Land Your Dream Private Credit Job: 5 Dos And Don'ts To Follow

Table of Contents

H2: Do Your Research: Understanding the Private Credit Landscape

Before even considering applying for a private credit job, thorough research is paramount. This involves understanding both the broader industry and the specific firms you're targeting.

H3: Researching Specific Firms: Don't just apply blindly; understand the firms you're targeting. Their investment strategies, company culture, and recent deals offer crucial insights.

- Use LinkedIn: Research employees' backgrounds and career paths within the firm.

- Analyze Firm Websites: Understand their investment mandates (e.g., distressed debt, senior secured loans, mezzanine financing), portfolio companies, and team structure.

- Read News Articles: Stay up-to-date on the firm's recent activities, investments, and any relevant news. This demonstrates your genuine interest.

- Understand Investment Mandates: Knowing the firm's focus – whether it's real estate private credit, direct lending, or something else – allows you to tailor your application to showcase relevant experience.

H3: Networking Within the Industry: Networking is crucial in the private credit world. It’s not just about who you know; it’s about building genuine relationships.

- Attend Industry Conferences: These events provide unparalleled networking opportunities and insights into market trends.

- Join Industry Associations: Membership in relevant associations offers access to events, resources, and connections within the private credit community.

- Connect on LinkedIn: Engage with professionals, participate in relevant groups, and reach out for informational interviews.

- Informational Interviews: These casual conversations offer invaluable insights into specific roles, firms, and the industry overall.

H2: Craft a Compelling Resume and Cover Letter for Private Credit Roles

Your resume and cover letter are your first impression – make it count. Generic applications won't cut it in this competitive field.

H3: Tailoring Your Resume: Each application should be tailored to the specific job description. Highlight the skills and experiences most relevant to the role.

- Keyword Optimization: Incorporate keywords directly from the job description to improve your chances of getting noticed by Applicant Tracking Systems (ATS).

- Quantify Achievements: Use numbers to showcase your impact. Instead of "managed a portfolio," use "managed a $50 million portfolio, achieving a 12% annual return."

- Highlight Software Proficiency: Emphasize your expertise in relevant software like Bloomberg Terminal, Argus, and financial modeling tools.

H3: Showcasing Your Financial Acumen: Your resume and cover letter should demonstrate your mastery of financial modeling, valuation, and credit analysis.

- Illustrate Success: Include brief descriptions of successful financial models, valuation exercises, or credit analysis projects you've completed.

- Use Action Verbs: Use strong action verbs (e.g., developed, analyzed, implemented, optimized) to highlight your contributions and achievements.

- Showcase Technical Skills: Clearly articulate your understanding of key financial concepts, such as discounted cash flow (DCF) analysis, leveraged buyout (LBO) modeling, and credit risk assessment.

H2: Ace the Private Credit Job Interview: Preparation is Key

Interview preparation is crucial. Expect both behavioral and technical questions.

H3: Practicing Behavioral Questions: Behavioral questions assess your soft skills and how you've handled past situations.

- Use the STAR Method: Structure your answers using the STAR method (Situation, Task, Action, Result) to provide clear and concise responses.

- Prepare Examples: Anticipate common behavioral questions (e.g., "Tell me about a time you failed," "Describe a challenging project") and prepare compelling examples that demonstrate your problem-solving abilities, teamwork skills, and resilience.

- Research the Interviewers: Understanding the interviewers’ backgrounds and experience can help you tailor your responses and build rapport.

H3: Technical Interview Preparation: Be prepared for in-depth technical questions testing your financial knowledge.

- Review Fundamental Concepts: Brush up on core financial concepts like discounted cash flow (DCF) analysis, valuation methodologies, and credit metrics (e.g., leverage ratios, interest coverage ratios).

- Practice Case Studies: Practice case studies to prepare for potential scenarios you might encounter in a private credit role. These often involve analyzing financial statements, evaluating investment opportunities, and making strategic recommendations.

- Understand Credit Risk: Demonstrating a solid understanding of credit risk assessment, including different credit rating agencies and methodologies, is crucial.

H2: Don't Neglect These Crucial Aspects of Your Job Search

Avoiding these common mistakes can significantly boost your chances.

H3: Ignoring Networking Opportunities: Networking isn’t just about finding a job; it’s about building relationships and learning about unadvertised opportunities.

- Missed Opportunities: Failing to network can lead to missed opportunities, as many private credit jobs are filled through referrals.

- Limited Insights: Networking provides valuable insights into different firms, roles, and market trends.

H3: Submitting Generic Applications: A generic application demonstrates a lack of interest and effort. Each application needs to be tailored to the specific job and company.

- Reduced Chances: Generic applications are easily identified and often discarded. They fail to showcase your genuine interest in the specific role or firm.

- Lack of Personalization: A personalized approach shows the hiring manager that you’ve taken the time to understand their needs and how your skills can address them.

H2: Don't Underestimate the Power of Follow-Up

Following up demonstrates your persistence and interest.

H3: The Importance of Following Up: Following up after interviews and applications is a crucial step often overlooked.

- Reinforce Interest: A follow-up email reiterates your interest and keeps your application top-of-mind with the hiring manager.

- Provides Updates: If you haven't heard back within a reasonable timeframe, a polite follow-up inquiry is appropriate.

H3: Professionalism in Follow-Up Communication: Maintain a professional and courteous tone in all communications.

- Thank-You Notes: Send thank-you notes promptly after interviews to express your gratitude and reiterate your interest.

- Professional Tone: Ensure all your communications are professional, grammatically correct, and error-free.

3. Conclusion:

Securing your dream private credit job requires a strategic approach. By diligently researching firms, crafting compelling application materials, acing interviews, avoiding common pitfalls, and following up effectively, you significantly increase your chances of success. Remember to network actively, tailor your applications, and showcase your financial acumen throughout the process. Start your private credit job search today and use these dos and don'ts to accelerate your private credit career. Land your dream private credit job by following these tips!

Featured Posts

-

Public Outcry Over Expensive Kendrick Lamar Tickets For Hampden Concert

Apr 26, 2025

Public Outcry Over Expensive Kendrick Lamar Tickets For Hampden Concert

Apr 26, 2025 -

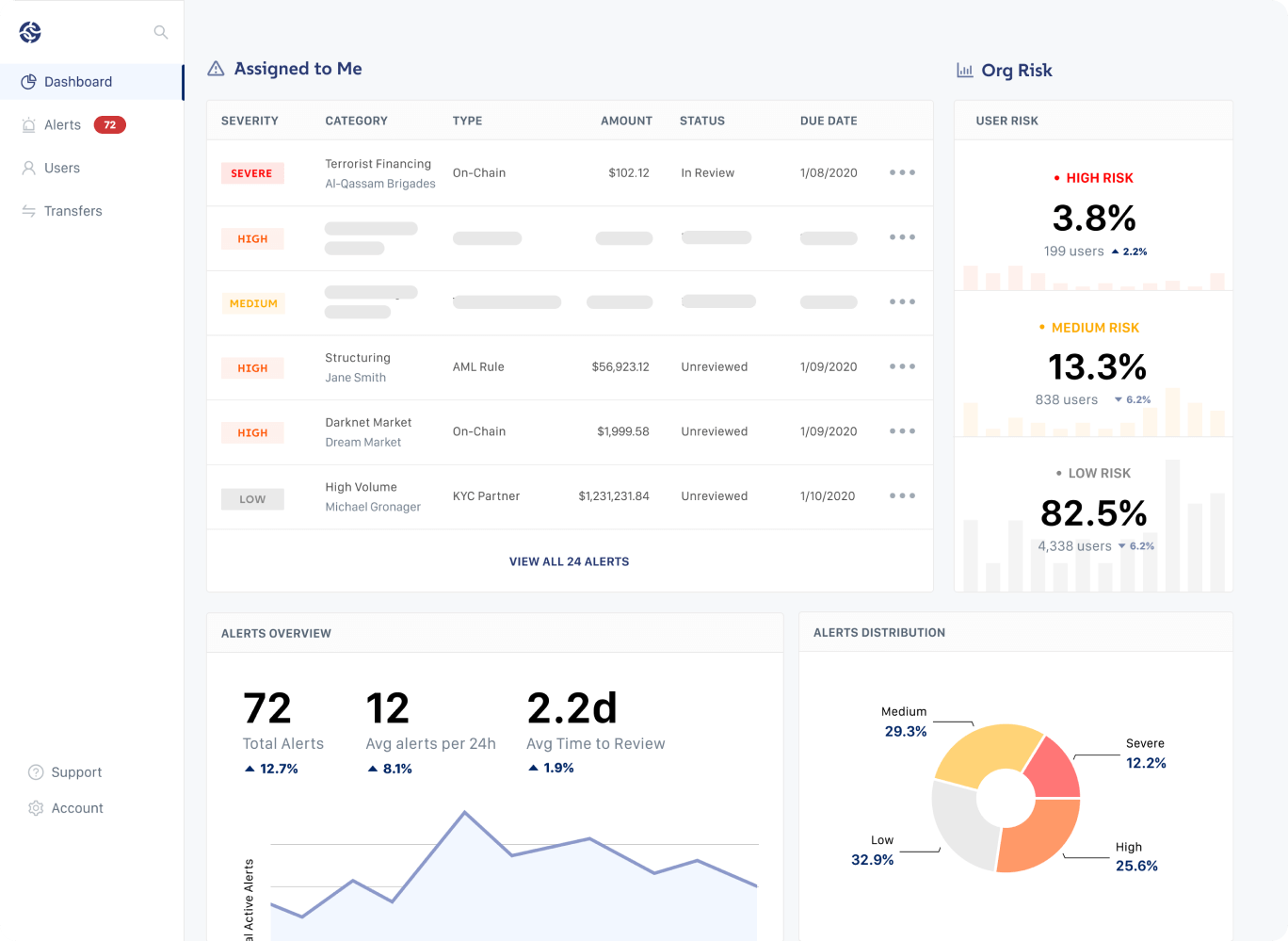

Blockchain Analytics Firm Chainalysis Integrates Ai Through Alterya Purchase

Apr 26, 2025

Blockchain Analytics Firm Chainalysis Integrates Ai Through Alterya Purchase

Apr 26, 2025 -

Benson Boone Sheer Lace Top 2025 I Heart Radio Music Awards

Apr 26, 2025

Benson Boone Sheer Lace Top 2025 I Heart Radio Music Awards

Apr 26, 2025 -

Deion Sanders Influence Shedeur Sanders Path To The Cleveland Browns

Apr 26, 2025

Deion Sanders Influence Shedeur Sanders Path To The Cleveland Browns

Apr 26, 2025 -

A Critical Look At Gavin Newsoms Recent Public Statements

Apr 26, 2025

A Critical Look At Gavin Newsoms Recent Public Statements

Apr 26, 2025