Tesla Q1 Profit Decline: Impact Of Musk's Trump Ties

Table of Contents

The Direct Impact of Trump's Policies on Tesla's Business

The Trump administration's policies, particularly its trade agenda, had a multifaceted impact on numerous businesses, and Tesla was no exception. Musk's close alignment with Trump during this period warrants careful consideration of its effects on Tesla's bottom line.

Trade Wars and Tariffs

- Increased Raw Material Costs: Trump's tariffs on imported goods, including steel and aluminum, significantly increased Tesla's production costs. These tariffs impacted the price of raw materials crucial for vehicle manufacturing, directly affecting profit margins. Financial reports from this period showed a notable increase in manufacturing expenses.

- Supply Chain Disruptions: The trade wars initiated by the Trump administration created significant disruptions to global supply chains. Tesla, like many multinational corporations, experienced delays and increased costs in sourcing components from China and other affected regions. This affected production timelines and ultimately, profitability.

- Impact on Export Markets: Tariffs imposed by other countries in retaliation to Trump's policies affected Tesla's ability to export vehicles, limiting market reach and revenue streams. This reduced access to crucial international markets hampered overall growth.

Regulatory Hurdles and Government Support

- Changes in Environmental Regulations: The Trump administration's weakening of environmental regulations, particularly regarding emissions standards, might seem beneficial for an electric vehicle company at first glance. However, any resulting decrease in consumer demand for electric vehicles due to weaker regulatory pressures could indirectly hurt Tesla.

- Access to Federal Incentives: Changes in government support for electric vehicles under the Trump administration, or any subsequent shifts influenced by Trump's legacy, could have affected Tesla's access to crucial subsidies or tax breaks aimed at promoting electric vehicle adoption. This potentially impacted Tesla's competitiveness and profitability.

The Indirect Impact of Musk's Political Stance on Tesla's Brand and Investor Confidence

Musk's outspoken political endorsements and association with Trump have created a significant ripple effect beyond direct policy impacts.

Brand Perception and Consumer Sentiment

- Alienation of Key Demographics: Musk's alignment with Trump alienated a considerable segment of environmentally conscious consumers, a critical demographic for an electric vehicle company. This resulted in negative publicity and potential boycotts, directly impacting sales and brand image.

- Negative PR and Social Media Backlash: Musk's political stances frequently ignited controversy on social media, resulting in negative press coverage and a damaged brand reputation. This negatively impacted consumer perception and potentially reduced sales.

Investor Reactions and Stock Volatility

- Stock Price Fluctuations: There's a clear correlation between Musk's controversial political statements and fluctuations in Tesla's stock price. Significant drops frequently coincided with periods of heightened political controversy surrounding Musk.

- Erosion of Investor Confidence: Musk's political activities created uncertainty among investors, leading to a decline in confidence and impacting Tesla's stock valuation. This uncertainty can lead to investors seeking safer alternatives, negatively impacting Tesla's stock performance.

Alternative Explanations for Tesla's Q1 Profit Decline

While Musk's political associations are noteworthy, it's crucial to acknowledge other contributing factors to Tesla's Q1 profit decline.

Global Economic Factors

- Inflation and Recessionary Fears: High inflation and global recessionary anxieties significantly reduced consumer spending on discretionary items, including luxury vehicles like Teslas. This is a key macroeconomic factor unrelated to Musk's politics.

- Supply Chain Disruptions (Beyond Trade Wars): The global supply chain continues to experience disruptions beyond those stemming from trade wars, including the ongoing impact of the COVID-19 pandemic and geopolitical instability. These independent factors also impact Tesla's production and profitability.

Competition and Market Saturation

- Increased Competition: The electric vehicle market has become increasingly competitive, with established automakers and new entrants aggressively vying for market share. This intensified competition directly impacts Tesla's ability to maintain profitability.

- Market Saturation Concerns: The rapid expansion of the EV market leads to concerns about potential market saturation in certain segments, which can negatively affect pricing and profit margins.

Conclusion

Tesla's Q1 2024 profit decline is a complex issue stemming from a confluence of factors. While macroeconomic conditions, increased competition, and ongoing supply chain challenges played a significant role, the impact of Elon Musk's increasingly public and controversial ties to Donald Trump cannot be ignored. Musk's political stance and its resulting controversies may have negatively affected Tesla's brand image, investor confidence, and ultimately, its bottom line. While isolating the exact impact of Musk’s political affiliations requires further investigation, the potential connection between Tesla Q1 earnings and Musk’s political ties warrants serious consideration.

Continue the discussion! Share your thoughts on the impact of Elon Musk's political affiliations on Tesla's performance in the comments below. Let's analyze the complex relationship between Tesla Q1 earnings and Musk's political ties. What are your predictions for Tesla's future performance given this context? #Tesla #ElonMusk #Trump #Q1Earnings #ElectricVehicles

Featured Posts

-

Is Betting On The Los Angeles Wildfires A Sign Of The Times Exploring The Dark Side Of Disaster

Apr 24, 2025

Is Betting On The Los Angeles Wildfires A Sign Of The Times Exploring The Dark Side Of Disaster

Apr 24, 2025 -

Untapped Potential Locating The Countrys Next Business Hotspots

Apr 24, 2025

Untapped Potential Locating The Countrys Next Business Hotspots

Apr 24, 2025 -

60 Minutes Producer Resigns Amidst Trump Lawsuit Fallout

Apr 24, 2025

60 Minutes Producer Resigns Amidst Trump Lawsuit Fallout

Apr 24, 2025 -

Tensions Rise South Carolina Voter Challenges Rep Nancy Mace

Apr 24, 2025

Tensions Rise South Carolina Voter Challenges Rep Nancy Mace

Apr 24, 2025 -

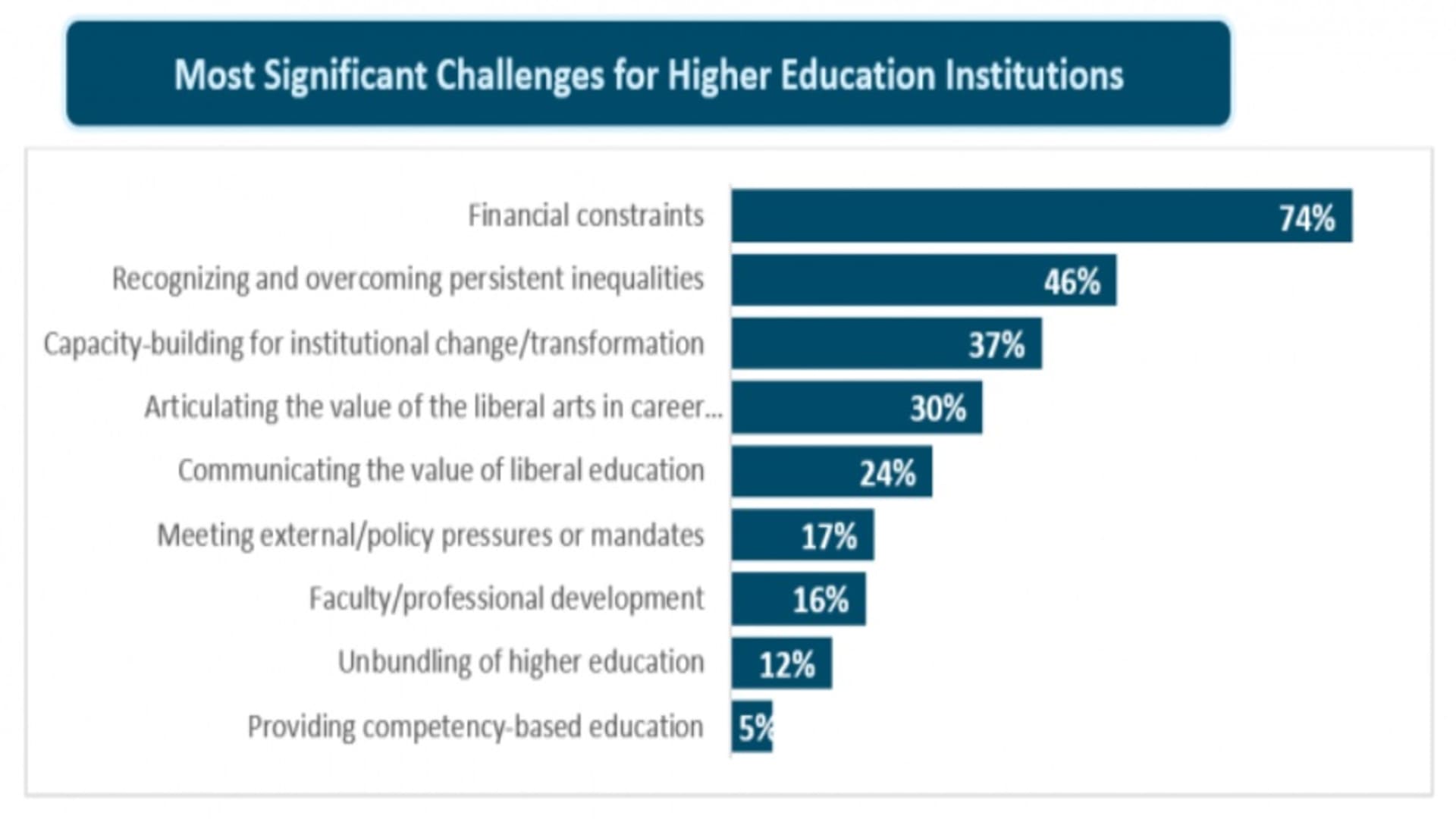

Elite Institutions And The Funding Crisis A Look At Current Challenges

Apr 24, 2025

Elite Institutions And The Funding Crisis A Look At Current Challenges

Apr 24, 2025