The Effectiveness Of Film Tax Credits In Growing Minnesota's Production Sector

Table of Contents

Economic Impact of Film Tax Credits in Minnesota

Film tax credits in Minnesota generate significant direct and indirect economic benefits. They create a ripple effect, impacting various sectors beyond just film production itself. The influx of film productions leads to increased spending in local businesses, boosting revenue for the state and creating numerous jobs.

-

Job Creation: Film productions require a wide range of skilled and unskilled labor, from actors and directors to crew members, caterers, and transportation services. Statistics show a direct correlation between the increased utilization of Film Tax Credits Minnesota and a rise in employment within the state's film industry. For example, [Insert hypothetical statistic: e.g., a recent study indicated a 15% increase in film-related jobs since the implementation of the tax credit program].

-

Increased Local Spending: Film productions don't just employ local workers; they also spend money within the community. Hotels, restaurants, equipment rental companies, and transportation services all benefit from the increased activity. [Insert hypothetical example: e.g., the production of "North Star Nights" generated over $2 million in local spending during its filming in Duluth].

-

Revenue Generation: While the state provides tax credits, the increased economic activity generates substantial tax revenue through sales taxes, income taxes, and other sources. This helps offset the cost of the incentive program, demonstrating a positive return on investment for Minnesota taxpayers. [Insert hypothetical data on tax revenue generated: e.g., a recent analysis showed a 3:1 return on investment for the state's film tax credit program]. Keywords: Minnesota film industry, film production jobs, economic impact Minnesota.

Attracting Film Productions to Minnesota

Minnesota's film tax credit program plays a vital role in attracting film productions, competing effectively with neighboring states like Wisconsin, Illinois, and Iowa. The program's competitiveness is a crucial factor in drawing high-profile productions and nurturing a thriving film ecosystem.

-

Competitive Incentives: A comparison of tax credit rates reveals Minnesota's program's standing relative to its neighbors. [Insert comparative data on tax credit rates in neighboring states. E.g., "Minnesota offers a 25% tax credit, compared to Wisconsin's 20% and Illinois' 30%."]. A detailed analysis considering additional incentives offered by each state should be presented for a truly informative comparison.

-

Successful Productions Attracted: The success of the Film Tax Credits Minnesota program can be measured by highlighting projects that have chosen Minnesota due to these incentives. [Insert examples of successful film productions that have chosen Minnesota because of the tax credit program]. These case studies showcase the program’s impact.

-

Challenges and Opportunities: Despite the incentives, attracting major productions remains a challenge. Factors such as infrastructure limitations (studio space, skilled workforce availability) require attention. Addressing these challenges, potentially through complementary initiatives, can further enhance the effectiveness of the tax credit program. Keywords: film incentives Minnesota, attracting film productions, state film tax credits.

Long-Term Sustainability and Future of Minnesota's Film Industry

The long-term success of Minnesota's film industry hinges on the continued effectiveness and adaptation of its tax credit program. Sustained growth requires ongoing evaluation and adjustments to optimize its impact.

-

Sustainability Analysis: Long-term projections of industry growth based on current trends and tax credit projections can help assess the program’s long-term effects. This may require predictive modeling incorporating potential changes in the program itself or in the national and international film markets.

-

Program Improvements: Recommendations for refining the tax credit program may include adjusting eligibility criteria, streamlining the application process, or expanding support for specific areas like post-production. These improvements would increase the program’s effectiveness and efficiency.

-

Infrastructure Development: Investing in critical infrastructure, such as state-of-the-art studios and training programs to cultivate a skilled workforce, is crucial for attracting larger-scale productions and supporting long-term industry growth. Keywords: sustainable film industry, future of Minnesota film, long-term economic growth.

Addressing Criticisms and Concerns Regarding Film Tax Credits

Criticisms regarding the cost to taxpayers and the potential for abuse of film tax credits are valid concerns. However, a balanced assessment requires considering the overall economic benefits and implementing measures to mitigate potential negative impacts.

-

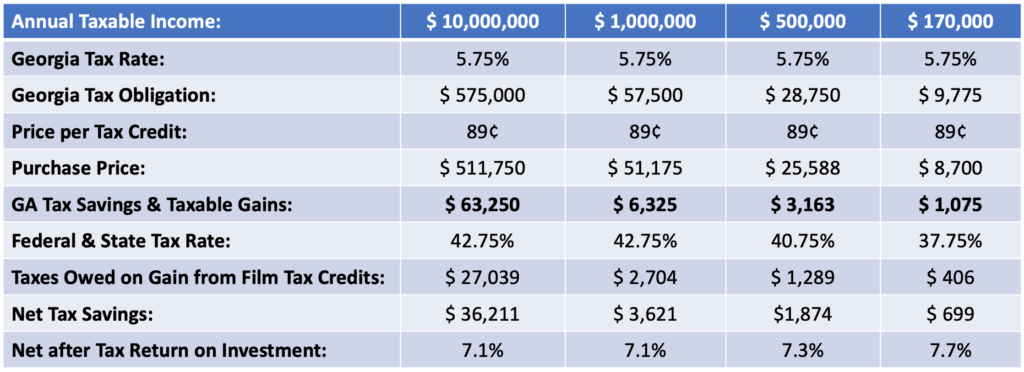

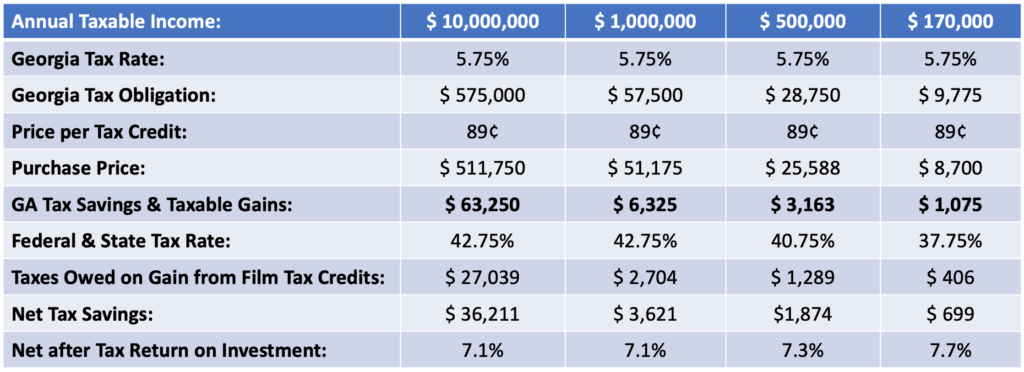

Cost-Effectiveness: While the program incurs costs, the return on investment (ROI) needs to be carefully analyzed. [Insert data demonstrating the return on investment; e.g., studies showing the economic multiplier effect of film productions]. This data is crucial in justifying the program’s continued support.

-

Fraud Prevention: Mechanisms to prevent fraud and abuse, such as rigorous auditing procedures and transparent application processes, are essential to maintain the program's integrity and public trust. Regular reviews of the system are key to improving its security and preventing abuses.

-

Transparency and Accountability: Publicly available data detailing the program's impact, including the number of jobs created, economic activity generated, and tax revenue returned, is essential to enhance transparency and accountability. Keywords: film tax credit effectiveness, taxpayer return on investment, transparency in film incentives.

Conclusion: The Future of Film Tax Credits in Minnesota's Growth

Film Tax Credits Minnesota have demonstrably positive effects on the state's economy and film industry. They stimulate job growth, attract productions, and lay the foundation for a sustainable film ecosystem. To maintain this momentum, continued investment in infrastructure, ongoing program evaluation, and transparent reporting are vital. Learn more about Minnesota's film tax credits and support initiatives designed to grow Minnesota's film industry. By leveraging Film Tax Credits Minnesota effectively, we can ensure a vibrant and prosperous future for the state's film production sector, fostering both economic growth and cultural enrichment.

Featured Posts

-

Nba Fines Anthony Edwards 50 000 For Vulgar Remarks To Fan

Apr 29, 2025

Nba Fines Anthony Edwards 50 000 For Vulgar Remarks To Fan

Apr 29, 2025 -

Georgian Man Arrested For Allegedly Setting Wife On Fire In Germany

Apr 29, 2025

Georgian Man Arrested For Allegedly Setting Wife On Fire In Germany

Apr 29, 2025 -

Germanys Stricter Border Controls Migration Numbers At Post Covid Low

Apr 29, 2025

Germanys Stricter Border Controls Migration Numbers At Post Covid Low

Apr 29, 2025 -

Unveiling The Ccp United Fronts Activities In Minnesota

Apr 29, 2025

Unveiling The Ccp United Fronts Activities In Minnesota

Apr 29, 2025 -

Mlb 160km

Apr 29, 2025

Mlb 160km

Apr 29, 2025