ECB's Holzmann: Trump Tariffs Could Curb Inflation

Table of Contents

Holzmann's Concerns and the ECB's Stance

Robert Holzmann, a member of the ECB's Governing Council, expressed apprehension regarding the inflationary impact of Trump's tariffs. While the exact quotes may vary depending on the source, his core argument centered on the idea that tariffs, by increasing the prices of imported goods, could dampen consumer spending and subsequently curb inflation. This contrasts with the traditional expectation that tariffs lead to higher prices and thus increased inflation. The ECB, aiming for an inflation rate of "below, but close to, 2% over the medium term," faces a complex challenge. Currently, the Eurozone's inflation rate fluctuates, sometimes falling short of the target.

- Summary of Holzmann's key arguments: Tariffs increase prices, reducing consumer purchasing power and potentially leading to lower-than-expected inflation.

- ECB's inflation target and current inflation rate: The ECB aims for inflation close to 2%, but the actual rate is subject to considerable variability and external shocks.

- How Holzmann's views align with or differ from the broader ECB perspective: While the ECB's overall stance is to monitor inflation closely, Holzmann's specific warning highlights a potential unforeseen consequence of protectionist trade policies.

The Mechanism: How Tariffs Could Curb Inflation

The mechanism through which tariffs might curb inflation is multifaceted. Higher prices on imported goods due to tariffs directly impact consumer spending. Facing increased costs, consumers may reduce their overall spending, leading to decreased demand. This reduced demand can put downward pressure on prices, counteracting the inflationary effect typically associated with tariffs. Furthermore, tariffs disrupt global supply chains, increasing production costs for businesses. This can lead to reduced production and potentially even job losses, further contributing to lower inflationary pressures.

- Reduced consumer demand due to increased prices of imported goods: Higher prices at the checkout lead to less spending, especially on discretionary items.

- Disruption of global supply chains leading to reduced production: Tariffs create bottlenecks and uncertainties, impacting manufacturing and distribution.

- Potential for decreased business investment due to uncertainty: Businesses may postpone investments due to the volatile trade environment.

Counterarguments and Alternative Perspectives

It's crucial to acknowledge counterarguments. Some economists argue that tariffs, by increasing production costs, can indeed lead to higher inflation. Increased costs are often passed on to consumers, resulting in higher prices for goods and services. Furthermore, the impact of tariffs can vary significantly across different sectors. Industries heavily reliant on imported inputs might experience a stronger inflationary effect than those with more domestically sourced materials.

- Arguments for tariffs potentially increasing inflation (e.g., increased production costs): The increased cost of raw materials or intermediate goods directly affects the final price of products.

- Differing viewpoints on the overall effect of tariffs on the global economy: The net effect is debated extensively, with diverse conclusions depending on the specific model used and assumptions made.

- Analysis of specific sectors potentially more or less impacted by the tariffs: The automotive industry, for example, is highly sensitive to trade disruptions, while others might be more resilient.

Implications for the European Economy

Holzmann's warning carries significant implications for the Eurozone economy. Reduced inflation, if it materializes as a result of Trump's tariffs, could necessitate adjustments to the ECB's monetary policy. The ECB might need to consider further stimulative measures, such as lower interest rates or quantitative easing, to support economic growth. This could impact borrowing costs for businesses and consumers.

- Potential implications for economic growth in the Eurozone: Lower inflation could stifle economic expansion, impacting employment and investment.

- The ECB's potential response to lower-than-expected inflation: The ECB might need to employ further monetary easing to meet its inflation targets.

- Risks and opportunities for European businesses: Businesses need to adapt to the changing trade environment and navigate the uncertainties.

Conclusion: Understanding the Impact of Trump Tariffs on Inflation – ECB's Holzmann's Warning

Robert Holzmann's concerns highlight the complex and potentially counterintuitive relationship between trade policies and inflation. While tariffs are often associated with higher prices, the dampening effect on consumer spending and supply chains could lead to lower-than-expected inflation. Understanding this nuance is critical for policymakers and businesses alike. Different economists offer varied perspectives, underscoring the need for careful analysis of specific industries and the overall global economic context.

Stay updated on the evolving situation and the ECB's responses by following our coverage on the impact of trade policies and inflation. Understanding the complexities surrounding ECB's Holzmann's concerns regarding Trump tariffs is crucial for navigating the current economic landscape.

Featured Posts

-

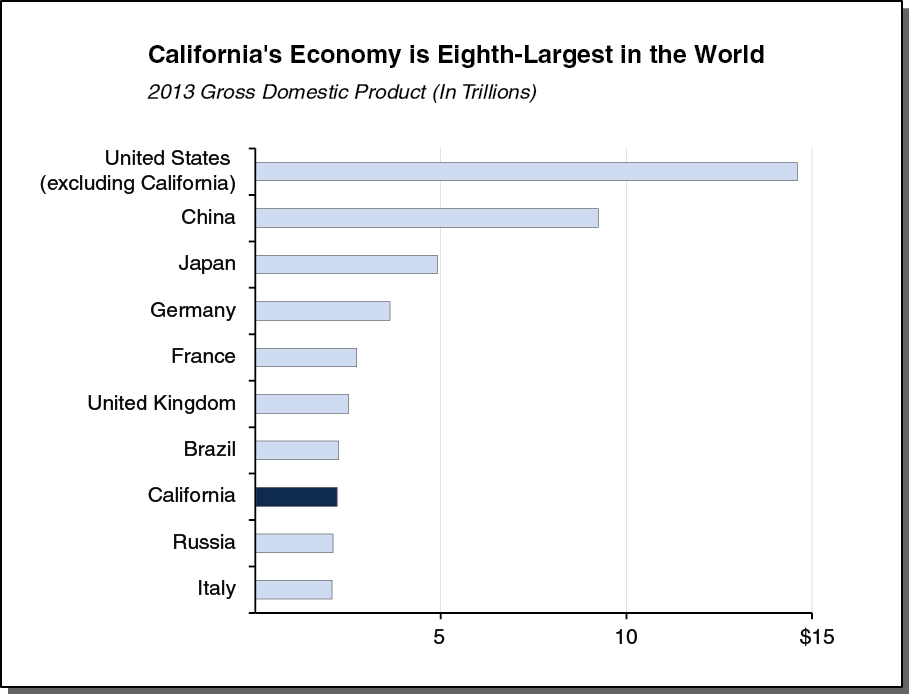

Worlds Fourth Largest Economy Californias Economic Powerhouse

Apr 26, 2025

Worlds Fourth Largest Economy Californias Economic Powerhouse

Apr 26, 2025 -

Analysis Dow Futures Chinas Economy And The Current Stock Market

Apr 26, 2025

Analysis Dow Futures Chinas Economy And The Current Stock Market

Apr 26, 2025 -

Benson Boones Coachella Surprise Brian May Guest Appearance

Apr 26, 2025

Benson Boones Coachella Surprise Brian May Guest Appearance

Apr 26, 2025 -

Nieuwe Combat Support Schip Voor Koninklijke Marine Gedoopt In Den Helder

Apr 26, 2025

Nieuwe Combat Support Schip Voor Koninklijke Marine Gedoopt In Den Helder

Apr 26, 2025 -

Fox News Faces Defamation Lawsuit From Ray Epps Over January 6th Coverage

Apr 26, 2025

Fox News Faces Defamation Lawsuit From Ray Epps Over January 6th Coverage

Apr 26, 2025

Latest Posts

-

Preordering Nintendo Switch 2 The Game Stop Method

Apr 26, 2025

Preordering Nintendo Switch 2 The Game Stop Method

Apr 26, 2025 -

A Game Stop Trip My Switch 2 Preorder Journey

Apr 26, 2025

A Game Stop Trip My Switch 2 Preorder Journey

Apr 26, 2025 -

I Secured My Switch 2 Preorder At Game Stop

Apr 26, 2025

I Secured My Switch 2 Preorder At Game Stop

Apr 26, 2025 -

Nintendo Switch 2 Preordering The Old Fashioned Way

Apr 26, 2025

Nintendo Switch 2 Preordering The Old Fashioned Way

Apr 26, 2025 -

My Switch 2 Preorder Waiting In Line At Game Stop

Apr 26, 2025

My Switch 2 Preorder Waiting In Line At Game Stop

Apr 26, 2025