US Stocks Attract Record Canadian Investment: Trade War Impact Analyzed

Table of Contents

Why the Surge in Canadian Investment in US Equities?

Several key factors contribute to the recent surge in Canadian investment in US equities. These factors are intertwined and often reinforce each other.

Diversification Strategies

Canadian investors are increasingly diversifying their portfolios to mitigate risk associated with potential volatility in the Canadian market and global uncertainties. The US market, with its size and diversity, offers a compelling avenue for diversification. Specific sectors attracting significant Canadian investment include:

- Technology: The robust growth of US tech giants continues to be a major draw.

- Healthcare: The innovative nature and growth potential of the US healthcare sector attracts considerable interest.

- Consumer Staples: These defensive sectors often offer stability during economic uncertainty.

Benefits of Diversification:

- Reduced Risk: Spreading investments across different markets and asset classes lowers overall portfolio risk.

- Access to Growth Opportunities: The US market offers exposure to a broader range of companies and growth opportunities.

- Improved Portfolio Performance: Diversification can potentially enhance long-term portfolio returns.

Favorable US Dollar Exchange Rate

A favorable US dollar exchange rate relative to the Canadian dollar significantly impacts the attractiveness of US stocks for Canadian investors. When the US dollar is stronger, Canadian investors receive more US dollars for each Canadian dollar spent, effectively increasing their purchasing power in the US market. Fluctuations in the exchange rate can significantly impact investment returns; a weakening Canadian dollar can boost returns when converting US dollar profits back into Canadian currency, while the opposite is true if the Canadian dollar strengthens. [Insert chart or data illustrating recent exchange rate trends].

Attractive Valuation of US Stocks

Many analysts believe that certain sectors of the US stock market are currently undervalued compared to their Canadian counterparts. This perception, driven by factors like market corrections and sector-specific performance, has incentivized Canadian investors to seek out perceived bargains. [Insert data or charts comparing valuations of US and Canadian equities in relevant sectors]. This analysis should consider factors such as Price-to-Earnings ratios (P/E) and other relevant valuation metrics.

The Impact of the Trade War on Canadian Investment Decisions

The ongoing trade war has undoubtedly played a significant role in shaping Canadian investment decisions.

Trade War Uncertainty and Safe Haven Assets

The uncertainty surrounding the trade war has driven investors towards perceived "safe haven" assets. The US market, despite its own vulnerabilities, is often considered a relatively stable investment destination compared to more volatile emerging markets. Increased volatility in other global markets due to trade tensions further incentivizes investment in more established markets like the US. [Include data on market volatility during periods of trade tension].

Shifting Global Economic Landscape

The trade war has reshaped the global economic landscape, creating both challenges and opportunities. Some industries have been negatively impacted, while others have seen unexpected growth. Canadian investors are actively assessing these changes and adjusting their investment strategies accordingly. For example, companies involved in sectors impacted by tariffs might see reduced investment, while companies benefiting from trade realignments might see increased interest. [Provide specific examples of companies and sectors affected].

Opportunities in Specific Sectors

The trade war has created niche opportunities in specific US sectors. Canadian investors are strategically positioning themselves to capitalize on these opportunities. For example, companies that can substitute for imports from countries affected by tariffs might experience significant growth. [Provide examples of sectors benefiting from trade realignments, such as domestic manufacturing or alternative supply chains].

Risks and Considerations for Canadian Investors in US Stocks

While the potential returns are attractive, Canadian investors must carefully consider the risks associated with investing in US stocks.

Currency Risk

Fluctuations in the US-Canadian dollar exchange rate represent a significant risk. A weakening US dollar can significantly reduce returns when converting profits back into Canadian currency.

Political and Regulatory Risks

Changes in US political and regulatory landscapes can dramatically impact investment returns. Policy shifts, new regulations, and political uncertainty all introduce considerable risk.

Market Volatility

Investing in any stock market inherently involves risk. The US market, while large and generally stable, is not immune to periods of significant volatility.

Conclusion: Navigating the Landscape of Canadian Investment in US Stocks

The surge in Canadian investment in US stocks is a complex phenomenon driven by diversification strategies, favorable exchange rates, perceived undervaluation of certain US equities, and the shifting global economic landscape created by the trade war. While potential rewards are significant, investors must carefully consider the inherent risks associated with currency fluctuations, political and regulatory changes, and market volatility. Understanding these factors is crucial for making informed investment decisions. To navigate this landscape effectively, conducting thorough research on Canadian investment in US stocks and consulting with a qualified financial advisor is strongly recommended. Only with a well-informed strategy can investors maximize potential returns while mitigating inherent risks.

Featured Posts

-

Brewers Offensive Explosion Nine Stolen Bases Highlight Win Against Oakland As

Apr 23, 2025

Brewers Offensive Explosion Nine Stolen Bases Highlight Win Against Oakland As

Apr 23, 2025 -

8 2 Brewers Win Jackson Chourios Two Home Run Display

Apr 23, 2025

8 2 Brewers Win Jackson Chourios Two Home Run Display

Apr 23, 2025 -

Four Inning Blitz Milwaukee Steals Nine Bases Sets New Record

Apr 23, 2025

Four Inning Blitz Milwaukee Steals Nine Bases Sets New Record

Apr 23, 2025 -

Christian Yelichs First Spring Training Start Post Back Surgery

Apr 23, 2025

Christian Yelichs First Spring Training Start Post Back Surgery

Apr 23, 2025 -

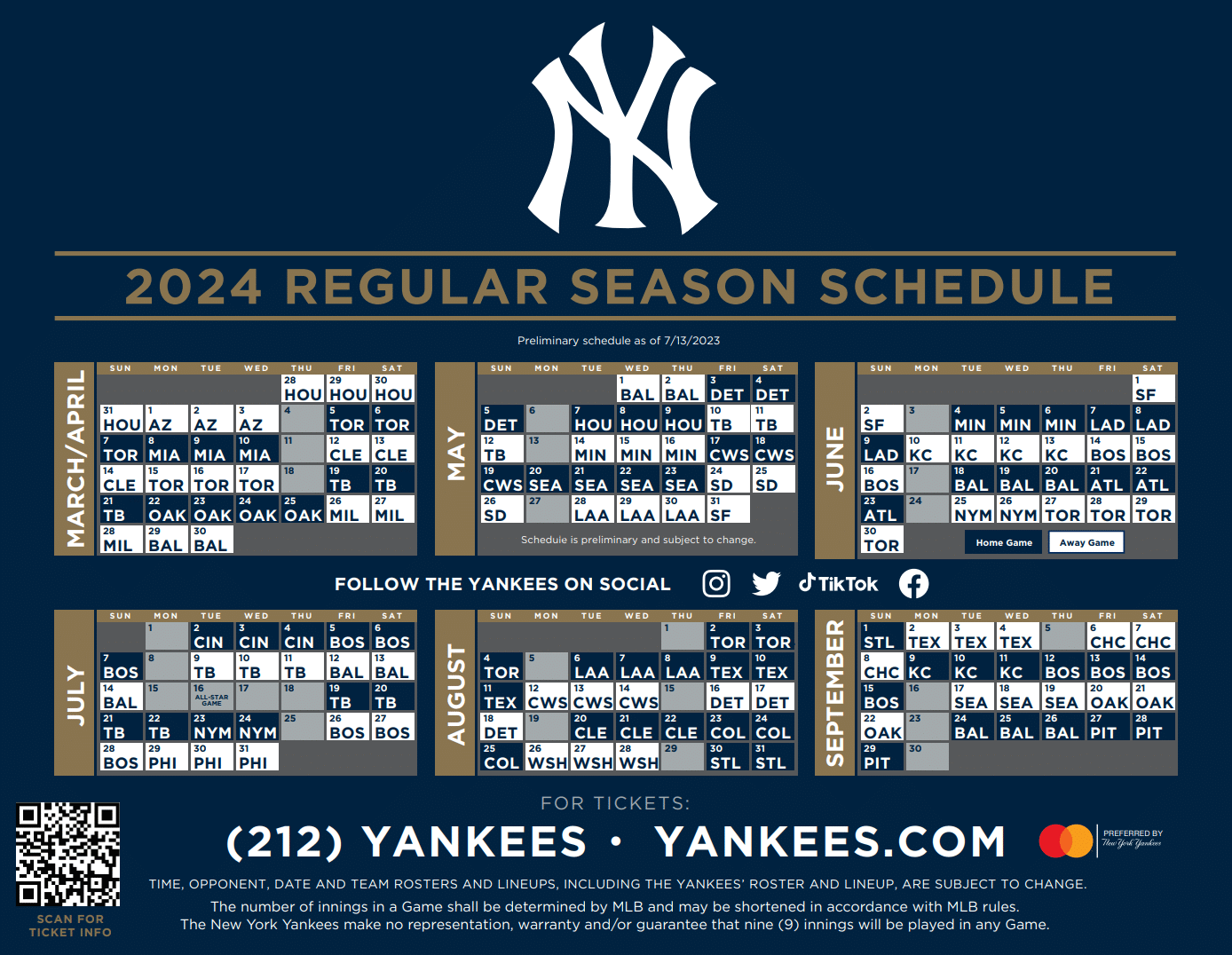

Yankees Opening Day Win A Winning Formula Against Brewers

Apr 23, 2025

Yankees Opening Day Win A Winning Formula Against Brewers

Apr 23, 2025