X's Financial Reorganization: Insights From Musk's Recent Debt Sale

Table of Contents

The Details of the Debt Sale

Musk's acquisition of X was largely financed through a complex debt structure, a characteristic of many leveraged buyouts. Understanding this debt structure is key to assessing X's financial reorganization. Key aspects of the debt sale include:

-

Breakdown of Debt Tranches: The debt financing was likely comprised of several tranches, including senior secured debt (typically the lowest risk), subordinated debt (higher risk, lower priority in repayment), and potentially high-yield bonds (also known as junk bonds, carrying significant interest rate risk). The precise breakdown remains partially undisclosed, adding to the complexity of analyzing X's financial health.

-

Interest Rates and Risks: The high-yield nature of some of the debt means significantly higher interest rates compared to traditional corporate borrowing. These elevated rates increase X's interest expense, potentially impacting profitability and leaving the company vulnerable if revenue growth doesn't meet expectations. The risk is further amplified by the potential for increased interest rates in the broader market.

-

Maturity Dates and Refinancing Challenges: The maturity dates of the various debt tranches are crucial. Shorter-term debt requires refinancing sooner, potentially posing a challenge if market conditions worsen or X's financial performance falters. Failing to refinance could trigger a liquidity crisis.

-

Debt Covenants and Restrictions: The loan agreements likely include covenants—restrictions on X's actions, such as limitations on dividend payments or further debt issuance—designed to protect lenders. These covenants can constrain X's operational flexibility.

-

Comparison to Other Leveraged Buyouts: Musk's financing strategy can be compared to other high-profile leveraged buyouts, allowing for a broader understanding of the risks and rewards involved in this type of aggressive financing. Analyzing similar deals reveals patterns and potential outcomes.

Impact on X's Financial Health

The substantial debt load from the Musk debt sale significantly impacts X's financial health, primarily through increased financial risk and leverage.

-

Debt-to-Equity Ratio: The acquisition dramatically increased X's debt-to-equity ratio, a key metric reflecting financial leverage. A high ratio signifies higher risk, making the company more vulnerable to economic downturns.

-

Credit Rating Downgrade: The increased debt burden likely led to a downgrade in X's credit rating by credit rating agencies. A lower credit rating makes future borrowing more expensive and potentially limits access to capital.

-

Liquidity and Debt Service: X's ability to meet its debt obligations (debt service) depends on its liquidity – its readily available cash. A shortfall could trigger a default. X's revenue generation capacity is crucial for ensuring sufficient liquidity.

-

Default Risk: The significant debt load introduces substantial default risk—the risk of X failing to meet its debt obligations. A default could result in bankruptcy, asset seizure, and potentially significant financial losses for lenders and investors.

-

Comparison to Competitors: Comparing X's financial health to competitors in the social media landscape provides context. A comparative analysis highlights the relative strengths and weaknesses resulting from Musk's financial strategy.

Musk's Strategic Rationale

Musk's decision to employ such aggressive debt financing for the X acquisition raises questions about his strategic rationale and risk tolerance.

-

Goals for X: Musk’s stated goals for X, including ambitious expansion plans and technological integrations, necessitate substantial investment. The debt sale provides the capital required to pursue these potentially transformative goals.

-

Risk Tolerance: Musk's high-risk, high-reward approach is evident in his financial strategy. He's demonstrably willing to accept substantial financial risk to achieve his ambitious goals for X.

-

Alternative Financing Options: While equity financing (selling shares) could have reduced the debt burden, it would have diluted Musk's ownership stake. This debt-focused approach might reflect his desire to retain maximum control.

-

Broader Business Strategy: The X acquisition fits within Musk's broader business strategy of building a technologically integrated ecosystem. This debt financing underpins that overall vision.

-

Long-Term Viability: The long-term viability of Musk's strategy hinges on X's ability to generate sufficient revenue to service its substantial debt and achieve its ambitious goals. Success depends on rapid growth and innovation.

The Role of Private Equity

While details remain limited, the potential involvement of private equity firms in the debt financing warrants consideration.

-

Private Equity Involvement: Private equity firms might have co-invested alongside traditional lenders, sharing the risk and potentially influencing strategic decisions.

-

Shaping Musk's Strategy: Private equity's investment might have influenced aspects of Musk’s strategy, potentially prioritizing short-term financial targets alongside long-term vision.

-

Implications for X's Future: Private equity's involvement could influence X's future direction, potentially pushing for specific strategic shifts or operational changes to maximize returns on their investment.

Implications for Investors and the Market

Musk's debt-fueled acquisition of X has broad implications for investors and the market.

-

Market Reaction: The market's reaction to the debt sale reflected a mixture of excitement about Musk’s ambitious vision and apprehension about the significant financial risk.

-

Impact on X's Stock Price (if applicable): The stock price (if X is publicly traded) is likely to reflect investor sentiment regarding the debt load and its implications for future profitability and solvency.

-

Broader Implications for Credit Markets and Investor Sentiment: This transaction could influence investor risk appetite and potentially impact the cost of borrowing for other companies with similar risk profiles.

-

Impact on Competitors: The financial maneuvering around X’s acquisition could trigger competitive reactions within the social media landscape, potentially spurring consolidation or innovative responses from rival companies.

Conclusion

Elon Musk's debt-fueled acquisition of X and its subsequent financial reorganization represent a significant gamble with potentially far-reaching consequences. This article has explored the details of the debt sale, its impact on X's financial health, Musk's strategic motivations, and the implications for investors and the broader market. The success or failure of this strategy will significantly shape X's future and provide valuable lessons on high-stakes leveraged buyouts. The high-yield debt financing and resulting X financial restructuring present both opportunities and significant risks. Careful monitoring of X's financial performance is crucial.

Call to Action: Stay informed on the evolving financial landscape of X and other high-profile companies by following our analysis of X’s financial reorganization and other key developments in corporate finance. Understanding X's financial strategy is crucial for navigating the complexities of the modern business world.

Featured Posts

-

Trumps Higher Education Policies A National Perspective

Apr 28, 2025

Trumps Higher Education Policies A National Perspective

Apr 28, 2025 -

Louisiana Judge To Decide Fate Of Harvard Researcher Facing Russian Deportation

Apr 28, 2025

Louisiana Judge To Decide Fate Of Harvard Researcher Facing Russian Deportation

Apr 28, 2025 -

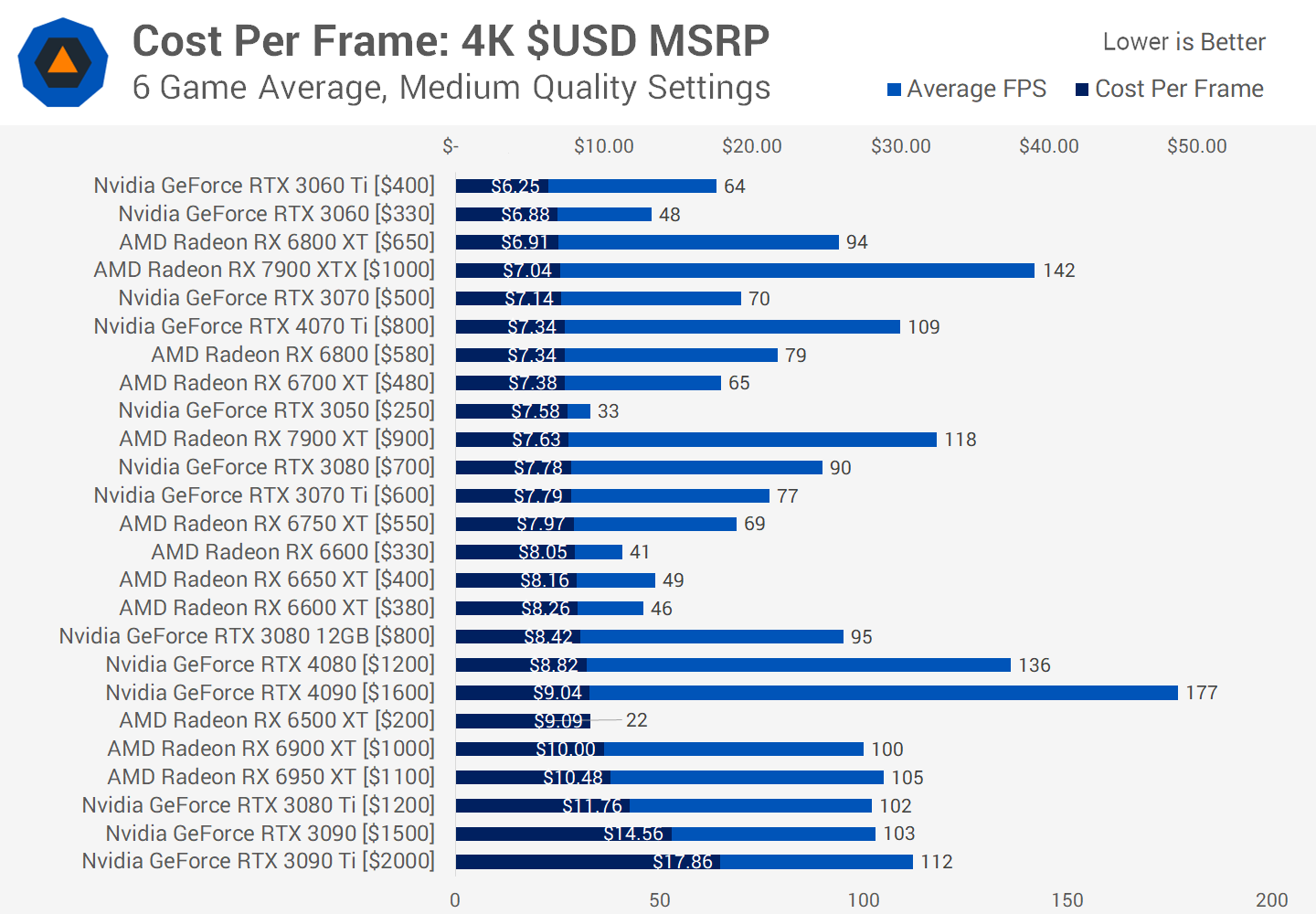

Gpu Price Volatility What To Expect In The Coming Months

Apr 28, 2025

Gpu Price Volatility What To Expect In The Coming Months

Apr 28, 2025 -

Lapd

Apr 28, 2025

Lapd

Apr 28, 2025 -

Tesla And Tech Stocks Drive Us Market Surge

Apr 28, 2025

Tesla And Tech Stocks Drive Us Market Surge

Apr 28, 2025