Why Investors Shouldn't Be Concerned About Elevated Stock Market Valuations (BofA)

Table of Contents

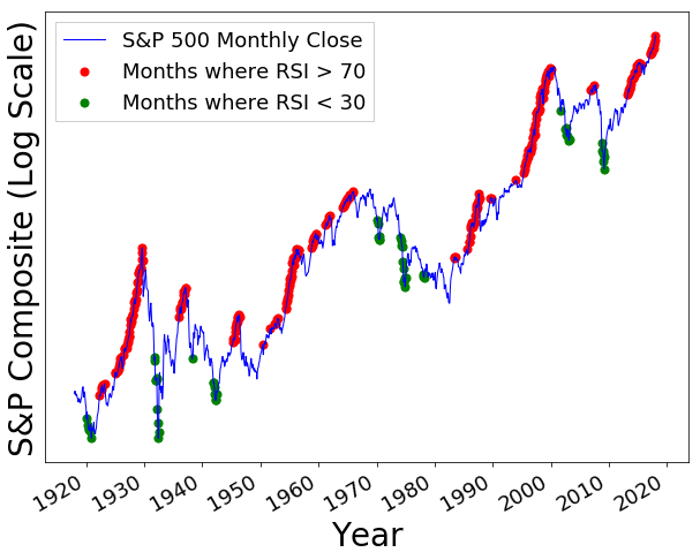

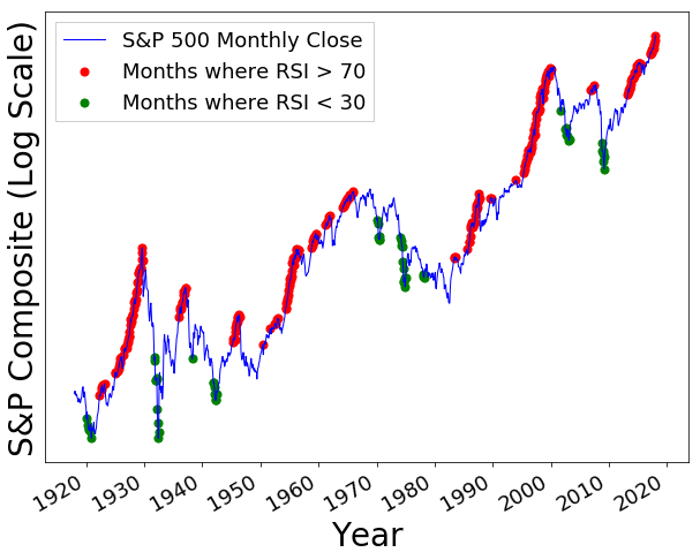

Recent market reports highlight elevated stock valuations, sparking anxiety among investors. The headlines scream about overvalued markets, prompting many to consider pulling back from investments. However, Bank of America (BofA) research offers a more nuanced perspective. This article explores why investors shouldn't be overly concerned about these seemingly high valuations and examines the factors supporting continued market growth. We'll delve into the intricacies of valuation metrics, economic fundamentals, and long-term growth prospects, providing a clearer picture of the current market landscape.

The Limitations of Traditional Valuation Metrics

Traditional methods of assessing market valuation can be misleading, particularly in the current economic climate. Understanding these limitations is crucial to avoiding knee-jerk reactions.

PE Ratios and Their Context

Price-to-Earnings (PE) ratios, a common valuation metric, can be deceptive in a low-interest-rate environment.

- Low interest rates impact discount rates: Lower interest rates decrease the discount rate used in discounted cash flow (DCF) models, a key method for valuing companies. This, in turn, can lead to higher valuations, even if earnings remain unchanged. A lower discount rate means future earnings are worth more today.

- Earnings growth expectations significantly influence PE ratios: High PE ratios are often justified by expectations of strong future earnings growth. Investors are willing to pay more for a company anticipated to deliver substantial profits in the years to come. A high PE ratio isn't necessarily a negative if the growth potential is strong.

- Alternative valuation metrics provide a broader picture: Relying solely on PE ratios is risky. The Price/Earnings to Growth (PEG) ratio, for example, takes earnings growth into account, providing a more comprehensive assessment of a company’s valuation.

- Example: A company with a high PE ratio might be considered overvalued if compared to its historical average. However, if its earnings are growing rapidly, and its PEG ratio is favorable, that high PE ratio might be perfectly justified.

Considering Cyclical Factors

Market valuations are inherently cyclical, fluctuating based on economic conditions. High valuations today might reflect strong, forward-looking expectations.

- Economic recovery fuels corporate earnings: Following periods of economic downturn, strong corporate earnings growth is often observed as businesses recover and consumer spending increases. This positive trend contributes to higher valuations.

- Industry-specific growth drivers: Certain sectors experience disproportionate growth, driving up valuations within those specific markets. Technological advancements and regulatory changes can significantly impact industry performance.

- Technological advancements as a valuation driver: Innovation frequently leads to increased efficiency and market expansion, fueling higher stock prices for companies at the forefront of technological change.

- BofA's research supports this: BofA's recent reports have highlighted the robust earnings growth in several key sectors, corroborating this view of elevated valuations reflecting future potential.

Strong Underlying Economic Fundamentals

Beyond the nuances of valuation metrics, strong economic fundamentals support the current market levels.

Robust Corporate Earnings Growth

Despite high valuations, corporate earnings have remained remarkably strong, supporting current market levels.

- Data on corporate earnings growth: Recent financial reports demonstrate a consistent trend of robust year-over-year earnings growth across many sectors. This positive trend justifies the higher valuations to a significant extent.

- Sectors driving earnings growth: Certain sectors, like technology and healthcare, have consistently shown exceptional earnings growth, significantly contributing to overall market strength.

- Government stimulus packages (where applicable): In some cases, government stimulus measures have played a role in supporting corporate earnings and bolstering investor confidence.

- Future earnings growth projections: Analysts are largely positive about future earnings growth, further validating current market valuations.

Low Interest Rate Environment

The prevailing low-interest-rate environment makes equities a more attractive investment compared to bonds, thus supporting higher valuations.

- Inverse relationship between interest rates and stock valuations: When interest rates are low, the return on bonds is reduced, making stocks, with their potential for higher returns, comparatively more appealing. This increase in demand drives up stock prices.

- Central bank policies influence interest rates: Central bank policies play a crucial role in maintaining low interest rates, creating a favorable environment for equity investments.

- Potential implications of future interest rate changes: While low interest rates currently support higher valuations, future interest rate increases could potentially impact market levels. However, BofA's analysis suggests this is not an immediate concern.

Long-Term Growth Potential and Technological Disruption

Looking ahead, long-term growth potential and ongoing technological disruption provide further justification for current market valuations.

Innovation Driving Growth

Technological advancements and industry disruption are key drivers of long-term market growth, supporting premium valuations in certain sectors.

- Specific technological advancements and their impact: Artificial intelligence (AI), cloud computing, and biotechnology, for instance, are transforming industries and creating significant growth opportunities.

- Companies benefiting from technological disruption: Companies at the forefront of innovation are experiencing substantial growth and commanding premium valuations as a result.

- Long-term growth potential of these sectors: These technologically driven sectors are poised for sustained long-term growth, justifying current premium valuations.

- Market capitalization growth in these sectors: Data reveals significant growth in market capitalization for companies leading in these innovative sectors.

Global Economic Growth Prospects

Positive global economic growth forecasts further support continued market strength.

- Data on global economic growth forecasts: Numerous economic forecasts predict continued global economic expansion, offering a favorable backdrop for market performance.

- Regions or countries driving growth: Emerging markets and developed economies alike contribute to this positive outlook.

- Potential impact of geopolitical events: While geopolitical risks exist, their impact on overall global growth is anticipated to be limited, according to BofA's analysis.

- BofA's projections regarding global GDP growth: BofA's own projections for global GDP growth remain optimistic, reinforcing the positive outlook.

Conclusion

While elevated stock market valuations are a valid concern for some, BofA's analysis suggests that several factors, including robust corporate earnings, a low-interest-rate environment, and compelling long-term growth prospects, merit a more nuanced perspective. These factors indicate that the current market levels are not necessarily unsustainable.

Call to Action: Don't let elevated stock market valuations deter you from strategic investing. Carefully consider your risk tolerance and investment goals, and explore BofA's research for a comprehensive understanding of the current market dynamics before making any investment decisions. Understand the nuances of elevated stock market valuations and make informed investment choices. Develop a long-term investment strategy that accounts for these factors, and navigate the market with confidence.

Featured Posts

-

Turkish Desan In Talks To Acquire Romanian Shipyard Mangalia

Apr 26, 2025

Turkish Desan In Talks To Acquire Romanian Shipyard Mangalia

Apr 26, 2025 -

Is This The Smelliest Congressman Investigating The Claims

Apr 26, 2025

Is This The Smelliest Congressman Investigating The Claims

Apr 26, 2025 -

Gaslighting Claims Rock Newsoms Podcast Launch A Social Media Analysis

Apr 26, 2025

Gaslighting Claims Rock Newsoms Podcast Launch A Social Media Analysis

Apr 26, 2025 -

Long Live Lente Embrace The Spring Season With New Vocabulary

Apr 26, 2025

Long Live Lente Embrace The Spring Season With New Vocabulary

Apr 26, 2025 -

Mission Impossible Dead Reckoning Part Two Plane Scene Bts Footage

Apr 26, 2025

Mission Impossible Dead Reckoning Part Two Plane Scene Bts Footage

Apr 26, 2025