Where To Invest: Mapping Promising Business Hotspots In The Country

Table of Contents

Analyzing Key Economic Indicators for Investment Decisions

Before diving into specific regions, it's vital to understand the broader economic landscape. Analyzing key economic indicators helps identify areas with high investment potential and minimizes risk.

GDP Growth and Sectoral Performance

Regions exhibiting robust GDP growth generally offer more promising investment opportunities. Focusing on sectors experiencing significant growth within these regions further refines your investment strategy.

- Examples of Regions with Strong GDP Growth: The coastal regions consistently demonstrate high GDP growth, driven primarily by the tourism and technology sectors. Furthermore, the central region shows promising growth in agriculture and renewable energy.

- Identification of Leading Sectors in Each Region: Coastal regions are dominated by technology startups and tourism-related businesses. The central region boasts a flourishing agricultural sector and a rapidly growing renewable energy industry.

- Data Sources: Reliable data can be found through government publications like the annual Economic Survey, reports from the Central Bank, and independent industry analyses from reputable firms like [insert name of reputable firm]. High-growth sectors like technology are frequently covered by specialized market research companies.

This analysis of economic indicators helps pinpoint regions with high investment potential. Understanding the regional growth patterns and the performance of specific sectors is crucial for informed investment decisions.

Infrastructure Development and Logistics

Efficient infrastructure is the backbone of a thriving economy. Regions with well-developed transportation networks, reliable internet access, and modern port facilities offer significant advantages for businesses.

- Examples of Regions with Superior Infrastructure: The northern region boasts a well-established highway system, facilitating efficient logistics. The southern region benefits from a modern port and high-speed internet connectivity.

- Impact of Logistics on Business Efficiency: Efficient logistics networks reduce transportation costs, improve supply chain management, and enhance overall business efficiency. This translates to increased profitability and faster time-to-market.

- Cost Savings Related to Efficient Infrastructure: Businesses operating in regions with well-developed infrastructure experience significant cost savings due to reduced transportation delays and improved supply chain efficiency. This cost-effectiveness is a key factor in determining investment potential.

Investing in regions with robust infrastructure significantly reduces operational costs and enhances efficiency, making them attractive locations for various businesses. Prioritizing regions with strong logistics networks is a smart investment strategy.

Government Policies and Incentives

Government policies and incentives play a crucial role in shaping the investment landscape. Regions with business-friendly environments and attractive tax benefits attract significant investment.

- Tax Breaks, Subsidies, Grants Available in Different Regions: The government offers tax incentives for businesses investing in renewable energy in the central region. The coastal regions provide subsidies for technology startups. Specific grant programs are available for businesses establishing operations in designated underdeveloped areas.

- Regulatory Environment Analysis: A transparent and efficient regulatory environment is essential for attracting investment. A thorough analysis of the regulatory landscape in each region is crucial before making investment decisions.

Understanding government incentives and the regulatory landscape is essential for making informed investment decisions. Favorable policies and a supportive business environment significantly enhance the attractiveness of a region.

Emerging Business Hotspots Across the Country

Several regions stand out as promising business hotspots, each with its own unique strengths and investment opportunities.

Region A: Silicon Valley South

This region is experiencing explosive growth in the technology sector, attracting numerous startups and established tech companies.

- Key Industries: Technology (Software, AI, Fintech), Renewable Energy

- Reasons for Growth: A highly skilled workforce, a supportive government, and proximity to major universities are fueling the region's growth.

- Examples of Businesses to Watch: [Insert names of successful businesses in the region]

- Investment Opportunities: Early-stage tech startups, expanding existing tech companies, supporting infrastructure development.

Region B: AgriTech Hub

This region is becoming a center for agricultural technology, leveraging advancements in farming techniques and biotechnology.

- Key Industries: Agriculture, Biotechnology, Food Processing

- Reasons for Growth: Fertile land, government support for agricultural innovation, and a growing demand for sustainable farming practices.

- Examples of Businesses to Watch: [Insert names of successful businesses in the region]

- Investment Opportunities: AgriTech startups, precision agriculture companies, food processing facilities.

Region C: Coastal Tourism Paradise

This region is experiencing a tourism boom, with its pristine beaches and diverse attractions drawing visitors from around the world.

- Key Industries: Tourism, Hospitality, Real Estate

- Reasons for Growth: Beautiful natural scenery, improving infrastructure, and government initiatives to promote tourism.

- Examples of Businesses to Watch: [Insert names of successful businesses in the region]

- Investment Opportunities: Hotels, resorts, tourism-related businesses, real estate development.

Mitigating Risks and Due Diligence

While these regions offer significant investment potential, thorough due diligence is crucial to mitigate risks.

Conducting Thorough Market Research

Before committing to any investment, conduct extensive market research to understand the competitive landscape and evaluate market size.

- Competitive Analysis: Identify major competitors, assess their strengths and weaknesses, and develop strategies to differentiate your business.

- Market Size Evaluation: Determine the size of the target market, growth potential, and assess market saturation.

- Risk Assessment: Identify potential risks associated with the investment and develop strategies to mitigate these risks.

- Financial Projections: Develop realistic financial projections based on market analysis and risk assessment.

Understanding Local Regulations and Compliance

Familiarize yourself with local regulations and ensure your business operates in full compliance with all applicable laws.

- Legal Requirements: Understand all legal requirements related to establishing and operating a business in the chosen region.

- Licensing Procedures: Obtain all necessary licenses and permits before commencing operations.

- Environmental Regulations: Comply with environmental regulations to ensure sustainability and minimize negative impact.

- Labor Laws: Adhere to all labor laws and ensure fair employment practices.

Conclusion

Identifying where to invest requires careful consideration of various factors. By analyzing key economic indicators, exploring emerging business hotspots, and conducting thorough due diligence, you can significantly increase your chances of success. This article has provided a roadmap to navigating the investment landscape of the country, highlighting promising regions and sectors poised for growth. Begin your journey to finding the most profitable investments by conducting your own in-depth research into the specific areas that resonate with your investment strategy. Remember, understanding where to invest your money is the first step towards building a strong and profitable portfolio.

Featured Posts

-

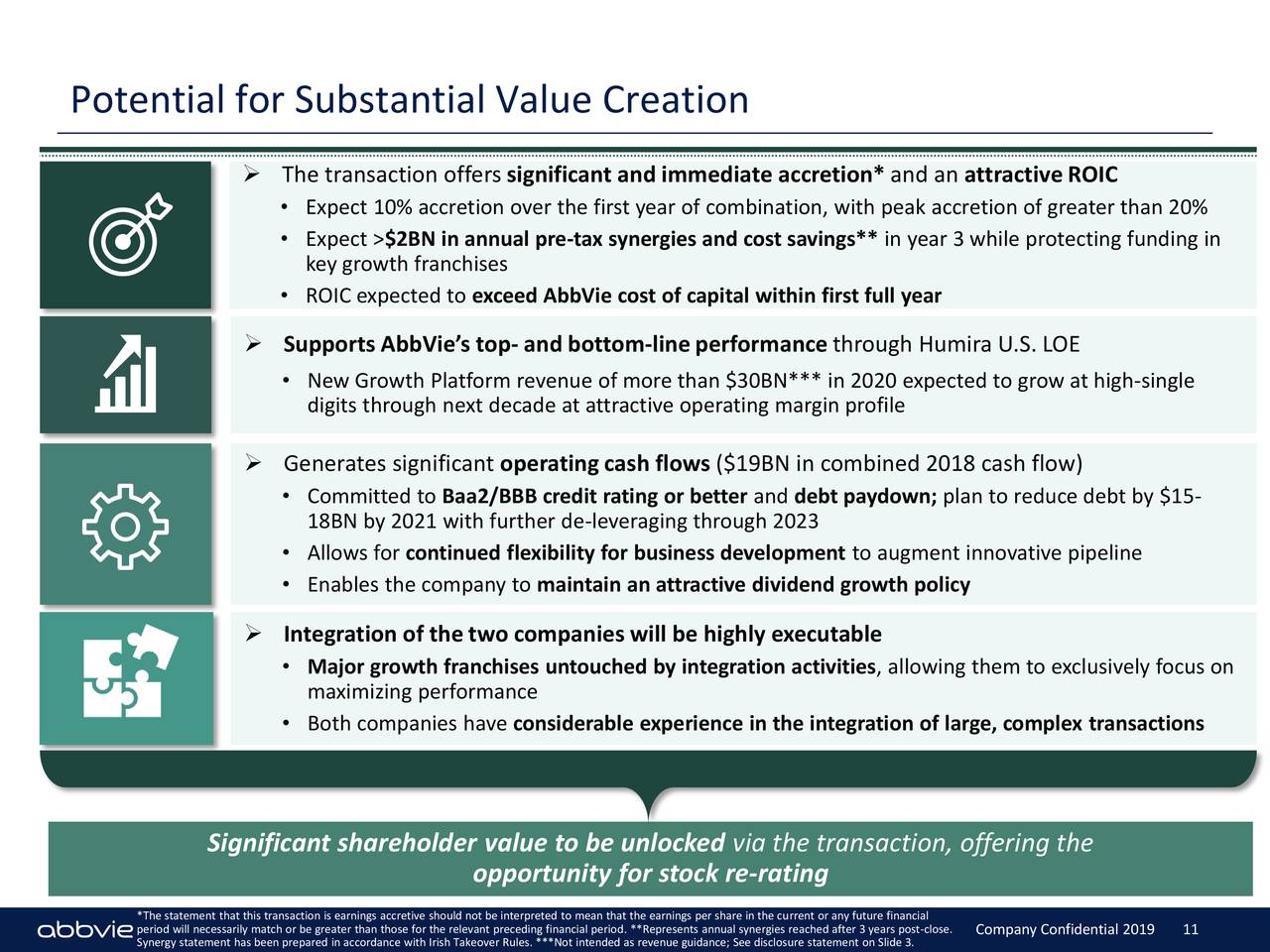

Abb Vie Abbv Increased Profit Guidance Reflects Success Of Newer Drugs

Apr 26, 2025

Abb Vie Abbv Increased Profit Guidance Reflects Success Of Newer Drugs

Apr 26, 2025 -

Velikonoce 2024 Jake Jsou Ceny Potravin A Jak Se Pripravit Na Zdrazovani

Apr 26, 2025

Velikonoce 2024 Jake Jsou Ceny Potravin A Jak Se Pripravit Na Zdrazovani

Apr 26, 2025 -

Pogacars New Colnago Speed Technology And The Uae Tour

Apr 26, 2025

Pogacars New Colnago Speed Technology And The Uae Tour

Apr 26, 2025 -

Neighbours Reunion A 38 Year Gap Ends In Murder

Apr 26, 2025

Neighbours Reunion A 38 Year Gap Ends In Murder

Apr 26, 2025 -

Russias Disinformation Campaign False Greenland News Fuels Denmark Us Tensions

Apr 26, 2025

Russias Disinformation Campaign False Greenland News Fuels Denmark Us Tensions

Apr 26, 2025