Understanding Tesla's Canadian Price Increase And Inventory Strategy

Table of Contents

Factors Contributing to Tesla's Canadian Price Increases

Several interconnected factors contribute to Tesla's recent price increases in Canada. These are not isolated incidents but rather a reflection of global economic trends and specific challenges faced by the company in the Canadian market.

Currency Fluctuations

The fluctuating Canadian dollar (CAD) against the US dollar (USD) significantly impacts Tesla's pricing strategy. Since Tesla vehicles are primarily manufactured in the US, a weaker CAD increases the cost of importing these vehicles into Canada. This necessitates price adjustments to maintain profitability.

- Increased manufacturing costs in USD: A weaker CAD translates to higher costs for Tesla in Canadian dollars, impacting the bottom line.

- Transportation expenses: Shipping costs are usually denominated in USD, further adding to the expense burden when the CAD weakens.

- Import duties and tariffs: These remain relatively constant in USD, meaning a weaker CAD increases their impact on the final price.

For instance, a 10% decrease in the CAD/USD exchange rate can directly increase import costs by a similar percentage, forcing Tesla to raise prices to compensate. Consistent monitoring of the CAD/USD exchange rate is crucial for understanding these price fluctuations.

Rising Raw Material Costs

The global automotive industry faces significant pressure from rising raw material costs. Tesla, like its competitors, is not immune to these challenges. Key materials like lithium, nickel, and cobalt, essential for electric vehicle batteries, have experienced dramatic price increases due to supply chain disruptions and increased global demand.

- Impact of inflation on raw materials: Global inflation exacerbates the cost pressures on raw material sourcing, pushing up production expenses.

- Supplier constraints and pricing power: Limited supply and strong demand for raw materials give suppliers greater pricing power, further impacting Tesla's production costs.

- Tesla's vertical integration efforts to mitigate these costs: Tesla is actively pursuing vertical integration strategies, such as securing its own lithium supplies, to reduce its reliance on external suppliers and lessen the impact of fluctuating prices.

Increased Demand and Limited Supply

Tesla vehicles continue to enjoy strong demand in Canada, leading to significant waiting lists for various models. This high demand, coupled with limited production capacity, allows Tesla to command higher prices.

- Waiting lists for various models: Extended waiting periods highlight the imbalance between supply and demand in the Canadian market.

- Strong sales figures in Canada: Robust sales figures indicate a healthy market appetite for Tesla vehicles, supporting the justification for higher prices.

- Limited production capacity: Tesla's production capacity, while expanding, remains constrained, creating a situation where demand outstrips supply.

Government Regulations and Incentives

Canadian government policies, including incentives for electric vehicles (EVs) and import regulations, influence Tesla's pricing decisions. Changes in these policies can impact both the cost of doing business and consumer demand.

- Impact of any changes in EV subsidies: Modifications to EV subsidies can indirectly impact the final price a consumer pays, influencing Tesla's pricing strategy.

- Compliance costs associated with Canadian regulations: Meeting Canadian safety and emissions standards entails compliance costs, potentially impacting pricing.

- Potential future policy changes: Uncertainty surrounding future government policies adds another layer of complexity to Tesla's Canadian pricing strategy.

Tesla's Inventory Management Strategy in Canada

Tesla's inventory management approach in Canada differs significantly from traditional automotive manufacturers, leveraging its direct-to-consumer model and a data-driven production strategy.

Direct-to-Consumer Sales Model

Tesla's direct sales model eliminates the intermediary role of dealerships, giving the company greater control over pricing and inventory management.

- Reduced reliance on traditional dealerships: This eliminates the need for large dealership inventories and associated costs.

- Greater control over pricing and sales: Tesla directly sets prices and manages sales, allowing for quicker responses to market changes.

- Potential for faster adjustments to market conditions: Tesla can rapidly adjust pricing and production based on real-time demand data.

Demand-Based Production

Tesla employs a demand-based production strategy, aligning production with actual consumer demand to optimize inventory levels. This minimizes warehousing costs and reduces the risk of overstocking.

- Flexible manufacturing capabilities: Tesla's factories are designed for flexible production, allowing rapid adjustments to model output.

- Data-driven production planning: Tesla utilizes extensive data analysis to forecast demand and optimize production accordingly.

- Minimizing warehousing costs: By closely aligning production with demand, Tesla minimizes the need for large-scale warehousing.

Strategic Inventory Locations

Tesla strategically places its service centers and delivery points across Canada to efficiently manage inventory and ensure timely delivery to customers.

- Regional distribution centers: These centers optimize inventory distribution across Canada, reducing delivery times.

- Efficient delivery logistics: Tesla's logistics network is designed for efficient and cost-effective delivery to customers.

- Proximity to major population centers: Service centers are strategically located near major population centers to minimize delivery times.

Conclusion

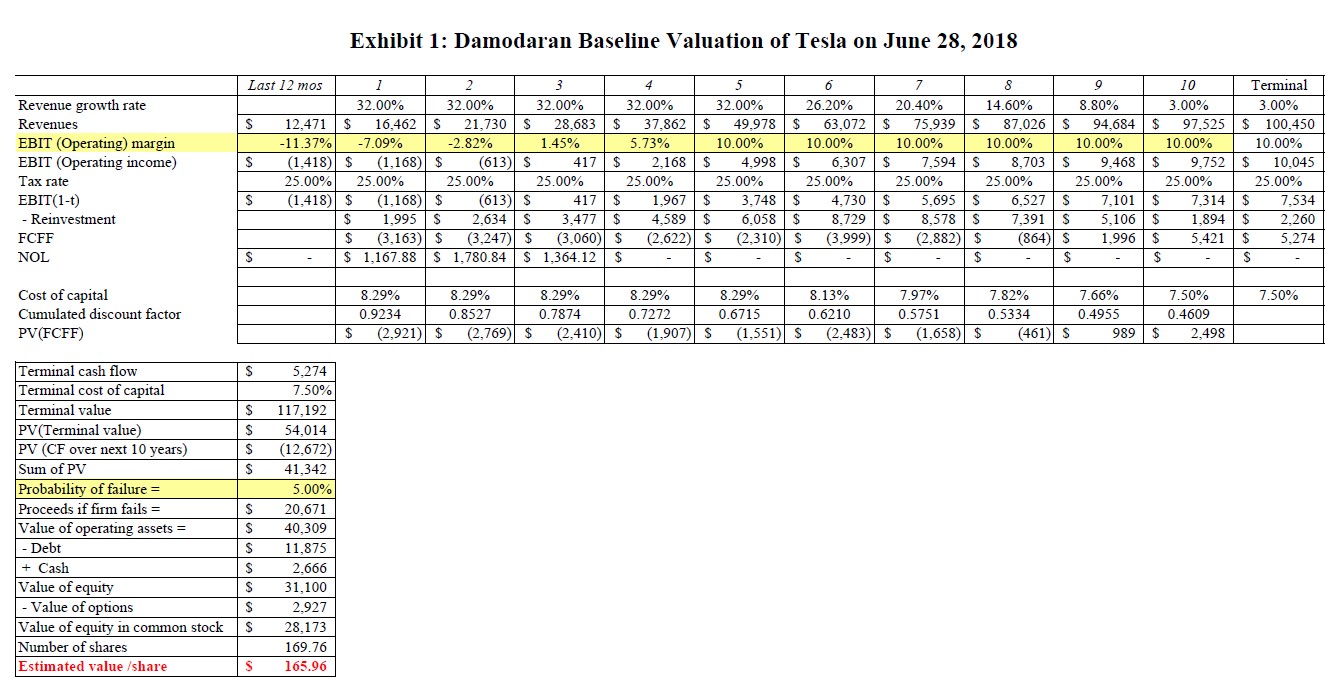

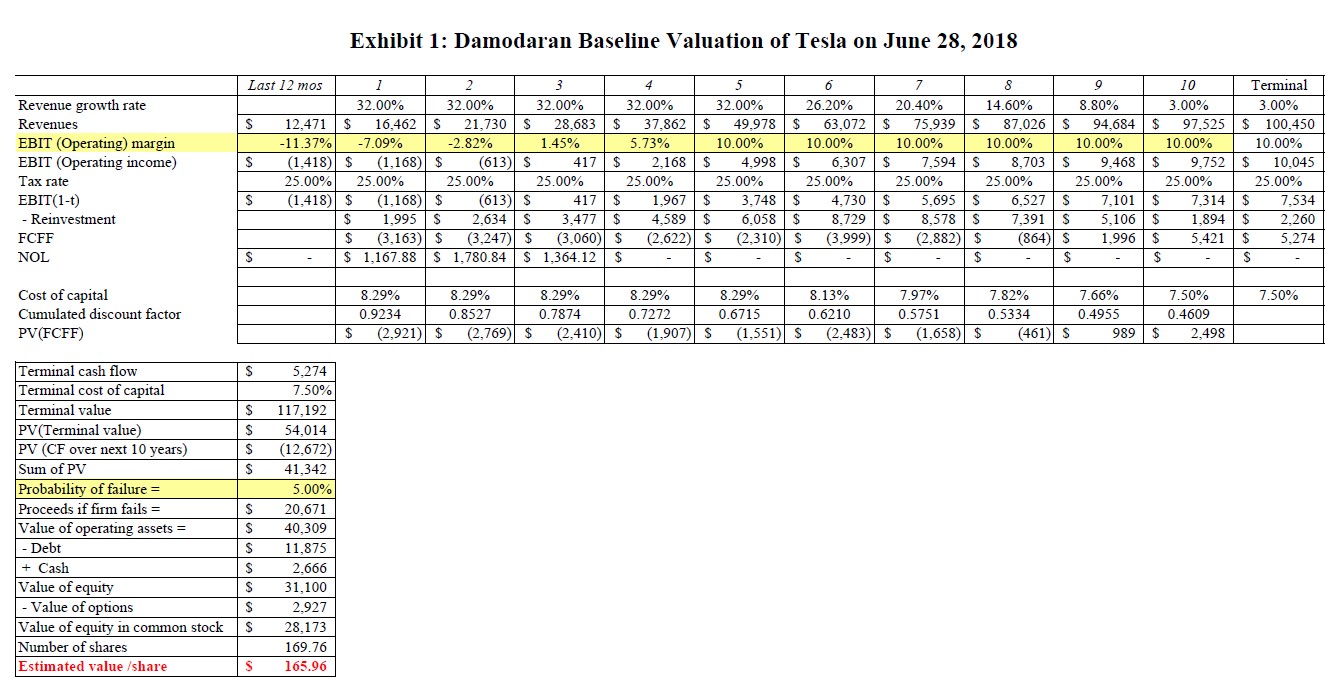

Tesla's Canadian price increases are a multifaceted issue stemming from currency fluctuations, rising raw material costs, strong demand, and evolving government regulations. The company’s direct-to-consumer model and demand-based production strategies are central to its inventory management approach. Understanding these intertwined factors is vital for both potential Tesla buyers and investors interested in the company's Canadian market performance. To stay abreast of future changes to Tesla's Canadian pricing and inventory, regularly consult reputable automotive news sources and monitor Tesla's official website. Staying informed on Tesla's Canadian Price Increase and Inventory Strategy is essential for making informed decisions in this dynamic market.

Featured Posts

-

Getting Ariana Grandes Look Finding The Right Professional Help For Hair And Tattoos

Apr 27, 2025

Getting Ariana Grandes Look Finding The Right Professional Help For Hair And Tattoos

Apr 27, 2025 -

Spds Response To Crumbachs Resignation From Bsw Leadership Role

Apr 27, 2025

Spds Response To Crumbachs Resignation From Bsw Leadership Role

Apr 27, 2025 -

Thueringens Amphibien Und Reptilien Der Neue Atlas Ist Da

Apr 27, 2025

Thueringens Amphibien Und Reptilien Der Neue Atlas Ist Da

Apr 27, 2025 -

3 Million Record Price For Camille Claudel Bronze At French Auction

Apr 27, 2025

3 Million Record Price For Camille Claudel Bronze At French Auction

Apr 27, 2025 -

Mc Cook Business Helps Nfl Players Rebuild Their Lives

Apr 27, 2025

Mc Cook Business Helps Nfl Players Rebuild Their Lives

Apr 27, 2025