Understanding High Stock Market Valuations: BofA's Viewpoint

Table of Contents

BofA's Assessment of Current Market Conditions

BofA's assessment of current stock market valuations often fluctuates, reflecting the dynamic nature of the market. While specific reports and statements change frequently, a common thread in their analysis tends to focus on a nuanced view rather than simply labeling the market as "overvalued," "fairly valued," or "undervalued." Instead, they usually highlight specific sectors and asset classes exhibiting varying degrees of valuation. Their analysis often incorporates a multitude of factors, making a blanket statement difficult.

- Summary of BofA's key findings regarding current market valuations: BofA regularly publishes market commentary and research reports that offer insights into their current assessment. These reports often incorporate a variety of valuation metrics. It is crucial to access the most up-to-date research directly from BofA's website for the most current perspective.

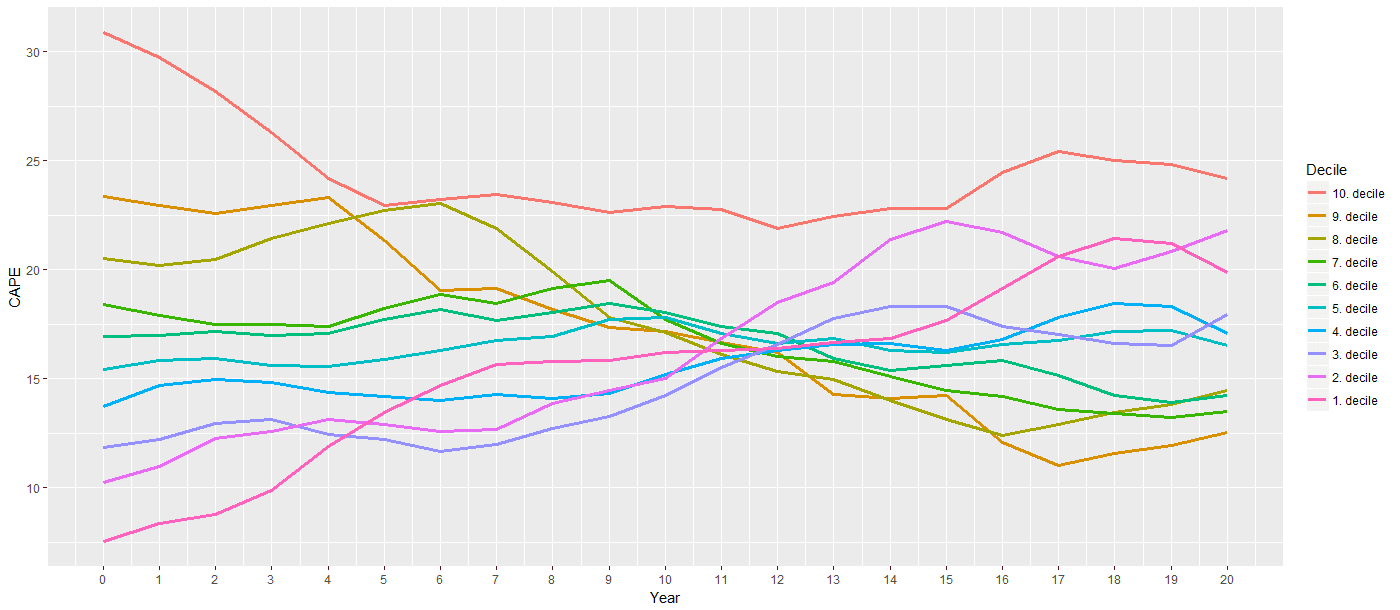

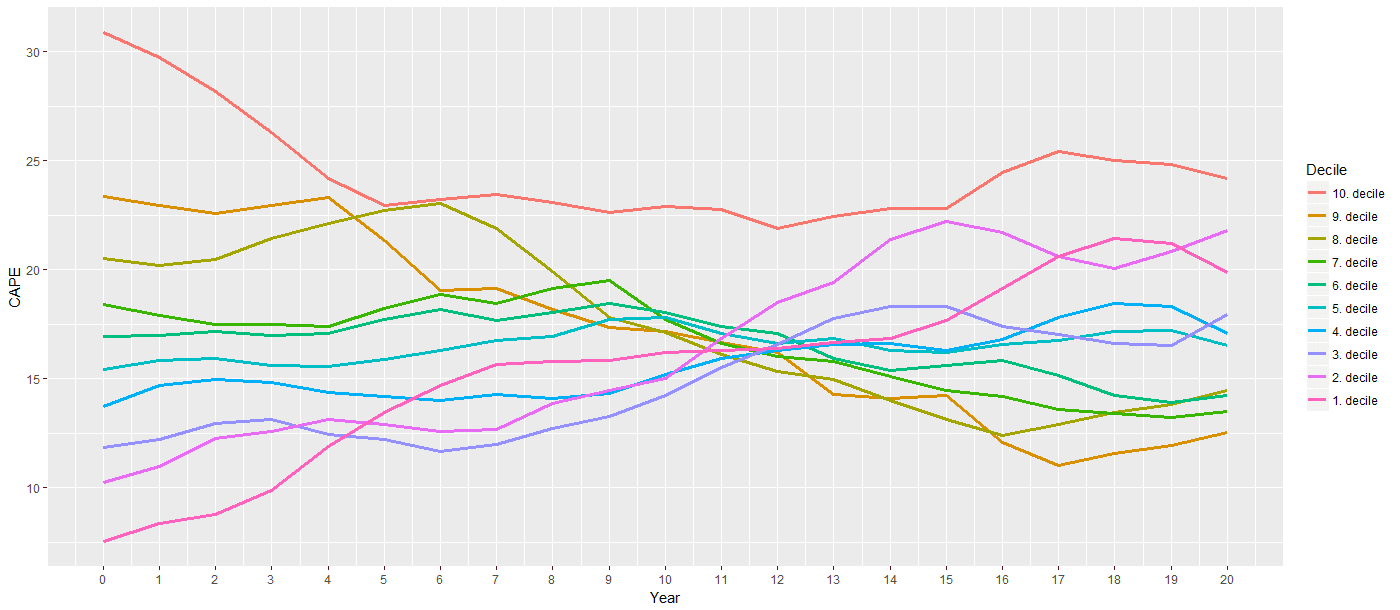

- Specific valuation metrics used by BofA: BofA's analysts employ a range of metrics, including the Price-to-Earnings ratio (P/E), the Shiller P/E ratio (CAPE), and various other sector-specific valuation multiples, depending on the asset class under consideration. They often compare these metrics to historical averages and peer group valuations to gauge relative valuation.

- Potential risks and opportunities identified by BofA: BofA's analyses typically highlight both the risks and opportunities within the market. Potential risks could include inflation, rising interest rates, geopolitical instability, and the possibility of a market correction. Opportunities might be found in specific sectors poised for growth or undervalued asset classes.

Factors Contributing to High Stock Market Valuations

Several factors contribute to the currently elevated stock market valuations. BofA's analysis often emphasizes the interplay of these factors, rather than attributing the high valuations to a single cause.

- Low interest rates and their impact on stock valuations: Extremely low interest rates make bonds less attractive, pushing investors towards higher-yielding assets like stocks. This increased demand contributes to higher stock prices, increasing stock market valuation.

- The role of quantitative easing and monetary policy: Central bank policies like quantitative easing (QE) inject liquidity into the market, further stimulating demand for stocks and pushing prices higher.

- Strong corporate earnings growth (or lack thereof): Consistent and robust corporate earnings growth can justify higher stock valuations. However, the relationship is not always linear, and periods of strong earnings growth might be followed by periods of valuation compression.

- Investor sentiment and market psychology: Investor confidence and market sentiment play a significant role. Optimistic expectations about future growth often drive up valuations, even in the face of potentially concerning metrics.

- Impact of technological advancements and innovation: The emergence of new technologies and innovative companies can also contribute to high valuations, especially in sectors like technology and healthcare.

The Influence of Low Interest Rates

Low interest rates have a profound impact on stock market valuations. When interest rates are low, the opportunity cost of investing in stocks (versus bonds) is reduced, leading to increased demand for equities. This is because the return on bonds is comparatively low, making stocks a more attractive investment for yield-seeking investors. The inverse relationship between the bond market and the stock market is clearly observable during periods of low interest rates.

The Role of Corporate Earnings

Corporate earnings play a crucial role in determining stock market valuation. Strong earnings growth often supports higher valuations, as companies demonstrate the ability to generate profits and potentially increase dividends. However, profit margins and future earnings expectations are equally important. If profit margins are squeezed or future earnings expectations are lowered, this can put downward pressure on valuations, even if current earnings are strong.

BofA's Investment Strategy Recommendations

BofA's recommendations for investors navigating these high stock market valuations tend to emphasize a balanced and cautious approach. While they may not explicitly advocate for a complete market exit, their advice frequently includes the following considerations:

- Suggested asset allocation strategies: BofA likely recommends a diversified portfolio, adjusting the allocation based on risk tolerance and market outlook. This may involve increasing holdings in less volatile asset classes during periods of elevated valuations.

- Recommendations for specific sectors or asset classes: BofA’s research may highlight specific sectors or asset classes that appear relatively less overvalued or offer greater potential for growth.

- Advice on risk management in a high-valuation market: Risk management is crucial. BofA may advise investors to consider strategies like hedging or diversification to mitigate potential losses.

- Specific investment products or services: BofA might promote its investment products or services, aligning with their risk management recommendations and market outlook.

Potential Risks and Opportunities

Despite the high valuations, opportunities and risks coexist. BofA's analysis usually points to these:

- Risk of a market correction or crash: High valuations inherently increase the risk of a significant market correction or even a crash. This is due to the potential for a sudden reversal of investor sentiment or unexpected negative economic news.

- Potential for inflation and its impact on valuations: Inflation can erode the purchasing power of earnings, potentially leading to lower valuations.

- Opportunities in specific sectors or industries: Even in a high-valuation market, some sectors or industries may offer better risk-adjusted returns than others.

- The importance of diversification and long-term investing: A diversified portfolio and a long-term investment horizon are essential for mitigating risk in any market environment.

Conclusion

BofA's perspective on high stock market valuations is typically nuanced, acknowledging the complexities of the current market conditions. While pinpointing a definitive "overvalued" or "undervalued" label is generally avoided, their analyses emphasize the importance of considering multiple valuation metrics, understanding contributing factors, and implementing prudent risk management strategies. They likely advocate for a diversified portfolio, focusing on both opportunities and potential risks within specific sectors and asset classes.

To make informed decisions regarding your investment strategy, further research into BofA's reports and analyses is highly recommended. Understanding high stock market valuations and using this knowledge to manage your portfolio effectively is crucial for achieving your long-term financial goals. Visit the BofA website for access to their latest research and market insights.

Featured Posts

-

Bencics Stylish Abu Dhabi Open Victory

Apr 27, 2025

Bencics Stylish Abu Dhabi Open Victory

Apr 27, 2025 -

Abu Dhabi Open Bencics Dominant Win

Apr 27, 2025

Abu Dhabi Open Bencics Dominant Win

Apr 27, 2025 -

Getting Ariana Grandes Look Finding The Right Professional Help For Hair And Tattoos

Apr 27, 2025

Getting Ariana Grandes Look Finding The Right Professional Help For Hair And Tattoos

Apr 27, 2025 -

El Sistema Alberto Ardila Olivares Tu Garantia De Gol En El Futbol

Apr 27, 2025

El Sistema Alberto Ardila Olivares Tu Garantia De Gol En El Futbol

Apr 27, 2025 -

Robert Pattinsons Sleepless Night Knives And A Horror Movie

Apr 27, 2025

Robert Pattinsons Sleepless Night Knives And A Horror Movie

Apr 27, 2025