The US-China Trade War: A Timeline And Ackman's Insight

Table of Contents

A Timeline of the US-China Trade War:

The Early Stages (2017-2018):

The seeds of the US-China trade war were sown long before the first tariffs were imposed. Rising trade deficits and accusations of unfair trade practices by the US, including concerns over intellectual property theft and forced technology transfer, fueled growing tensions. The Trump administration, aiming to "rebalance" the trade relationship, began imposing tariffs on specific goods.

- March 2018: The US imposed tariffs on imported steel and aluminum, impacting China among other countries. This move was presented as a matter of national security.

- July 2018: The US imposed tariffs on $34 billion worth of Chinese goods, targeting technology and industrial sectors. China immediately retaliated with equivalent tariffs.

- August-September 2018: Further rounds of tariffs were announced and implemented, significantly escalating the trade war. Products ranging from agricultural goods (soybeans) to consumer electronics were affected.

- Negotiations and Escalating Tensions: Throughout this period, there were attempts at negotiation, but these were often overshadowed by further rounds of tariffs and increasingly hostile rhetoric.

Intensification and Escalation (2018-2019):

The trade war intensified significantly in late 2018 and 2019. The scope of tariffs expanded dramatically, encompassing a much wider range of goods. Beyond tariffs, the conflict extended to broader trade restrictions and investment limitations, affecting numerous sectors and companies. The economic consequences were felt globally, with market volatility and concerns about slowing economic growth.

- September 2019: Tariffs were extended to nearly all remaining imports from China.

- G20 Summits (2018, 2019): High-profile meetings between President Trump and President Xi Jinping yielded limited progress, with temporary truces frequently followed by further escalation.

- Economic Consequences: The trade war led to increased prices for consumers, disrupted supply chains, and contributed to global economic uncertainty. Both the US and China experienced economic slowdown, although the impact varied across sectors.

"Phase One" Deal and Beyond (2020-Present):

In January 2020, the US and China signed the "Phase One" trade deal. This agreement involved China committing to purchase a significant amount of US goods and services over a two-year period. However, the deal did not resolve all trade disputes, and tensions persisted. The COVID-19 pandemic further complicated the situation, disrupting global supply chains and impacting trade flows.

- Key Aspects of "Phase One": Increased purchases of US agricultural products, energy, and manufactured goods were central to the agreement. China also made commitments related to intellectual property protection.

- Continued Tensions: Despite the "Phase One" deal, significant trade disputes remain unresolved. Issues like technology transfer, market access, and industrial subsidies continue to fuel tensions between the two countries.

- Post-Pandemic Developments: The pandemic's impact on global trade has created new challenges in managing US-China economic relations.

Bill Ackman's Insights on the US-China Trade War:

Ackman's Perspective on the Economic Impact:

Bill Ackman, the founder of Pershing Square Capital Management, is known for his outspoken views on various market events. While his specific public statements on the intricacies of the US-China trade war might not be as readily available as general commentary on the situation, we can surmise his likely perspective. Given his general investment philosophy, we can assume he would see the initial stages as a period of potential opportunity through short-selling of companies negatively impacted by the trade war. Later, as the trade war expanded and uncertainty prevailed, his focus would likely shift towards companies better positioned to navigate the geopolitical changes.

- Ackman's focus: His focus would likely have been on assessing individual companies and their abilities to cope with higher tariffs and supply chain disruptions.

- Investment strategies: He likely adjusted his portfolio based on anticipated winners and losers in this new trade environment.

Analyzing Ackman's Investment Decisions:

Unfortunately, detailed public information on Ackman's specific investment decisions directly tied to the US-China trade war is limited. However, it is safe to assume that the trade war would have influenced his overall investment strategy, leading to adjustments in portfolio allocation and hedging against trade-related risks.

- Sectoral Shifts: Ackman might have reduced exposure to sectors heavily reliant on Chinese exports or supply chains while increasing his positions in companies better equipped to handle the challenges posed by tariffs.

- Geopolitical Considerations: His investment choices likely took into account potential long-term implications of the trade war for individual companies and the global economy as a whole.

The Long-Term Implications According to Ackman (if available):

Given the lack of specific and publicly available statements from Bill Ackman directly addressing the long-term implications of the US-China trade war, it's difficult to definitively outline his views. However, based on his general investment philosophy, one might assume he anticipated a prolonged period of uncertainty and adjustments, and potentially saw it as a catalyst for long-term shifts in global supply chains and geopolitical alliances.

- Decoupling Potential: Ackman would likely have considered the potential for further decoupling of the US and Chinese economies.

- Investment Opportunities: This decoupling might present new long-term investment opportunities in strategically important sectors, such as technology and manufacturing.

Conclusion:

This article has traced the timeline of the US-China trade war, highlighting its key phases and the significant economic implications. We’ve also explored the potential perspectives and likely investment strategies of Bill Ackman, demonstrating how this major geopolitical event shaped investment strategies. The US-China trade war serves as a case study in the complexities of international relations and their impact on global markets.

Understanding the complexities of the US-China trade war is vital for investors and businesses alike. Continue your research into the US-China trade war and its ongoing impact to make informed decisions in today's dynamic global market. Learn more about the intricacies of this conflict and how it continues to shape global economics, including its effect on inflation and supply chains. This includes further research on US-China trade relations and their implications for future global economic growth.

Featured Posts

-

Thueringen Atlas Der Amphibien Und Reptilien Erschienen

Apr 27, 2025

Thueringen Atlas Der Amphibien Und Reptilien Erschienen

Apr 27, 2025 -

Turkish Logistics Market Cma Cgms 440 Million Acquisition

Apr 27, 2025

Turkish Logistics Market Cma Cgms 440 Million Acquisition

Apr 27, 2025 -

Thueringens Amphibien Und Reptilien Der Neue Atlas Ist Da

Apr 27, 2025

Thueringens Amphibien Und Reptilien Der Neue Atlas Ist Da

Apr 27, 2025 -

Ariana Grandes Hair And Tattoo Transformation Seeking Professional Help

Apr 27, 2025

Ariana Grandes Hair And Tattoo Transformation Seeking Professional Help

Apr 27, 2025 -

Novak Djokovics Monte Carlo Masters 2025 Campaign Ends In Straight Sets Loss

Apr 27, 2025

Novak Djokovics Monte Carlo Masters 2025 Campaign Ends In Straight Sets Loss

Apr 27, 2025

Latest Posts

-

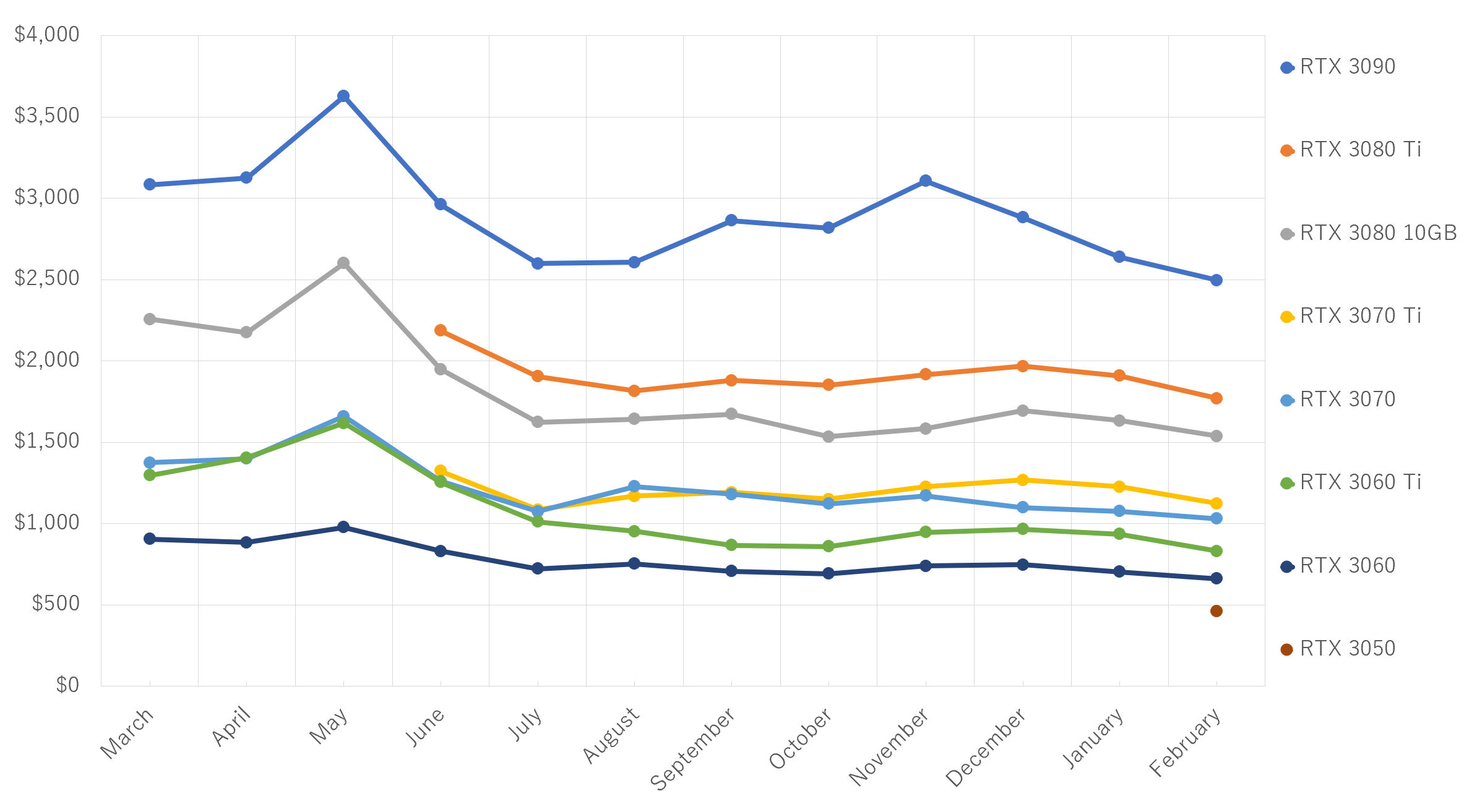

Gpu Market Update High Prices And Limited Availability

Apr 28, 2025

Gpu Market Update High Prices And Limited Availability

Apr 28, 2025 -

The Current State Of Gpu Prices An Overview

Apr 28, 2025

The Current State Of Gpu Prices An Overview

Apr 28, 2025 -

Gpu Price Hikes Factors Affecting Affordability

Apr 28, 2025

Gpu Price Hikes Factors Affecting Affordability

Apr 28, 2025 -

Why Are Gpu Prices Skyrocketing Again A Market Analysis

Apr 28, 2025

Why Are Gpu Prices Skyrocketing Again A Market Analysis

Apr 28, 2025 -

Understanding The Recent Surge In Gpu Prices

Apr 28, 2025

Understanding The Recent Surge In Gpu Prices

Apr 28, 2025