Trump's Trade War: Why Investment Strategists Are Less Bullish On European Stocks

Table of Contents

Increased Uncertainty and Volatility in Global Markets

Trump's trade protectionist measures, characterized by aggressive tariff imposition and the initiation of trade wars, have injected unprecedented uncertainty into global markets. This unpredictability directly undermines investor confidence, leading to a more risk-averse investment environment.

- Increased market volatility: The constant threat of new tariffs and retaliatory measures creates a climate of heightened market volatility, discouraging long-term investment and prompting investors to seek safer havens.

- Uncertainty surrounding future trade agreements: The lack of clarity regarding future trade agreements leaves European businesses facing significant uncertainty about their future trading relationships and market access. This uncertainty makes long-term strategic planning extremely difficult.

- Negative impact on supply chains: Disruptions to global supply chains caused by tariffs and trade disputes increase production costs and complicate logistics for European businesses, impacting their competitiveness and profitability.

- Specific sectors negatively affected: The automotive and agricultural sectors in Europe have been particularly hard hit, facing substantial tariff barriers and reduced market access in key export destinations.

Weakening of the Euro and its Impact on European Companies

The ongoing trade war has also contributed to a weakening Euro, further impacting the profitability of European businesses. This currency fluctuation presents a significant challenge to European companies.

- Impact on export competitiveness: A weaker Euro can theoretically boost export competitiveness by making European goods cheaper for buyers using other currencies. However, this benefit is often offset by increased import costs and supply chain disruptions.

- Impact on European company earnings: The combined effects of reduced demand, increased costs, and currency fluctuations translate into lower earnings for many European companies, directly impacting their stock valuations.

- Currency fluctuations as a risk factor: Currency volatility has become a major risk factor for investors, making it harder to predict the future performance of European companies.

- Specific companies hurt by currency shifts: Companies with significant export-oriented businesses or those heavily reliant on imported raw materials are particularly vulnerable to the effects of currency fluctuations stemming from Trump's trade policies.

Slowdown in Global Economic Growth and its Spillover Effect on Europe

The interconnectedness of the global economy means that Trump's trade actions have a significant spillover effect on Europe. The resulting slowdown in global economic growth negatively impacts European economic prospects.

- Reduced global demand: The trade war dampens global demand for European goods and services, leading to reduced export revenue and slower economic growth.

- Decreased investment: A less optimistic global economic outlook discourages investment, both domestic and foreign, further slowing European economic growth.

- Reduced consumer spending: Reduced economic confidence and job security can lead to reduced consumer spending in Europe, negatively impacting economic activity.

- Impact on European GDP growth: The combined impact of these factors translates into lower European GDP growth, reflected in lower stock market valuations.

Retaliatory Measures and Their Consequences for European Businesses

The imposition of tariffs by the US has provoked retaliatory measures from other countries, further complicating the situation for European businesses. These retaliatory actions add another layer of complexity to the challenges faced by European companies.

- Examples of retaliatory tariffs: Several countries have imposed retaliatory tariffs on European products in response to US trade actions, impacting a range of industries.

- Negative impact on specific industries: European industries such as wine, cheese, and textiles have been particularly targeted by retaliatory tariffs.

- Increased costs and reduced competitiveness: Retaliatory measures increase costs and reduce the competitiveness of European exporters in global markets.

- Potential for escalation: The risk of further escalation in trade tensions remains a significant concern, with the potential for even more damaging consequences for European businesses.

Conclusion: Re-evaluating Investment Strategies in Light of Trump's Trade War

In conclusion, Trump's trade war has created a climate of significant uncertainty and volatility in global markets, significantly dampening the bullish sentiment on European stocks. The weakening Euro, reduced global demand, and retaliatory measures are all contributing factors. This uncertainty has profoundly impacted investor confidence, leading to a reassessment of investment strategies. To mitigate the risks associated with the ongoing effects of Trump's trade policies, investors need to carefully analyze the potential impacts of global trade uncertainty and consider diversifying their investment portfolios. Staying informed about global trade developments and their implications for investment decisions is crucial in navigating this challenging economic landscape. Don't underestimate the impact of the impact of trade wars on your investment strategy; take proactive steps to protect your portfolio.

Featured Posts

-

Index Investigates Allegations Of Fraud At Hungarys Central Bank

Apr 26, 2025

Index Investigates Allegations Of Fraud At Hungarys Central Bank

Apr 26, 2025 -

Millions Lost Federal Charges Filed In Massive Office365 Data Breach

Apr 26, 2025

Millions Lost Federal Charges Filed In Massive Office365 Data Breach

Apr 26, 2025 -

The Canberra Times Exploring The Tim The Yowie Man Anzac Day Tradition

Apr 26, 2025

The Canberra Times Exploring The Tim The Yowie Man Anzac Day Tradition

Apr 26, 2025 -

Private Credit Jobs 5 Dos And Don Ts For A Successful Application

Apr 26, 2025

Private Credit Jobs 5 Dos And Don Ts For A Successful Application

Apr 26, 2025 -

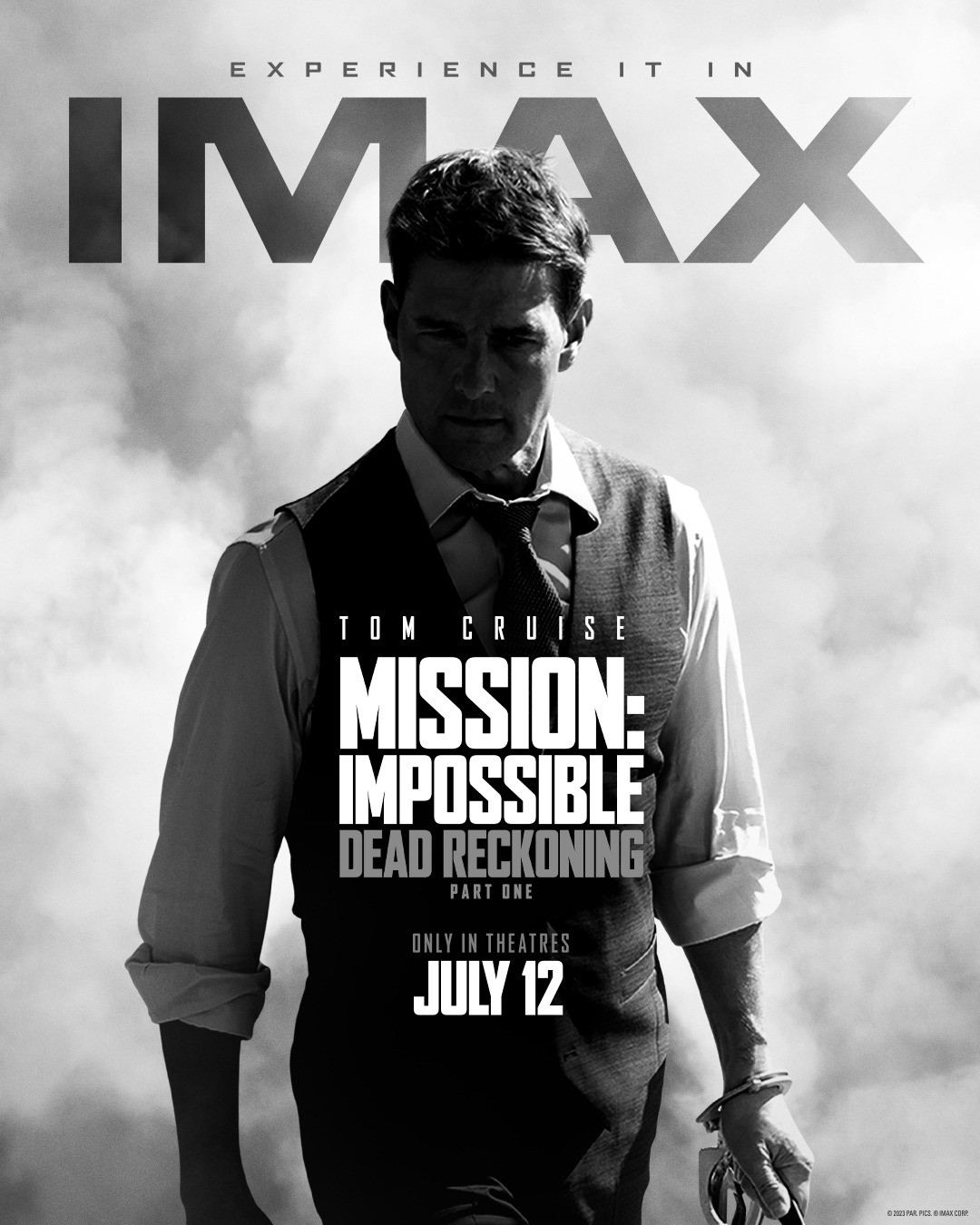

Review Mission Impossible Dead Reckoning Part One Teaser Ethan Hunt Returns

Apr 26, 2025

Review Mission Impossible Dead Reckoning Part One Teaser Ethan Hunt Returns

Apr 26, 2025