Japan Bond Market: Swap Data Signals Continued Foreign Investment And Yield Rise

Table of Contents

Rising Yields in the Japan Bond Market: A Deep Dive

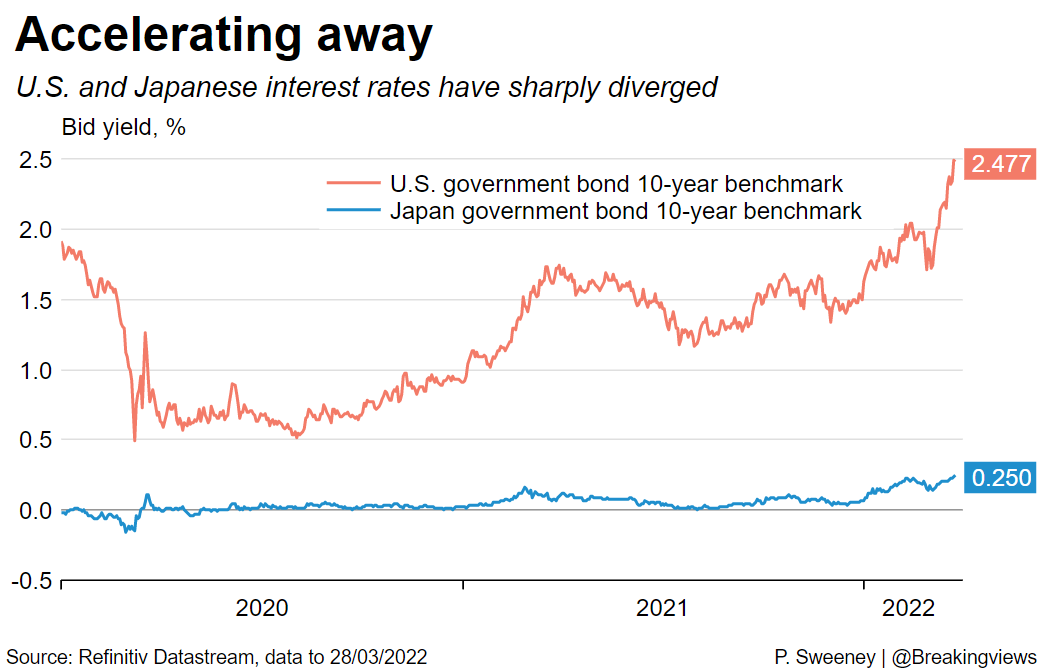

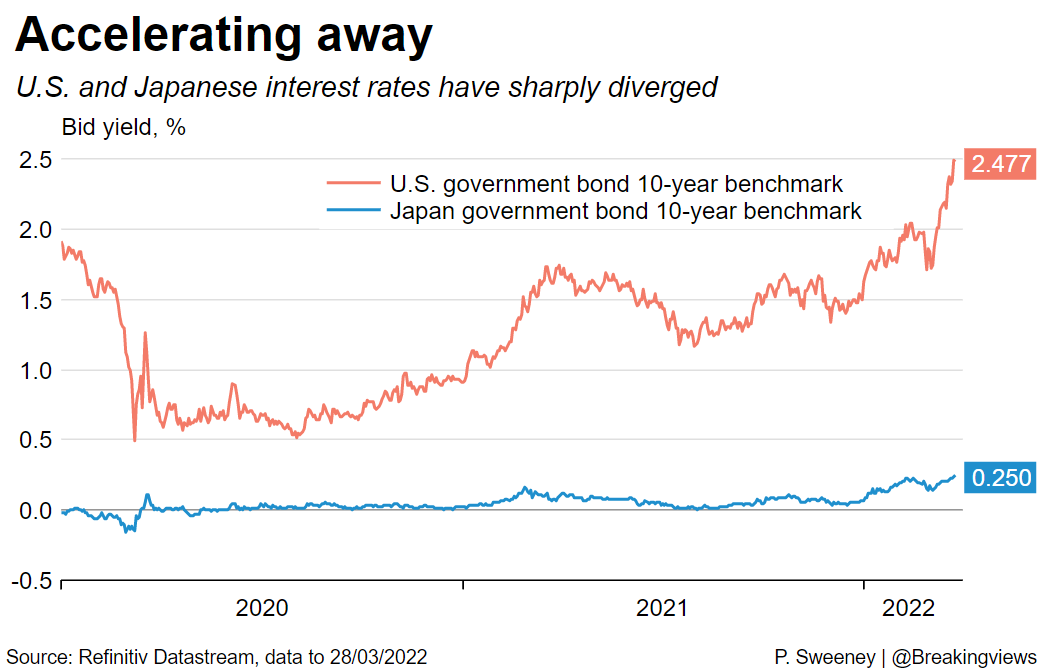

The yield curve for Japanese Government Bonds (JGBs) has been steepening, signaling a notable increase in JGB yields. Several factors contribute to this phenomenon. Understanding these factors is crucial to grasping the broader dynamics of the Japan bond market.

-

The Bank of Japan's (BOJ) Monetary Policy: For years, the BOJ maintained a policy of yield curve control, aiming to keep long-term JGB yields near zero. However, recent adjustments to this policy, including a widening of the yield band, have allowed yields to rise. This shift reflects a gradual move away from ultra-loose monetary policy, influenced by persistent, albeit moderate, inflationary pressures.

-

Inflation's Impact: While Japan's inflation remains relatively low compared to other developed nations, it is steadily climbing, exceeding the BOJ's target. This inflationary pressure puts upward pressure on JGB yields, as investors demand higher returns to compensate for the erosion of purchasing power.

-

Global Interest Rate Hikes: The global trend of rising interest rates, primarily driven by central banks in the US and Europe combating inflation, has indirectly impacted JGB yields. Investors are seeking higher returns globally, potentially leading to some capital outflow from JGBs, although this effect has been limited so far.

(Insert Chart/Graph illustrating the JGB yield curve changes over the past year)

Foreign Investment in Japanese Government Bonds: Sustained Interest Despite Higher Yields

Despite the rise in JGB yields, foreign investment in Japanese government bonds remains robust. This sustained interest is driven by several key factors:

-

Safe-Haven Status: JGBs are widely considered a safe-haven asset, particularly during times of global economic uncertainty. Their low default risk makes them attractive to risk-averse investors.

-

Relative Value: Even with the recent yield increases, JGBs often offer a relatively attractive yield compared to other government bonds in developed markets, especially considering the yen's exchange rate.

-

Global Portfolio Diversification: Many international investors incorporate JGBs into their portfolios as a means of diversification, reducing overall portfolio risk. The low correlation between JGB returns and those of other asset classes makes them valuable for risk management.

(Insert Data/Graph illustrating foreign holdings of JGBs over time)

- Yen Exchange Rate: Fluctuations in the yen's exchange rate significantly influence the attractiveness of JGBs to foreign investors. A weaker yen can boost returns for foreign investors when converted back to their home currencies.

The Role of Swap Data in Understanding Market Dynamics

Swap data provides invaluable insights into the Japan bond market. Interest rate swaps, where two parties exchange fixed and floating interest rate payments, are a powerful tool for gauging market sentiment and predicting future yield movements.

-

Interest Rate Swaps and JGBs: Swap rates reflect market expectations for future interest rates. Changes in swap rates can therefore anticipate shifts in JGB yields before they materialize in the cash market.

-

Predicting Yield Movements: By analyzing swap data, market participants can gain a better understanding of the future trajectory of JGB yields. This information is crucial for making informed investment decisions.

-

Correlation with JGB Futures: Swap rates often exhibit a strong correlation with JGB futures prices, providing further confirmation of market sentiment and future yield expectations.

Implications for the Japanese Economy

The interplay of rising JGB yields and sustained foreign investment has significant implications for the Japanese economy:

-

Government Borrowing Costs: Higher JGB yields increase the cost of borrowing for the Japanese government, potentially impacting its fiscal policy and spending plans.

-

Domestic Investment and Consumption: Rising interest rates can dampen domestic investment and consumption, impacting overall economic growth.

-

Yen Exchange Rate: The combination of rising yields and foreign investment can influence the yen's exchange rate, affecting the competitiveness of Japanese exports and imports.

Conclusion

The Japan bond market is dynamic and complex. Recent data reveals a compelling narrative: rising JGB yields are not deterring foreign investment. Swap data serves as a critical leading indicator, revealing market expectations and guiding future investment strategies. Understanding the interplay between JGB yields, foreign investment, and the BOJ's monetary policy is essential for navigating this evolving market. Stay informed about the dynamic shifts in the Japan bond market. Follow our analysis for continued insights into the interplay of JGB yields, foreign investment, and the overall health of the Japan bond market. Subscribe to our newsletter for regular updates on the Japan bond market and deepen your understanding of this crucial sector.

Featured Posts

-

Ashton Jeanty Trade The Price For A Chiefs Run Game Upgrade

Apr 25, 2025

Ashton Jeanty Trade The Price For A Chiefs Run Game Upgrade

Apr 25, 2025 -

Matthew Golden A First Round Option For The Dallas Cowboys

Apr 25, 2025

Matthew Golden A First Round Option For The Dallas Cowboys

Apr 25, 2025 -

More Than Bmw And Porsche Western Automakers Struggle In China

Apr 25, 2025

More Than Bmw And Porsche Western Automakers Struggle In China

Apr 25, 2025 -

Behind The Uks Eurovision Bid A Focus Beyond The Scoreboard

Apr 25, 2025

Behind The Uks Eurovision Bid A Focus Beyond The Scoreboard

Apr 25, 2025 -

March Concert Lineup Okc Buy Tickets Now For Top Shows

Apr 25, 2025

March Concert Lineup Okc Buy Tickets Now For Top Shows

Apr 25, 2025