U.S. Dollar's Troubled Start: Worst 100 Days Since Nixon?

Table of Contents

Recent Volatility in the U.S. Dollar

Decline Against Major Currencies

The U.S. dollar has experienced a notable decline against major currencies in the past 100 days. This weakening of the dollar has sparked concerns among investors and economists alike. Let's examine the specifics:

- EUR/USD: The Euro has appreciated significantly against the dollar, reaching levels not seen in several years. For example, on [insert date], the EUR/USD exchange rate hit [insert specific value], representing a [insert percentage]% increase from [insert earlier date].

- USD/JPY: Similarly, the Japanese Yen has strengthened against the dollar. On [insert date], the USD/JPY pair fell to [insert specific value], reflecting a [insert percentage]% drop from [insert earlier date].

- GBP/USD: The British Pound Sterling also saw gains against the U.S. dollar, reaching [insert specific value] on [insert date], an increase of [insert percentage]% compared to [insert earlier date].

These movements, confirmed by reputable sources like Bloomberg and Reuters, indicate a significant weakening of the U.S. dollar in the foreign exchange market.

Impact on Global Markets

The dollar's weakness has far-reaching implications for global markets. The ripple effect is felt across various sectors:

- Increased import costs for U.S. consumers: A weaker dollar makes imports more expensive, potentially fueling inflation within the United States.

- Potential for inflation in the U.S.: Rising import prices contribute to higher consumer prices, increasing the cost of living and impacting purchasing power.

- Impact on emerging market economies reliant on dollar-denominated debt: Countries with significant dollar-denominated debt face increased repayment burdens as the value of their local currencies falls against the dollar. This can lead to economic instability and financial crises in vulnerable nations.

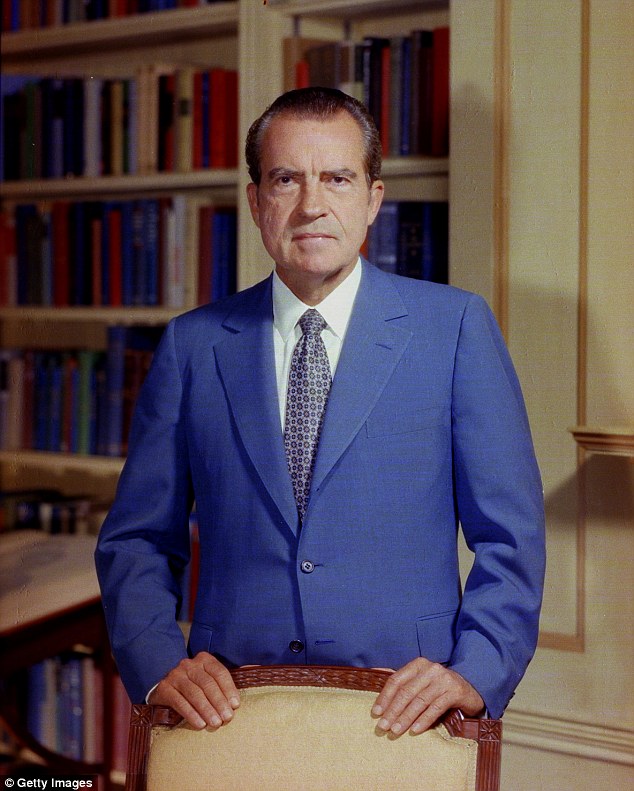

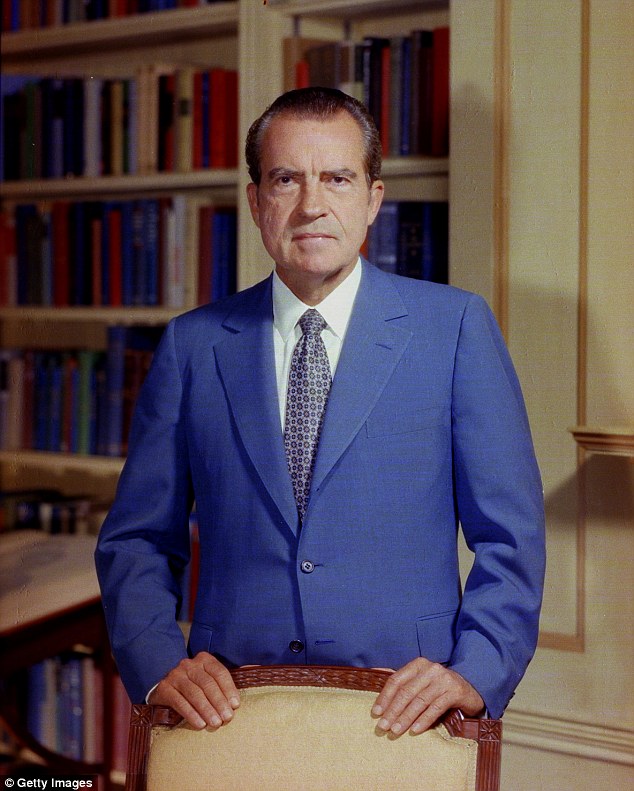

Comparison to the Nixon Shock of 1971

Historical Context

The Nixon shock of 1971, marked by President Nixon's closing of the gold window, dramatically altered the global monetary system. This pivotal moment ended the Bretton Woods system, which pegged the U.S. dollar to gold.

- Key events: The U.S. faced significant inflation and a trade deficit, leading to pressure on the dollar's peg to gold.

- Immediate aftermath: The immediate result was increased currency volatility and a period of uncertainty in global financial markets.

- Long-term consequences: The Nixon shock ushered in an era of floating exchange rates, fundamentally changing the dynamics of international finance. The parallels to the current situation are worth considering, although the specifics differ greatly.

Similarities and Differences

While direct comparisons between the current situation and the 1971 crisis need nuance, some parallels exist:

- Inflation rates: Both periods see relatively high inflation rates, though the causes and magnitudes differ.

- Global economic conditions: Both eras feature a complex geopolitical landscape impacting investor confidence and market sentiment. However, the specific factors contributing to the volatility differ greatly.

- Geopolitical tensions: The current geopolitical landscape, marked by the war in Ukraine and heightened tensions with China, adds another layer of complexity absent during the 1971 crisis.

The current situation, while potentially disruptive, is not a direct replica of the Nixon shock; the underlying economic and geopolitical factors differ significantly.

Potential Causes of the U.S. Dollar's Weakness

Inflation and Monetary Policy

High inflation and the Federal Reserve's monetary policy responses are key factors contributing to the dollar's decline.

- Interest rate hikes: While intended to curb inflation, interest rate hikes can simultaneously weaken a currency by attracting less foreign investment.

- Quantitative easing (QE): The lingering effects of previous QE programs might be contributing to the current inflationary pressures and subsequent dollar weakness.

- Inflation data: High inflation figures negatively impact investor confidence and may lead to a flight from the dollar.

Geopolitical Factors

Geopolitical events play a significant role in shaping investor sentiment and influencing the dollar's value.

- War in Ukraine: The ongoing conflict creates uncertainty and impacts global supply chains, negatively affecting investor confidence in the dollar.

- Rising tensions with China: Escalating trade tensions and geopolitical rivalry between the U.S. and China further contribute to market uncertainty.

- Flight to safety: During times of geopolitical instability, investors might seek "safe haven" assets like gold or the Japanese Yen, decreasing demand for the dollar.

Future Outlook for the U.S. Dollar

Expert Opinions and Predictions

Forecasts regarding the U.S. dollar's future trajectory vary among economists and analysts.

- Range of predictions: Some predict a continued decline, while others anticipate stabilization or even a rebound.

- Reputable sources: Consulting reports from institutions like the IMF, World Bank, and major financial firms provides valuable insights.

Potential Scenarios

Several scenarios regarding the dollar's future are possible:

- Continued decline: Persistent inflation, further interest rate hikes, or escalating geopolitical tensions could lead to continued dollar weakness.

- Stabilization: A combination of factors, such as controlled inflation and reduced geopolitical uncertainty, might lead to dollar stabilization.

- Rebound: Positive economic data, a successful inflation-control strategy, or a shift in global investor sentiment could trigger a dollar rebound.

Conclusion:

The recent volatility of the U.S. dollar raises concerns about its long-term stability, prompting comparisons to the tumultuous period following the Nixon shock. While the current situation presents unique challenges related to inflation and geopolitical instability, understanding the historical context and potential causes is crucial for navigating the uncertain future. Investors and businesses must carefully monitor the U.S. dollar's performance and adjust their strategies accordingly. Stay informed on the latest developments surrounding the U.S. dollar and its potential impact on global markets. Further research into the ongoing dynamics of the U.S. dollar and its potential impact on your investments is highly recommended.

Featured Posts

-

A Look At Espns 2025 Red Sox Outfield Prediction

Apr 28, 2025

A Look At Espns 2025 Red Sox Outfield Prediction

Apr 28, 2025 -

Yankees Lineup Aaron Judges Leadoff Position Debate

Apr 28, 2025

Yankees Lineup Aaron Judges Leadoff Position Debate

Apr 28, 2025 -

Red Sox Roster Update Lineup Restructured Casas Position Shift

Apr 28, 2025

Red Sox Roster Update Lineup Restructured Casas Position Shift

Apr 28, 2025 -

Red Sox Breakout Star An Unexpected Contributors Rise

Apr 28, 2025

Red Sox Breakout Star An Unexpected Contributors Rise

Apr 28, 2025 -

Market Downturns Opportunities For Individual Investors

Apr 28, 2025

Market Downturns Opportunities For Individual Investors

Apr 28, 2025