Analysis: Trump's Words And The US Stock Futures Market

Table of Contents

The Mechanism: How Trump's Words Affect Stock Futures

The impact of Trump's rhetoric on US stock futures is a complex interplay of psychology, media amplification, and algorithmic trading. Investors, constantly seeking to anticipate market movements, react emotionally to his statements. A sudden, unexpected policy shift, for example, creates uncertainty, prompting risk-averse investors to sell, driving down futures prices. Conversely, positive pronouncements can trigger a short-term surge in buying and a subsequent increase in futures values.

The 24/7 news cycle plays a crucial role in amplifying these reactions. Every statement, no matter how minor, is dissected and analyzed, often leading to exaggerated interpretations and further market volatility. This constant stream of information, fueled by speculation and media commentary, contributes to the rapid and sometimes unpredictable shifts in stock futures.

- Sudden policy announcements create uncertainty. Ambiguous language or incomplete information can lead to widespread speculation and market fluctuations.

- Controversial statements trigger sell-offs. Statements perceived as divisive or damaging to the economy often result in immediate drops in futures prices.

- Positive pronouncements can lead to short-term gains. Announcements of positive economic developments or policy changes can lead to temporary surges in stock futures.

- The 24/7 news cycle amplifies the impact of his words. Continuous media coverage and analysis exacerbate market reactions to Trump's pronouncements.

Algorithmic trading further accelerates these reactions. Computer programs designed to react instantaneously to news events can amplify the initial market response, leading to a rapid escalation or de-escalation of price fluctuations in the US stock futures market.

Case Studies: Analyzing Specific Events

Several specific events highlight the direct impact of Trump's words on US stock futures.

1. The Trade War with China: Trump's imposition of tariffs on Chinese goods, announced via tweets and press conferences, triggered significant volatility in the E-mini S&P 500 and Dow Jones Futures. Initially, uncertainty led to sell-offs, but subsequent negotiations and announcements occasionally resulted in temporary market rebounds. The overall impact, however, was a period of extended uncertainty and fluctuating futures prices. (Charts or graphs depicting these fluctuations would be included here).

2. Unexpected Policy Shifts: The announcement of unexpected policy changes, such as those related to the Federal Reserve's interest rate decisions, has also shown a clear correlation to stock market movement. Trump's public criticism or praise of the Fed's actions frequently translated into immediate reactions in the futures market. (Charts or graphs would be included here).

3. Controversial Tweets: Even seemingly insignificant tweets, particularly those concerning specific companies or industries, have occasionally caused significant shifts in related stock futures. For example, a tweet criticizing a particular company could trigger a sell-off in its futures contracts. (Charts or graphs would be included here).

Predicting Market Movements Based on Trump's Rhetoric?

While there's a clear correlation between Trump's pronouncements and market fluctuations, predicting stock futures movements solely based on his rhetoric is unreliable and extremely challenging. Market reactions are complex and multifaceted, influenced by a multitude of economic indicators, global events, and investor sentiment beyond just presidential statements.

- Market reactions are complex and multifaceted. Numerous factors influence market behavior, making it difficult to isolate the impact of Trump's words.

- Trump's words are only one factor among many. Economic data, geopolitical events, and investor confidence all play significant roles.

- Overreliance on his statements can lead to inaccurate predictions. Focusing solely on Trump's rhetoric risks overlooking other crucial market drivers.

- Fundamental economic data plays a crucial role. Strong economic indicators can mitigate the negative impact of negative statements, and vice-versa.

Diversifying investment strategies is crucial to mitigate risk and reduce exposure to the volatility stemming from unpredictable political events.

The Role of Uncertainty in Market Fluctuations

Unpredictable statements from Trump generate uncertainty and risk aversion in the market. This uncertainty impacts investor confidence, leading to decreased investment and increased market volatility as investors adjust their portfolios in response to the perceived level of risk. The lack of clarity surrounding future policy decisions or sudden shifts in direction can trigger a flight to safety, causing investors to move away from riskier assets, thereby influencing futures prices negatively.

Implications for Investors

Navigating the market volatility stemming from Trump's pronouncements requires a proactive and cautious approach.

- Diversification of investment portfolio. Spread investments across different asset classes to reduce exposure to political risk.

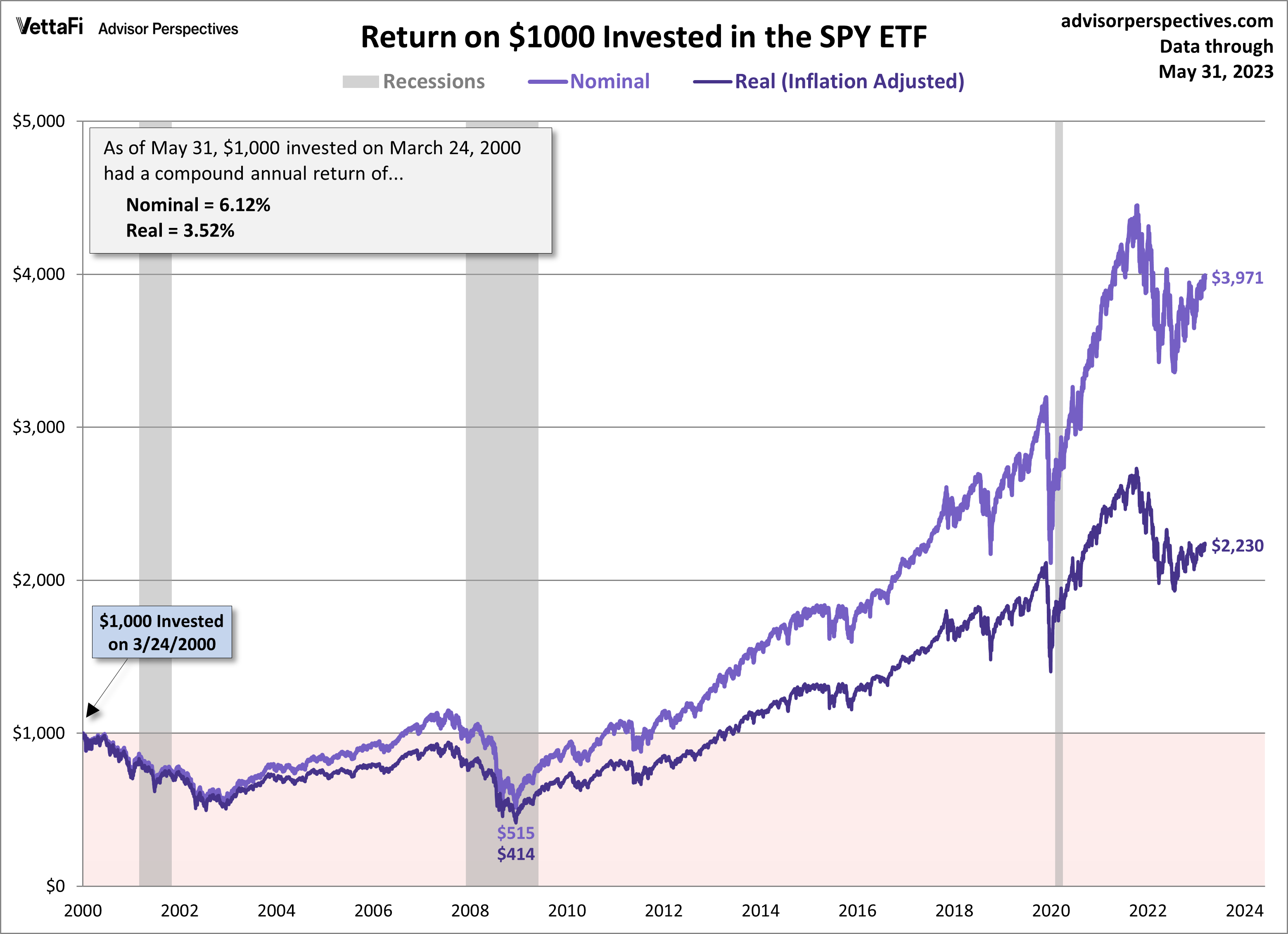

- Importance of long-term investment strategies. Focus on the long-term rather than reacting to short-term fluctuations.

- Careful analysis of market trends beyond Trump's rhetoric. Consider a wide range of economic indicators and global events when making investment decisions.

- Seeking professional financial advice. Consult with a qualified financial advisor to develop a personalized investment strategy.

Conclusion

This analysis demonstrates a clear correlation between Donald Trump's statements and fluctuations in the US stock futures market. While his words can significantly influence investor sentiment and market volatility in the short term, they are only one piece of a much larger puzzle. Successfully navigating the market requires a comprehensive understanding of broader economic trends and a diversified investment strategy. To mitigate risk and manage investments effectively during periods of uncertainty, investors should prioritize a long-term perspective, seek professional advice and remain informed about the complex interplay between political rhetoric and market dynamics.

Call to Action: To stay informed on the complex interplay between political rhetoric and the US stock futures market, continue following our analysis and gain insights into managing your investments effectively during periods of uncertainty driven by factors like Trump's pronouncements. Stay tuned for further updates on Trump's words and the US stock futures market.

Featured Posts

-

Gambling On Natural Disasters The Troubling Trend Of Betting On The Los Angeles Wildfires

Apr 24, 2025

Gambling On Natural Disasters The Troubling Trend Of Betting On The Los Angeles Wildfires

Apr 24, 2025 -

Stock Market Today Dow Jumps 1000 Points Nasdaq And S And P 500 Surge On Tariff Hopes

Apr 24, 2025

Stock Market Today Dow Jumps 1000 Points Nasdaq And S And P 500 Surge On Tariff Hopes

Apr 24, 2025 -

Nba Investigates Ja Morant Report Details New Probe

Apr 24, 2025

Nba Investigates Ja Morant Report Details New Probe

Apr 24, 2025 -

John Travolta Reassures Fans Following Controversial Family Home Photo

Apr 24, 2025

John Travolta Reassures Fans Following Controversial Family Home Photo

Apr 24, 2025 -

Future Of Utac Chip Tester A Chinese Buyout Firms Decision

Apr 24, 2025

Future Of Utac Chip Tester A Chinese Buyout Firms Decision

Apr 24, 2025