The U.S. Dollar's First 100 Days: A Historical Perspective And Economic Forecast

Table of Contents

Historical Context: The First 100 Days of the U.S. Dollar

The Coinage Act of 1792: Laying the Foundation

The foundation of the U.S. dollar was laid with the Coinage Act of 1792. This landmark legislation established the dollar as the nation's official currency, defining its value relative to gold and silver under a bimetallic standard. This meant both metals were used to back the currency, a system with inherent complexities.

- Key features of the Act: Defined the dollar's weight and composition, established mints for coinage, and set the initial exchange rates between gold and silver.

- Initial exchange rates: The Act aimed for a 15:1 ratio of silver to gold, but this proved difficult to maintain in practice.

- Early challenges: Difficulties in establishing a stable exchange rate between gold and silver, along with inconsistent minting practices, were early hurdles in stabilizing the dollar's value.

Early Economic Challenges: A Nation's Struggle

The fledgling United States faced numerous economic obstacles during its formative years, profoundly impacting the dollar's value. The Napoleonic Wars disrupted international trade, creating significant uncertainty in the global economy. Domestically, economic instability and a lack of a well-developed banking system further compounded challenges.

- Specific examples of economic hardships: High inflation, debt from the Revolutionary War, and a lack of a unified economic policy.

- International trade relations: The disruptions caused by the Napoleonic Wars made it challenging for the U.S. to establish consistent trade relations and maintain the value of its currency.

- The impact of wars on currency values: International conflicts significantly impacted the stability of the dollar, demonstrating its vulnerability to global events.

The Dollar's Evolution in its First 100 Days: Milestones and Events

The first 100 days of the U.S. dollar witnessed a period of significant evolution, with government policy playing a vital role in stabilizing the currency. Early banking practices and the establishment of a national bank were crucial steps in this process.

- Key dates: The exact 100-day period can be debated depending on the starting point; however, analyzing the first few months after the Coinage Act provides crucial insights.

- Significant economic events: The early establishment of trade agreements, the impact of agricultural production on the economy, and the initial efforts to control inflation.

- The role of government policy: Government efforts to regulate coinage and banking practices were critical in guiding the dollar's early development.

- Early banking practices: The development of state-chartered banks and the later establishment of the First Bank of the United States played a significant role in shaping the financial landscape and influencing the dollar's stability.

Analyzing Historical Trends to Predict Future Performance

Comparing Past Performances: Lessons from History

By examining similar historical periods, we can gain insight into the potential performance of the dollar under current circumstances. Looking at periods with comparable inflation rates, interest rate environments, and levels of geopolitical uncertainty allows for a more informed analysis.

- Specific historical periods: The periods following major wars, periods of high inflation (such as the 1970s), and times of significant geopolitical instability offer valuable lessons.

- Similarities and differences to the current economic situation: A careful comparison reveals patterns and suggests potential outcomes, while acknowledging important differences in the current context.

- Outcomes for the dollar in those periods: Analysis of past responses provides a framework for predicting future trends but should not be taken as definitive predictions.

Key Economic Indicators: Gauging the Current Climate

Current economic indicators are crucial for forecasting the dollar's future performance. Factors like inflation, interest rates, GDP growth, and global events significantly influence its value.

- List and brief definition of relevant indicators: Inflation (CPI, PCE), interest rates (Federal Funds Rate), GDP growth, unemployment rates, trade balances, and consumer confidence.

- Current values of these indicators: Real-time data from reliable sources provides a clear picture of the present economic climate.

- Analysis of their potential impact on the dollar: Higher inflation typically weakens the dollar, while higher interest rates can strengthen it, though the relationship is complex and influenced by global factors.

Geopolitical Factors: Global Events and Their Impact

Geopolitical events exert significant influence on the U.S. dollar's strength. International conflicts, trade wars, and shifts in global power dynamics can all impact currency markets.

- Major global events: Ongoing international conflicts, trade disputes, and political instability in major economies have significant influence.

- Their potential impact on the U.S. dollar (positive or negative): Uncertainty often weakens the dollar, while perceived stability can strengthen it.

- Examples from history: Historical examples of geopolitical events and their impact on the dollar's value.

Economic Forecast for the U.S. Dollar's Next 100 Days

Projected Value Fluctuations: Scenarios and Probabilities

Based on the analysis of historical trends and current economic indicators, we can outline potential scenarios for the dollar's performance. This involves acknowledging inherent uncertainties and offering a range of possibilities, not definitive predictions.

- Possible scenarios: Optimistic (strong dollar), pessimistic (weak dollar), and neutral (moderate fluctuations).

- Factors influencing each scenario: Changes in inflation, interest rate decisions, geopolitical events, and investor sentiment will be key factors.

- Supporting data for each prediction: The forecast is supported by the data points and analysis provided earlier in the article.

Impact on Global Markets: Ripple Effects Across Borders

Fluctuations in the dollar's value have significant implications for global markets and international trade. Changes in the dollar's strength directly impact import and export prices, foreign investment, and economic growth in various countries.

- Impact on import/export prices: A stronger dollar makes imports cheaper and exports more expensive for U.S. businesses.

- Effect on foreign investments: Dollar fluctuations affect the returns for investors holding assets denominated in other currencies.

- Potential implications for different countries: The impact will vary significantly across nations depending on their trade relationships with the U.S. and their currency's peg (if any).

Investment Strategies: Navigating Uncertainty (Disclaimer: This is not financial advice)

Navigating potential economic shifts requires careful planning and diversified investment strategies. While we cannot offer specific financial advice, some general strategies can aid in mitigating risk.

- General investment strategies: Diversifying investments across different asset classes, maintaining an emergency fund, and regularly reviewing your portfolio.

- Diversification techniques: Spreading investments across different asset classes (stocks, bonds, real estate) to reduce overall risk.

- Importance of financial planning: Seeking professional financial advice can help create a personalized plan to manage risk and achieve long-term financial goals.

Conclusion

Understanding the U.S. dollar's first 100 days offers valuable insights into its resilience and vulnerability. While the historical context reveals challenges faced during its early establishment, current economic indicators and geopolitical events suggest potential volatility in the coming months. Our analysis points to several possible scenarios, ranging from a strong to a weak dollar, underscoring the need for careful monitoring of economic and geopolitical factors. Staying informed about the intricate dance of the U.S. dollar is crucial for navigating the future economic landscape. By continuing to research the U.S. dollar's trajectory and staying informed about its long-term implications, individuals and businesses can make more informed decisions. Follow reputable financial news sources to stay up-to-date on the latest developments affecting the value and stability of the U.S. dollar.

Featured Posts

-

State And Local Government Jobs A Realistic Look For Laid Off Federal Employees

Apr 28, 2025

State And Local Government Jobs A Realistic Look For Laid Off Federal Employees

Apr 28, 2025 -

Cairo Hosts Hamas Delegation For Ceasefire Negotiations Trump Weighs In

Apr 28, 2025

Cairo Hosts Hamas Delegation For Ceasefire Negotiations Trump Weighs In

Apr 28, 2025 -

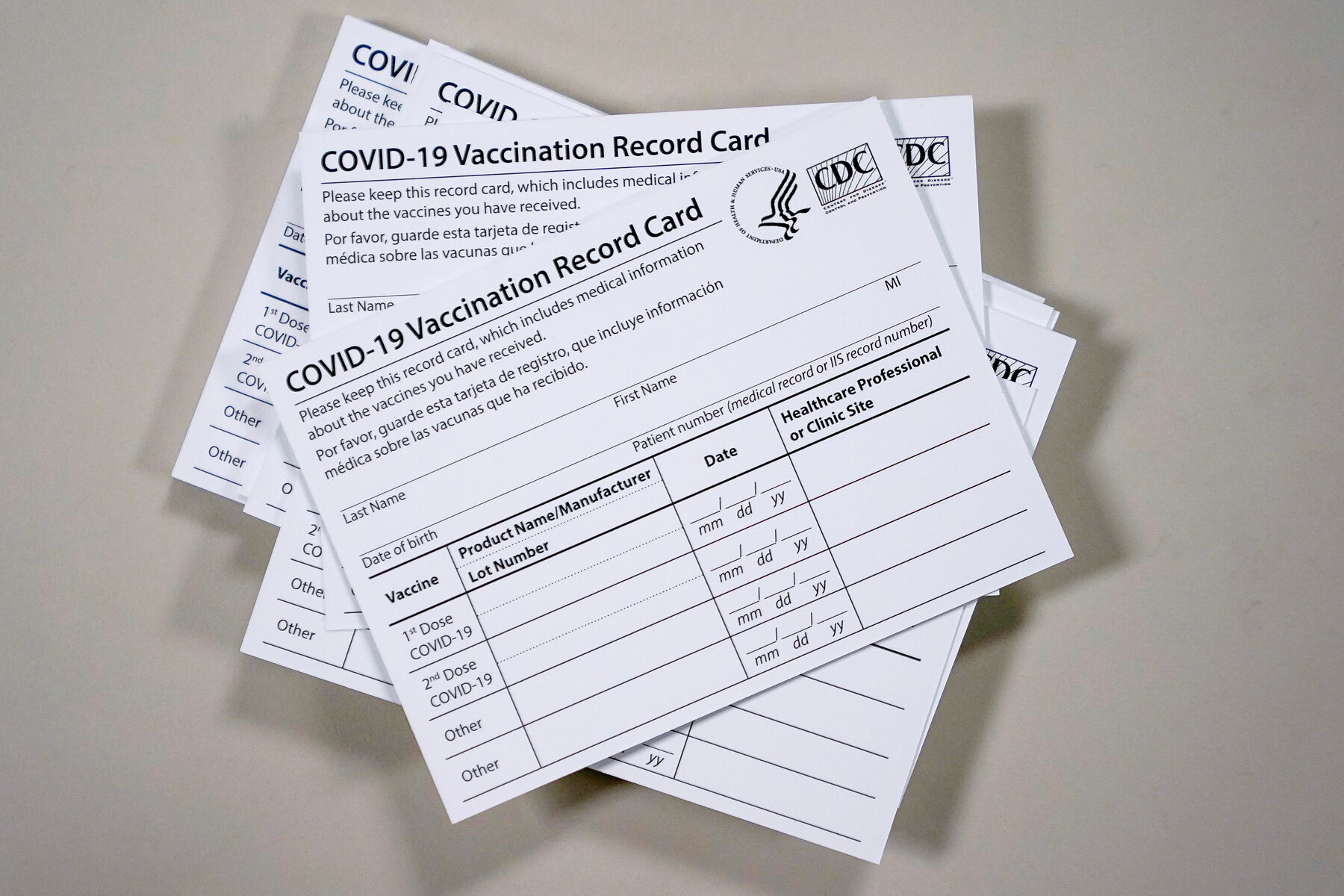

Guilty Plea Lab Owner Admitted To Fraudulent Covid 19 Testing

Apr 28, 2025

Guilty Plea Lab Owner Admitted To Fraudulent Covid 19 Testing

Apr 28, 2025 -

Supporters Of Luigi Mangione Their Perspectives And Priorities

Apr 28, 2025

Supporters Of Luigi Mangione Their Perspectives And Priorities

Apr 28, 2025 -

Trumps Higher Education Policies A National Perspective

Apr 28, 2025

Trumps Higher Education Policies A National Perspective

Apr 28, 2025

Latest Posts

-

Orioles Hit Streak Snapped Was It The Broadcasters Jinx

Apr 28, 2025

Orioles Hit Streak Snapped Was It The Broadcasters Jinx

Apr 28, 2025 -

The End Of A Streak Orioles Broadcasters Jinx And 160 Games

Apr 28, 2025

The End Of A Streak Orioles Broadcasters Jinx And 160 Games

Apr 28, 2025 -

160 Game Hit Streak Ends Orioles Broadcasters Jinx Broken

Apr 28, 2025

160 Game Hit Streak Ends Orioles Broadcasters Jinx Broken

Apr 28, 2025 -

Orioles Announcers Curse Lifted 160 Game Hit Streak Ends

Apr 28, 2025

Orioles Announcers Curse Lifted 160 Game Hit Streak Ends

Apr 28, 2025 -

Orioles Broadcasters Jinx Broken 160 Game Hit Streak Ends

Apr 28, 2025

Orioles Broadcasters Jinx Broken 160 Game Hit Streak Ends

Apr 28, 2025