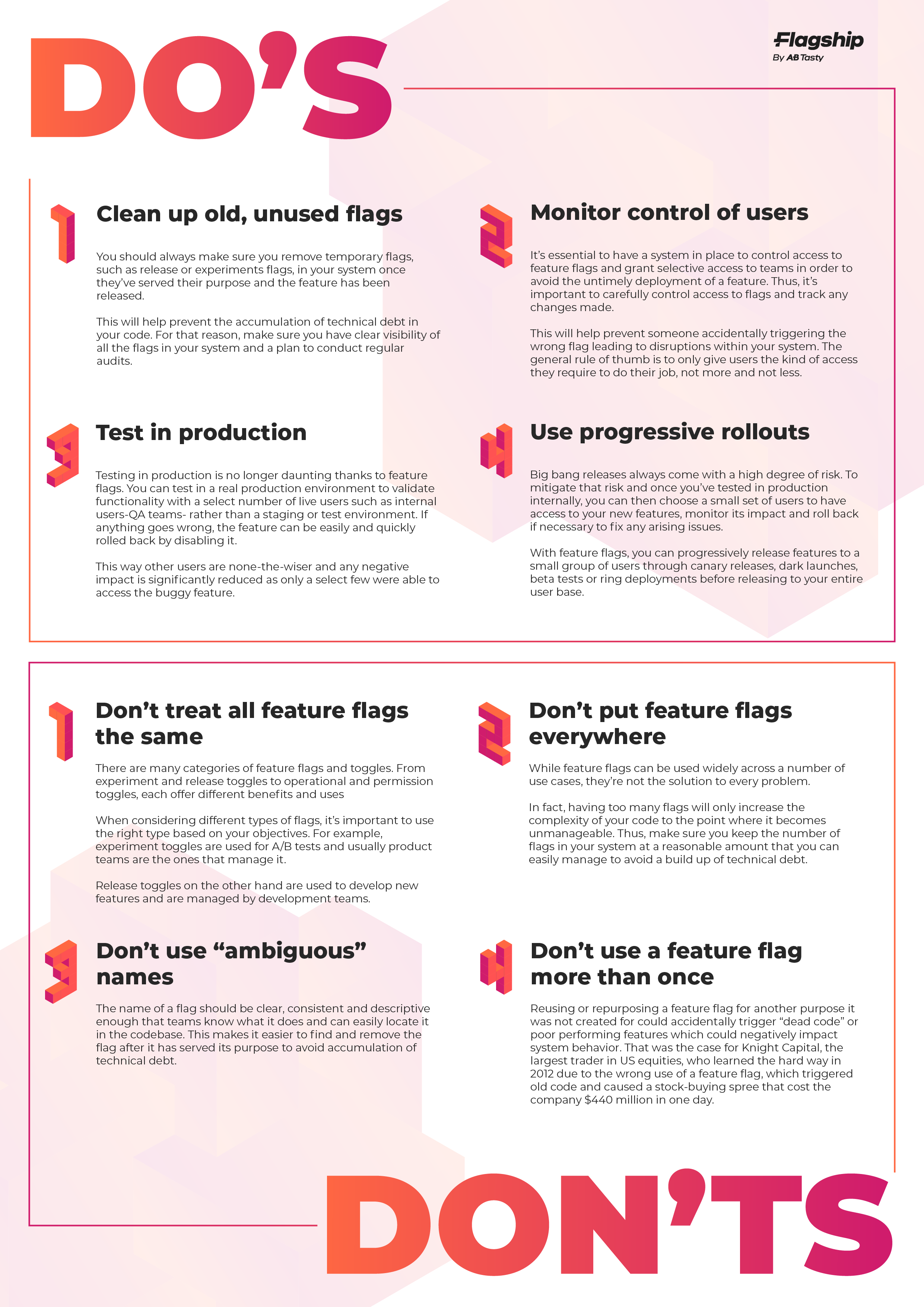

5 Dos And Don'ts: Succeeding In The Private Credit Hiring Boom

Table of Contents

DO: Network Strategically within the Private Credit Industry

Building a strong network is paramount in the private credit industry. It's not just about knowing people; it's about building genuine relationships with professionals who can advocate for you and provide valuable insights.

- Build relationships with professionals in private credit firms. Attend industry conferences like SuperReturn and Private Debt Investor conferences to connect with key players. Actively participate in relevant LinkedIn groups and online forums dedicated to private credit, sharing insightful comments and engaging in discussions.

- Leverage your existing network. Inform your contacts about your job search and request informational interviews. These conversations can provide invaluable advice, uncover hidden job opportunities, and demonstrate your initiative.

- Target specific firms. Research firms known for their expertise in areas that align with your skills and interests. This targeted approach shows you're serious and knowledgeable about the industry. Identify firms with a strong track record in areas like leveraged lending, direct lending, or mezzanine financing, focusing your efforts on those most aligned with your career aspirations.

- Craft a compelling elevator pitch. Practice a concise and impactful summary of your experience and passion for private credit. Highlight quantifiable achievements and tailor your pitch to the specific firm and role you're targeting.

DON'T: Neglect Your Online Presence

Your online presence is often the first impression potential employers get of you. A strong online profile is crucial for standing out in the competitive private credit hiring boom.

- Avoid a generic resume and LinkedIn profile. Tailor your resume and LinkedIn profile to highlight relevant experience and skills for private credit roles. Use keywords like "private debt," "leveraged lending," "direct lending," "private credit fund management," "credit analysis," and "financial modeling" throughout your profile. Quantify your accomplishments wherever possible.

- Neglect your digital footprint. Ensure your online presence reflects positively on your professional image. Clean up any potentially embarrassing content from social media platforms.

- Underestimate the importance of a strong online portfolio (if applicable). Showcase your work, especially if you have experience in areas like financial modeling or portfolio management. A well-curated online portfolio can significantly enhance your credibility and demonstrate your capabilities.

DO: Showcase Specialized Skills & Knowledge

The private credit industry demands specialized skills and in-depth knowledge. Highlighting these assets is key to securing a position.

- Highlight relevant experience in areas such as financial modeling, credit analysis, portfolio management, or legal aspects of private credit. Quantify your achievements whenever possible. For instance, instead of saying "improved financial models," say "improved financial models, resulting in a 15% reduction in forecast error."

- Demonstrate understanding of key concepts. Showcase your knowledge of different private credit strategies (e.g., unitranche, mezzanine financing, senior secured loans) and relevant market trends. Staying current on industry news and regulations demonstrates your commitment and professionalism.

- Obtain relevant certifications. CFA, CAIA, or other industry-specific certifications can significantly enhance your credentials and demonstrate your commitment to professional development.

DON'T: Underprepare for Interviews

Interviews are your chance to shine. Thorough preparation is essential for success in the competitive private credit hiring boom.

- Avoid generic interview answers. Prepare thoughtful responses to common interview questions specific to private credit. Practice your answers out loud and tailor them to the specific firm and role.

- Neglect research on the firm and interviewer. Thoroughly research the firm's investment strategy, recent deals, and the interviewer's background. Demonstrating your knowledge shows genuine interest and initiative.

- Fail to ask insightful questions. Prepare insightful questions to demonstrate your interest and understanding of the role and firm. Asking thoughtful questions shows your engagement and initiative.

DO: Negotiate Effectively and Professionally

Once you've secured a job offer, negotiating your compensation package effectively is crucial.

- Research salary expectations. Understand the market rate for similar roles in private credit using online resources and networking contacts.

- Be prepared to discuss your compensation package holistically. Consider not only salary but also benefits, bonus structures, relocation assistance, and other perks.

- Maintain a professional and positive demeanor throughout the negotiation process. Remember that building a strong relationship is crucial for long-term success.

Conclusion

Successfully navigating the competitive private credit hiring boom requires a strategic approach. By following these dos and don'ts—from networking effectively and showcasing your specialized skills to preparing thoroughly for interviews and negotiating confidently—you can significantly increase your chances of landing your dream role. Don't delay; start implementing these strategies today to seize the opportunities in the exciting world of private credit hiring. Remember to tailor your approach to the specific private credit opportunities you pursue, enhancing your chances of success in this thriving market.

Featured Posts

-

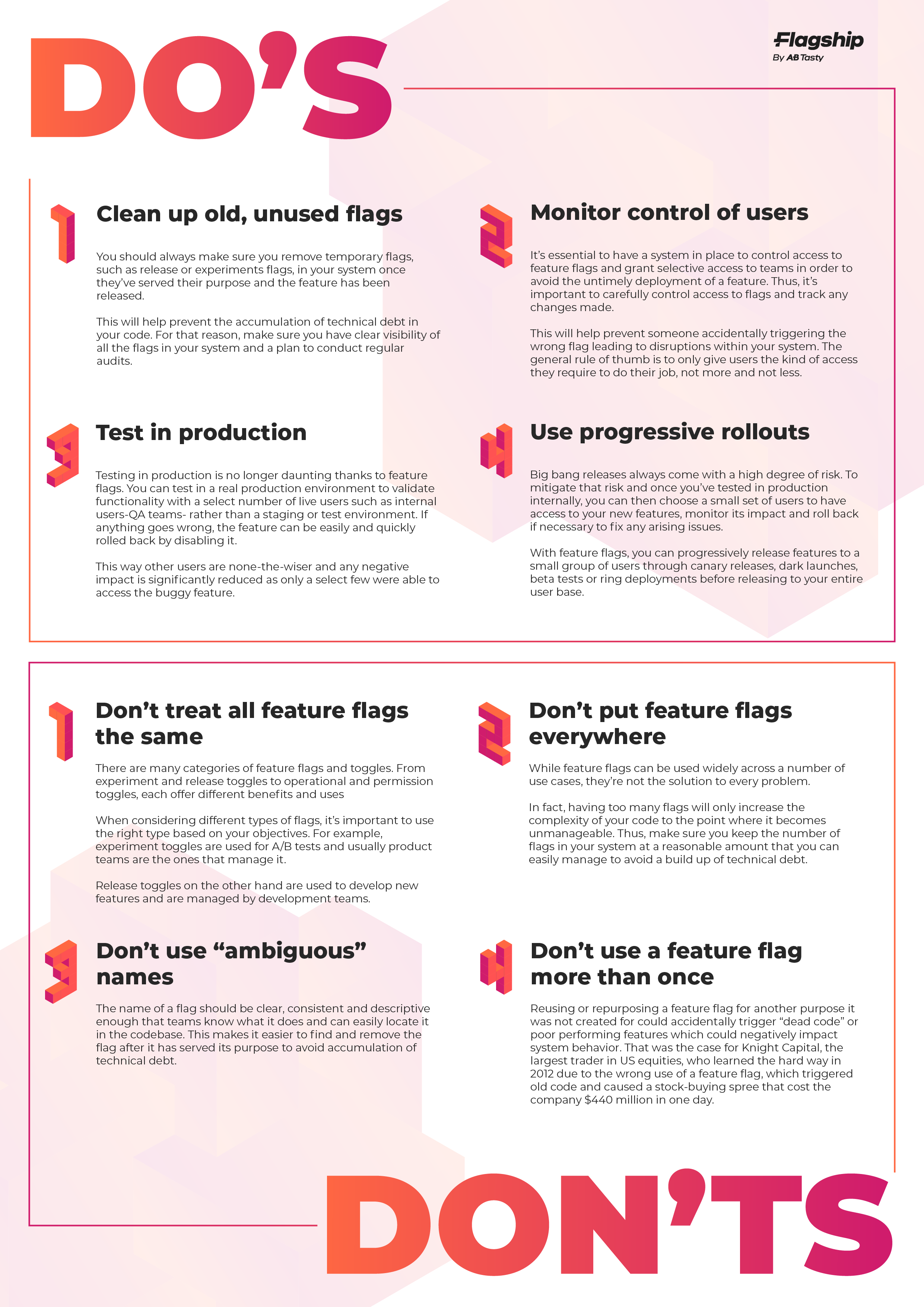

Us Market Slump Emerging Markets Post Positive Returns

Apr 24, 2025

Us Market Slump Emerging Markets Post Positive Returns

Apr 24, 2025 -

Hollywood Shutdown Double Strike Cripples Film And Television Production

Apr 24, 2025

Hollywood Shutdown Double Strike Cripples Film And Television Production

Apr 24, 2025 -

Two New Oil Refineries Planned Saudi Arabia India Collaboration

Apr 24, 2025

Two New Oil Refineries Planned Saudi Arabia India Collaboration

Apr 24, 2025 -

Nba All Star Game Draymond Green Moses Moody And Buddy Hield Participate

Apr 24, 2025

Nba All Star Game Draymond Green Moses Moody And Buddy Hield Participate

Apr 24, 2025 -

Instagram Targets Tik Tok Creators With New Editing App

Apr 24, 2025

Instagram Targets Tik Tok Creators With New Editing App

Apr 24, 2025