Analyzing Market Behavior: Professionals Vs. Individuals During Downturns

Table of Contents

Professional Investor Behavior During Downturns

Professional investors, with their expertise and resources, approach market downturns with calculated strategies rather than panic. Their behavior is characterized by a focus on risk management, opportunistic investment strategies, and data-driven decision-making.

Risk Assessment and Mitigation

Professionals employ sophisticated risk management techniques to protect their portfolios during market volatility. This includes:

- Utilizing advanced analytical tools and models: They leverage complex algorithms and statistical models to forecast market trends and assess potential risks. This includes scenario planning and stress testing to understand the potential impact of various economic shocks.

- Focusing on long-term investment strategies: Unlike many individual investors, professionals typically prioritize long-term growth over short-term gains. Their strategies are less susceptible to short-term market fluctuations. This often involves investing in fundamentally strong companies with a proven track record.

- Employing defensive strategies: This might include short selling (betting against the market), purchasing put options (insurance against price drops), or increasing their cash holdings to capitalize on future buying opportunities.

Opportunistic Investing

Downturns create opportunities for shrewd professional investors to acquire undervalued assets. They actively seek out:

- Companies with strong fundamentals despite temporary market setbacks: Professionals look beyond short-term market noise and identify companies with solid earnings, strong balance sheets, and a competitive advantage that are temporarily undervalued.

- Distressed asset sales and mergers & acquisitions: Economic downturns often lead to distressed sales, providing opportunities to acquire assets at significantly reduced prices. Similarly, M&A activity can be robust during downturns as larger firms look to consolidate.

- Employing value investing strategies: Value investors, a prominent group of professionals, focus on identifying stocks trading below their intrinsic value, believing the market has mispriced them.

Data-Driven Decision Making

Professional investors rely heavily on data analysis and market research to inform their decisions. Their approach includes:

- Utilizing macroeconomic indicators: They carefully monitor economic indicators such as inflation rates, interest rates, GDP growth, and unemployment figures to predict market trends and anticipate potential risks.

- Conducting thorough due diligence: Before making any investment, professionals conduct extensive research, analyzing financial statements, industry reports, and competitive landscapes.

- Monitoring portfolio performance closely and adjusting strategies accordingly: They continuously monitor their portfolios and adjust their strategies based on the latest market data and economic indicators. This ensures they remain adaptable to changing market conditions.

Individual Investor Behavior During Downturns

Individual investors often react differently to market downturns, frequently driven by emotion and a lack of sophisticated tools and knowledge.

Emotional Responses to Market Volatility

Market volatility often triggers emotional responses among individual investors, leading to impulsive decisions:

- Fear and panic selling: The fear of further losses often leads to panic selling, often at the worst possible time, locking in losses.

- Overreaction to negative news: Individuals may overreact to negative news headlines, making hasty decisions based on fear and speculation rather than rational analysis.

- Herd behavior: The tendency to follow the crowd can amplify losses, as investors mimic each other's actions, exacerbating market downturns.

Lack of Diversification

Many individual investors lack the diversification necessary to mitigate risk during a downturn:

- Concentration in specific sectors or stocks: Concentrating investments in a few sectors or stocks increases vulnerability to sector-specific downturns.

- Limited understanding of complex investment instruments: Individual investors may lack the knowledge and expertise to understand and utilize sophisticated investment tools for risk mitigation.

- Susceptibility to market manipulation and misinformation: Individual investors are more susceptible to market manipulation and misinformation, potentially leading to poor investment choices.

Short-Term Focus

A common trait among individual investors is a focus on short-term gains:

- Difficulty sticking to long-term investment plans: Market volatility can make it challenging for individuals to stick to their long-term investment plans.

- Chasing quick profits: The pursuit of quick profits can lead to risky investments and significant losses.

- Inability to withstand temporary market downturns: Individuals may be unprepared for temporary market downturns, leading to impulsive decisions and potentially irreversible losses.

Key Differences in Market Behavior

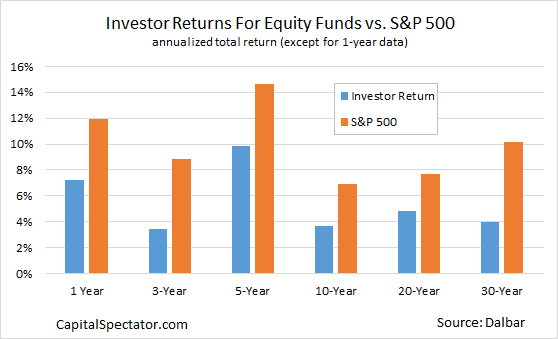

The differences in market behavior during downturns between professionals and individuals are striking:

Risk Tolerance

Professionals generally exhibit higher risk tolerance due to their expertise, diversified portfolios, and longer-term investment horizons.

Time Horizon

Professionals often adopt a longer-term perspective, focusing on long-term growth and weathering short-term market fluctuations. Individuals may be more short-sighted, focusing on immediate returns.

Information Access

Professionals have access to superior market intelligence, advanced analytical tools, and research resources unavailable to individual investors.

Emotional Control

Professionals are better equipped to manage emotional responses to market fluctuations, relying on data and analysis rather than gut feelings.

Conclusion

Analyzing market behavior during downturns reveals stark contrasts between professional and individual investors. Professionals leverage data-driven strategies, risk mitigation techniques, and a longer-term perspective to navigate economic uncertainty. Individuals, on the other hand, are often influenced by emotional responses, lack diversification, and focus on short-term gains. Understanding these differences is crucial for making informed investment decisions. By learning from the approaches of professional investors and adopting a more disciplined approach, individuals can improve their chances of navigating market volatility successfully and achieving their long-term financial goals. For further insights into effective strategies for managing your investments during market downturns, continue your research on analyzing market behavior during downturns.

Featured Posts

-

Abrz Mealm Fn Abwzby Fy Dwrth Alqadmt 19 Nwfmbr

Apr 28, 2025

Abrz Mealm Fn Abwzby Fy Dwrth Alqadmt 19 Nwfmbr

Apr 28, 2025 -

Market Volatility And Investor Behavior A Study Of Recent Trends

Apr 28, 2025

Market Volatility And Investor Behavior A Study Of Recent Trends

Apr 28, 2025 -

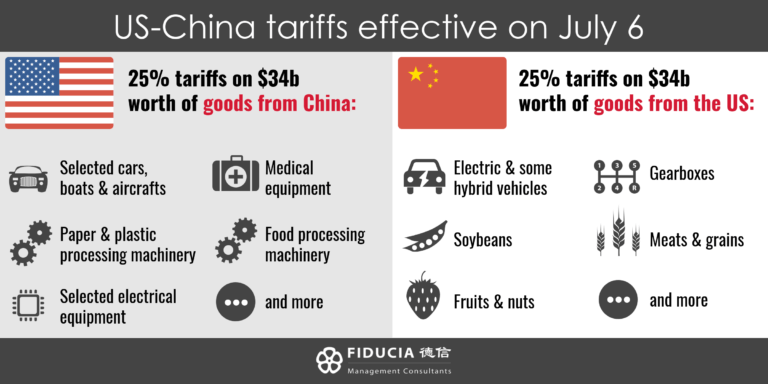

China Adjusts Tariffs Impact On Specific Us Imports

Apr 28, 2025

China Adjusts Tariffs Impact On Specific Us Imports

Apr 28, 2025 -

Why Are Gpu Prices Skyrocketing Again A Market Analysis

Apr 28, 2025

Why Are Gpu Prices Skyrocketing Again A Market Analysis

Apr 28, 2025 -

Bubba Wallace Misses Out On Martinsville Victory Last Lap Restart Analysis

Apr 28, 2025

Bubba Wallace Misses Out On Martinsville Victory Last Lap Restart Analysis

Apr 28, 2025