Market Volatility And Investor Behavior: A Study Of Recent Trends

Table of Contents

The stock market's inherent unpredictability, characterized by periods of significant market volatility, profoundly impacts investor behavior. Recent trends reveal fascinating insights into how investors react to these fluctuations, from panic selling to calculated risk-taking. This article explores the interplay between market volatility and investor behavior, examining recent trends and offering strategies for navigating turbulent times.

The Psychological Impact of Market Volatility on Investors

Market volatility triggers powerful emotional responses in investors, often leading to irrational decisions. Understanding these psychological factors is crucial for effective investment management.

Fear and Greed

The twin forces of fear and greed are primary drivers of investor behavior during volatile periods.

-

Fear-driven selling: When markets plummet, fear can lead to panic selling, causing investors to liquidate assets at a loss to avoid further potential declines. This often occurs at the worst possible time, exacerbating market downturns. The fear of missing out (FOMO) can also drive impulsive decisions.

-

Greed-fueled speculation: Conversely, periods of market growth can fuel greed, prompting investors to chase quick profits through speculative investments. This can lead to overexposure to risky assets and substantial losses when the market corrects. This is often seen in "bubble" markets.

-

Herding behavior: Investors often mimic the actions of others, creating a herd mentality. This can lead to market bubbles, where asset prices are driven far beyond their intrinsic value, followed by sharp corrections and crashes as investors simultaneously attempt to exit the market.

Cognitive Biases

Cognitive biases – systematic errors in thinking – further distort investment decisions during market volatility.

-

Confirmation bias: Investors may selectively seek information confirming their pre-existing beliefs, ignoring evidence that contradicts their views. This can lead to holding onto losing investments for too long or ignoring warning signs.

-

Anchoring bias: Investors tend to over-rely on the initial price or information they receive when making decisions. This can prevent them from objectively assessing current market conditions and making rational adjustments to their portfolio.

-

Availability heuristic: Investors overestimate the likelihood of recent events happening again. A recent market crash, for example, may lead investors to overestimate the probability of another crash in the near future.

Recent Trends in Investor Behavior During Volatility

Recent years have witnessed significant shifts in investor behavior driven by technological advancements and evolving market dynamics.

Increased Use of Technology and Data

The proliferation of trading platforms and access to real-time market data have profoundly affected investor behavior.

-

Algorithmic trading: Automated trading systems execute trades based on pre-programmed algorithms, often contributing to increased market volatility, especially during periods of uncertainty. High-frequency trading is a subset of this.

-

High-frequency trading (HFT): HFT firms execute a vast number of trades at incredibly high speeds, impacting market liquidity and potentially exacerbating short-term price fluctuations. The effect on long-term trends is a subject of ongoing debate.

-

Social media influence: Social media platforms have become significant channels for disseminating market news and opinions, influencing investor sentiment and potentially creating market bubbles or crashes based on viral trends and misinformation.

Shift Towards Passive Investing

Market uncertainty has fueled a shift towards passive investment strategies.

-

Lower fees: Passive investment vehicles like index funds and exchange-traded funds (ETFs) generally have lower expense ratios than actively managed funds.

-

Diversification: Passive investing inherently offers diversification across a broad range of assets, reducing the risk associated with individual stock selection.

-

Reduced emotional decision-making: Passive investing removes the emotional element of constant stock picking, helping investors avoid impulsive reactions to market volatility.

Strategies for Managing Market Volatility and Investor Behavior

Navigating market volatility requires a proactive approach encompassing diversification and robust risk management strategies.

Diversification

Diversification is key to mitigating risk and reducing the impact of market downturns.

-

Asset allocation: Carefully allocate assets across different investment classes, such as stocks, bonds, real estate, and commodities, to balance risk and return.

-

Geographic diversification: Spread investments across different countries to reduce exposure to country-specific risks.

-

Sector diversification: Diversify holdings across various economic sectors to mitigate the impact of sector-specific downturns.

Risk Management

Implementing effective risk management techniques is crucial for protecting your investment portfolio.

-

Stop-loss orders: Set stop-loss orders to automatically sell assets when they reach a predetermined price, limiting potential losses.

-

Dollar-cost averaging: Invest a fixed amount at regular intervals, regardless of market fluctuations, to reduce the impact of market timing.

-

Long-term investment horizon: Maintain a long-term investment perspective, recognizing that short-term market fluctuations are a normal part of the investment cycle. This allows you to ride out the volatility.

Conclusion

Market volatility significantly influences investor behavior, leading to both opportunities and challenges. Understanding the psychological impact of volatility, recognizing recent trends, and implementing effective risk management strategies are crucial for navigating the complexities of the market. By employing diversification, utilizing appropriate risk management techniques, and maintaining a long-term perspective, investors can improve their chances of success even amidst periods of significant market volatility. Learn more about effective strategies to manage your investments during periods of high market volatility; continue your research into stock market volatility and investor behavior today!

Featured Posts

-

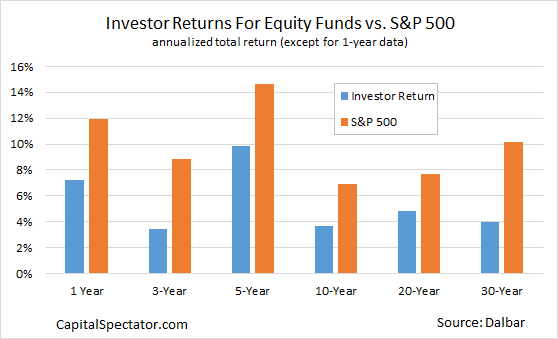

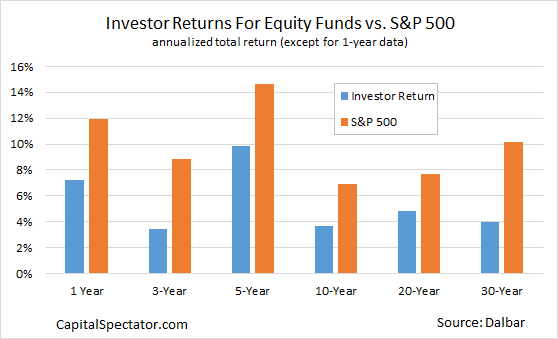

Profits And Losses A Comparative Look At Professional And Individual Investor Behavior During Market Corrections

Apr 28, 2025

Profits And Losses A Comparative Look At Professional And Individual Investor Behavior During Market Corrections

Apr 28, 2025 -

Aaron Judges Family Grows A New Baby Arrives

Apr 28, 2025

Aaron Judges Family Grows A New Baby Arrives

Apr 28, 2025 -

Aaron Judge Ties Babe Ruths Yankees Record A Historic Feat

Apr 28, 2025

Aaron Judge Ties Babe Ruths Yankees Record A Historic Feat

Apr 28, 2025 -

Mets Send Nunez To Syracuse Megill Back In Starting Rotation

Apr 28, 2025

Mets Send Nunez To Syracuse Megill Back In Starting Rotation

Apr 28, 2025 -

Luigi Mangione Understanding His Supporters Key Concerns

Apr 28, 2025

Luigi Mangione Understanding His Supporters Key Concerns

Apr 28, 2025