Trump's Economic Agenda: Who Pays The Price?

Table of Contents

H2: Tax Cuts and Their Impact

Trump's signature 2017 tax cuts significantly altered the US tax code. This section explores the beneficiaries and the long-term costs associated with these changes.

H3: Beneficiaries of the Tax Cuts

The tax cuts disproportionately favored high-income earners and corporations.

- Corporate Tax Rate Reduction: The reduction of the corporate tax rate from 35% to 21% was a major component, leading to increased corporate profits and shareholder returns.

- Individual Tax Cuts: While many individuals saw some tax relief, the biggest cuts went to those in the highest income brackets.

- Increased Wealth Inequality: Studies show a widening gap between the rich and the poor following the tax cuts, exacerbating existing wealth inequality. This outcome contradicted claims of a "trickle-down" effect, where tax cuts for the wealthy stimulate economic growth that benefits everyone. Critics argued that the benefits were largely retained at the top, failing to significantly boost wages or investment for the majority.

H3: The Cost of Tax Cuts

The substantial tax cuts contributed significantly to the national debt.

- National Debt Increase: The national debt ballooned during the Trump administration, partially fueled by the revenue shortfall from the tax cuts.

- Reduced Government Spending: The decreased tax revenue constrained government spending in other areas, potentially impacting social programs and infrastructure development.

- Long-Term Economic Consequences: Economists debate the long-term consequences of this increased debt, with concerns about future interest payments and potential economic instability. The sustainability of such a policy in the long run remains a significant point of contention.

H2: Trade Wars and Their Consequences

Trump's trade policies, characterized by tariffs and trade disputes, had significant repercussions for various sectors of the US economy.

H3: Impact on American Farmers and Manufacturers

Tariffs imposed by the Trump administration on goods from China and other countries had devastating impacts on certain industries.

- Agriculture: American farmers, particularly soybean and pork producers, faced significant losses due to retaliatory tariffs from China. Government subsidies were implemented to mitigate some of these losses, but many farmers faced bankruptcy or financial hardship.

- Manufacturing: Certain manufacturing sectors experienced increased input costs due to tariffs on imported materials, leading to job losses and reduced competitiveness. The impact was not uniform, however, with some domestic industries benefiting from increased protection.

- Increased Consumer Prices: Tariffs contributed to higher prices for consumers on various goods, impacting household budgets.

H3: Winners and Losers in the Trade War

While some domestic industries benefited from protectionist measures, the overall impact of the trade wars was largely negative.

- Domestic Industries: Certain sectors, particularly steel and aluminum, experienced temporary gains due to increased protection.

- Consumers and Importers: Consumers faced higher prices, and importers suffered from reduced trade volumes.

- International Relations: The trade disputes strained relationships with key trading partners, leading to uncertainty and instability in global markets. Retaliatory tariffs imposed by other countries further exacerbated the negative effects.

H2: Deregulation and its Ramifications

The Trump administration pursued a policy of deregulation across various sectors, leading to both potential benefits and risks.

H3: Environmental Regulations and Their Impact

The rollback of environmental regulations raised concerns about environmental protection and public health.

- Weakening of Environmental Standards: Numerous environmental regulations were weakened or repealed, impacting air and water quality, and potentially increasing risks associated with climate change.

- Long-Term Environmental Costs: The long-term costs associated with environmental damage from deregulation could be substantial, including increased healthcare costs and damage to natural resources.

- Public Health Concerns: Relaxed environmental standards could contribute to increased respiratory illnesses and other health problems.

H3: Financial Deregulation and its Risks

Reduced financial regulations raised concerns about potential financial instability.

- Increased Risk of Financial Crises: Critics warned that deregulation could increase the risk of future financial crises, similar to the 2008 crisis.

- Arguments for and Against Deregulation: Supporters of deregulation argue it promotes economic efficiency and growth. Opponents, however, emphasize the need for regulations to protect consumers and maintain financial stability.

3. Conclusion

Trump's economic agenda resulted in a highly uneven distribution of benefits and burdens. While corporations and high-income earners largely benefited from tax cuts, many workers, farmers, and consumers faced negative consequences from trade wars and deregulation. The long-term impact of increased national debt and environmental damage remains a significant concern. Understanding the complexities of Trump's economic agenda is crucial to informing future economic policy decisions. Continue to research and engage in the ongoing debate surrounding Trump's economic policies and their lasting effects.

Featured Posts

-

Another Court Battle Doj Vs Googles Search Dominance

Apr 22, 2025

Another Court Battle Doj Vs Googles Search Dominance

Apr 22, 2025 -

The Human Cost Of Trumps Economic Goals

Apr 22, 2025

The Human Cost Of Trumps Economic Goals

Apr 22, 2025 -

Comparing Public Perception Blue Origins Difficulties Vs Katy Perrys Career Low Points

Apr 22, 2025

Comparing Public Perception Blue Origins Difficulties Vs Katy Perrys Career Low Points

Apr 22, 2025 -

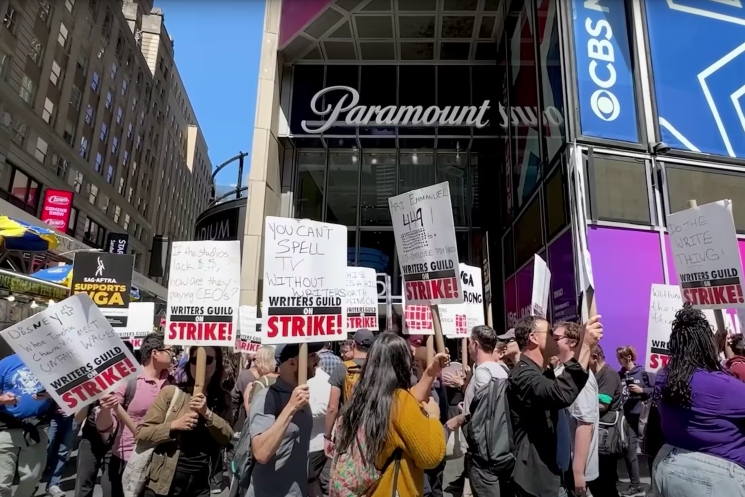

Hollywood Strike Actors Join Writers Bringing Production To A Halt

Apr 22, 2025

Hollywood Strike Actors Join Writers Bringing Production To A Halt

Apr 22, 2025 -

China And Indonesia Forging Stronger Security Bonds

Apr 22, 2025

China And Indonesia Forging Stronger Security Bonds

Apr 22, 2025