Trump's Attack On Currency Manipulation: Implications For The KRW/USD Exchange Rate

Table of Contents

Understanding Trump's Accusations of Currency Manipulation

Defining Currency Manipulation

Currency manipulation refers to deliberate government intervention to influence a country's exchange rate. This often involves a central bank buying or selling its own currency in the foreign exchange market to artificially lower or raise its value. Countries might engage in this practice to gain a trade advantage, making their exports cheaper and imports more expensive. The International Monetary Fund (IMF) has specific criteria for defining currency manipulation, though these are often subject to interpretation and debate.

Trump's Rationale

Trump consistently argued that certain countries, including South Korea, were manipulating their currencies to gain an unfair competitive edge in international trade. He viewed this as a form of protectionism that harmed American businesses and workers. His administration threatened tariffs and other trade sanctions as a response to perceived currency manipulation, aiming to level the playing field for US exporters.

- Examples: Trump's public statements frequently labeled China and South Korea as currency manipulators. He threatened tariffs on imported goods to counter this perceived unfair advantage.

- Trade Agreements: The renegotiation of the US-Korea Free Trade Agreement (KORUS) was significantly influenced by Trump's concerns about currency manipulation and trade imbalances.

- Relevant Statements: Official White House statements and Trump's tweets provide ample evidence of his position on this issue. Searching for "Trump currency manipulation" will yield many relevant news articles and official pronouncements.

The Impact on the KRW/USD Exchange Rate

Historical Context

The KRW/USD exchange rate has historically fluctuated significantly, influenced by various economic and political factors. Periods of global economic uncertainty, changes in interest rate differentials between the US and South Korea, and geopolitical events have all contributed to its volatility.

Direct Impact of Trump's Actions

Trump's rhetoric and threats of sanctions directly impacted the KRW/USD exchange rate. Periods of heightened tensions often led to a depreciation of the South Korean Won (KRW) against the US dollar (USD), reflecting investor uncertainty and capital flight. Conversely, periods of de-escalation or positive trade news could lead to Won appreciation.

Indirect Impact through Trade

The broader impact of trade tensions between the US and South Korea also affected the KRW/USD exchange rate. Uncertainty regarding future trade policies and the potential for tariffs influenced investor sentiment and capital flows, indirectly impacting the exchange rate. Reduced trade volume and disruptions to supply chains could further affect the South Korean economy and its currency.

- Statistical Data: Analyzing historical data from sources like the Bank of Korea and the Federal Reserve will reveal significant fluctuations in the KRW/USD exchange rate correlated to Trump's actions and statements.

- Market Reactions: News reports and financial market data demonstrate the immediate reactions of the KRW/USD exchange rate to specific announcements or actions by the Trump administration.

- Investor Sentiment: Surveys of investor confidence and market analyses provide insights into the role of speculation and sentiment in driving exchange rate movements.

Predicting Future Trends in the KRW/USD Exchange Rate

Factors Influencing Future Movements

Predicting future movements in the KRW/USD exchange rate requires considering several factors. Ongoing trade negotiations between the US and South Korea, global economic conditions (including interest rates and inflation), and monetary policy decisions by both the US Federal Reserve and the Bank of Korea will all play a role. Geopolitical events, such as tensions on the Korean Peninsula, could also significantly influence the exchange rate.

Risk Assessment for Investors

The KRW/USD exchange rate remains highly volatile and sensitive to political and economic factors. Investors involved in KRW/USD trading should carefully assess the risks involved and diversify their portfolios to mitigate potential losses. Understanding the interplay between US-South Korea relations and global economic trends is essential for managing risk effectively.

- Forecasting Models: While various forecasting models exist, they are subject to limitations and uncertainties. No model can perfectly predict future exchange rate movements.

- Geopolitical Events: Unexpected geopolitical developments can significantly impact the KRW/USD exchange rate, creating both opportunities and risks for investors.

- Economic Indicators: Monitoring key economic indicators, such as interest rates, inflation, and GDP growth, is crucial for understanding potential future movements in the exchange rate.

Conclusion

Trump's accusations of currency manipulation significantly impacted the KRW/USD exchange rate, creating periods of both appreciation and depreciation. The exchange rate's volatility highlights its sensitivity to political and economic factors, particularly those related to US-South Korea trade relations. Understanding Trump's approach to currency manipulation is crucial for navigating the complexities of the KRW/USD exchange rate. Stay informed about the evolving landscape of the KRW/USD exchange rate and its relationship to the ongoing shifts in global trade policy. Continued monitoring of relevant economic indicators and geopolitical events is necessary for informed decision-making regarding investments and trade in this dynamic market.

Featured Posts

-

Emilia Pereyra Y Carlos Manuel Estrella Ganadores De Los Premios Caonabo De Oro 2025

Apr 25, 2025

Emilia Pereyra Y Carlos Manuel Estrella Ganadores De Los Premios Caonabo De Oro 2025

Apr 25, 2025 -

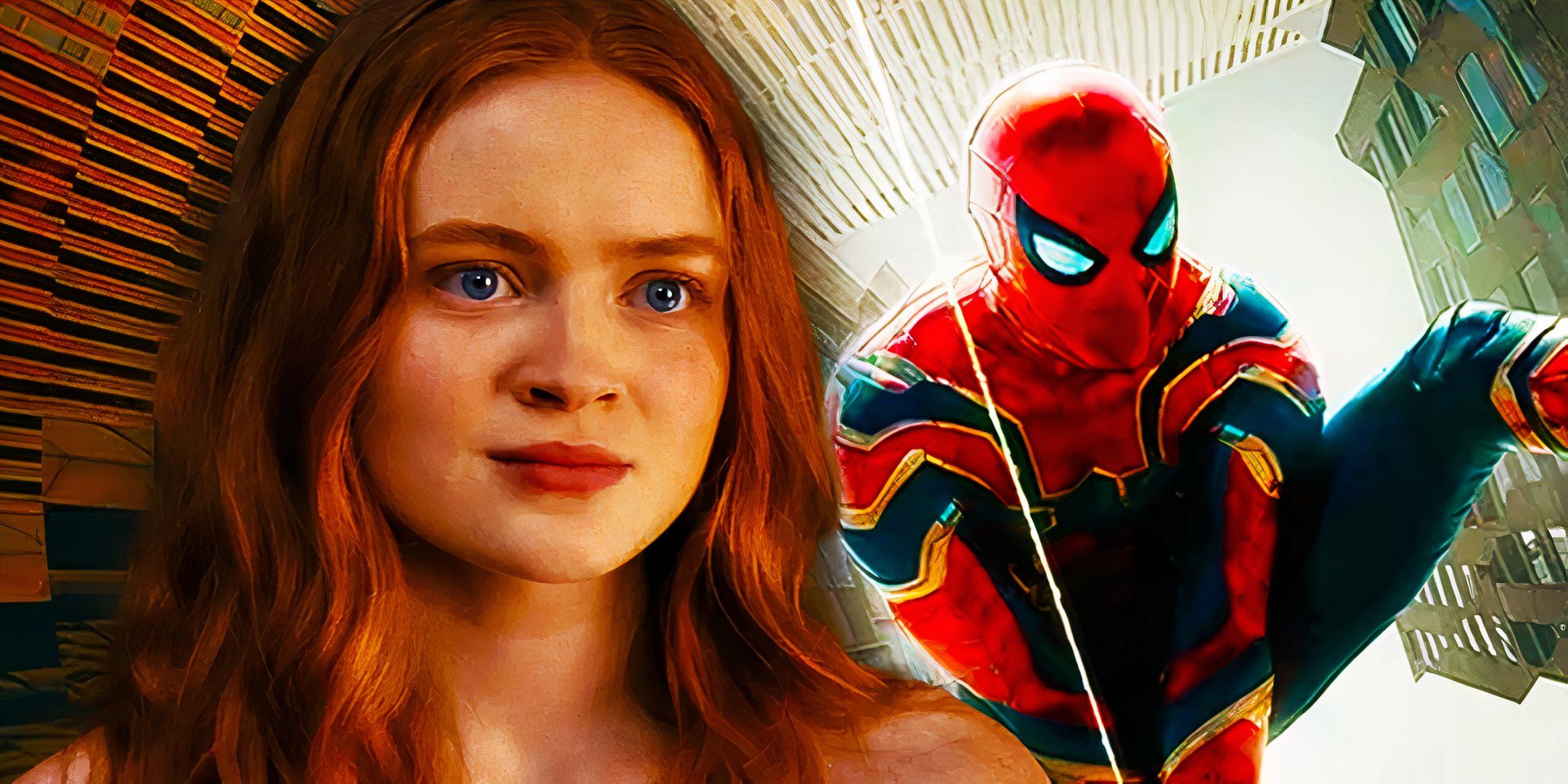

Marvels Spider Man 4 Excited Fan Response To The Latest Casting

Apr 25, 2025

Marvels Spider Man 4 Excited Fan Response To The Latest Casting

Apr 25, 2025 -

The Impact Of Sinners Jack O Connells Powerful Performance And Career Trajectory

Apr 25, 2025

The Impact Of Sinners Jack O Connells Powerful Performance And Career Trajectory

Apr 25, 2025 -

Sadie Sink Age And Potential Spider Man 4 Role An Analysis

Apr 25, 2025

Sadie Sink Age And Potential Spider Man 4 Role An Analysis

Apr 25, 2025 -

Live Stream Stagecoach 2025 A Complete Viewing Guide

Apr 25, 2025

Live Stream Stagecoach 2025 A Complete Viewing Guide

Apr 25, 2025