April 24, 2024: In-Depth Oil Market News And Analysis

Table of Contents

Global Crude Oil Price Movements on April 24, 2024

April 24th, 2024, saw considerable fluctuation in global crude oil prices. Let's examine the benchmark crudes:

- Brent Crude: Opened at $85.50 per barrel, reached a high of $87.20, experienced a low of $84.80, and closed at $86.70. This represents a 1.2% increase compared to the previous day and a 3.5% increase compared to the previous week.

- WTI Crude: Opened at $82.00 per barrel, reached a high of $83.80, saw a low of $81.20, and closed at $83.50. This represents a 1.5% increase from the previous day and a 4.0% increase from the previous week.

This price surge can be attributed to several factors:

- Increased geopolitical risk: The escalating situation in the Middle East created uncertainty about future oil supplies, prompting investors to buy more crude oil, thus driving up prices. This highlights the significant impact of geopolitical risk on oil price volatility.

- Stronger-than-expected demand: Positive economic indicators from major oil-consuming nations suggested a surge in oil demand, further contributing to the price increase. This emphasizes the correlation between oil demand and economic growth.

- OPEC+ production decisions (discussed below): The decisions made by OPEC+ regarding oil production quotas significantly impacted the global supply and influenced price movements.

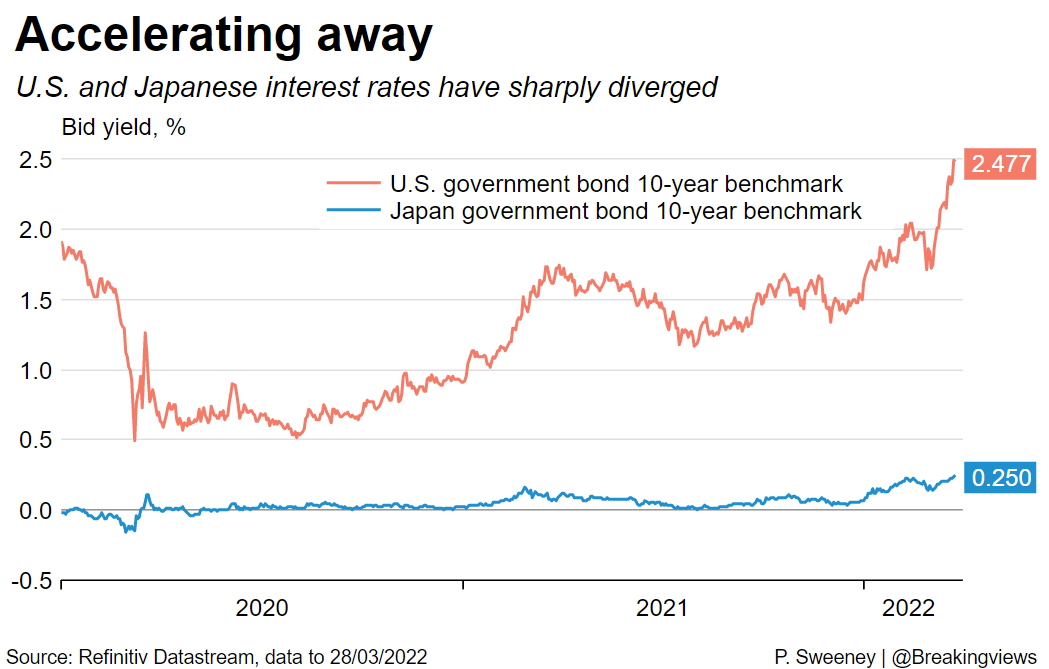

[Insert a chart or graph visualizing Brent and WTI crude oil price movements on April 24, 2024, here.]

OPEC+ Influence and Production Decisions

The OPEC+ meeting preceding April 24th, 2024, resulted in a decision to maintain current production levels. While some members advocated for a production increase to meet rising demand, others, citing economic uncertainty, preferred to remain cautious. This internal disagreement within OPEC+ contributed to the overall uncertainty in the oil market. The decision to maintain production, although expected by some analysts, nonetheless impacted the crude oil price chart significantly. The lack of an increase in oil production helped support the price increases seen on April 24th. This decision underlines OPEC+'s ongoing influence on oil supply and global oil prices. Further analysis of the OPEC meeting minutes and press releases would be necessary for a more complete understanding of the nuances of this decision.

Geopolitical Factors Affecting Oil Prices

Geopolitical instability in the Middle East played a dominant role in shaping oil prices on April 24th, 2024. The ongoing conflict and associated sanctions resulted in concerns about potential disruptions to oil supply from the region. Specifically, concerns regarding potential disruptions to oil transportation through key shipping lanes in the region played a major part in the price increase. Russia's continued involvement in global oil markets also remains a key geopolitical factor impacting global oil prices and oil supply. The potential for further escalation in the Middle East presents a significant geopolitical risk, capable of triggering substantial oil price volatility in the future.

Economic Indicators and Their Impact on Oil Demand

Positive economic data released before April 24th, 2024, particularly from major oil-consuming countries like the US and China, indicated strong economic growth. This boosted expectations for increased oil demand, contributing to the upward pressure on prices. Growing global GDP and robust industrial activity signaled a rise in energy consumption and, consequently, higher oil demand. Conversely, rising inflation rates and increasing interest rates could potentially dampen economic growth and reduce oil demand in the future. The interplay of these economic indicators will continue to shape the future of oil demand and its impact on global oil prices.

Conclusion: Understanding the April 24, 2024 Oil Market Landscape and Looking Ahead

The oil market on April 24th, 2024, was characterized by increased crude oil prices, driven primarily by geopolitical tensions, OPEC+ production decisions, and strong economic indicators suggesting higher oil demand. Brent and WTI crude oil prices experienced notable increases, reflecting these influencing factors. The short-term outlook remains uncertain, with the potential for further price volatility contingent on the evolution of the geopolitical situation and economic growth. For a more detailed oil price forecast, close monitoring of these factors is crucial. Stay informed about the latest oil market news and subscribe for regular updates on oil market analysis to remain well-equipped to navigate the complexities of the oil market. Understanding the interplay between geopolitical risk, OPEC+ decisions, and economic indicators is vital for accurately predicting oil prices.

Featured Posts

-

Kot Kellog V Kieve Vizit 20 Fevralya I Ego Znachenie

Apr 25, 2025

Kot Kellog V Kieve Vizit 20 Fevralya I Ego Znachenie

Apr 25, 2025 -

Japan Bond Market Swap Data Signals Continued Foreign Investment And Yield Rise

Apr 25, 2025

Japan Bond Market Swap Data Signals Continued Foreign Investment And Yield Rise

Apr 25, 2025 -

Walton Goggins Cultured Photo In Fluoro Speedos A Fashion Leading Man

Apr 25, 2025

Walton Goggins Cultured Photo In Fluoro Speedos A Fashion Leading Man

Apr 25, 2025 -

Find County Durhams Best Hairdresser 2025 Northern Echo

Apr 25, 2025

Find County Durhams Best Hairdresser 2025 Northern Echo

Apr 25, 2025 -

Ftc Launches Investigation Into Open Ai And Chat Gpt

Apr 25, 2025

Ftc Launches Investigation Into Open Ai And Chat Gpt

Apr 25, 2025