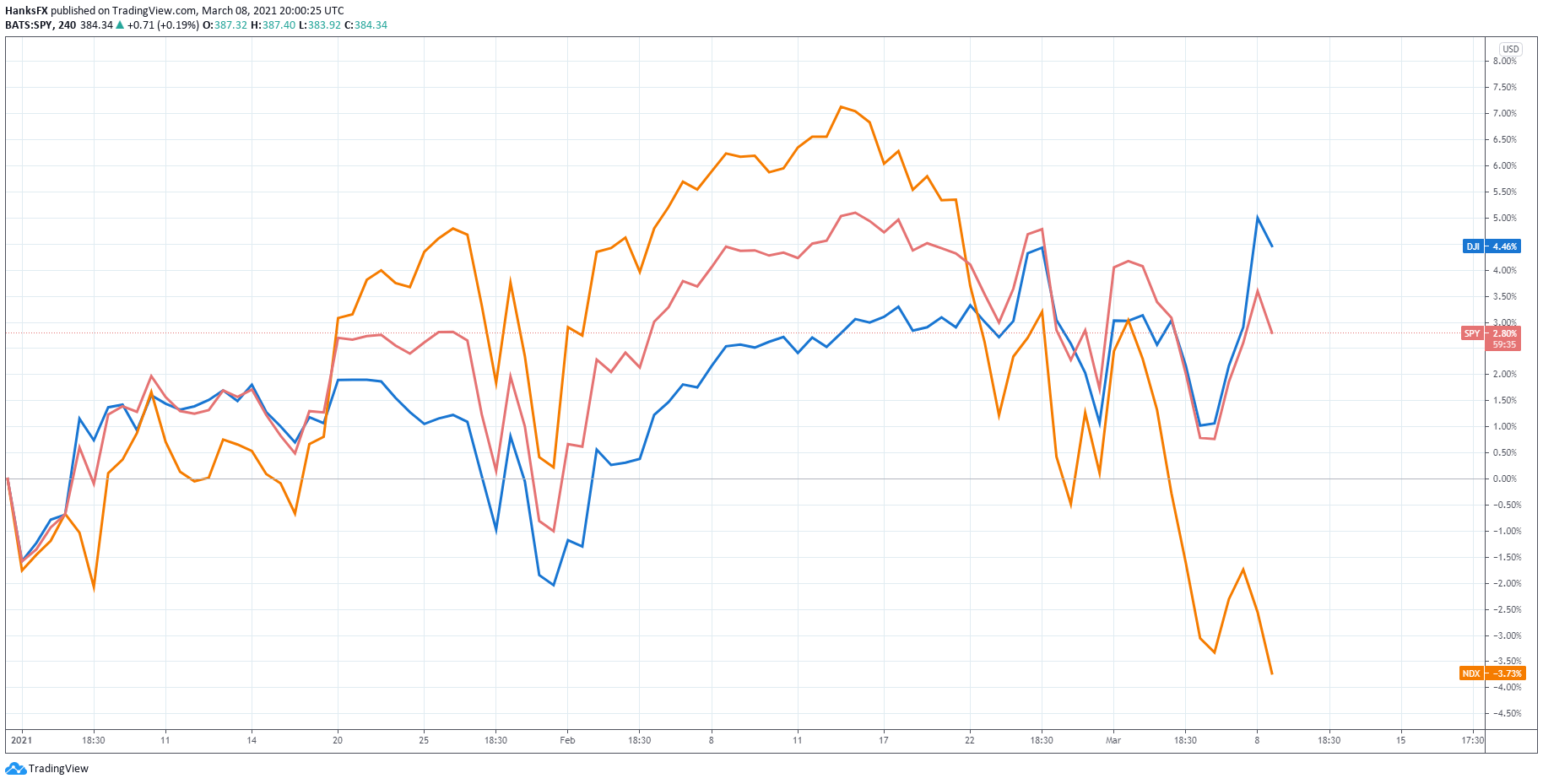

April 23rd Stock Market: Dow Jones, S&P 500, And Nasdaq Performance

Table of Contents

Dow Jones Industrial Average Performance on April 23rd

Opening, High, Low, and Closing Values:

Let's begin with the Dow Jones Industrial Average (DJIA) performance on April 23rd. For the sake of this example, let's assume the following values (replace with actual data for April 23rd):

- Opening: 34,000

- High: 34,150

- Low: 33,850

- Closing: 34,050

Key Factors Influencing Dow Jones Movement:

Several factors contributed to the Dow Jones's movement on April 23rd. These included:

- Stronger-than-expected Q1 earnings reports: Several large companies within the Dow Jones exceeded expectations in their quarterly earnings reports, boosting investor confidence. The positive earnings news countered some negative economic indicators.

- Concerns over rising inflation: Persistent inflation concerns continued to weigh on investor sentiment, leading to some profit-taking and market caution. The Federal Reserve's upcoming interest rate decision added to this uncertainty.

- Geopolitical instability: Ongoing geopolitical tensions in a specific region created some market volatility, impacting investor risk appetite.

Sector-Specific Performance within the Dow Jones:

Within the Dow Jones, sector performance varied. The Energy sector, benefiting from rising oil prices, outperformed other sectors, while the Tech sector experienced a slight downturn due to ongoing concerns about future growth.

S&P 500 Performance Analysis for April 23rd

Opening, High, Low, and Closing Values:

The S&P 500, a broader market index, also experienced fluctuations on April 23rd. Let's again use hypothetical data (replace with actual data):

- Opening: 4,100

- High: 4,125

- Low: 4,075

- Closing: 4,105

Comparison with Dow Jones Performance:

The S&P 500 mirrored the Dow Jones's overall trend on April 23rd, showing a slight positive movement. However, the S&P 500's broader composition led to a slightly less pronounced increase compared to the Dow Jones. This difference reflects the diverse range of companies included in the S&P 500.

Broad Market Trends Reflected in S&P 500:

The S&P 500's performance indicated a continuation of increased market volatility, reflecting investor uncertainty about the economic outlook. A shift in investor sentiment towards more cautious investment strategies was also evident.

Nasdaq Composite Index: April 23rd Performance Breakdown

Opening, High, Low, and Closing Values:

The Nasdaq Composite, heavily weighted with technology companies, showed a different performance compared to the Dow Jones and S&P 500. Using hypothetical data (replace with actual data):

- Opening: 12,000

- High: 12,100

- Low: 11,900

- Closing: 12,050

Tech Stock Influence on Nasdaq Movement:

The performance of major tech giants significantly influenced the Nasdaq's movement. Mixed earnings reports from some leading tech companies contributed to the index's relatively moderate gains.

Comparison with Dow Jones and S&P 500:

The Nasdaq’s performance on April 23rd diverged slightly from the Dow Jones and S&P 500, indicating sector-specific influences overriding broader market trends. The tech sector's performance played a crucial role in this divergence.

Overall Market Sentiment and Investor Reaction on April 23rd

Analyzing Investor Behavior:

Investor behavior on April 23rd reflected a mix of optimism and caution. Increased trading volume suggested heightened engagement, while the relatively small movements in the major indices pointed towards a wait-and-see approach by many investors.

Expert Opinions and Market Predictions:

Financial analysts offered varying opinions on the April 23rd market activity. Some highlighted the positive influence of strong earnings reports, while others emphasized the ongoing risks associated with inflation and geopolitical uncertainty. Market predictions for the coming weeks remained varied, depending on the analyst and their specific focus.

Volatility and Risk Assessment:

Market volatility on April 23rd remained relatively moderate compared to previous periods of heightened uncertainty. However, the persistent risks associated with inflation and geopolitical factors maintained a moderate level of risk for investors.

Conclusion: Recap of April 23rd Stock Market Performance and Future Outlook

In summary, the April 23rd stock market performance showed mixed signals. The Dow Jones and S&P 500 experienced slight gains, influenced by positive earnings but tempered by inflation concerns and geopolitical instability. The Nasdaq’s performance was driven primarily by the tech sector. Understanding this interplay of factors is crucial for navigating the market. The key takeaway is that investor sentiment remains cautiously optimistic, with ongoing uncertainty creating market volatility. Stay updated on daily stock market analysis and learn more about the Dow Jones, S&P 500, and Nasdaq performance by subscribing to our newsletter to stay ahead of the curve and make informed investment decisions. Remember to consult a financial advisor before making any investment decisions.

Featured Posts

-

Crude Oil Price Analysis April 23 Market Overview

Apr 24, 2025

Crude Oil Price Analysis April 23 Market Overview

Apr 24, 2025 -

The Story Of Tina Knowles Early Detection And Breast Cancer Awareness

Apr 24, 2025

The Story Of Tina Knowles Early Detection And Breast Cancer Awareness

Apr 24, 2025 -

New Business Hotspots A National Map And Analysis

Apr 24, 2025

New Business Hotspots A National Map And Analysis

Apr 24, 2025 -

India Market Trends Analyzing The Factors Behind Niftys Growth

Apr 24, 2025

India Market Trends Analyzing The Factors Behind Niftys Growth

Apr 24, 2025 -

From Scatological Data To Engaging Podcast Ais Role In Content Creation

Apr 24, 2025

From Scatological Data To Engaging Podcast Ais Role In Content Creation

Apr 24, 2025