US-China Trade War Impact: Stock Market Analysis And Dow Futures

Table of Contents

The US-China Trade War: A Historical Overview and its Economic Ramifications

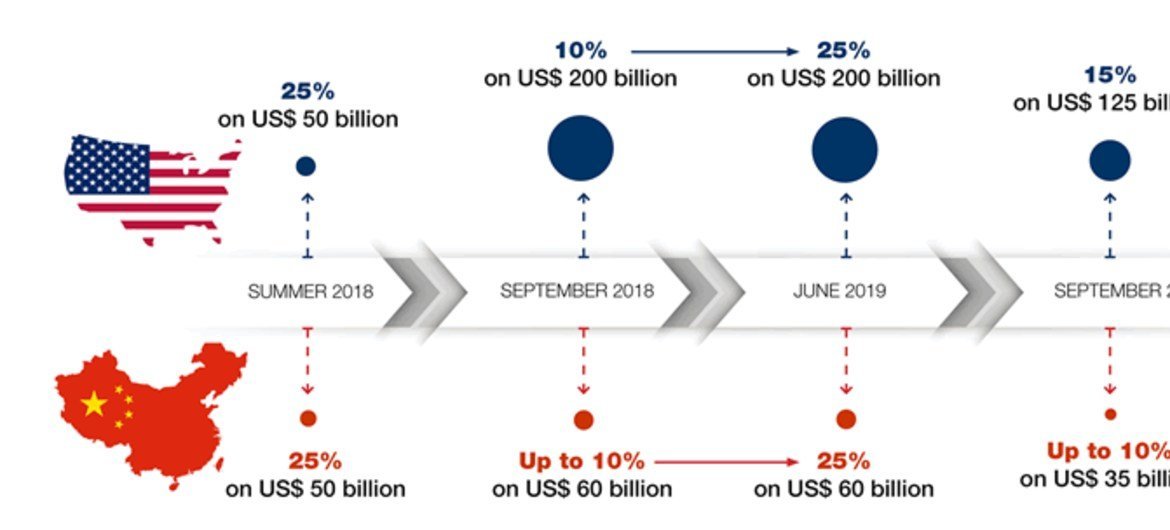

The US-China trade war, which intensified significantly starting in 2018, stemmed from long-standing trade imbalances and disagreements over intellectual property rights, technology transfer, and market access. Key events included the imposition of tariffs on billions of dollars worth of goods by both nations, leading to retaliatory measures and escalating tensions. The economic consequences were far-reaching.

- Impact on specific industries: The technology sector, particularly companies reliant on Chinese markets or supply chains, experienced significant disruptions. Agriculture also suffered, with substantial losses for US farmers due to Chinese tariffs on soybeans and other agricultural products.

- Changes in global supply chains: Companies scrambled to diversify their supply chains, moving production away from China to mitigate risks associated with tariffs and trade disruptions. This led to increased costs and logistical challenges.

- Increased uncertainty and volatility in financial markets: The ongoing uncertainty surrounding trade negotiations created significant volatility in stock markets globally, impacting investor confidence and investment decisions. This uncertainty directly influenced Dow Futures prices.

Keywords: Trade war timeline, tariff impact, economic consequences, global supply chain disruption

Stock Market Volatility and Dow Futures During the Trade War

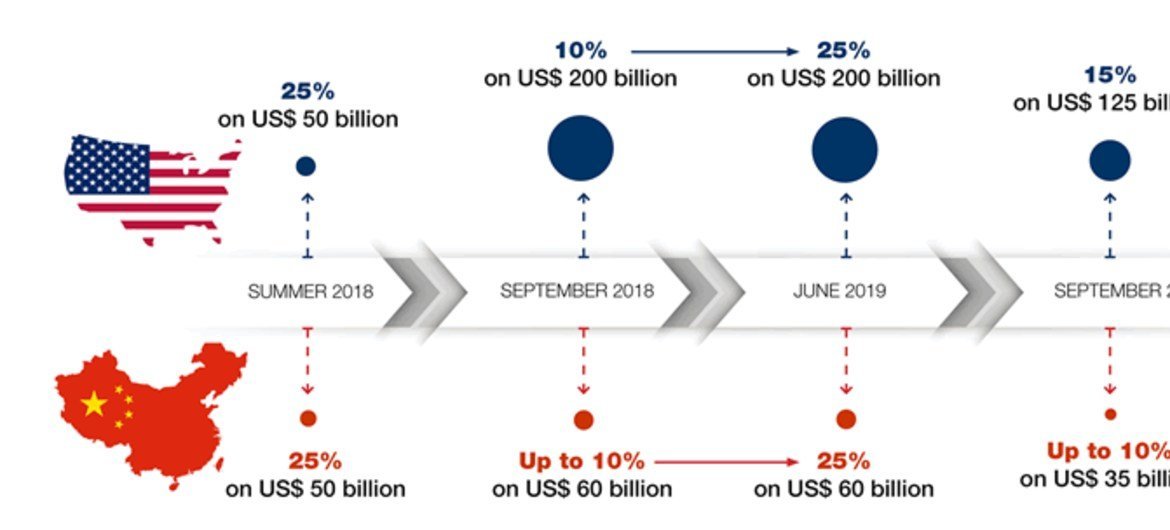

The US-China trade war created a period of heightened volatility in the stock market. Dow Futures, often considered a leading indicator of market sentiment, reflected this uncertainty. Price movements were closely correlated with trade war news, with sharp drops often following negative headlines and periods of relative stability occurring during periods of de-escalation.

- Specific examples of market reactions to trade war news: Announcements of new tariffs or trade restrictions frequently led to immediate and significant declines in Dow Futures and broader stock market indices. Conversely, positive news about potential trade deals often resulted in market rallies.

- Analysis of Dow Futures price movements during key periods: A detailed analysis of Dow Futures price charts during the trade war reveals a strong correlation between trade war events and market fluctuations, highlighting the sensitivity of the market to trade tensions.

- Discussion of investor behavior and sentiment during periods of uncertainty: Investors reacted with caution, shifting their portfolios toward safer assets during periods of heightened uncertainty. This "flight to safety" impacted Dow Futures contracts and other market indicators.

Keywords: Dow Jones Industrial Average, market volatility, futures trading, investor sentiment, market reaction

Sector-Specific Analysis: Winners and Losers in the Trade War

The US-China trade war had a varied impact on different sectors of the economy. Some industries benefited from increased domestic demand and reduced competition from Chinese imports, while others suffered from reduced exports and increased costs.

- Sectors positively impacted: Certain domestic manufacturing sectors, particularly those producing goods previously imported from China, experienced a surge in demand. However, this positive impact wasn't uniform across all manufacturing sectors.

- Sectors negatively impacted: The technology sector, including companies heavily reliant on Chinese markets or components, faced considerable challenges. Similarly, the agricultural sector suffered greatly from retaliatory tariffs imposed by China.

- Analysis of the shifting global landscape for specific industries: The trade war accelerated the trend towards global supply chain diversification, forcing companies to re-evaluate their sourcing strategies and geographic footprints.

Keywords: Sector performance, industry analysis, trade war winners and losers, economic diversification

Forecasting Future Trends: Dow Futures and the Post-Trade War Landscape

Predicting the future impact of US-China trade relations on Dow Futures and the broader stock market is challenging. However, several potential scenarios can be considered.

- Potential for further escalation or de-escalation: The relationship between the US and China continues to evolve, with potential for both further escalation or a period of reduced tension.

- Impact of geopolitical factors: Global geopolitical events and shifts in international alliances will continue to play a role in shaping trade relations and influencing market sentiment, impacting the Dow Futures market.

- Predictions for long-term market trends based on various scenarios: Different scenarios regarding US-China trade relations will lead to differing market outcomes, impacting Dow Futures and long-term investment strategies. Careful analysis of these different scenarios is crucial.

Keywords: Future market trends, Dow futures predictions, economic forecast, geopolitical risks

Conclusion: Understanding the US-China Trade War’s Lasting Impact on Investments

The US-China trade war demonstrated the significant impact of geopolitical events on global stock markets and Dow Futures. Understanding the complexities of these relationships is crucial for informed investment decisions. The volatility and uncertainty created by the trade war highlight the need for careful analysis of market trends and a thorough understanding of the risks involved.

To stay informed about the ongoing impact of US-China trade relations and its influence on your investments, we encourage further research. Explore resources dedicated to stock market analysis and investment strategies to refine your understanding of Dow Futures and other market indicators in the context of evolving global trade dynamics. Understanding the nuances of the US-China trade war is essential for navigating the complexities of the modern investment landscape.

Featured Posts

-

Bof As View Why Current Stock Market Valuations Shouldnt Deter Investors

Apr 26, 2025

Bof As View Why Current Stock Market Valuations Shouldnt Deter Investors

Apr 26, 2025 -

Nintendo Switch 2 Preorder My Game Stop Line Experience

Apr 26, 2025

Nintendo Switch 2 Preorder My Game Stop Line Experience

Apr 26, 2025 -

Solve Todays Nyt Spelling Bee Puzzle 360 February 26th Hints And Answers

Apr 26, 2025

Solve Todays Nyt Spelling Bee Puzzle 360 February 26th Hints And Answers

Apr 26, 2025 -

Game Stop Switch 2 Preorder A First Hand Account

Apr 26, 2025

Game Stop Switch 2 Preorder A First Hand Account

Apr 26, 2025 -

Kings Early Birthday Celebration Plans Revealed

Apr 26, 2025

Kings Early Birthday Celebration Plans Revealed

Apr 26, 2025