As Markets Swooned, Pros Sold—and Individuals Pounced: A Market Analysis

Table of Contents

Professional Investor Behavior During Market Downturns

Risk Mitigation Strategies

Professional investors, particularly institutional investors and hedge funds, employ sophisticated risk mitigation strategies during market downturns. These strategies are designed to protect capital and minimize losses, prioritizing preservation of principal over short-term gains. Common strategies include:

- Hedging: Utilizing financial instruments like options or futures contracts to offset potential losses in other investments.

- Diversification: Maintaining a well-diversified portfolio across different asset classes (stocks, bonds, real estate, commodities) to reduce exposure to any single market sector.

- Reducing Leverage: Decreasing the use of borrowed funds to reduce the impact of market declines on overall portfolio value.

- Increasing Cash Positions: Shifting a greater proportion of assets into cash or highly liquid instruments to capitalize on potential buying opportunities later.

The rationale behind these strategies rests on a strong emphasis on risk aversion and capital preservation. Professionals often utilize sophisticated models to assess risk and volatility, using indicators like the VIX (Volatility Index) to gauge market sentiment and potential for further declines. For instance, during periods of heightened uncertainty, large institutional investors might significantly reduce their equity holdings and increase their cash reserves, waiting for a clearer market picture before redeploying capital.

The Role of Sentiment Analysis and Predictive Modeling

Professional investors heavily rely on sentiment analysis and predictive modeling to inform their investment decisions. Sentiment analysis involves gauging market mood through news articles, social media trends, and investor surveys. Predictive models, frequently quantitative in nature, use historical data and various economic indicators to forecast future market movements.

These models incorporate a wide range of quantitative and qualitative data, including:

- Economic indicators: GDP growth, inflation rates, interest rates, unemployment figures.

- Company fundamentals: Earnings reports, revenue projections, debt levels, and industry trends.

- Market data: Stock prices, trading volumes, and market capitalization.

While these models aren’t always perfectly accurate, they can provide valuable insights and help professionals adjust their portfolios proactively. The success or failure of these predictions can significantly impact investment strategies, demonstrating the importance of sophisticated analysis in navigating market volatility.

Individual Investor Behavior During Market Dowturns

Emotional Responses to Market Volatility

Unlike professional investors, individual investors are often more susceptible to emotional responses during market downturns. Psychological biases play a significant role, leading to decisions driven by fear, greed, herd mentality, and confirmation bias.

- Fear: Panic selling can occur when investors react emotionally to market declines, selling assets at potentially significant losses.

- Greed: The desire for quick profits can lead to impulsive buying of overvalued assets, increasing the risk of substantial losses.

- Herd Mentality: Following the actions of others without independent analysis, often exacerbating market swings.

- Confirmation Bias: Seeking out information that confirms pre-existing beliefs, ignoring contradictory evidence and increasing risk.

News media and social media further amplify these emotional responses, often spreading misinformation and contributing to market instability. Sensational headlines and social media chatter can trigger impulsive buying or selling decisions, often exacerbating market volatility.

Opportunities Sought by Individual Investors

Despite the risks, some individual investors view market downturns as buying opportunities. This perspective often stems from the concept of "value investing," which involves identifying undervalued assets with the potential for significant appreciation once market conditions improve.

- Value Investing: This strategy focuses on buying assets trading below their intrinsic value, betting on a future price recovery.

- Sector-Specific Opportunities: Certain sectors may become more attractive during downturns. For instance, defensive sectors like consumer staples often perform relatively better during economic uncertainty.

During a downturn, individual investors might seek opportunities in companies with strong fundamentals but temporarily depressed stock prices, hoping to profit from a price rebound. This requires a long-term perspective and a strong understanding of fundamental analysis.

Analyzing the Discrepancy in Investment Approaches

Comparing Professional vs. Individual Investor Strategies

The contrasting approaches of professional and individual investors during market downturns are stark. Professionals prioritize risk mitigation and data-driven decision-making, while individuals are more prone to emotional reactions and often lack the resources for sophisticated analysis.

[Insert chart/graph here comparing average portfolio allocations of professional and individual investors during a market downturn. For example, show a higher cash allocation for professionals vs. a higher equity allocation for individuals during a downturn.]

This visual representation highlights the differing risk tolerance and investment strategies between the two groups. Professionals are typically more prepared for downturns and better equipped to navigate them effectively.

The Impact on Market Dynamics

The contrasting investment behaviors of professionals and individuals significantly influence market dynamics. The selling pressure from individual investors during panic periods can exacerbate market declines, while professional buying during downturns can help to stabilize markets and create buying opportunities. Market liquidity also plays a crucial role; during periods of low liquidity, the actions of a few large players can have a disproportionate impact on prices. The short-term consequences can be dramatic price swings, while long-term effects can shape market trends for months or even years to come.

Conclusion: Key Takeaways and Call to Action

This analysis of "As Markets Swooned, Pros Sold—and Individuals Pounced" highlights the significant differences in how professional and individual investors react to market downturns. Professionals employ sophisticated risk management strategies, leveraging data and predictive models, while individual investors are often driven by emotion and susceptible to psychological biases. These contrasting approaches have a substantial impact on market dynamics, shaping both short-term volatility and long-term trends. Understanding these dynamics is crucial for navigating future market fluctuations. The implications underscore the importance of developing a well-defined investment strategy and, if needed, seeking professional financial guidance to make informed decisions and manage risk effectively. Consider seeking professional financial advice to navigate future market volatility effectively, understanding the nuances of "As Markets Swooned, Pros Sold—and Individuals Pounced" to build a more resilient investment portfolio.

Featured Posts

-

Le Bron Jamess Comments Following Richard Jeffersons Espn Appearance

Apr 28, 2025

Le Bron Jamess Comments Following Richard Jeffersons Espn Appearance

Apr 28, 2025 -

Bubba Wallace Suffers Brake Failure Crashes At Phoenix Raceway

Apr 28, 2025

Bubba Wallace Suffers Brake Failure Crashes At Phoenix Raceway

Apr 28, 2025 -

Profitable Prop Bets For The 2025 Nascar Jack Link 500 At Talladega

Apr 28, 2025

Profitable Prop Bets For The 2025 Nascar Jack Link 500 At Talladega

Apr 28, 2025 -

Redick Weighs In Espns Move On Richard Jefferson

Apr 28, 2025

Redick Weighs In Espns Move On Richard Jefferson

Apr 28, 2025 -

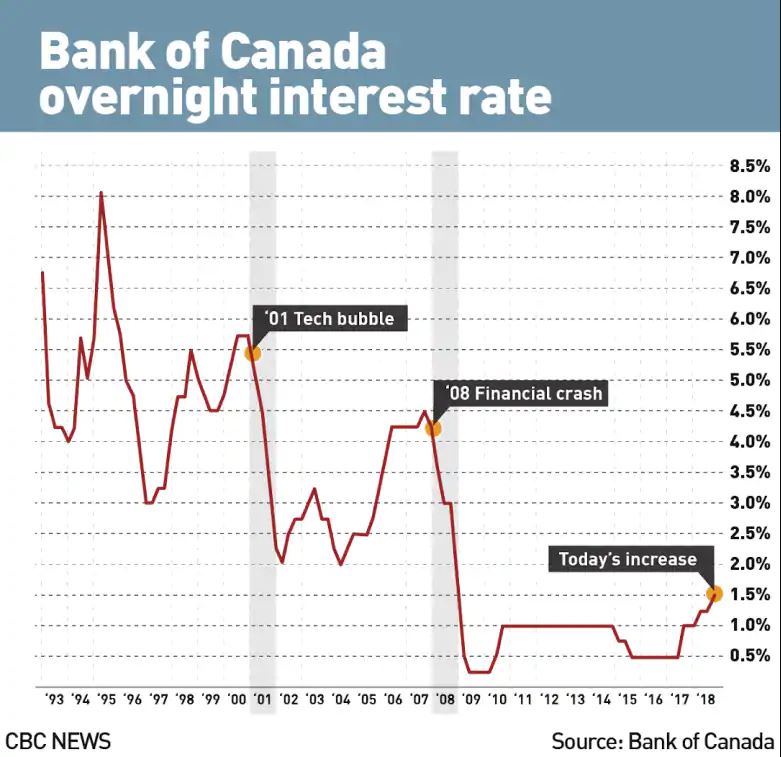

The Grim Truth About Retail Implications For Bank Of Canada Interest Rates

Apr 28, 2025

The Grim Truth About Retail Implications For Bank Of Canada Interest Rates

Apr 28, 2025