumer Spending: A burgeoning middle class in many emerging markets is driving increased consumer spending, boosting economic activity and creating demand for goods and services.

- Infrastructure Development: Massive investments in infrastructure projects—roads, railways, energy grids—are creating jobs and stimulating economic growth across numerous developing economies.

- Young and Growing Populations: Many emerging markets boast young and expanding populations, providing a large and growing workforce to fuel economic productivity.

- Urbanization: Rapid urbanization creates opportunities in construction, real estate, and related industries, further driving economic expansion.

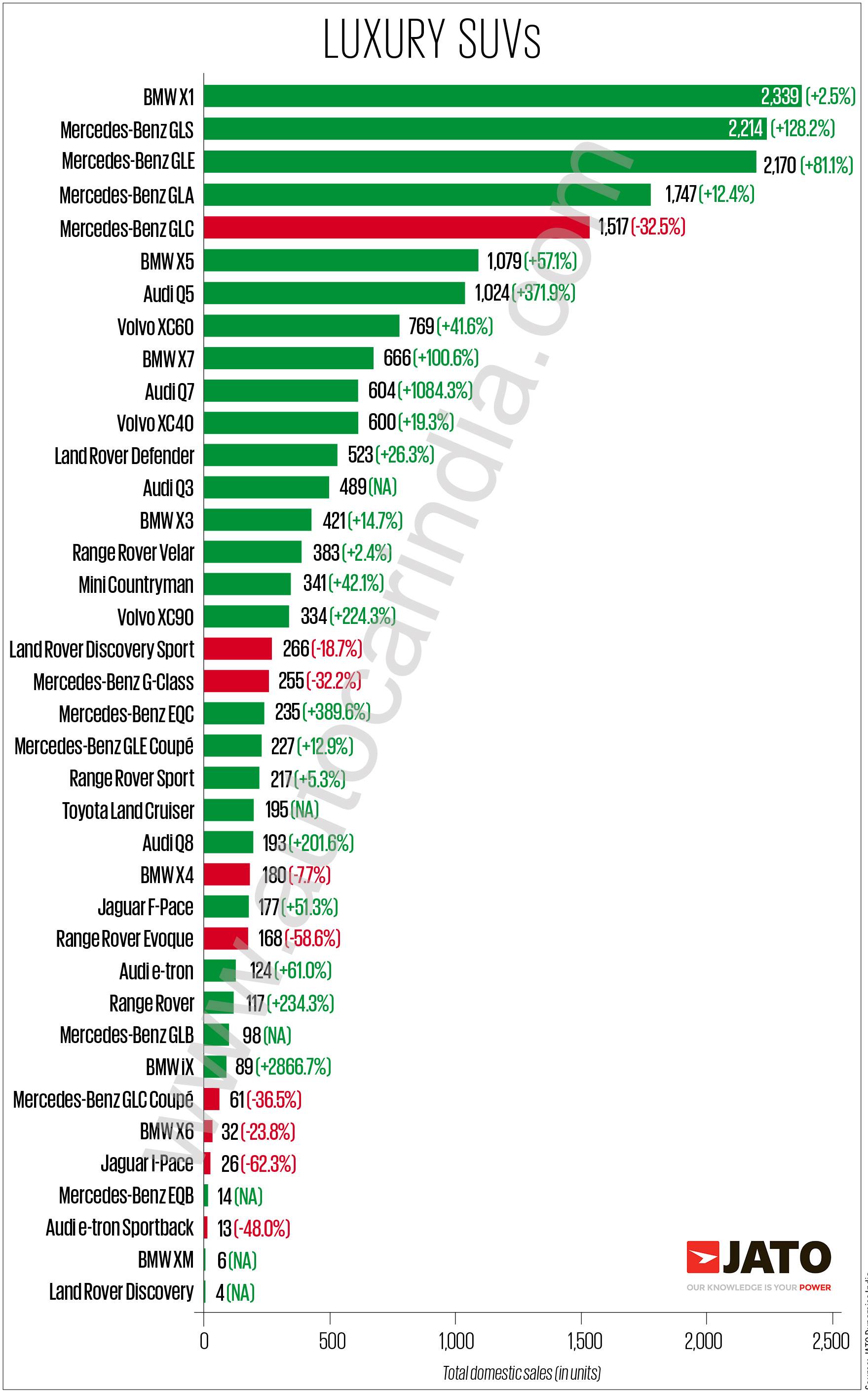

Examples of high-growth emerging markets include India, several Southeast Asian nations (like Vietnam and Indonesia), and parts of Africa. These regions are experiencing rapid GDP growth, making them attractive destinations for investors seeking strong returns. Keywords such as "GDP growth," "economic expansion," and "developing economies" highlight the potential of these markets.

Undervalued Assets and Attractive Valuation Metrics

Compared to their US counterparts, emerging market stocks may be undervalued relative to their growth potential. This undervaluation is supported by several valuation metrics:

- Lower Price-to-Earnings (P/E) Ratios: Many emerging market indices boast significantly lower P/E ratios than major US indices, suggesting that these stocks may be priced more attractively relative to their earnings potential.

- Higher Growth Potential: Despite lower current earnings, many emerging market companies are expected to experience significantly faster earnings growth in the coming years, making their lower P/E ratios even more attractive.

Comparison of Valuation Metrics (Illustrative Example):

| Index | P/E Ratio (Example) | Expected Earnings Growth (Example) |

|---|---|---|

| US Index (S&P 500) | 25 | 5% |

| Emerging Market Index | 15 | 15% |

This illustrative example demonstrates how emerging markets might offer a more compelling value proposition, despite inherent risks. Keywords like "valuation," "P/E ratio," "undervalued stocks," and "market capitalization" are crucial for SEO purposes.

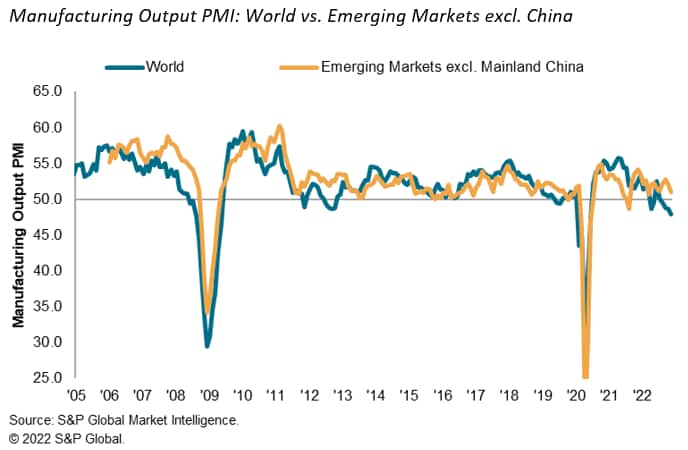

Diversification Benefits and Reduced Portfolio Correlation

Investing in emerging markets offers significant diversification benefits. Emerging market stocks often exhibit low correlation with developed market stocks, meaning their price movements are not strongly linked. This low correlation can significantly reduce overall portfolio risk and volatility.

- Reduced Portfolio Volatility: A diversified portfolio including emerging market stocks can help smooth out returns during market downturns.

- Improved Risk-Adjusted Returns: By reducing overall portfolio risk, adding emerging markets can lead to improved risk-adjusted returns.

Hypothetical Portfolio Example: A portfolio heavily weighted in US stocks could experience significant losses during a US market downturn. Adding emerging market stocks can act as a buffer, limiting overall losses. Keywords like "portfolio diversification," "risk management," "asset allocation," and "correlation" are important for targeting relevant search queries.

Sector-Specific Opportunities in Emerging Markets

Within emerging markets, specific sectors offer particularly strong growth potential.

- Technology: The rapid adoption of technology in many emerging markets presents significant opportunities in areas such as fintech, e-commerce, and mobile technology.

- Infrastructure: Massive infrastructure development projects create demand for construction materials, equipment, and services.

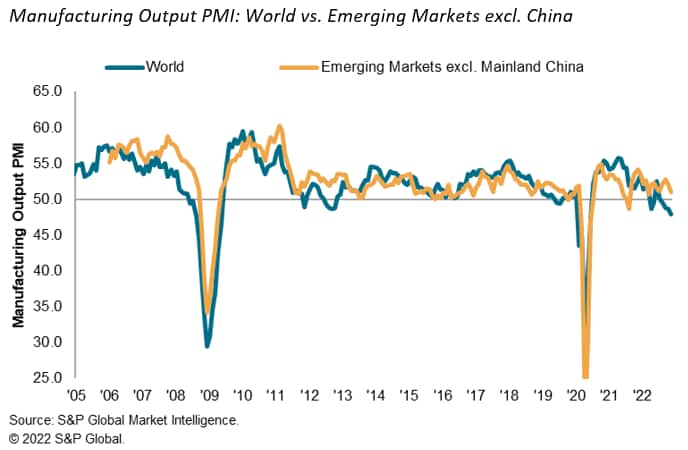

- Consumer Goods: A growing middle class is driving increasing demand for consumer goods, from food and beverages to automobiles and electronics.

Numerous successful companies within these sectors illustrate the potential for higher returns compared to their US counterparts. Keywords such as "sector performance," "growth sectors," and specific sector names (like "fintech" or "e-commerce") will enhance SEO performance.

Navigating the Risks of Investing in Emerging Markets

While the potential rewards are significant, investing in emerging markets does carry inherent risks:

- Political Instability: Political risks, such as regime changes or policy uncertainty, can significantly impact market performance.

- Currency Fluctuations: Fluctuations in exchange rates can affect returns for investors in foreign markets.

- Regulatory Uncertainties: Changes in regulations or legal frameworks can pose challenges for investors.

However, these risks can be mitigated through careful planning:

- Diversification: Diversifying across different emerging markets and sectors can help reduce exposure to specific risks.

- Hedging: Currency hedging strategies can help mitigate the impact of exchange rate fluctuations.

- Thorough Due Diligence: Conducting thorough research and due diligence on individual companies and markets is crucial.

Keywords like "risk mitigation," "currency risk," "political risk," and "emerging market risks" are essential for addressing concerns and demonstrating expertise.

Capitalize on the Potential: Invest in Emerging Market Stocks for 2024 and Beyond

Emerging market stocks offer attractive growth prospects in 2024 and beyond, driven by strong economic growth, undervalued assets, and diversification benefits. While inherent risks exist, these can be managed through careful planning and diversification. Remember that investing in emerging markets requires a long-term perspective and a thorough understanding of the associated risks. Consider incorporating emerging market investment as part of a well-diversified portfolio to potentially enhance returns while managing risk. Consult with a financial advisor before making any investment decisions to ensure your investment strategy aligns with your financial goals and risk tolerance. Further research into specific emerging markets and sectors is also recommended before committing capital to this potentially rewarding but riskier asset class.

Featured Posts

-

Stock Market Valuations Bof A Explains Why Investors Shouldnt Worry

Apr 24, 2025

Stock Market Valuations Bof A Explains Why Investors Shouldnt Worry

Apr 24, 2025 -

Us Lawyers Face Judge Abrego Garcias Crackdown On Stonewalling

Apr 24, 2025

Us Lawyers Face Judge Abrego Garcias Crackdown On Stonewalling

Apr 24, 2025 -

The China Factor Assessing The Challenges For Luxury Car Brands Like Bmw And Porsche

Apr 24, 2025

The China Factor Assessing The Challenges For Luxury Car Brands Like Bmw And Porsche

Apr 24, 2025 -

Instagram Launches Video Editor To Rival Tik Tok

Apr 24, 2025

Instagram Launches Video Editor To Rival Tik Tok

Apr 24, 2025 -

Emerging Markets Rally A Year Of Growth Despite Us Downturn

Apr 24, 2025

Emerging Markets Rally A Year Of Growth Despite Us Downturn

Apr 24, 2025