The Elon Musk Network: A Guide To Investing In His Private Companies

Table of Contents

Understanding the Elon Musk Network: More Than Just Tesla and SpaceX

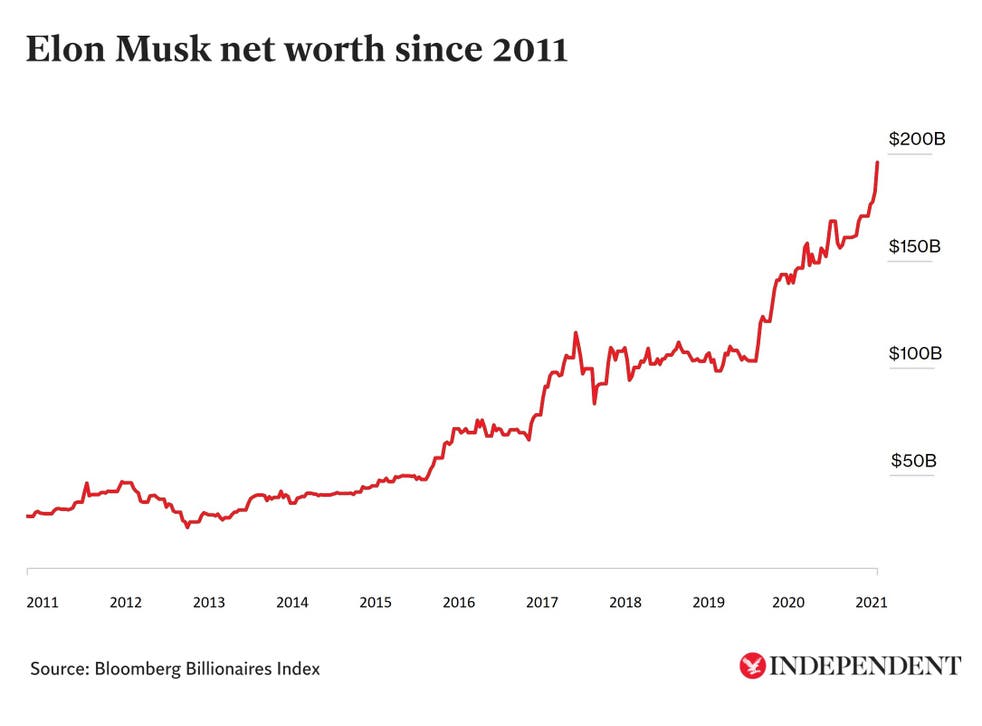

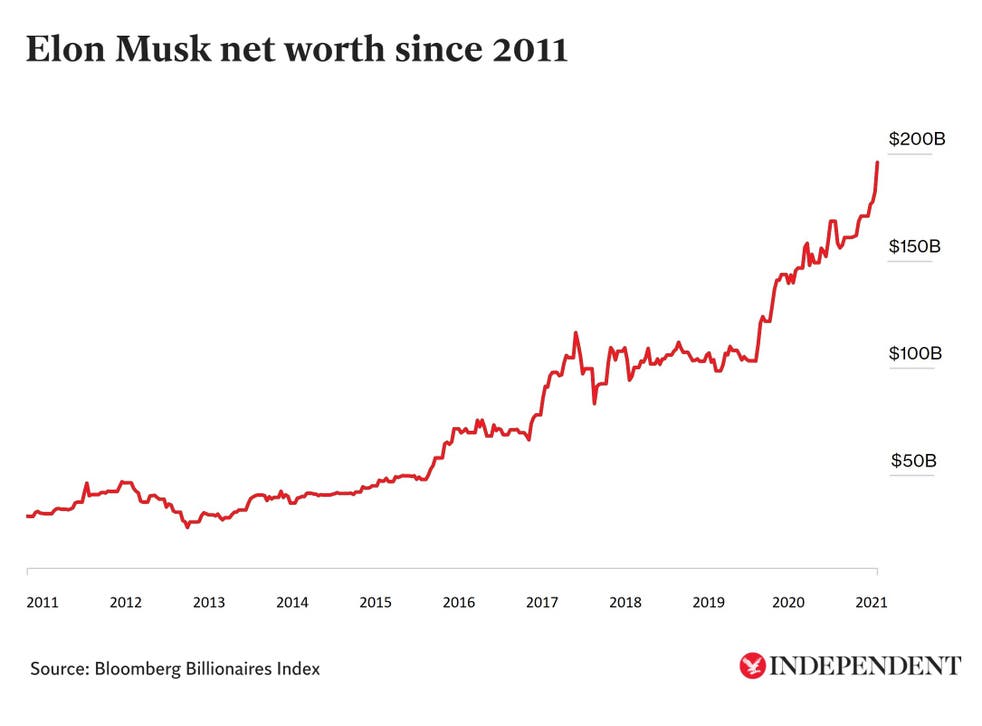

The term "Elon Musk Network" encompasses a diverse portfolio of private companies extending far beyond the publicly known Tesla and SpaceX. While these publicly traded giants offer a glimpse into Musk's visionary approach, his private ventures represent a higher-risk, higher-reward investment landscape. This network includes companies operating across diverse technological sectors, offering a unique diversification opportunity for seasoned investors.

-

Key Private Companies: The Elon Musk Network includes companies like Neuralink (focused on brain-computer interfaces and AI), The Boring Company (developing innovative tunneling and transportation solutions), and X Corp (formerly Twitter, now focusing on AI and a broad range of digital services). These are just a few examples; new ventures frequently emerge within the Musk ecosystem.

-

Diverse Technological Sectors: The companies within the Elon Musk Network span multiple sectors, including artificial intelligence (AI), sustainable energy, space exploration, infrastructure development, and digital communications. This diversification offers a unique hedge against risks associated with single-sector investments.

-

High Risk, High Reward: Investing in the Elon Musk Network inherently involves significant risk. These are often early-stage companies with unproven business models. However, the potential for exponential growth and substantial returns is equally significant, attracting investors seeking high-impact ventures.

Accessing the Elon Musk Network: Investment Avenues and Challenges

Accessing investment opportunities within the Elon Musk Network presents considerable challenges. Unlike publicly traded stocks, these private companies don't offer readily available shares to the general public.

-

Limited Direct Investment: Direct investment opportunities are extremely limited, often reserved for high-net-worth individuals, institutional investors, and venture capital firms. The average investor will rarely find direct access.

-

Alternative Routes: Alternative routes to participate include investing in venture capital funds that focus on early-stage technology companies or connecting with angel investors who specialize in this sphere. These routes still require significant capital and a robust network.

-

Significant Capital Requirements: Investing in private companies typically demands substantial capital commitments, far exceeding what many individual investors can afford. Minimum investment thresholds are often very high.

-

Networking and Relationships: Building a strong network within the venture capital and technology industries is crucial. Access to these opportunities frequently relies on existing relationships and industry connections.

Due Diligence: Evaluating Risks and Potential Returns in the Elon Musk Network

Before committing to any investment in the Elon Musk Network, thorough due diligence is paramount. The high-risk nature of these ventures necessitates a careful evaluation of potential returns against the considerable risks involved.

-

Assessing Company Financials and Market Potential: This includes examining available financial projections (if available), assessing the company's competitive landscape, and evaluating the total addressable market for its products or services.

-

Management Team Evaluation: The experience and track record of the management team, particularly their success in navigating challenging environments, are crucial factors. Elon Musk's reputation is undoubtedly a major consideration, but individual companies require their own assessment.

-

Inherent Risks of Early-Stage Investments: Investing in early-stage companies always carries a significant risk of complete loss. These ventures are inherently volatile, and many will fail to reach their projected potential.

-

Seek Professional Advice: Consult experienced financial advisors specializing in venture capital and high-risk investments before making any commitments. Their expertise will significantly aid in navigating the complexities involved.

The Future of the Elon Musk Network: Potential Growth and Investment Trends

Predicting the future of the Elon Musk Network is inherently speculative, but analyzing current trends and technological advancements offers valuable insight.

-

Long-Term Vision and Industry Disruption: Each company within the network possesses a long-term vision aimed at disrupting established industries. Success hinges on the execution of these ambitious goals.

-

Emerging Technologies and Trends: Pay attention to emerging technologies like advancements in AI, space exploration, sustainable energy solutions, and infrastructure technologies. These trends will significantly influence the valuation of these companies.

-

Future Investment Opportunities: As the Elon Musk Network expands, new companies and investment opportunities will likely emerge. Staying informed about these developments is crucial for identifying potential future ventures.

-

Cautiously Optimistic Outlook: While the potential rewards are substantial, it’s crucial to maintain a cautiously optimistic outlook, acknowledging the inherent volatility and risks involved in these investments.

Conclusion

Investing in Elon Musk's private companies, the Elon Musk Network, offers immense potential but demands careful consideration of risks and challenges. Access is limited, requiring significant capital and a sophisticated understanding of the venture capital landscape. Thorough due diligence is crucial before committing resources. While direct investment in the Elon Musk network might be out of reach for many, staying informed about these groundbreaking ventures and exploring potential indirect investment opportunities through established financial channels can offer a strategic path to participating in the future of innovation. Learn more about navigating the complexities of the Elon Musk Network today and begin your research into the world of venture capital.

Featured Posts

-

Seyfried Uses Profanity To Defend Nepotism In Hollywood

Apr 26, 2025

Seyfried Uses Profanity To Defend Nepotism In Hollywood

Apr 26, 2025 -

The Dong Duong Hotel In Hue A Fusion Hotel Experience

Apr 26, 2025

The Dong Duong Hotel In Hue A Fusion Hotel Experience

Apr 26, 2025 -

Neighbours Unexpected Twist Murder Mystery After 38 Year Absence

Apr 26, 2025

Neighbours Unexpected Twist Murder Mystery After 38 Year Absence

Apr 26, 2025 -

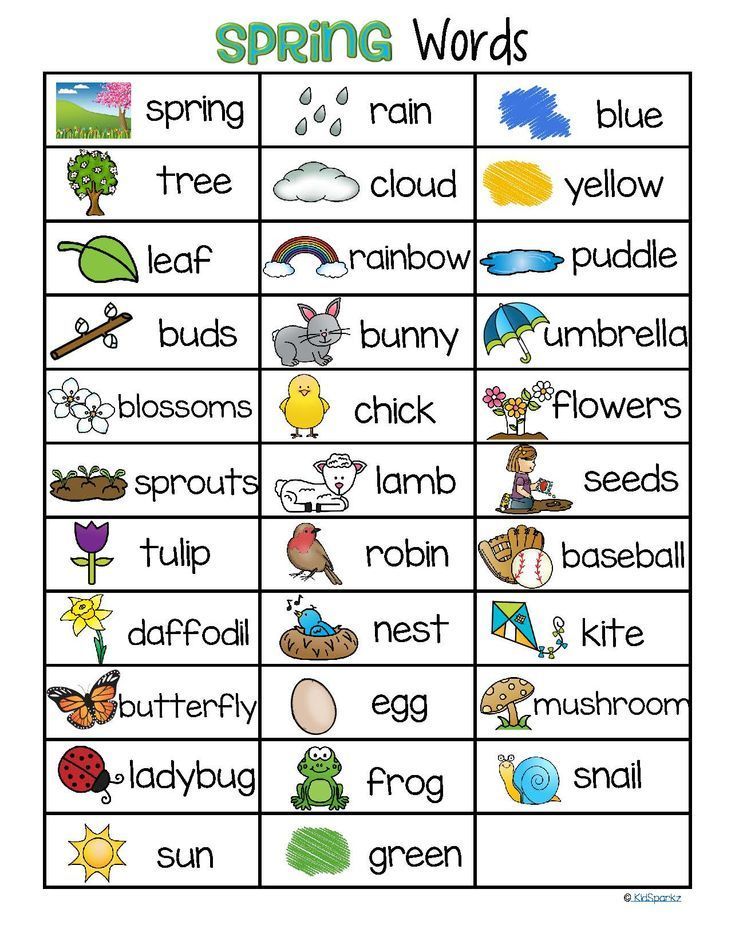

Spring Into Lente A Comprehensive Vocabulary Lesson

Apr 26, 2025

Spring Into Lente A Comprehensive Vocabulary Lesson

Apr 26, 2025 -

Love Islands Biggest Nepo Baby Who Takes The Crown

Apr 26, 2025

Love Islands Biggest Nepo Baby Who Takes The Crown

Apr 26, 2025