Trump Tariffs And Inflation: Analysis From ECB's Holzmann

Table of Contents

Holzmann's Stance on the Relationship Between Trump Tariffs and Inflation

Robert Holzmann, a renowned economist and influential voice within the ECB, has voiced concerns about the inflationary consequences of the Trump tariffs. His arguments center on the idea that tariffs, by increasing the cost of imported goods, directly contribute to higher prices for consumers. This mechanism is further exacerbated by supply chain disruptions caused by trade restrictions, reducing competition and increasing prices even further.

Holzmann's perspective, gleaned from his public statements and publications, highlights the following key mechanisms:

- Increased prices for imported goods: Tariffs directly raise the cost of imported products, which are then passed on to consumers in the form of higher prices. This impact is particularly pronounced for goods with limited domestic substitutes.

- Supply chain bottlenecks and reduced competition: Trade wars and tariffs disrupt established supply chains, leading to shortages and reduced competition. This scarcity drives up prices as businesses struggle to secure necessary inputs.

- Impact on consumer price index (CPI) and producer price index (PPI): Holzmann likely points to increases in both the CPI and PPI as evidence supporting his claims. These indices track price changes at the consumer and producer levels, respectively, offering concrete data on the inflationary pressure exerted by tariffs.

- Potential for second-round effects (wage increases): Higher prices for goods and services can lead to demands for higher wages, triggering a wage-price spiral and further fueling inflation. This is a significant concern, as it can lead to persistent, self-sustaining inflationary pressure.

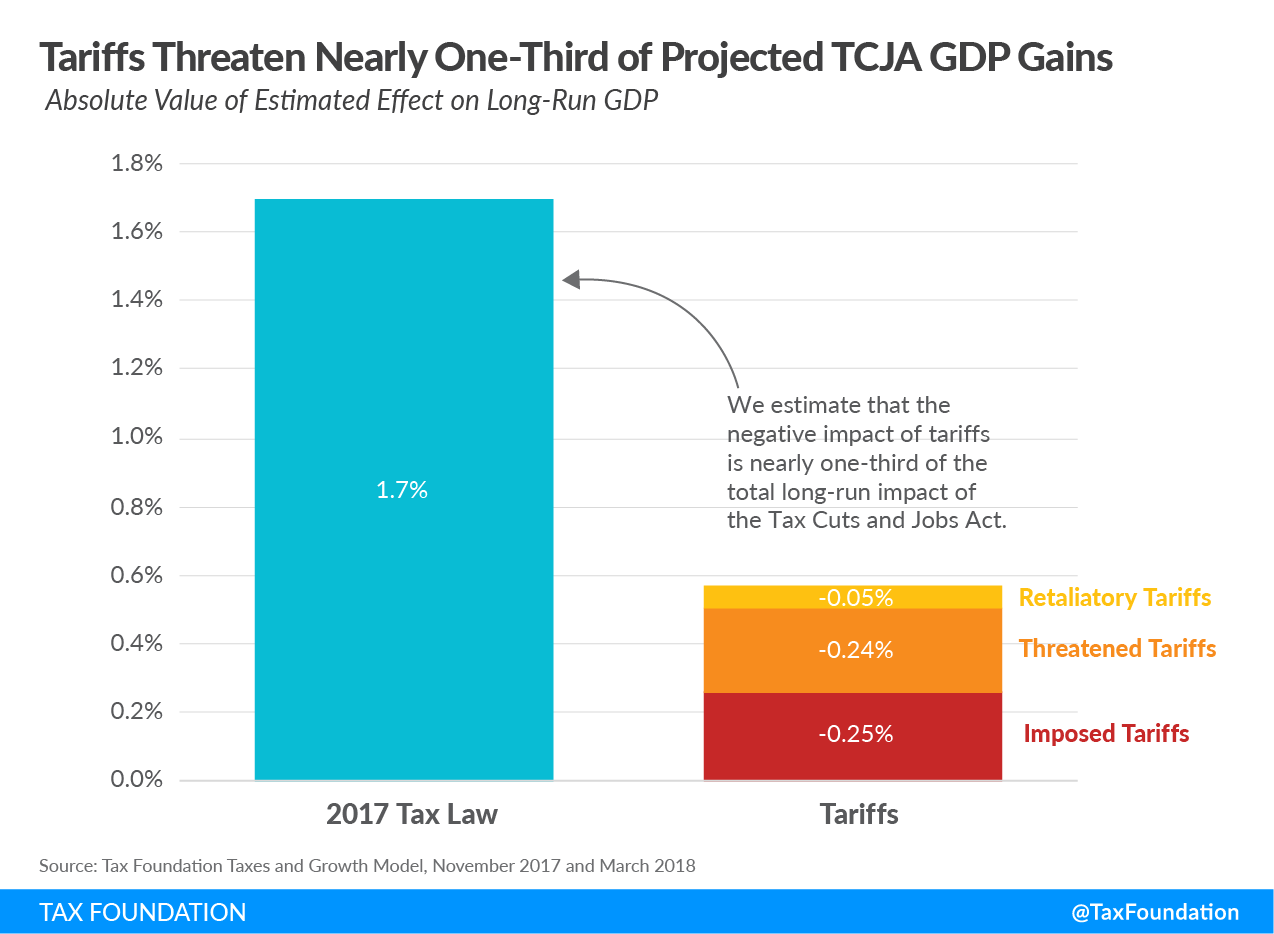

Analyzing the Data: Evidence Supporting or Contradicting Holzmann's Views

To assess the validity of Holzmann's assertions, it's necessary to examine relevant economic data from the period of the Trump tariffs. Analyzing CPI and PPI data, alongside import price indices, can reveal the extent to which tariffs contributed to inflation.

- CPI and PPI data during the Trump administration: Examining changes in these indices during the period of tariff implementation, compared to pre- and post-tariff periods, can provide valuable insights into the inflationary impact of the tariffs. A noticeable increase in these indices during the tariff period would lend support to Holzmann's views.

- Analysis of specific sectors impacted by tariffs: A sector-specific analysis can help to pinpoint the industries most affected by tariff-induced inflation. Sectors heavily reliant on imported inputs are likely to have experienced the most significant price increases.

- Comparison with inflation in other countries: Comparing inflation rates in countries that were less affected by the Trump tariffs can help isolate the impact of the tariffs themselves, controlling for other global factors influencing inflation.

- Consideration of other factors influencing inflation during this period (e.g., oil prices, global demand): It's crucial to acknowledge that other macroeconomic factors, such as oil price fluctuations and global demand, also affect inflation. A thorough analysis needs to account for these confounding variables.

Alternative Perspectives on the Impact of Trump Tariffs

While Holzmann's perspective emphasizes the inflationary effects of Trump's tariffs, it is important to consider alternative viewpoints. Some economists argue that the link between tariffs and inflation is less direct or significant than Holzmann suggests.

- Arguments against a strong link between tariffs and inflation: Critics might point to the limited size of the tariff increases or argue that the inflationary impact was offset by other economic factors.

- The role of other economic policies and global events: Macroeconomic policies implemented during the same period, along with global economic events (like the COVID-19 pandemic), could have significantly impacted inflation independently of the tariffs.

- Limitations of using simple correlation to establish causality: Simply observing a correlation between tariffs and inflation does not necessarily prove causality. Other factors could have driven both.

- Different modeling approaches and their results: Economists employ different econometric models to analyze the effects of tariffs. Differences in model specification can lead to divergent conclusions regarding the impact on inflation.

Implications for Future Economic Policy

Holzmann's analysis carries significant implications for future economic policy, particularly concerning international trade and inflation management. The experience with Trump's tariffs offers valuable lessons for policymakers.

- The role of international trade in price stability: The analysis underscores the importance of considering the inflationary consequences of protectionist trade policies.

- Policy recommendations based on Holzmann's findings: Holzmann's work may inform policy recommendations aimed at mitigating inflationary pressures from trade disputes, perhaps through targeted subsidies or other mechanisms to offset tariff-induced price increases.

- The importance of anticipating inflationary pressures from trade policies: Future trade negotiations should incorporate assessments of the potential inflationary consequences of tariffs and other trade barriers.

- Strengthening international cooperation to mitigate trade-related inflation: Greater cooperation among nations can help to avoid escalating trade wars that may lead to significant inflationary pressures.

Conclusion: The Lasting Impact of Trump Tariffs and Inflation – A Call to Action

Robert Holzmann's analysis of "Trump Tariffs and Inflation" provides a valuable framework for understanding the complex interplay between trade policy and price stability. While the evidence suggests a link between tariffs and inflation, the extent of this impact remains a subject of ongoing debate, highlighting the need for rigorous econometric analysis. It is crucial to consider the potential second-order effects and the influence of other macroeconomic factors. We must learn from this experience and continue to monitor the effects of trade policies on inflation.

To further understand the lasting impact of Trump tariffs and inflation, we encourage you to explore Robert Holzmann's publications and delve into relevant economic data from the period. This comprehensive understanding is vital for informed policymaking and safeguarding price stability in the face of future trade disputes. Continue researching the impact of "Trump Tariffs and Inflation" to contribute to the ongoing discussion.

Featured Posts

-

April 1999 A Photographic Memory Test

Apr 26, 2025

April 1999 A Photographic Memory Test

Apr 26, 2025 -

Solve Todays Nyt Spelling Bee Puzzle 360 February 26th Hints And Answers

Apr 26, 2025

Solve Todays Nyt Spelling Bee Puzzle 360 February 26th Hints And Answers

Apr 26, 2025 -

Quem E Benson Boone O Cantor Por Tras Do Hit Beautiful Thing E Do Lollapalooza

Apr 26, 2025

Quem E Benson Boone O Cantor Por Tras Do Hit Beautiful Thing E Do Lollapalooza

Apr 26, 2025 -

Benson Boone And Brian May Unexpected Coachella Collaboration

Apr 26, 2025

Benson Boone And Brian May Unexpected Coachella Collaboration

Apr 26, 2025 -

Deion And Shedeur Sanders A Browns Insiders Perspective

Apr 26, 2025

Deion And Shedeur Sanders A Browns Insiders Perspective

Apr 26, 2025