The Impact Of The US-China Trade War On Canada's Oil Sector

Table of Contents

Decreased Demand for Canadian Oil due to Slowed Global Growth

The US-China trade war significantly dampened global economic growth, directly impacting demand for energy commodities, including Canadian oil.

Reduced Chinese Demand: The trade war significantly hampered Chinese economic growth. As a result, China, a major importer of oil, reduced its purchases of crude oil, including Canadian imports.

- Specific examples: Reduced Chinese imports led to a surplus of oil in global markets, putting downward pressure on benchmark prices like West Texas Intermediate (WTI) and Brent Crude. This directly affected Canadian oil producers, who saw reduced revenues and profitability.

- Impact on benchmark oil prices: Data from the period shows a clear correlation between the escalation of trade tensions and the decline in global oil prices. For instance, [Insert specific data points and cite source, e.g., "during Q3 2019, WTI prices fell by X% following a new round of tariffs imposed by the US"]. This impacted Canadian producers' ability to operate profitably.

Ripple Effects on Other Markets: The decreased demand from China was not isolated; it rippled through interconnected global oil markets. The reduced Chinese demand created a surplus, affecting prices and demand globally.

- The interconnectedness of global oil markets means that reduced demand in one region directly impacts prices and demand in others. Trade agreements like the USMCA also played a role, influencing the flow of Canadian oil to the US market.

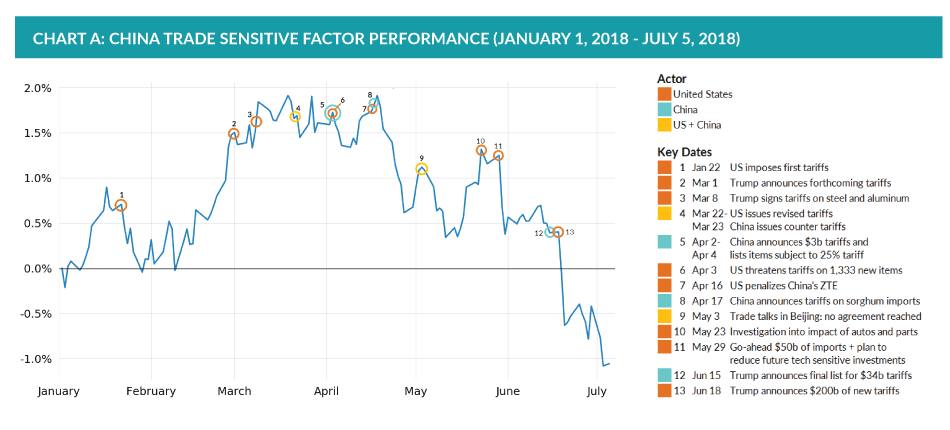

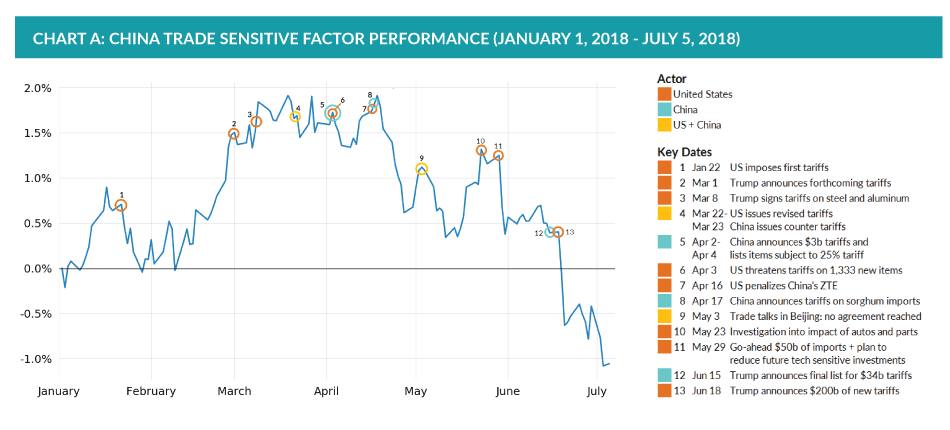

- [Insert relevant chart or graph illustrating price fluctuations during the trade war period, with clear labels and data source citation]. The price volatility created significant uncertainty for Canadian oil producers.

Increased Uncertainty and Investment Hesitation

The US-China trade war created a climate of uncertainty, significantly impacting investor sentiment and investment in Canada's oil sector.

Investor Sentiment and Capital Flows: The prolonged trade war discouraged investment in Canadian oil projects. The unpredictable nature of the conflict made it difficult for investors to assess long-term risks and returns.

- Impact on exploration and production: Companies delayed or cancelled exploration and production projects due to concerns about future demand and profitability.

- Impact on pipeline construction: Several pipeline projects faced delays or cancellations due to financing difficulties and regulatory hurdles exacerbated by the uncertainty caused by the trade war. [Cite relevant financial news sources and reports, e.g., "The Financial Post reported a X% decrease in investment in Canadian oil and gas projects during Y year"].

Geopolitical Risks and Energy Security: The trade war highlighted the geopolitical risks associated with Canada's reliance on specific export markets, particularly the US and Asia.

- The trade war underscored the vulnerability of Canada's energy security to global trade disputes and highlighted the need for diversification of export markets.

- Reliance on specific pipeline infrastructure like [mention specific pipelines] also became a major concern as trade tensions threatened the stability of these critical routes.

Impact on Canadian Oil Prices and Production

The US-China trade war had a direct and significant impact on Canadian oil prices and production levels.

Price Volatility and Market Fluctuations: The trade war's impact on global oil prices directly affected the price of Canadian crude.

- Canadian oil prices experienced significant volatility throughout the trade war, tracking closely with global benchmark prices. [Provide specific examples of price fluctuations with data and source citations].

- The correlation between Canadian oil prices and global prices demonstrates the vulnerability of the Canadian oil sector to external shocks.

Production Adjustments and Job Losses: The fluctuating prices and decreased demand forced Canadian oil producers to make difficult decisions, resulting in production cuts and job losses.

- [Provide statistics on production cuts and job losses in the oil industry, citing reliable sources like Statistics Canada or industry reports]. These cuts had a significant regional impact on communities heavily reliant on the oil sector.

- The job losses contributed to economic hardship in these communities and highlighted the social costs associated with the trade war's impact on the oil sector.

Government Response and Policy Adjustments

Both the Canadian federal and provincial governments responded to the trade war's negative impacts on the oil sector with various interventions and policy adjustments.

Federal and Provincial Interventions: Governments implemented support programs aimed at mitigating the negative impacts of the trade war on the oil industry and affected communities.

- [List specific government programs and financial aid packages introduced to support the oil industry]. These programs were intended to help oil companies survive the downturn and maintain employment levels.

- The provincial governments also played a significant role in supporting their respective oil industries through tax breaks, regulatory changes, and infrastructure investments.

Long-Term Implications for Energy Policy: The trade war emphasized the need for Canada to diversify its energy markets and potentially shift its long-term energy strategy.

- The experience highlighted the risks associated with over-reliance on specific export markets and fossil fuels.

- This has led to increased focus on diversification strategies, including investments in renewable energy sources and exploration of new markets for Canadian energy. [Mention any policy shifts toward diversification or renewable energy].

Conclusion: Understanding the Lasting Impact of the US-China Trade War on Canada's Oil Sector

The US-China trade war had a profound and multifaceted negative impact on Canada's oil sector. Decreased global demand, heightened investor uncertainty, price volatility, and production adjustments all contributed to significant challenges for the industry. Government interventions offered some support, but the experience underlined the vulnerability of Canada's economy to global trade disputes and emphasized the need for long-term diversification of energy sources and markets. To further understand the lasting impact of this significant global event on Canada’s oil sector, it is essential to continue researching and monitoring developments in the Canadian oil industry and the global energy market. Further research into the impact of the US-China trade war on Canada's oil sector can be conducted using resources from Statistics Canada, the National Energy Board, and various academic journals specializing in energy economics and international trade.

Featured Posts

-

Aaron Judges Historic Night Yankees Set New Home Run Record In 2025

Apr 23, 2025

Aaron Judges Historic Night Yankees Set New Home Run Record In 2025

Apr 23, 2025 -

Nine Home Runs Yankees Historic Offensive Outburst Led By Aaron Judge In 2025

Apr 23, 2025

Nine Home Runs Yankees Historic Offensive Outburst Led By Aaron Judge In 2025

Apr 23, 2025 -

Aaron Judges Historic Performance Fuels Yankees 9 Home Run Game

Apr 23, 2025

Aaron Judges Historic Performance Fuels Yankees 9 Home Run Game

Apr 23, 2025 -

Jackson Chourios 5 Rbi Game Leads Brewers To Victory Over Rockies

Apr 23, 2025

Jackson Chourios 5 Rbi Game Leads Brewers To Victory Over Rockies

Apr 23, 2025 -

Yankees And Mets Lupica On The Challenges Of Acquiring Top Closers This Week

Apr 23, 2025

Yankees And Mets Lupica On The Challenges Of Acquiring Top Closers This Week

Apr 23, 2025