Trump's Trade Wars: The Impact On US Financial Primacy

Table of Contents

Tariffs and Global Trade Flows

Trump's administration implemented a series of tariffs, primarily targeting China and other major trading partners. This aggressive approach had a profound impact on global trade flows, creating significant ripple effects throughout the global economy.

Disruption of Supply Chains

The imposition of tariffs immediately disrupted established global supply chains. Increased import costs forced businesses to re-evaluate their sourcing strategies, leading to delays, increased production costs, and heightened uncertainty.

- Industries Affected: The agricultural sector (soybeans, for example), manufacturing (electronics, textiles), and automotive industries all experienced significant disruptions. Farmers faced reduced export markets and lower prices, while manufacturers struggled with higher input costs.

- Consequences for US Businesses and Consumers: Higher prices for imported goods led to decreased consumer spending, while businesses faced increased operational costs and reduced competitiveness in international markets. This created a domino effect, impacting employment and economic growth.

- Keywords: Tariffs, supply chain disruption, global trade, import costs, export markets, inflation, consumer spending

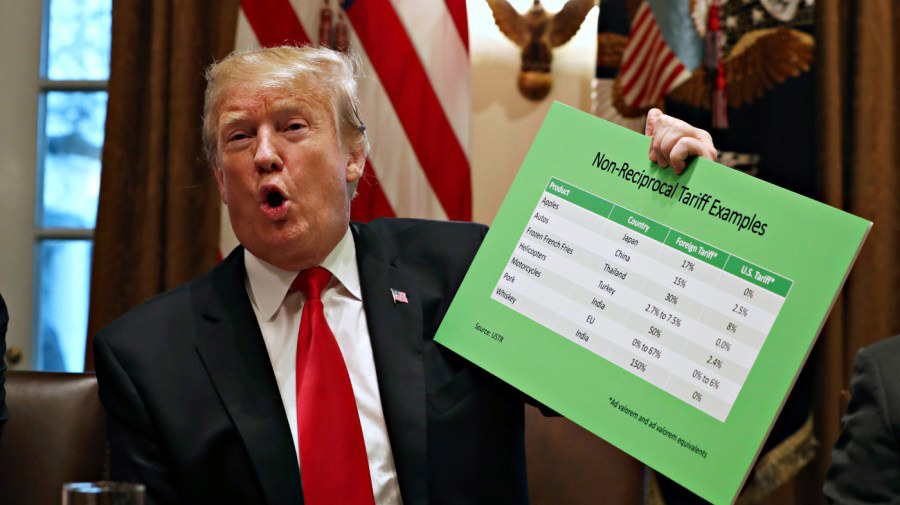

Retaliatory Tariffs and Economic Uncertainty

The US's imposition of tariffs triggered retaliatory measures from various countries, including China, the European Union, and others. These counter-tariffs further exacerbated global trade tensions and created a climate of significant economic uncertainty.

- Examples of Retaliatory Tariffs: China targeted US agricultural products, while the EU imposed tariffs on various US goods, further impacting US exports and businesses.

- Impact on Investor Confidence and Capital Flows: The uncertainty created by the trade war led to decreased investor confidence, impacting capital flows and investment decisions globally. Businesses delayed investments, and global financial markets experienced increased volatility.

- Keywords: Retaliation, economic uncertainty, investor confidence, capital flight, global investment, market volatility

Impact on the US Dollar's Hegemony

The trade wars raised questions about the long-term viability of the US dollar's dominance as the world's reserve currency.

Decline in Dollar's Reserve Currency Status?

The US dollar's role in international trade and finance is deeply entrenched. However, the uncertainty generated by the trade wars, combined with growing concerns about US economic and political stability, led some to consider alternatives.

- Role of the Dollar: The dollar's dominance facilitates global trade and finance by serving as a medium of exchange, a unit of account, and a store of value.

- Alternative Currencies Gaining Traction: While the dollar remains dominant, the Euro and the Chinese Yuan have seen increased usage in international transactions, suggesting a potential long-term shift in the global financial landscape. This trend was exacerbated by the unpredictability of US trade policy.

- Keywords: US dollar, reserve currency, global finance, currency devaluation, international trade, Euro, Chinese Yuan, de-dollarization

Increased Volatility in Foreign Exchange Markets

The trade wars induced heightened volatility in foreign exchange markets as investors reacted to the uncertainty surrounding trade relations.

- Examples of Significant Currency Fluctuations: The value of the dollar fluctuated significantly against other major currencies during the period of trade tensions, impacting businesses and investors globally.

- Impact on International Investments and Businesses: Currency volatility made international investments riskier, impacting the profitability and strategic planning of multinational corporations. Businesses had to implement sophisticated hedging strategies to mitigate these risks.

- Keywords: Foreign exchange markets, currency volatility, hedging strategies, international investment, risk management

Consequences for US Financial Institutions

The ramifications of Trump's trade wars extended to the US financial sector itself.

Impact on Banking and Finance

US banks, investment firms, and financial markets all felt the impact of the trade disputes.

- Increased Risk for Lenders and Investors: The uncertainty surrounding trade relations increased credit risk and investment risk, forcing financial institutions to reassess their lending and investment strategies.

- Changes in Investment Strategies and Portfolio Diversification: Investors diversified their portfolios to mitigate the risks associated with trade wars, leading to shifts in investment flows.

- Keywords: US banking, financial markets, investment risk, portfolio management, credit risk, diversification

Long-Term Effects on US Economic Growth

The trade wars had long-term implications for US economic growth and global competitiveness.

- Potential for Reduced Productivity and Innovation: The disruptions caused by tariffs and retaliatory measures hindered productivity growth and potentially stifled innovation, as businesses shifted their focus from long-term investments to reacting to immediate challenges.

- Impact on Long-Term Economic Prospects: The overall impact contributed to a slower pace of economic growth and raised questions about the US's long-term economic competitiveness on the global stage.

- Keywords: Economic growth, competitiveness, productivity, innovation, long-term economic impact

Conclusion

Trump's trade wars had a significant and multifaceted impact on US financial primacy. The disruption of global supply chains, retaliatory tariffs, and increased economic uncertainty all contributed to a decline in investor confidence and heightened volatility in currency markets. While the dollar remains the dominant reserve currency, the trade wars highlighted potential vulnerabilities and the growing influence of alternative currencies. The long-term consequences for US economic growth and global competitiveness remain a subject of ongoing debate and analysis. Understanding the lingering impact of Trump's trade policies on US financial leadership is crucial. Learn more about the complexities of global trade and their consequences today by researching further into the economic effects of protectionist policies and the ongoing evolution of the global financial landscape.

Featured Posts

-

Who Will Bear The Cost Of Trumps Economic Policies

Apr 22, 2025

Who Will Bear The Cost Of Trumps Economic Policies

Apr 22, 2025 -

Blue Origins Stumbles A Public Relations Disaster Surpassing Katy Perry S

Apr 22, 2025

Blue Origins Stumbles A Public Relations Disaster Surpassing Katy Perry S

Apr 22, 2025 -

Navigate The Private Credit Boom 5 Essential Dos And Don Ts

Apr 22, 2025

Navigate The Private Credit Boom 5 Essential Dos And Don Ts

Apr 22, 2025 -

Discovering The Countrys Next Big Business Centers

Apr 22, 2025

Discovering The Countrys Next Big Business Centers

Apr 22, 2025 -

Section 230 And Banned Chemicals On E Bay A Judges Ruling

Apr 22, 2025

Section 230 And Banned Chemicals On E Bay A Judges Ruling

Apr 22, 2025