The Richest Man's House: An American Battleground For Legal Rights And Property Disputes

Table of Contents

The Unique Legal Challenges of High-Net-Worth Estates

High-net-worth individuals face unique legal challenges when it comes to their properties, significantly complicating any potential disputes. The sheer scale of their assets and the complexity of their ownership structures often lead to protracted and expensive litigation.

Complex Asset Structures

High-net-worth individuals often possess incredibly complex asset structures, making property disputes exponentially more intricate. These structures can include a web of trusts, limited liability companies (LLCs), and offshore holdings, obscuring clear lines of ownership and complicating the process of determining rightful beneficiaries.

- Multiple beneficiaries: Large estates often have numerous beneficiaries, each with their own claims and potential disputes.

- Offshore accounts: Assets held in offshore accounts add another layer of complexity to already intricate legal proceedings, requiring international legal expertise.

- Family trusts: Trusts, designed to manage assets and protect beneficiaries, can become battlegrounds if poorly drafted or challenged.

- Complex wills: Ambiguously worded wills create fertile ground for disputes, often leading to costly and lengthy litigation.

- Ambiguous ownership clauses: Unclear language regarding ownership in legal documents can fuel disagreements and prolong legal battles.

Navigating these structures requires specialized legal expertise. Attorneys must untangle layers of ownership and meticulously examine numerous financial documents to establish clear lines of inheritance and asset distribution.

Valuation Disputes

Determining the accurate market value of extravagant properties is incredibly challenging and frequently leads to protracted litigation. The uniqueness of these properties—often featuring bespoke architectural designs, extensive acreage, and irreplaceable features—makes standard valuation methods unreliable.

- Appraisals: Even expert appraisals can vary significantly, creating room for disputes.

- Expert witness testimony: Legal battles often hinge on competing expert witness testimony, adding to the costs and complexity of the case.

- Market fluctuations: Market conditions can drastically affect property value, leading to arguments over valuation at the time of the dispute versus the time of inheritance.

- Unique property features impacting valuation: Features like custom-built amenities, priceless artwork, or irreplaceable historical significance make accurate valuation particularly difficult.

Establishing fair market value requires highly specialized expertise and often involves extensive discovery processes, leading to substantial legal fees and significant delays in resolving disputes.

Common Types of Property Disputes Among the Ultra-Wealthy

Several common types of property disputes plague the ultra-wealthy, often arising from poorly planned estates, contested wills, or broken agreements.

Inheritance Disputes

Contested wills, challenges to beneficiary designations, and family feuds are common causes of legal battles over "richest man's houses" and other significant properties. These disputes can stem from a variety of factors, often resulting in years of litigation.

- Will contests: Challenges to the validity of a will are frequent, based on claims of undue influence, lack of testamentary capacity, or improper execution.

- Undue influence claims: Allegations that a beneficiary manipulated the testator (the person making the will) to obtain a favorable outcome are common.

- Lack of testamentary capacity: Claims that the testator lacked the mental capacity to understand the will's implications can lead to lengthy legal battles.

- Pre-nuptial agreements: These agreements, intended to protect assets, can be challenged in inheritance disputes, if not properly executed or interpreted.

High-profile cases involving inheritance disputes frequently make headlines, highlighting the complex legal battles that can erupt within wealthy families.

Prenuptial and Postnuptial Agreements

These agreements, while intended to protect assets before and during marriage, can become focal points of legal conflict if not properly drafted or executed. Ambiguities in the agreements, challenges to validity, enforcement issues, and changing circumstances can all lead to protracted legal battles.

- Ambiguity in agreements: Poorly worded agreements create opportunities for disputes, as each party may interpret clauses differently.

- Challenges to validity: Agreements can be challenged on grounds of fraud, duress, or lack of full disclosure.

- Enforcement issues: Enforcing prenuptial or postnuptial agreements can be difficult, especially when significant assets are involved.

- Changing circumstances: Significant changes in the parties' financial situations or family dynamics can create grounds for challenging the agreement.

The legal intricacies of these agreements often require specialized legal expertise to navigate successfully.

Tax Implications and Estate Planning

Sophisticated tax planning strategies, while intended to minimize tax burdens, can become targets of legal challenges if found to be abusive or improperly executed. This can lead to disputes involving significant financial penalties and reputational damage.

- Tax evasion allegations: Allegations of tax evasion can trigger extensive investigations and severe legal consequences.

- Improper trust structures: Improperly structured trusts can be challenged by tax authorities, resulting in penalties and the unraveling of complex estate plans.

- Challenges to estate tax valuations: Disputes over the accurate valuation of assets for estate tax purposes are common, leading to lengthy legal battles.

Understanding the complex interplay between estate planning and tax law is crucial in minimizing the risk of these disputes.

The Role of Legal Professionals in Resolving Disputes

Navigating the complex legal landscape of high-net-worth estate disputes requires the expertise of specialized legal professionals.

Estate Planning Attorneys

Proactive and thorough estate planning is paramount in preventing future disputes. Estate planning attorneys play a vital role in mitigating the risks.

- Drafting comprehensive wills and trusts: Careful drafting of these documents is crucial in ensuring the smooth transfer of assets.

- Prenuptial agreements: Thorough and well-drafted prenuptial agreements can help protect assets in the event of divorce.

- Asset protection strategies: Strategies to protect assets from creditors and lawsuits are essential for high-net-worth individuals.

- Tax planning: Effective tax planning can minimize tax burdens and avoid potential legal challenges.

Engaging qualified estate planning attorneys early in the process is essential for long-term asset protection.

Litigation Attorneys

Specialized litigation attorneys are crucial in navigating the complexities of property disputes.

- Discovery process: They manage the extensive discovery process, gathering crucial evidence for the case.

- Expert witness testimony: They select and manage expert witnesses to provide credible testimony.

- Negotiation: They negotiate settlements to avoid lengthy and expensive trials.

- Mediation: They utilize mediation and arbitration to resolve disputes outside of court.

- Courtroom litigation: They represent clients in court if a settlement cannot be reached.

Experienced litigation attorneys possess the skills and knowledge to handle the nuances of high-stakes property disputes, employing various strategies to protect their clients' interests.

Conclusion

The "Richest Man's House" often symbolizes more than just wealth; it represents a significant legal battleground rife with complex disputes over property rights and inheritance. Understanding the intricacies of estate law, proper estate planning, and the role of skilled legal professionals is crucial for high-net-worth individuals and their families to avoid costly and emotionally draining legal battles. Proactive estate planning and strategic legal counsel are essential to secure the future of your assets and legacy, minimizing the risk of future property disputes related to your "richest man's house" or any significant property. Don't hesitate to consult with experienced estate planning and litigation attorneys to protect your interests and ensure a smooth transition of your assets.

Featured Posts

-

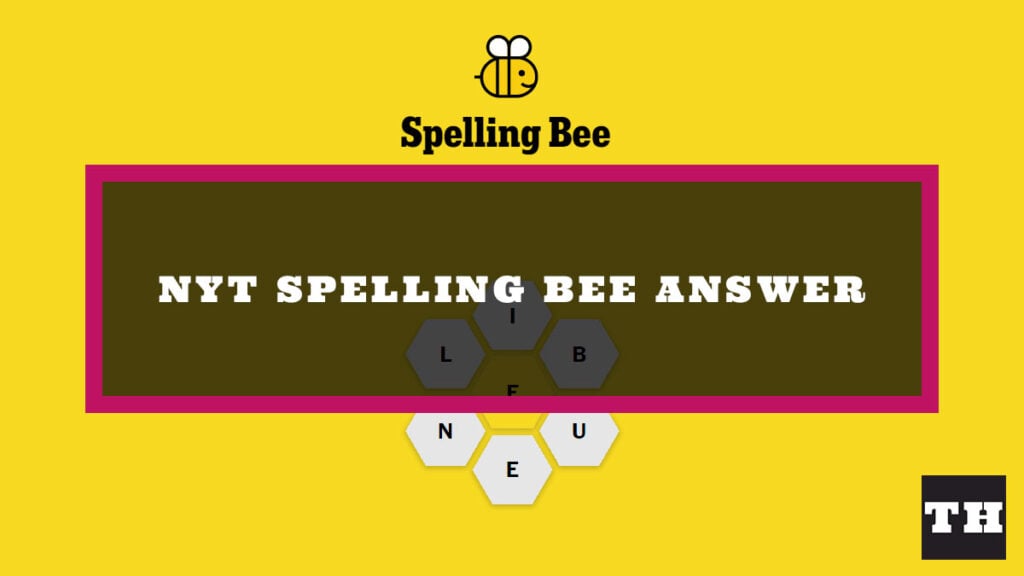

Solve Todays Nyt Spelling Bee Feb 5th 339 Hints And Answers

Apr 26, 2025

Solve Todays Nyt Spelling Bee Feb 5th 339 Hints And Answers

Apr 26, 2025 -

Damen And Fugro Deliver Advanced Vessel For Royal Netherlands Navys Surveillance Missions

Apr 26, 2025

Damen And Fugro Deliver Advanced Vessel For Royal Netherlands Navys Surveillance Missions

Apr 26, 2025 -

Portnoy Slams Newsom A Detailed Look At The Heated Exchange

Apr 26, 2025

Portnoy Slams Newsom A Detailed Look At The Heated Exchange

Apr 26, 2025 -

The Curious Case Of The Dutch Sweet Sandwich

Apr 26, 2025

The Curious Case Of The Dutch Sweet Sandwich

Apr 26, 2025 -

Mission Impossible Dead Reckoning Part Two New Trailer Unveiled

Apr 26, 2025

Mission Impossible Dead Reckoning Part Two New Trailer Unveiled

Apr 26, 2025