UK Wind Auction Reform: Vestas Flags Investment Uncertainty

Table of Contents

The Changes to the UK Wind Auction System

The UK's CfD auction system, designed to support low-carbon electricity generation, has undergone significant changes in recent rounds. These changes mark a departure from previous iterations, creating uncertainty for investors like Vestas. The key differences include:

-

Increased Competition: The number of projects competing for CfD support has increased significantly, leading to fiercer bidding and potentially lower strike prices for successful bidders. This increased competition, while seemingly positive for consumers, introduces higher risk for developers and manufacturers.

-

Changes to the Bidding Process: The bidding process itself has been modified, potentially adding complexity and increasing the uncertainty surrounding the outcome for individual projects. This includes changes to the weighting of various factors in the evaluation process.

-

New Eligibility Criteria: Stricter eligibility criteria have been introduced, potentially excluding some projects from consideration. This could disproportionately affect certain technologies or project sizes, impacting the diversity of the UK's renewable energy portfolio.

-

Potential Impact on Project Financing: The increased uncertainty surrounding the auction process and the outcome of bids has made it more challenging to secure project financing, potentially delaying or even cancelling projects. Securing loans and investments becomes significantly more difficult when the future revenue stream is less predictable.

The government's rationale behind these changes is ostensibly to drive down the cost of renewable energy and increase efficiency. [Insert link to relevant government document outlining the reforms]. However, the unintended consequence appears to be a chilling effect on investment.

Vestas' Concerns and Statement Analysis

Vestas, a leading wind turbine manufacturer, has publicly expressed serious concerns about the implications of the reformed UK wind auction system. [Insert direct quote from a Vestas press release or statement]. Their concerns primarily revolve around:

-

Specific Concerns about Investment Risk: Vestas highlights the increased risk associated with bidding in the new auction system. The uncertainty of winning a CfD and the potential for lower-than-expected strike prices make investment decisions significantly more challenging.

-

Impact on Project Viability: The stricter eligibility criteria and increased competition threaten the viability of several projects in the pipeline, potentially leading to project cancellations or delays. This directly impacts Vestas' own order book and revenue projections.

-

Potential Reduction in Future Investment Commitments: Vestas has warned of a potential reduction in future investment commitments in the UK if the current uncertainty persists. This signals a significant blow to the UK's ambition to become a global leader in offshore wind energy.

-

Specific Projects Affected: [Mention any specific projects Vestas has cited as being affected by the changes. Include links to news articles if available]. This demonstrates the tangible, immediate impact of the reforms.

Vestas' concerns are directly linked to the increased competition, the modified bidding process, and the stricter eligibility criteria outlined in the previous section. The higher risk profile associated with the reformed auction makes it less attractive for companies like Vestas to invest heavily in the UK wind energy sector.

Wider Implications for the UK Renewable Energy Sector

The uncertainty created by the UK wind auction reform has significant implications for the UK’s renewable energy sector as a whole:

-

Potential Delays in Reaching Net-Zero Goals: Reduced investment in wind energy projects will almost certainly lead to delays in achieving the UK's ambitious net-zero targets. This delay will negatively impact the UK's climate change commitments.

-

Impact on Job Creation within the Wind Energy Sector: Reduced investment will inevitably lead to job losses within the UK wind energy sector, impacting manufacturing, installation, and maintenance roles. This could have significant socio-economic ramifications for specific regions.

-

Effect on the UK's Position as a Leader in Offshore Wind Technology: The UK's leading position in offshore wind technology is under threat. Reduced investment and the loss of investor confidence will weaken the UK's ability to compete with other countries in this growing sector.

-

Attractiveness of the UK for Future Foreign Investment in Renewable Energy: The current uncertainty is likely to deter future foreign investment in the UK's renewable energy sector, damaging the UK's reputation as a stable and attractive location for such investments.

[Include quotes or paraphrases from industry experts supporting these points. Include links to their statements or articles]. The current situation paints a concerning picture for the future of UK renewable energy.

Potential Solutions and Future Outlook

Addressing the concerns raised by Vestas and other stakeholders requires a multi-faceted approach:

-

Government Policy Adjustments: The government could review and potentially adjust its policy framework to alleviate the uncertainty surrounding the CfD auction system. This may involve modifications to the bidding process or eligibility criteria.

-

Industry Collaboration and Dialogue: Increased collaboration and open dialogue between the government, industry stakeholders (including manufacturers like Vestas), and investors are crucial to finding mutually acceptable solutions. A collaborative approach to refine the auction system is necessary.

-

Alternative Financing Mechanisms: Exploring alternative financing mechanisms, such as project-specific risk mitigation strategies or long-term power purchase agreements, could help reduce the perceived risk associated with UK wind projects.

-

Potential for Long-Term Contract Guarantees: Providing long-term contract guarantees could offer investors greater certainty and encourage higher levels of investment. This would reduce the perceived risk associated with the current system.

The future trajectory of the UK wind energy sector hinges on the government's response to these challenges. A clear and stable policy framework that addresses the concerns of major players like Vestas is paramount for ensuring the continued growth and success of the UK's renewable energy ambitions.

Conclusion

The reform of the UK wind auction system has created significant uncertainty, impacting investment decisions and threatening the UK's renewable energy goals. Vestas’ concerns, reflecting broader industry anxieties, highlight the potential negative consequences of the current policy framework. The potential delays in achieving net-zero targets, job losses, and reduced attractiveness for foreign investment underscore the urgency of addressing this issue. A clear and stable policy framework is crucial to encourage continued investment in UK wind energy projects. We need to resolve the uncertainties highlighted by Vestas and other stakeholders to ensure the continued growth of the UK’s renewable energy sector. Engage with this crucial discussion by sharing your perspectives and contacting your representatives to advocate for a supportive policy environment for UK wind energy investment, including UK offshore wind auctions and broader UK wind energy investment strategies.

Featured Posts

-

Tv Show Amanda Holden And Tess Dalys Daughters Island Survival

Apr 26, 2025

Tv Show Amanda Holden And Tess Dalys Daughters Island Survival

Apr 26, 2025 -

Benson Boone Denies Copying Harry Styles Addressing The Accusations

Apr 26, 2025

Benson Boone Denies Copying Harry Styles Addressing The Accusations

Apr 26, 2025 -

Mission Impossible Dead Reckoning Ignores Key Franchise Installments

Apr 26, 2025

Mission Impossible Dead Reckoning Ignores Key Franchise Installments

Apr 26, 2025 -

Canakkale Savasindan Dogan Dostluk Yeni Bir Fotograf Sergisi

Apr 26, 2025

Canakkale Savasindan Dogan Dostluk Yeni Bir Fotograf Sergisi

Apr 26, 2025 -

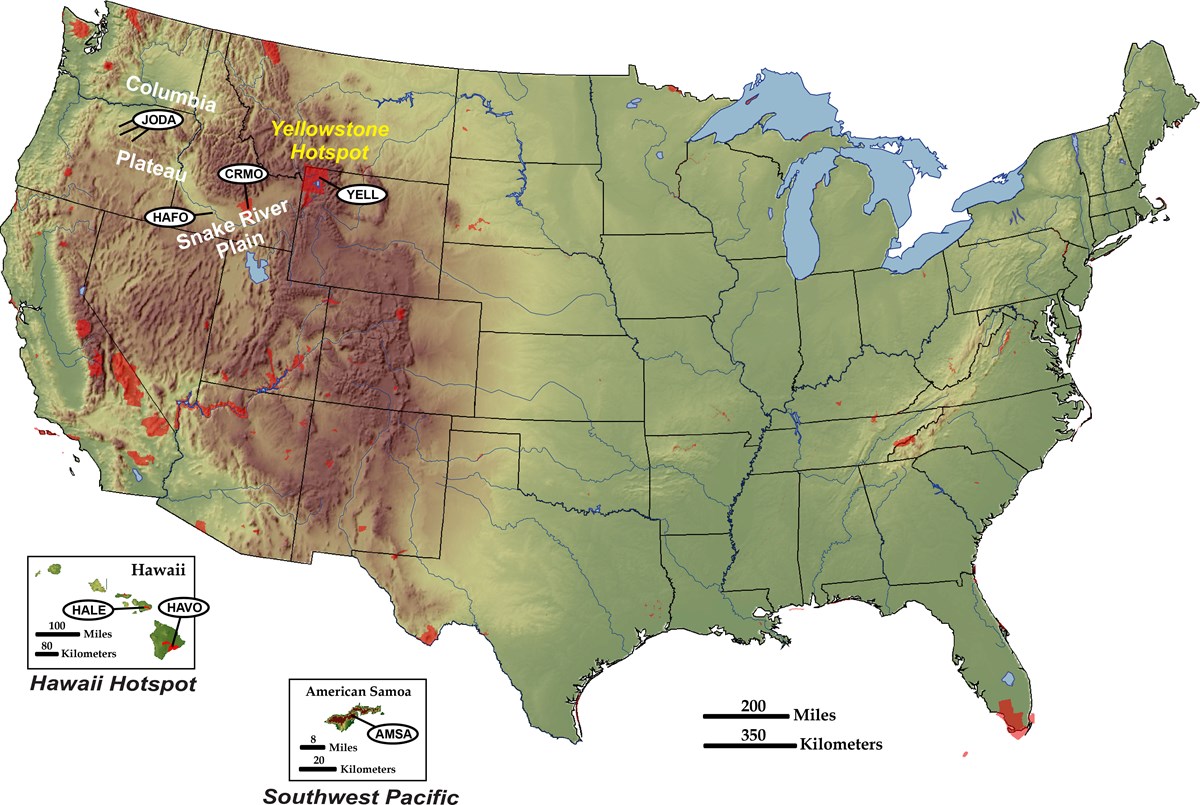

New Business Hotspots Across The Country An Interactive Map And Analysis

Apr 26, 2025

New Business Hotspots Across The Country An Interactive Map And Analysis

Apr 26, 2025