The Grim Truth About Retail: Implications For Bank Of Canada Interest Rates

Table of Contents

Weakening Retail Sales and Economic Slowdown

Declining retail sales often serve as a leading indicator of a broader economic slowdown. When consumers reduce spending, it signals a decrease in overall demand, impacting businesses across various sectors. This ripple effect can lead to job losses, reduced investment, and ultimately, a contraction in economic activity. Recent data paints a concerning picture. Beyond the July drop, year-over-year growth in retail sales has consistently lagged behind expectations, indicating a persistent weakening in consumer spending.

- Impact of inflation on consumer spending: High inflation erodes purchasing power, forcing consumers to cut back on non-essential purchases.

- Shifting consumer preferences and spending habits: The rise of e-commerce and changing lifestyle choices are reshaping the retail landscape, impacting traditional brick-and-mortar stores.

- The role of e-commerce in the changing retail landscape: While online shopping offers convenience, it also increases competition and puts pressure on traditional retailers' profit margins.

- Increased competition and business closures: The combination of inflation, shifting consumer habits, and increased competition is leading to increased business closures and job losses in the retail sector.

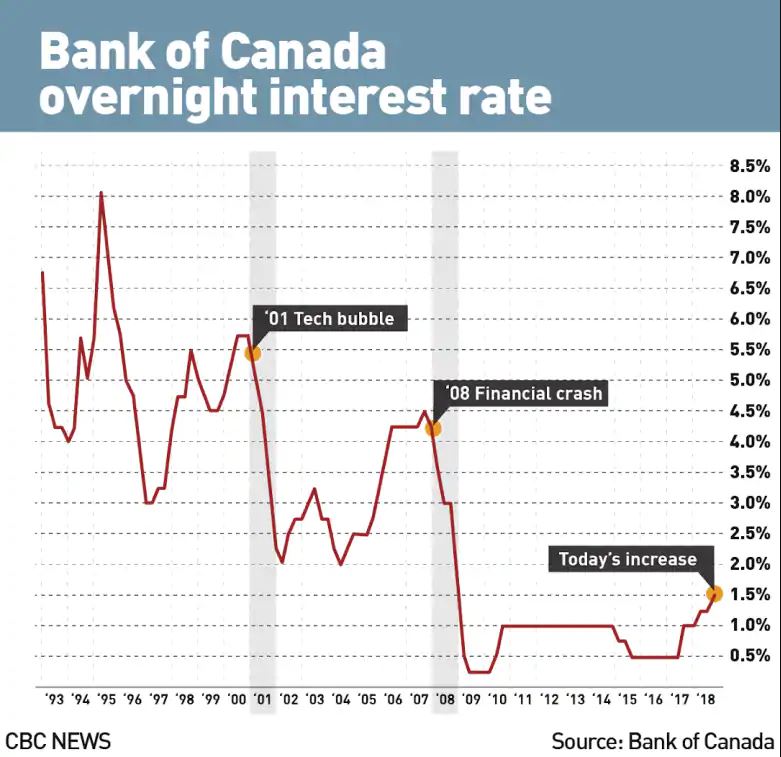

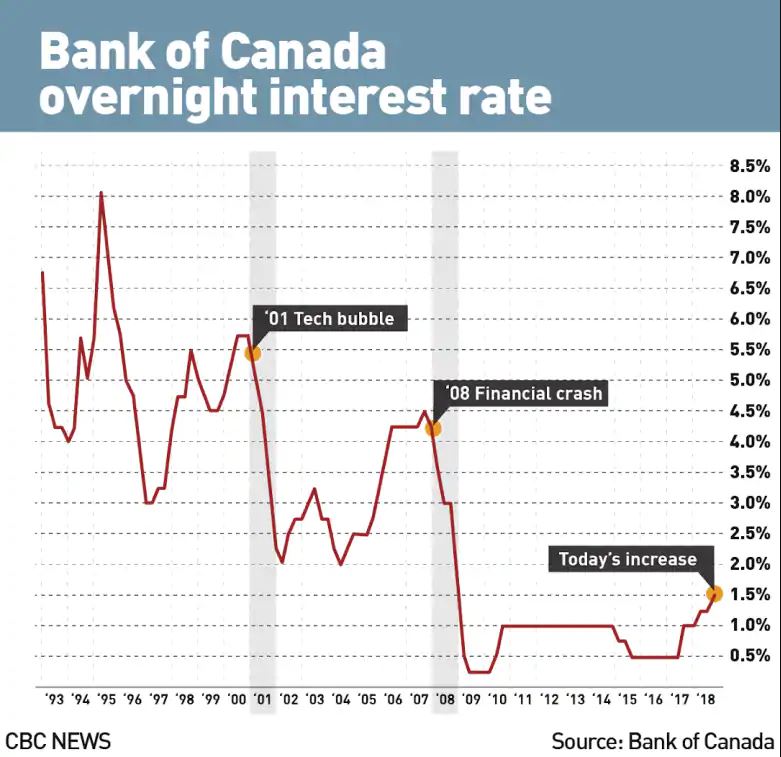

Bank of Canada's Response to Retail Weakness

The Bank of Canada's primary mandate is to maintain price stability and full employment. Retail sales data, as a key indicator of consumer spending and overall economic health, plays a significant role in its monetary policy decisions. Weak retail sales might prompt the Bank to lower interest rates to stimulate economic growth and boost consumer confidence. Lower interest rates can encourage borrowing and spending, thereby potentially revitalizing the retail sector.

- The transmission mechanism of interest rate changes on the retail sector: Lower interest rates reduce borrowing costs for businesses and consumers, potentially leading to increased investment and spending.

- Potential impact of lower rates on consumer borrowing and spending: Easier access to credit and lower borrowing costs can incentivize consumers to increase spending, benefiting the retail sector.

- Risks associated with lowering interest rates (e.g., inflation): Lowering interest rates too aggressively can fuel inflation if demand outpaces supply. This delicate balance requires careful consideration by the Bank of Canada.

- Alternative policy tools the Bank of Canada might employ: Besides interest rate adjustments, the Bank may consider quantitative easing or other unconventional monetary policy tools to stimulate the economy.

The Impact of Interest Rates on Retail Businesses

Interest rate changes significantly impact retail businesses, particularly their borrowing costs and investment decisions. Higher interest rates increase the cost of borrowing for inventory financing, expansion projects, and other operational needs. Businesses with high debt levels are particularly vulnerable to rising interest rates, as their debt servicing costs increase, squeezing profit margins.

- Impact on inventory financing: Increased borrowing costs for inventory can reduce a retailer's ability to stock shelves adequately, potentially leading to lost sales.

- Effect on expansion plans and hiring: Higher interest rates can discourage retailers from expanding their operations or hiring new employees, hindering growth.

- Increased pressure on profit margins: Rising borrowing costs and reduced consumer spending create a double whammy, significantly impacting retail businesses' profit margins.

- Potential for bankruptcies and business closures: Businesses unable to manage higher debt servicing costs or adapt to reduced consumer spending may face bankruptcy or closure.

Analyzing Consumer Behavior in a High-Interest Rate Environment

Interest rate hikes significantly impact consumer behavior, leading to adjustments in spending habits. Higher interest rates increase borrowing costs for mortgages, auto loans, and credit cards, reducing disposable income and impacting consumer spending. This effect is more pronounced among lower-income households, who are more sensitive to interest rate changes.

- Increased savings rates: Consumers may increase their savings rates to offset the increased cost of borrowing and protect their financial stability.

- Reduced discretionary spending: Consumers may cut back on non-essential purchases, focusing on necessities.

- Shift towards cheaper alternatives: Consumers may opt for cheaper alternatives or discount retailers to stretch their budgets.

- Changes in borrowing patterns (e.g., credit card usage): Consumers may reduce their reliance on credit cards to avoid accumulating high-interest debt.

Conclusion: Understanding the Interplay Between Retail and Bank of Canada Interest Rates

The retail sector plays a vital role in the Canadian economy, and its health significantly influences the Bank of Canada's interest rate decisions. Weakening retail sales signal a broader economic slowdown, potentially prompting the Bank to lower interest rates to stimulate growth. Conversely, rising interest rates can negatively impact retail businesses and consumer spending. Monitoring retail sales data and interest rate announcements is crucial for businesses and consumers alike to navigate this complex interplay effectively. Stay informed about the grim truth about retail and its implications for Bank of Canada interest rates by subscribing to reputable financial news sources and following key economic indicators. Further research into Canadian monetary policy and retail trends will provide a deeper understanding of this critical relationship.

Featured Posts

-

Access To Birth Control The Impact Of Over The Counter Availability Post Roe

Apr 28, 2025

Access To Birth Control The Impact Of Over The Counter Availability Post Roe

Apr 28, 2025 -

Final Mets Rotation Spot What Young Starter Needs To Do

Apr 28, 2025

Final Mets Rotation Spot What Young Starter Needs To Do

Apr 28, 2025 -

Bubba Wallace Suffers Brake Failure Crashes At Phoenix Raceway

Apr 28, 2025

Bubba Wallace Suffers Brake Failure Crashes At Phoenix Raceway

Apr 28, 2025 -

Trumps Time Interview Analysis Of His Views On Canada Xi And Presidential Term Loopholes

Apr 28, 2025

Trumps Time Interview Analysis Of His Views On Canada Xi And Presidential Term Loopholes

Apr 28, 2025 -

Fn Abwzby 2024 Brnamj Shaml Wfealyat Mmyzt

Apr 28, 2025

Fn Abwzby 2024 Brnamj Shaml Wfealyat Mmyzt

Apr 28, 2025