Tesla's Q1 2024 Earnings Report: A 71% Drop In Net Income

Table of Contents

Deep Dive into the 71% Net Income Decline

The 71% plunge in Tesla's net income during Q1 2024 is unprecedented for a company of its size and market influence. Understanding the root causes is crucial for investors and industry analysts alike.

Factors Contributing to the Significant Drop

Several interconnected factors contributed to this substantial decrease in profitability:

-

Increased Competition: The EV market is becoming increasingly crowded, with established automakers like Ford and GM, as well as emerging players like BYD, aggressively entering the space. This heightened competition has forced Tesla to implement significant price cuts to maintain market share, impacting margins.

-

Price Cuts: Tesla's aggressive price cuts, implemented globally throughout Q1 2024, directly impacted profitability. While boosting sales volume, these reductions significantly lowered the profit margin on each vehicle sold. This strategy aimed to stimulate demand and counter slowing sales growth.

-

Rising Production Costs: Inflationary pressures and supply chain disruptions continue to exert upward pressure on production costs for raw materials, components, and logistics. This increase in expenses directly eats into Tesla's profit margins.

-

Supply Chain Disruptions: Ongoing global supply chain challenges, including semiconductor shortages and logistical bottlenecks, continue to impact Tesla's production efficiency and overall costs.

-

Increased R&D Spending: Tesla's substantial investment in research and development, crucial for maintaining its technological edge in the rapidly innovating EV sector, further compressed its short-term profitability. This long-term investment is expected to yield future returns but negatively affected Q1 2024 earnings.

Comparing Q1 2024 performance to Q1 2023 reveals a stark contrast. While specific figures require referencing the official report, the 71% drop undeniably represents a significant setback for the company.

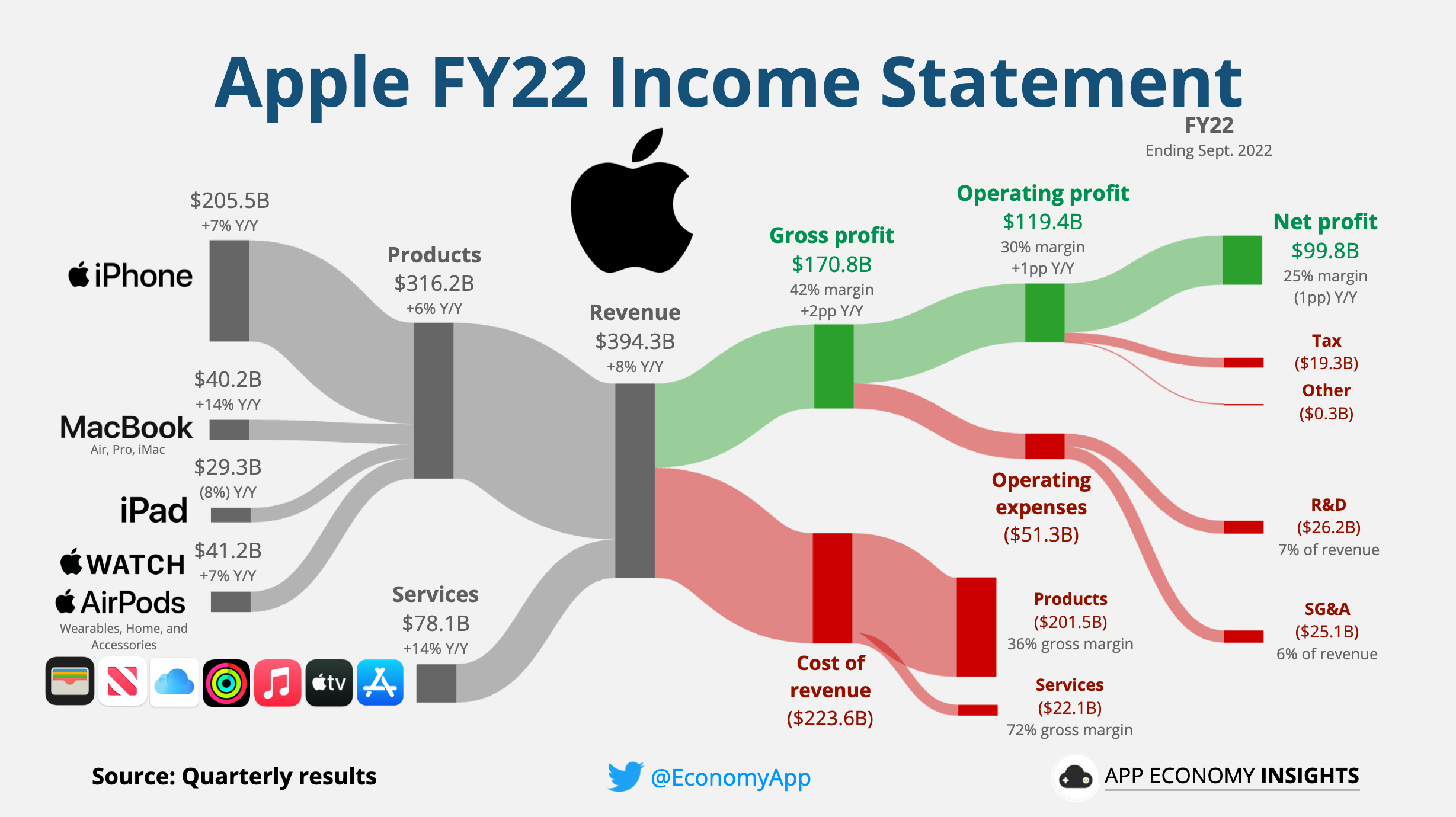

Analysis of Revenue Streams

Analyzing Tesla's different revenue streams provides a more nuanced understanding of the Q1 2024 decline. While precise figures vary depending on the official report, it's likely that:

- Vehicle sales were the primary driver of the revenue decline due to the price cuts and increased competition.

- Energy generation and storage may have shown some growth, but likely not enough to offset the losses in vehicle sales.

- Services revenue, encompassing maintenance and software updates, might have shown modest growth, but this segment is generally smaller compared to vehicle sales.

Visual representations, such as charts and graphs detailing the revenue contributions of each segment, would further clarify the situation.

Impact on Tesla Stock and Investor Sentiment

The Tesla Q1 2024 earnings report had a significant impact on Tesla stock and overall investor sentiment.

Market Reaction to the Earnings Report

The immediate market reaction was largely negative, with Tesla's stock price experiencing a considerable dip following the release. Investor confidence took a hit, reflecting concerns about the company's short-term profitability. Analyst comments were largely cautious, with many expressing concerns about the sustainability of Tesla's current strategies.

Investor Concerns and Future Outlook

Major investor concerns include:

- Profitability: The significant drop in net income raises serious questions about Tesla's long-term profitability and its ability to consistently deliver strong financial results in a competitive market.

- Competition: The intensifying competition in the EV market poses a significant challenge to Tesla's market dominance.

- Market Saturation: Concerns exist about potential market saturation, especially in established markets, which could further pressure pricing and profitability.

Tesla's strategies to address these concerns include continued cost-cutting measures, focusing on operational efficiency, and the launch of new vehicles and technologies to maintain its competitive edge.

Competition in the Electric Vehicle Market

The competitive landscape significantly influenced Tesla's Q1 2024 performance.

Analysis of Key Competitors

Key competitors like BYD, Rivian, Ford, and GM all showed varying degrees of success in Q1 2024. BYD, in particular, has gained significant market share, posing a serious challenge to Tesla's global dominance. A detailed comparison of market share data would illuminate the shift in the competitive landscape.

Tesla's Competitive Advantages and Strategies

Despite the challenges, Tesla still possesses several key competitive advantages:

- Supercharger network: Tesla's extensive Supercharger network remains a significant advantage, offering superior charging convenience compared to many competitors.

- Brand recognition: Tesla enjoys strong brand recognition and a loyal customer base.

- Technological advancements: Tesla continues to innovate in battery technology, autonomous driving, and other key areas, maintaining a technological edge.

Tesla's strategies to maintain its market position include:

- Continued innovation: Investing in cutting-edge technologies to stay ahead of the competition.

- Cost reduction: Implementing measures to improve efficiency and reduce production costs.

- Expansion into new markets: Growing its presence in emerging markets to broaden its customer base.

Conclusion

Tesla's Q1 2024 earnings report revealed a stunning 71% drop in net income, highlighting the challenges the company faces in a rapidly evolving and increasingly competitive EV market. Factors such as increased competition, price cuts, rising production costs, and supply chain disruptions significantly contributed to this decline. While investor sentiment has been impacted, Tesla's strong brand recognition, technological advancements, and strategic initiatives offer potential for a turnaround. However, the company will need to address concerns around profitability and competition to regain momentum. The future success of Tesla hinges on its ability to navigate these challenges effectively and maintain its position as a leader in the electric vehicle market. Stay updated on all things Tesla and future earnings reports by subscribing to our newsletter!

Featured Posts

-

Ev Mandate Opposition Grows Car Dealerships Push Back

Apr 24, 2025

Ev Mandate Opposition Grows Car Dealerships Push Back

Apr 24, 2025 -

Is Betting On The Los Angeles Wildfires A Sign Of The Times Exploring The Dark Side Of Disaster

Apr 24, 2025

Is Betting On The Los Angeles Wildfires A Sign Of The Times Exploring The Dark Side Of Disaster

Apr 24, 2025 -

Teslas Q1 2024 Financial Results Significant Net Income Decrease

Apr 24, 2025

Teslas Q1 2024 Financial Results Significant Net Income Decrease

Apr 24, 2025 -

Assessing The Impact Of Budget Cuts On Tornado Preparedness And Response

Apr 24, 2025

Assessing The Impact Of Budget Cuts On Tornado Preparedness And Response

Apr 24, 2025 -

The Future Of Luxury Cars In China Lessons From Bmw And Porsche

Apr 24, 2025

The Future Of Luxury Cars In China Lessons From Bmw And Porsche

Apr 24, 2025