Analysis: Dow Futures, China's Economy, And The Current Stock Market

Table of Contents

Dow Futures: A Leading Indicator of Market Sentiment

Dow futures contracts represent an agreement to buy or sell the Dow Jones Industrial Average at a specific price on a future date. They act as a powerful predictive tool, offering a glimpse into investor sentiment and anticipated market direction before the actual opening of the stock market. The price of Dow futures is influenced by a multitude of factors, constantly shifting the market landscape.

- Impact of overnight news: Major economic data releases, geopolitical events (like international conflicts or policy changes), and significant company announcements occurring after the US market closes can drastically impact Dow futures prices overnight.

- Relationship with the Dow Jones Industrial Average: While not always perfectly correlated, Dow futures generally mirror the direction of the actual Dow Jones Industrial Average. Discrepancies can provide valuable insights into potential market shifts.

- Hedging and speculation: Dow futures are used by both investors and traders. Hedging strategies use futures to mitigate potential losses in existing stock portfolios, while speculators aim to profit from anticipated price movements.

- Technical analysis: Traders extensively use technical analysis of Dow futures charts, employing indicators like moving averages, RSI, and MACD to identify potential trends and trading opportunities.

China's Economy: A Global Powerhouse and its Stock Market Influence

China's immense economic influence reverberates globally. Its growth trajectory, policy decisions, and trade relations significantly impact global stock markets, including the US. Monitoring key economic indicators is essential for understanding its influence.

- Key economic indicators: China's GDP growth rate, the Manufacturing Purchasing Managers' Index (PMI), and consumer spending figures provide vital insights into the health of its economy. These figures directly impact investor confidence and global market sentiment.

- US-China trade relations: The evolving relationship between the US and China, including trade disputes and tariffs, significantly affects global market stability and investor sentiment toward both nations’ stock markets.

- Regulatory changes: China's regulatory actions, particularly those affecting its domestic tech sector and other industries, can trigger significant volatility in both Chinese and global stock markets.

- The role of the Chinese Yuan: Fluctuations in the Chinese Yuan's value against the US dollar create ripple effects across global currency markets and can influence the performance of the Dow. Understanding these currency dynamics is crucial.

- Risks and opportunities: Investing in China presents both significant risks (political uncertainty, regulatory changes) and opportunities (long-term growth potential in specific sectors).

Current Stock Market Conditions and Their Correlation with Dow Futures and China

Analyzing the current market environment – whether bullish, bearish, or sideways – requires understanding the interplay between Dow futures, China’s economy, and other global factors.

- Inflationary pressures: High inflation rates can lead to interest rate hikes, impacting both stock prices and Dow futures.

- Interest rate hikes: Central bank decisions on interest rates directly affect borrowing costs for businesses and consumers, influencing investment decisions and overall market sentiment. This influence is reflected in Dow futures trading.

- Geopolitical uncertainties: Global political instability, wars, or major international conflicts significantly impact market volatility and investor confidence.

- Sector-specific analysis: Analyzing the performance of individual sectors (e.g., technology, energy, healthcare) within the current stock market helps to identify potential investment opportunities and risks.

Predicting Future Market Movements Based on Current Trends

Based on the observed correlations between Dow futures, China’s economic performance, and the broader market, we can cautiously suggest potential future trends. However, it's crucial to remember that market predictions are inherently uncertain. A diversified investment strategy, adjusted based on emerging data and economic shifts, is always recommended.

Conclusion: Navigating the Complex Relationship Between Dow Futures, China's Economy, and the Stock Market

Understanding the intricate relationship between Dow futures, China's economic performance, and the current stock market is paramount for making informed investment decisions. By closely monitoring key economic indicators, analyzing Dow futures movements, and staying abreast of geopolitical events, investors can better navigate the complexities of the global market. Regularly consult reputable financial news sources and seek professional financial advice to stay informed about Dow futures, China's economy, and the current stock market. Future articles will delve deeper into specific aspects, such as analyzing the impact of particular Chinese policies on Dow futures or predicting Dow Jones performance based on specific Chinese economic indicators.

Featured Posts

-

Transatlantic Ai Dispute Trump Administration Vs European Union

Apr 26, 2025

Transatlantic Ai Dispute Trump Administration Vs European Union

Apr 26, 2025 -

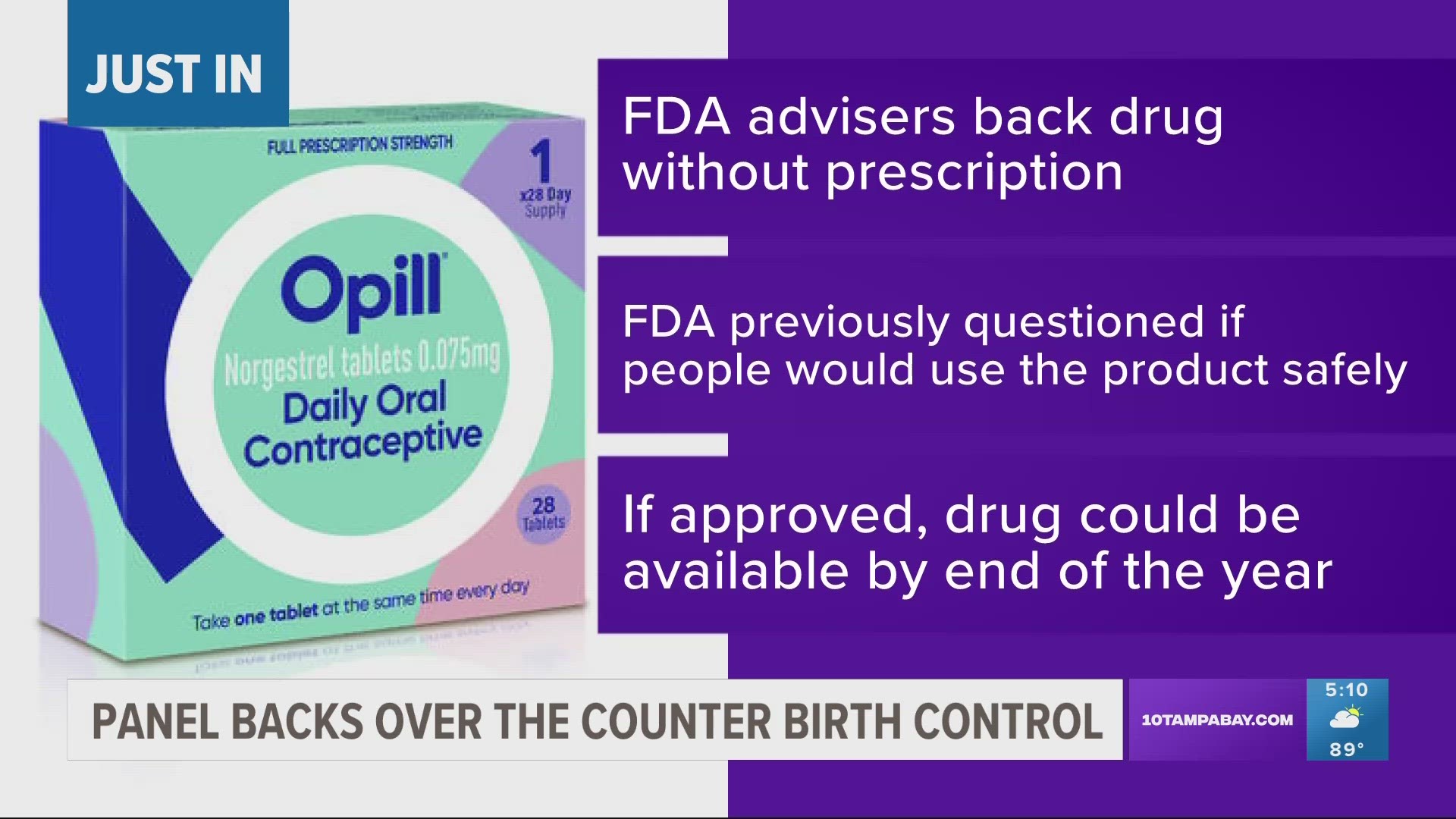

Post Roe America How Over The Counter Birth Control Impacts Access

Apr 26, 2025

Post Roe America How Over The Counter Birth Control Impacts Access

Apr 26, 2025 -

Cocaine Found At White House Secret Service Ends Inquiry

Apr 26, 2025

Cocaine Found At White House Secret Service Ends Inquiry

Apr 26, 2025 -

Beyond The Mouse 7 Must Try Orlando Restaurants Opening In 2025

Apr 26, 2025

Beyond The Mouse 7 Must Try Orlando Restaurants Opening In 2025

Apr 26, 2025 -

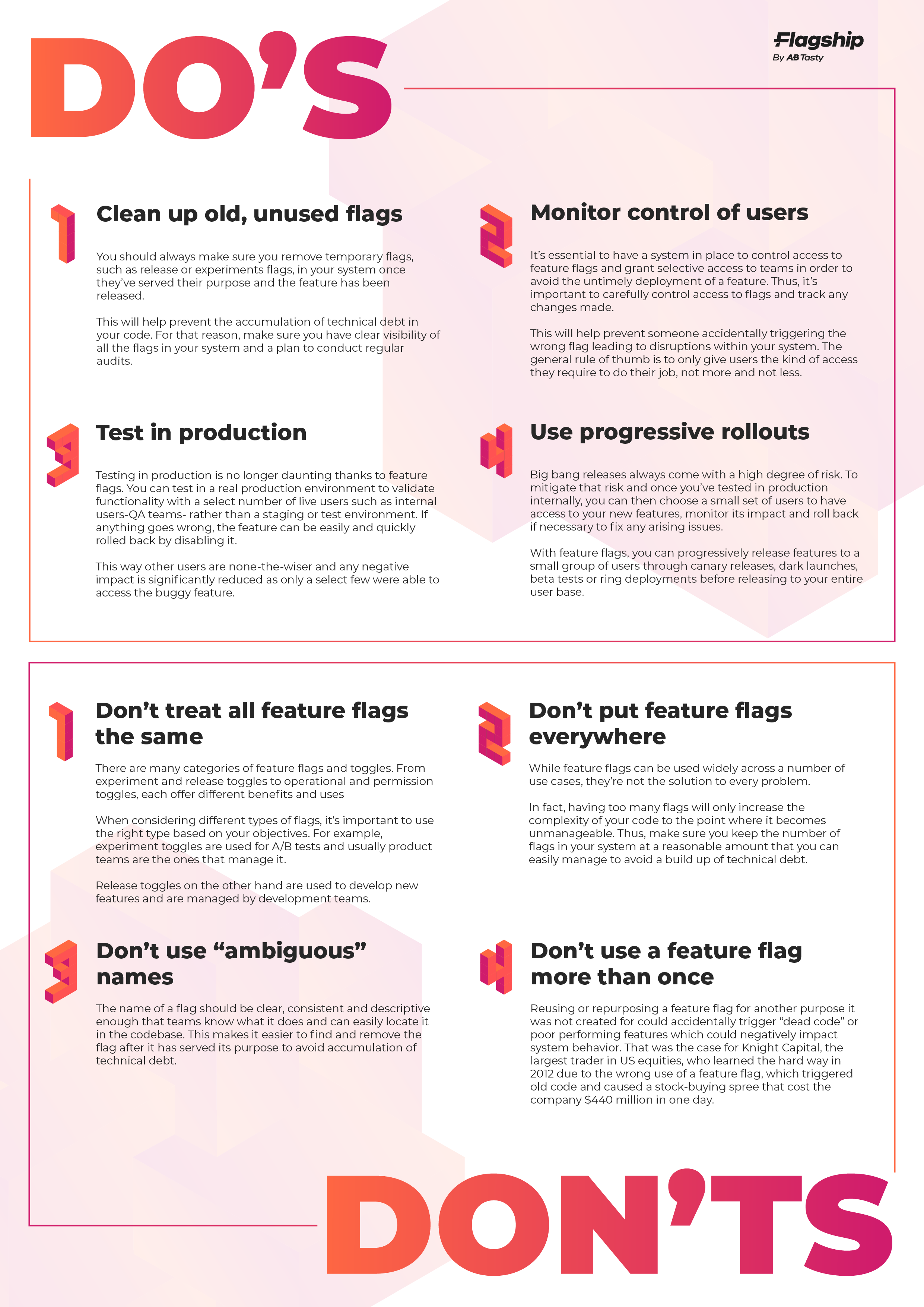

Land Your Dream Private Credit Job 5 Dos And Don Ts To Follow

Apr 26, 2025

Land Your Dream Private Credit Job 5 Dos And Don Ts To Follow

Apr 26, 2025