Credit Card Companies Feel The Pinch As Consumers Cut Back On Spending

Table of Contents

Declining Credit Card Spending and its Impact on Revenue

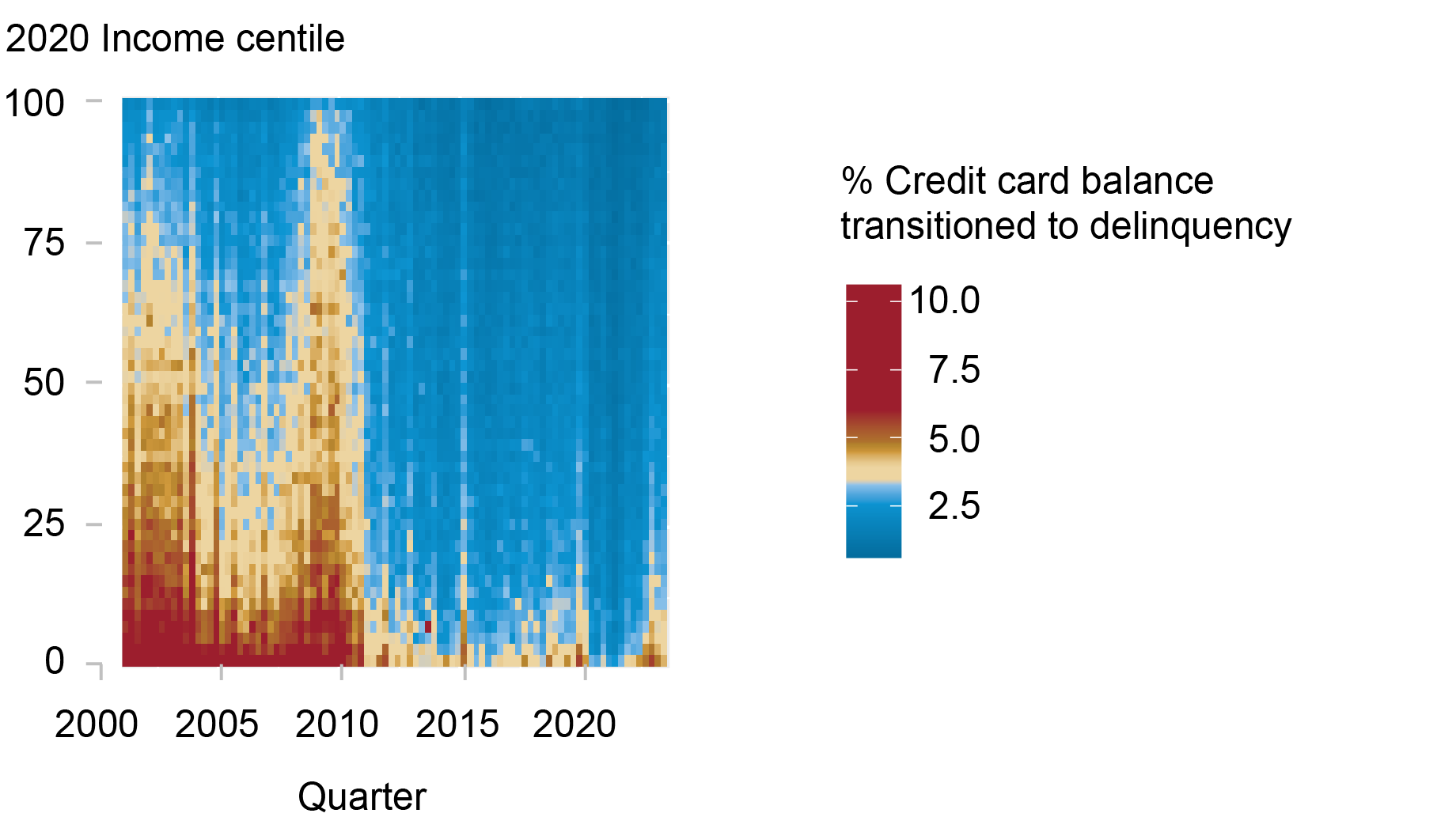

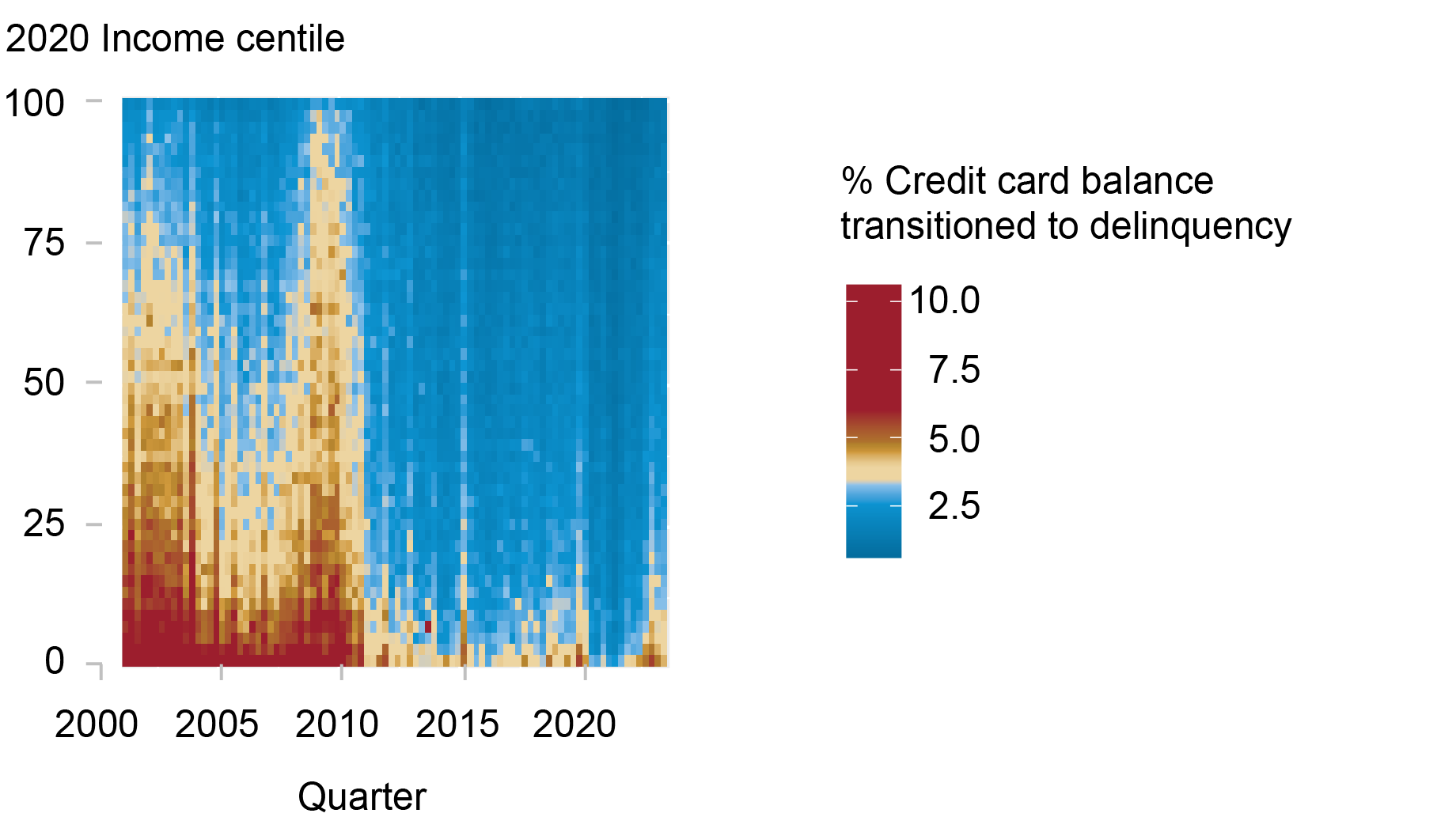

Reduced consumer spending directly translates to lower transaction volumes for credit card companies, significantly impacting their revenue streams. This decline affects several key areas: Lower spending means fewer transactions, resulting in lower merchant fees – the fees credit card companies charge businesses for processing payments. Furthermore, reduced spending leads to lower outstanding balances on credit cards, directly impacting interest income, a major source of revenue for these companies. Finally, as consumers struggle financially, there's a heightened risk of increased loan defaults, leading to further revenue losses.

- Lower merchant fees: With less consumer spending, businesses process fewer transactions, resulting in a direct decrease in merchant fees collected by credit card companies.

- Reduced interest income: Lower spending translates to lower outstanding credit card balances, meaning less interest accrues, leading to a decline in this crucial revenue stream.

- Potential for increased loan defaults: Financial hardship among consumers can lead to an increase in missed payments and ultimately loan defaults, posing significant financial risks to credit card companies.

Reports suggest that some major credit card companies are already experiencing a slowdown in revenue growth, reflecting the broader trend of decreased consumer spending. For example, [Insert example of a credit card company experiencing challenges with a source if possible]. This situation highlights the vulnerability of the credit card industry to macroeconomic factors.

Strategies Credit Card Companies are Employing to Mitigate Losses

Faced with declining revenue, credit card companies are actively implementing various strategies to mitigate losses and maintain profitability. These strategies often involve adjustments to fees, rewards programs, and credit approval processes.

- Increasing annual fees for premium cards: Credit card companies are increasingly relying on higher annual fees for premium cards to offset the decline in transaction fees.

- Offering enticing rewards programs to stimulate spending: Enhanced rewards programs, such as increased cashback or points accumulation, are designed to incentivize consumers to spend more.

- Tightening credit approval processes to reduce risk: More stringent credit checks aim to minimize the risk of loan defaults by lending only to lower-risk borrowers.

- Exploring alternative revenue streams: Some companies are diversifying their revenue streams by expanding into areas like personal loans, financial advisory services, and other related financial products.

However, these strategies are not without their potential downsides. Aggressive fee increases can alienate customers, while overly generous rewards programs may strain profitability. Similarly, tightening credit approval processes may limit customer acquisition and market share. The effectiveness of these strategies remains to be seen, and their long-term impact on the industry requires further observation.

The Rise of Buy Now, Pay Later (BNPL) and its Competition

The emergence of Buy Now, Pay Later (BNPL) services presents a significant challenge to traditional credit cards. BNPL platforms offer consumers a convenient alternative to credit cards for online purchases, often appealing to younger demographics less comfortable with traditional credit. This increased competition for consumer spending forces credit card companies to adapt their strategies and offerings to remain competitive.

- BNPL's appeal to younger demographics: BNPL services often target younger consumers who may not yet have established credit histories or prefer the perceived simplicity of these services.

- Increased competition for consumer spending: The rise of BNPL represents a direct challenge to credit card companies, fragmenting the market and potentially reducing their market share.

- Potential risks associated with BNPL: While offering convenience, BNPL also poses risks for both consumers (potential for debt accumulation) and lenders (higher default rates).

The Shifting Consumer Landscape and Future Outlook for Credit Card Companies

The current economic downturn is reshaping consumer behavior, forcing many to adopt more frugal spending habits and prioritize financial stability. This shift necessitates adaptability and innovation within the credit card industry.

- Increased focus on financial literacy and responsible spending: Consumers are increasingly seeking financial advice and tools to manage their finances effectively, including responsible credit card usage.

- Potential for consolidation in the credit card industry: The economic challenges may lead to mergers and acquisitions, resulting in industry consolidation and potentially fewer players in the market.

- The role of technology and innovation: Credit card companies must leverage technology to enhance customer experience, improve fraud detection, and develop more personalized financial products to remain competitive.

Looking ahead, the future of credit card companies depends significantly on their ability to adapt to evolving consumer needs and market dynamics. The industry will likely see a continued focus on personalized services, enhanced security measures, and potentially more innovative financial products to meet the demands of a changing consumer landscape.

The Future of Credit Card Companies in a Changing Economy

In conclusion, reduced consumer spending is undeniably impacting credit card companies, significantly affecting their revenue streams and profitability. The strategies employed to mitigate losses, including fee adjustments and alternative revenue streams, are crucial for navigating this challenging economic environment. The rise of BNPL services adds further complexity, highlighting the need for continuous adaptation and innovation. The credit card industry's long-term success hinges on its ability to adapt to the shifting consumer landscape, embracing technological advancements and focusing on responsible financial practices. To stay informed about the evolving landscape of consumer finance and the continued impact of credit card companies feeling the pinch, follow [Your Website/Blog/Social Media]. Continue your research into related topics like personal finance management and responsible credit card usage for a better understanding of your own financial health.

Featured Posts

-

Is Betting On The Los Angeles Wildfires A Sign Of The Times Exploring The Dark Side Of Disaster

Apr 24, 2025

Is Betting On The Los Angeles Wildfires A Sign Of The Times Exploring The Dark Side Of Disaster

Apr 24, 2025 -

Understanding Stock Market Valuations Bof As View On Investor Concerns

Apr 24, 2025

Understanding Stock Market Valuations Bof As View On Investor Concerns

Apr 24, 2025 -

60 Minutes Producer Resigns Amidst Trump Lawsuit Fallout

Apr 24, 2025

60 Minutes Producer Resigns Amidst Trump Lawsuit Fallout

Apr 24, 2025 -

Nba Investigates Ja Morant Report Details New Probe

Apr 24, 2025

Nba Investigates Ja Morant Report Details New Probe

Apr 24, 2025 -

The Ritual Destruction Of The Popes Ring History Symbolism And The Case Of Pope Francis

Apr 24, 2025

The Ritual Destruction Of The Popes Ring History Symbolism And The Case Of Pope Francis

Apr 24, 2025