US Stock Futures: Trump's Influence And Market Volatility

Table of Contents

Trump's Economic Policies and Their Effect on US Stock Futures

Trump's presidency was marked by significant economic policy shifts, each leaving its imprint on US stock futures. His administration implemented substantial tax cuts, pursued deregulation across various sectors, and engaged in trade wars, creating a volatile environment for investors.

-

The Tax Cuts and Jobs Act (TCJA): This legislation significantly lowered corporate tax rates. The anticipated increase in corporate profits fueled a surge in stock prices and a generally positive sentiment in the futures market. However, the long-term effects were debated, with some arguing that it disproportionately benefited large corporations. Analyzing the tax cut effect on specific sectors revealed varied responses, with some experiencing more pronounced gains than others. This impacted the corresponding futures contracts, creating opportunities and risks for traders.

-

Trade Wars: Trump's imposition of tariffs, particularly on goods from China, created significant market uncertainty. The "trade war impact" was far-reaching. Increased prices for imported goods fueled inflation concerns, while supply chain disruptions affected various sectors. This uncertainty translated into increased volatility in US stock futures, making trading more challenging and requiring more sophisticated risk management strategies. Charts depicting the correlation between tariff announcements and futures prices illustrate this dramatically.

-

Deregulation Consequences: The Trump administration's focus on deregulation aimed to stimulate economic growth by reducing regulatory burdens on businesses. While some sectors experienced immediate benefits, reflected in their futures contracts, the long-term consequences remained a point of contention, particularly regarding environmental protection and consumer safety. The "deregulation consequences" were complex and sector-specific, highlighting the nuanced impact of policy on the futures market.

Trump's Tweets and Their Influence on US Stock Futures Volatility

Perhaps the most unique aspect of the Trump era was the direct impact of his tweets on market sentiment. The phenomenon of "Trump tweets" became a significant factor in "volatility prediction," as seemingly impromptu pronouncements could trigger significant market reactions.

-

Case Studies in Market Reaction: Numerous examples exist where a single tweet sent stock futures prices soaring or plummeting. For instance, tweets announcing unexpected policy changes or criticizing specific companies often caused immediate and dramatic market responses. The speed and scale of these reactions highlighted the power of social media in instantly influencing market sentiment.

-

Social Media Impact: The instant dissemination of information via Twitter amplified market reactions, creating a rapid feedback loop between social media and the futures market. This "social media impact" presented both opportunities and challenges for traders, requiring a sophisticated understanding of sentiment analysis and rapid response strategies.

-

Predicting Market Movements: While analyzing "Trump tweets" offered valuable insights, predicting market movements solely based on them proved unreliable. The context, timing, and overall market environment all played crucial roles, making consistent profitability a significant challenge. Developing successful trading strategies requires a more comprehensive approach that goes beyond simply reacting to single tweets.

Geopolitical Events and Trump's Response: Their Effect on US Stock Futures

Trump's approach to international relations significantly impacted global market stability and subsequently US stock futures. His decisions on trade agreements, responses to geopolitical crises, and overall foreign policy stance created both opportunities and uncertainty for investors.

-

Iran Nuclear Deal Withdrawal: The withdrawal from the Iran nuclear deal sent ripples through global energy markets, directly impacting oil futures. The resulting uncertainty fueled broader market volatility, as investors grappled with the geopolitical implications of this decision.

-

Foreign Policy Decisions and Global Uncertainty: Trump's foreign policy decisions, often characterized by unpredictability, fostered an environment of heightened "market uncertainty." This uncertainty, in turn, affected investor confidence and impacted trading strategies across various futures contracts.

-

International Trade Agreements: The renegotiation and withdrawal from existing trade agreements, combined with the initiation of new trade disputes, significantly affected various sectors and their futures contracts. The uncertainty surrounding international trade relations created volatility, forcing investors to adapt their strategies to manage "geopolitical risk."

Conclusion: Navigating the Complex Relationship Between US Stock Futures and Political Influence

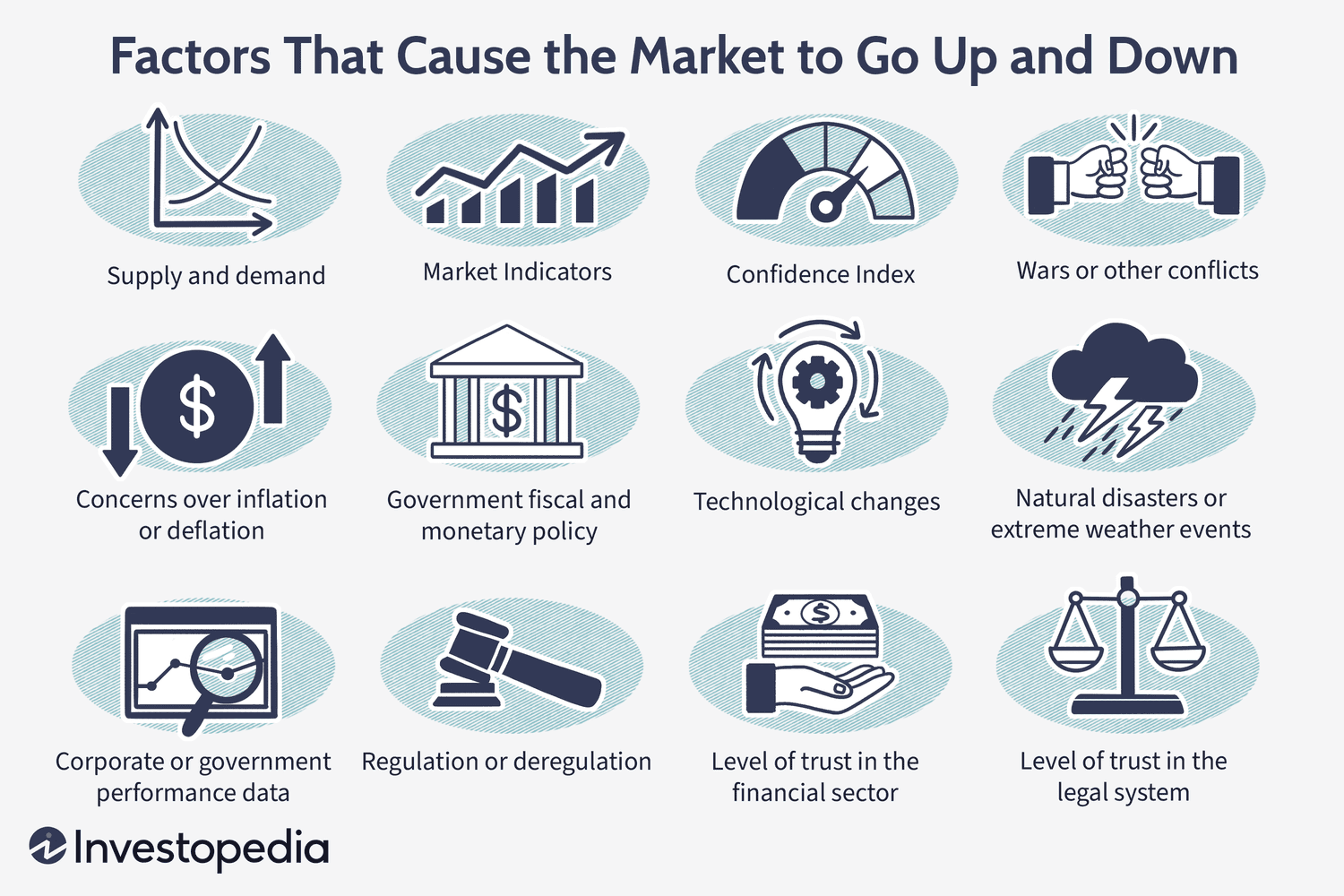

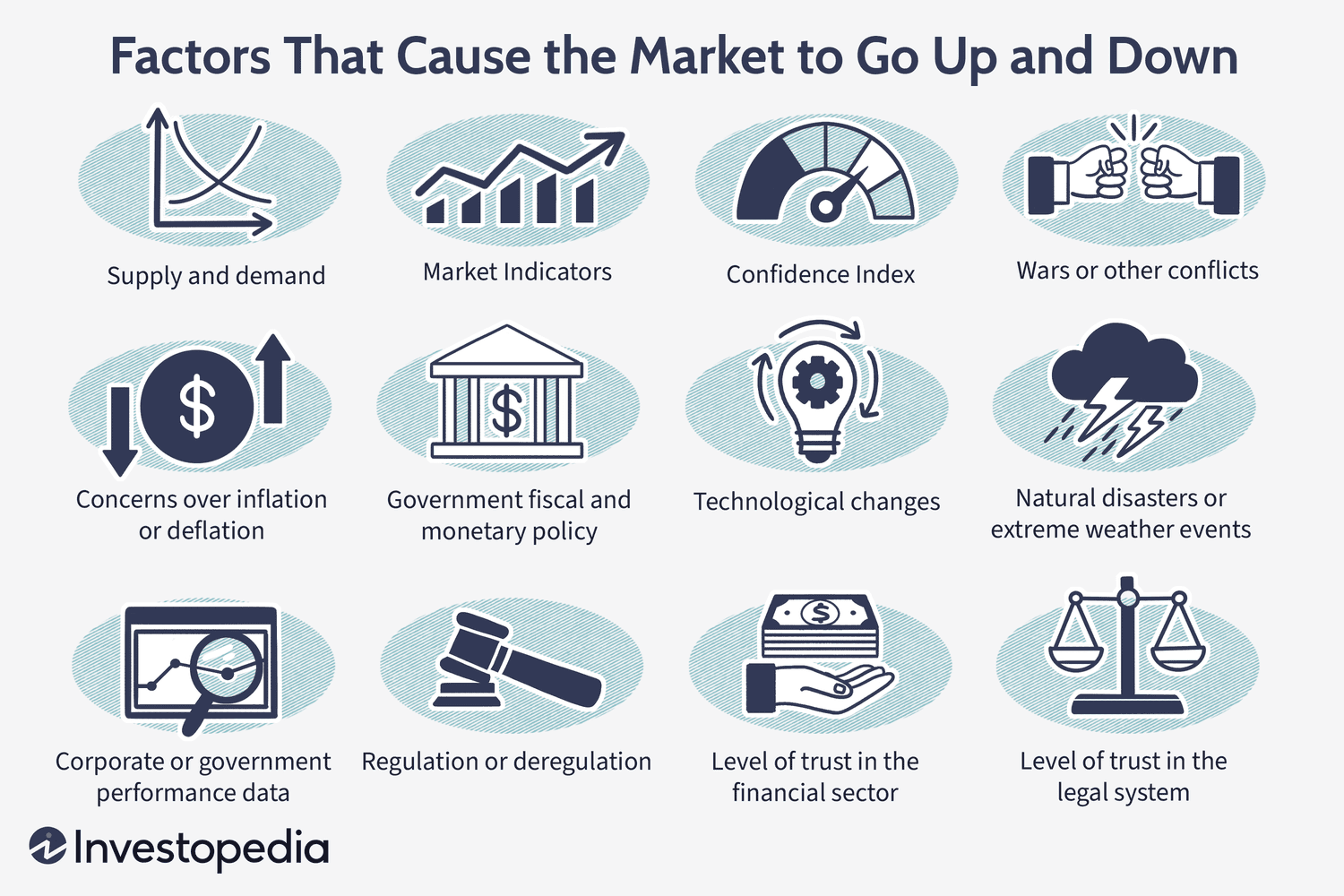

Trump's presidency showcased the complex interplay between political actions and the volatility of US stock futures. His economic policies, tweets, and geopolitical decisions created a unique and often unpredictable environment for investors. Understanding the impact of political factors on market behavior is critical for successful trading and investment strategies. For investors seeking to navigate this complex landscape, continuous learning about the factors impacting US stock futures and a keen awareness of political developments are essential for making informed investment decisions. By analyzing political impact and adopting robust strategies, investors can mitigate risks and capitalize on opportunities in the dynamic world of US stock futures. Mastering the art of understanding US stock futures is a continuous journey requiring diligent research and adaptation.

Featured Posts

-

Faa Investigates Las Vegas Airport Collision Risks

Apr 24, 2025

Faa Investigates Las Vegas Airport Collision Risks

Apr 24, 2025 -

The Value Of Middle Managers Benefits For Companies And Employees

Apr 24, 2025

The Value Of Middle Managers Benefits For Companies And Employees

Apr 24, 2025 -

The Bold And The Beautiful Spoilers Liams Medical Crisis And Potential Demise

Apr 24, 2025

The Bold And The Beautiful Spoilers Liams Medical Crisis And Potential Demise

Apr 24, 2025 -

The Demise Of Anchor Brewing Company A Look Back At 127 Years

Apr 24, 2025

The Demise Of Anchor Brewing Company A Look Back At 127 Years

Apr 24, 2025 -

Why Pope Francis Ring Will Be Destroyed After His Death Understanding The Tradition

Apr 24, 2025

Why Pope Francis Ring Will Be Destroyed After His Death Understanding The Tradition

Apr 24, 2025