Tech Powerhouses Propel US Stock Market Higher: Tesla's Impact

Table of Contents

Tesla's Meteoric Rise and its Market Influence

Tesla's recent performance has been nothing short of phenomenal, significantly contributing to the overall market capitalization of the US stock market. Its influence extends beyond its own market cap; it's become a bellwether for the entire electric vehicle (EV) sector and a symbol of technological innovation. Several factors are driving Tesla's stock price:

- Strong Q[insert latest quarter, e.g., 4 2023] earnings: Tesla consistently reports impressive quarterly earnings, exceeding analyst expectations and demonstrating strong financial health. This positive financial performance directly translates to investor confidence and a higher stock price.

- Successful new product launches (e.g., Cybertruck anticipation): The anticipation surrounding upcoming products like the Cybertruck fuels investor excitement and speculation, further driving up the Tesla stock price. The promise of future innovations keeps investors engaged.

- Expanding global market reach and production capacity: Tesla's aggressive expansion into new markets and its continuous efforts to increase production capacity showcase its growth potential and solidify its position as a market leader. This scalability is a key factor in investor confidence.

- Positive investor sentiment and analyst ratings: Strong positive sentiment from investors and consistently positive analyst ratings contribute to the upward trajectory of the Tesla stock price. This collective optimism fuels a self-reinforcing cycle of investment and growth.

This combination of strong fundamentals and positive market sentiment has propelled Tesla's market cap to impressive heights, significantly influencing the overall performance of the US stock market and the broader tech sector. The Tesla stock price is closely watched as an indicator of the health of the EV market and broader technological innovation.

The Broader Tech Sector's Contribution

Tesla's success isn't solely responsible for the US stock market's growth. Other major tech companies, often referred to as FAANG stocks (Facebook, Apple, Amazon, Netflix, and Google), have also contributed significantly. Their collective performance reflects a broader trend of growth within the tech sector.

- Strong performance of FAANG stocks: The consistent strong performance of FAANG stocks demonstrates the overall health and resilience of the technology sector. These companies' market capitalization significantly impacts the overall market index.

- Growth in cloud computing, AI, and other tech sectors: Growth in emerging technologies like cloud computing and artificial intelligence (AI) fuels investor interest and attracts significant investment, pushing up the value of related companies and contributing to the overall market surge.

- Positive economic indicators boosting investor confidence: Positive economic indicators, such as low unemployment rates and increased consumer spending, bolster investor confidence, leading to increased investment in the stock market, including the tech sector.

- Government support and investment in technology: Government initiatives aimed at supporting technological innovation and development further contribute to the growth of the tech sector and boost investor confidence.

The interconnectedness of these tech giants and their influence on investor confidence creates a synergistic effect, amplifying the positive impact on the US stock market.

Economic Factors Amplifying Tesla's Impact

Macroeconomic factors play a significant role in shaping the overall market trend and amplifying Tesla's impact. Understanding these factors is crucial to fully appreciating the current market dynamics.

- Impact of interest rate hikes on investor behavior: Interest rate hikes can influence investor behavior, potentially impacting the stock market's overall performance. However, the tech sector, with its growth potential, often remains attractive even in a higher-interest-rate environment.

- Effect of inflation on consumer spending and demand for EVs: Inflation can affect consumer spending, potentially impacting the demand for EVs. However, Tesla's focus on innovation and premium pricing often positions it to withstand inflationary pressures better than other sectors.

- Government policies supporting green energy initiatives: Government policies and subsidies supporting green energy initiatives bolster the EV market, directly benefiting Tesla and enhancing its market position.

- Global supply chain issues and their impact: Global supply chain disruptions can negatively impact production and sales, potentially affecting Tesla's performance and the overall market. However, Tesla's efforts to mitigate supply chain risks are contributing to its resilience.

Risks and Potential Downsides

While the current outlook for Tesla and the tech sector is positive, it's essential to acknowledge potential risks and challenges:

- Geopolitical instability and its effect on the market: Global geopolitical instability can create uncertainty in the market, potentially impacting investor sentiment and causing market volatility.

- Competition from other EV manufacturers: Increasing competition from other electric vehicle manufacturers could put pressure on Tesla's market share and profitability.

- Potential regulatory changes affecting the tech industry: New regulations and policies impacting the tech industry could present challenges for Tesla and other tech companies.

- Economic downturn risks: An economic downturn could significantly impact consumer spending and investment in the stock market, potentially affecting Tesla and the broader tech sector.

Conclusion: Tesla's Continued Influence on the US Stock Market

Tesla's significant contribution to the recent US stock market surge is undeniable. Its strong performance, combined with the overall growth of the tech sector and supportive economic factors, has propelled the market to new heights. However, the interconnectedness also means that potential risks and challenges facing Tesla could impact the broader market. Understanding this dynamic relationship is crucial for investors. To stay informed about Tesla's continued influence and its impact on market growth, stay tuned for further analysis on how Tesla and other tech powerhouses will continue to shape the US stock market. Learn more about investing in the tech sector and Tesla's continued impact on market growth.

Featured Posts

-

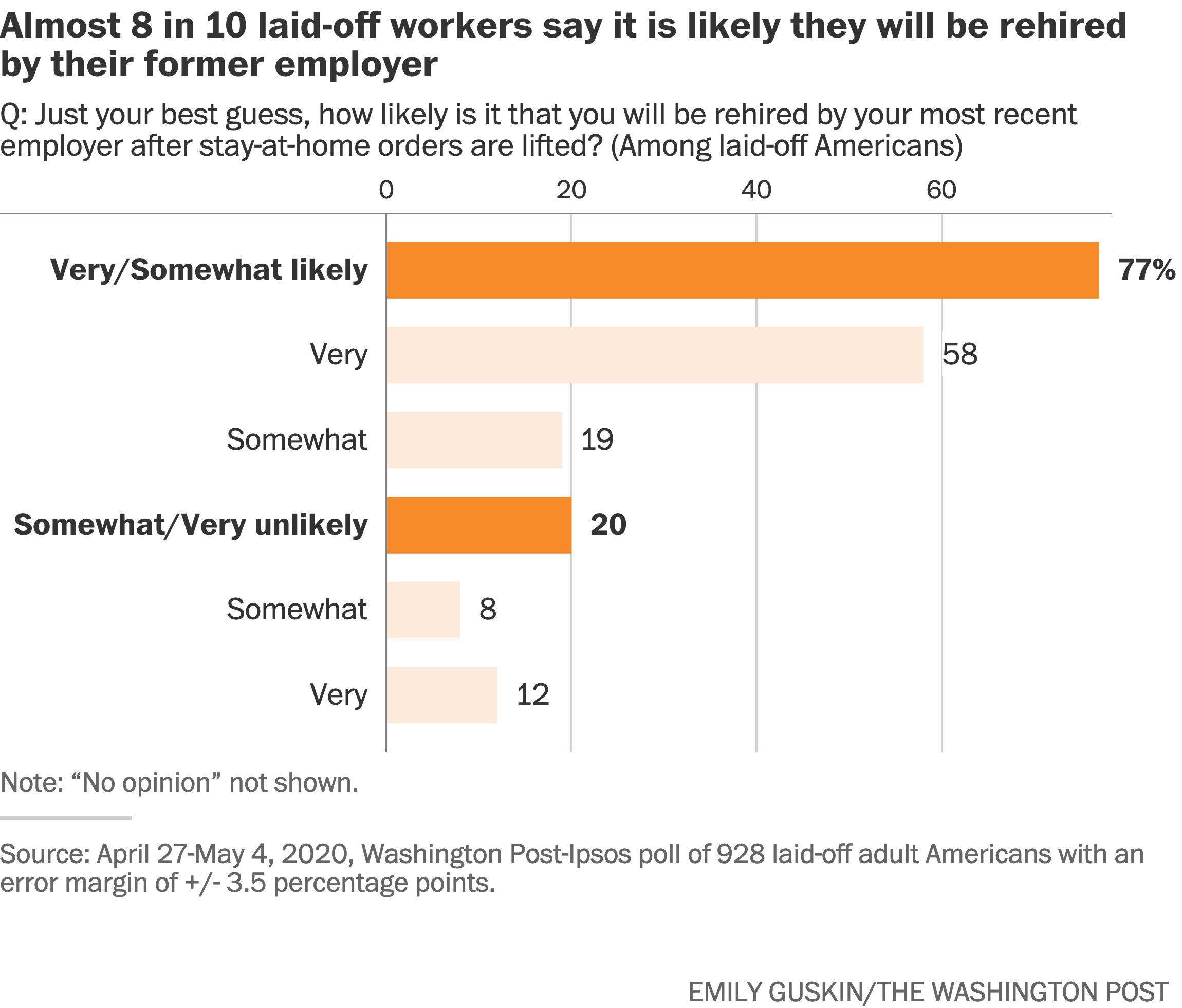

The Difficult Transition Laid Off Federal Workers Seeking State And Local Positions

Apr 28, 2025

The Difficult Transition Laid Off Federal Workers Seeking State And Local Positions

Apr 28, 2025 -

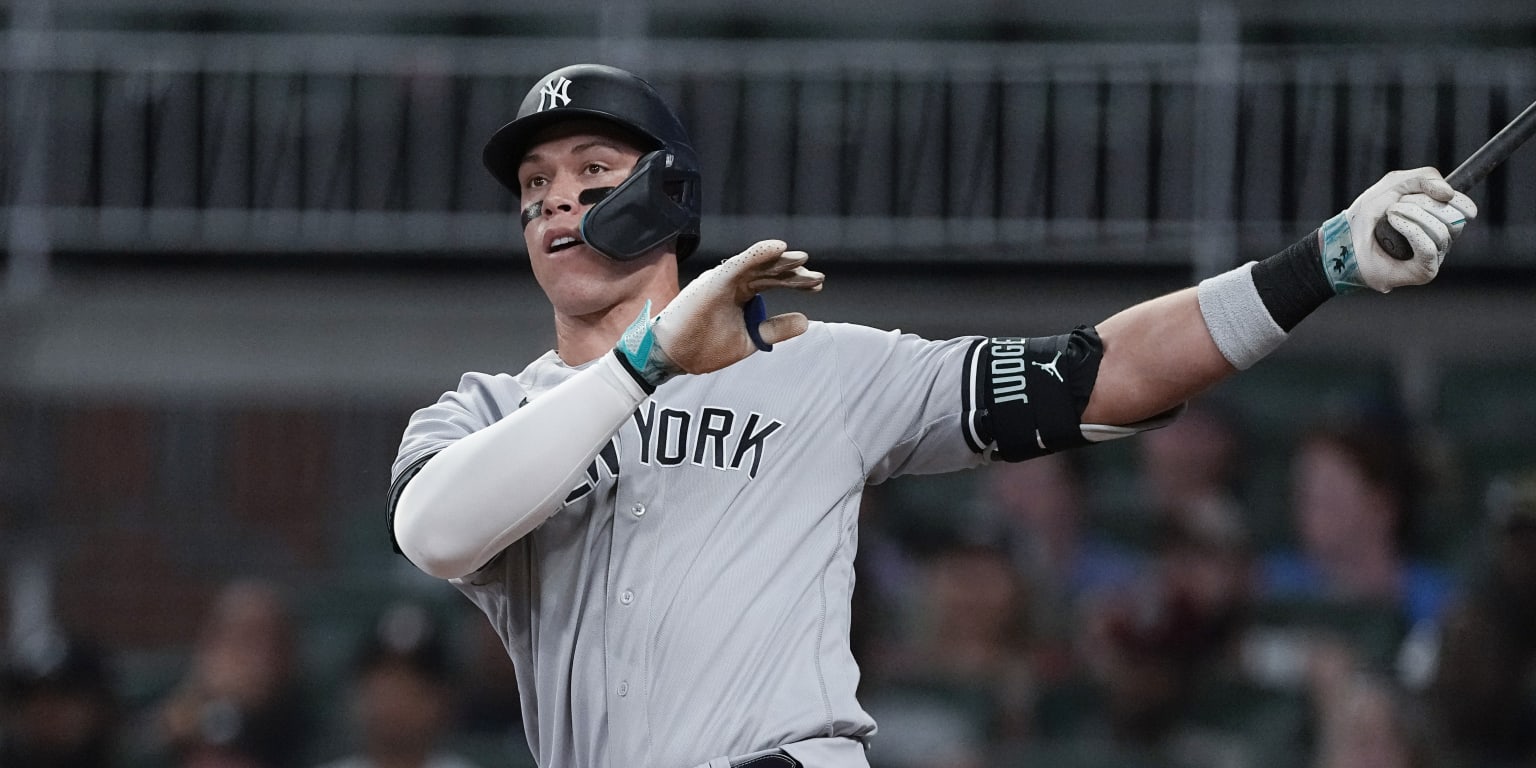

Devin Williams Costly Blown Save Leads To Yankees Loss Against Blue Jays

Apr 28, 2025

Devin Williams Costly Blown Save Leads To Yankees Loss Against Blue Jays

Apr 28, 2025 -

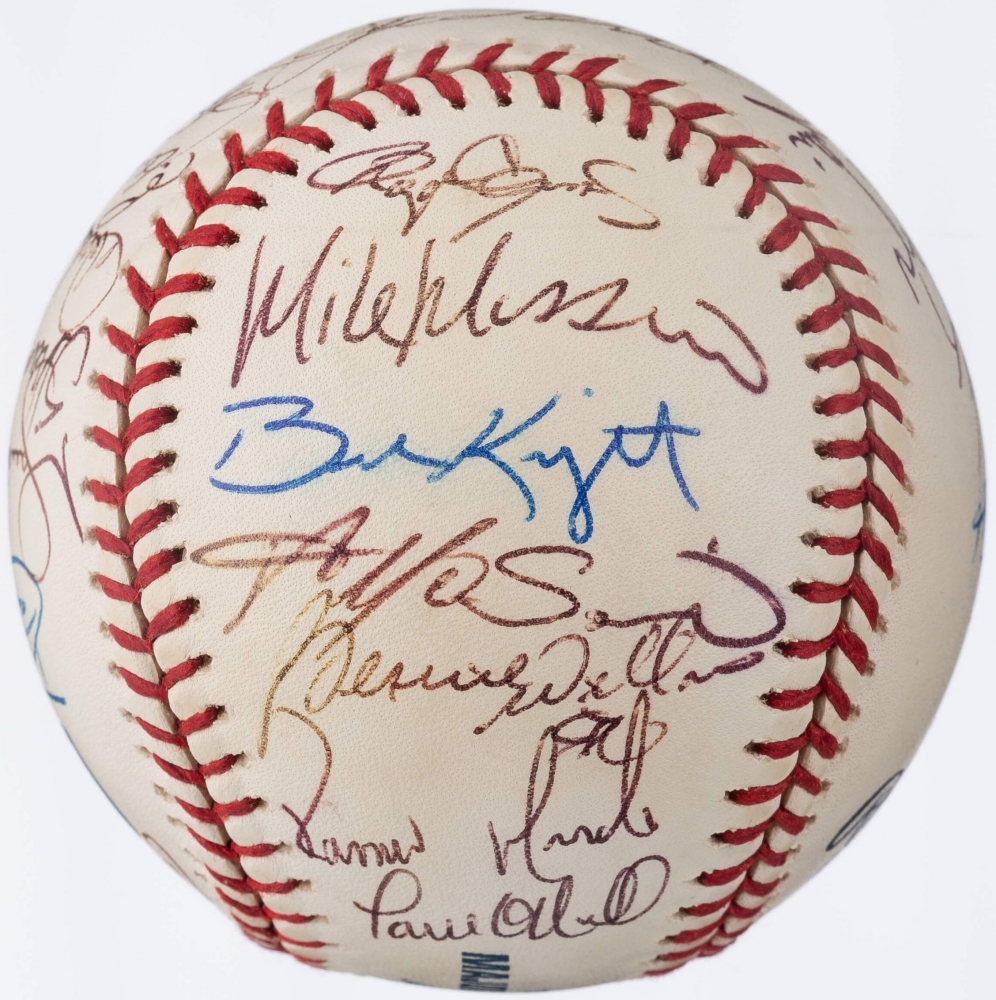

Remembering The 2000 Yankees Focus On Joe Torre And Andy Pettittes Contributions

Apr 28, 2025

Remembering The 2000 Yankees Focus On Joe Torre And Andy Pettittes Contributions

Apr 28, 2025 -

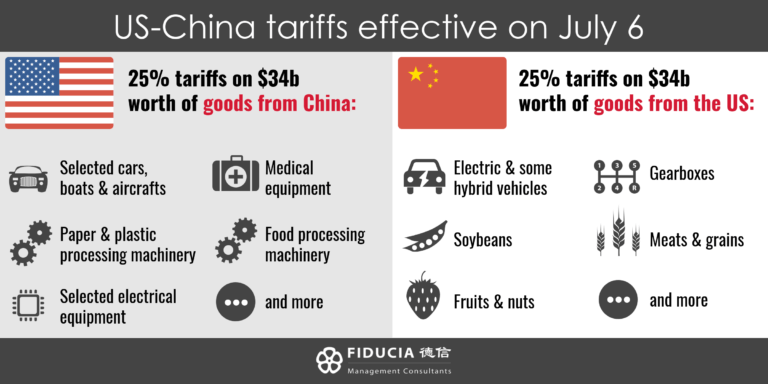

China Adjusts Tariffs Impact On Specific Us Imports

Apr 28, 2025

China Adjusts Tariffs Impact On Specific Us Imports

Apr 28, 2025 -

Gpu Prices Out Of Control Whats Driving The Cost Increase

Apr 28, 2025

Gpu Prices Out Of Control Whats Driving The Cost Increase

Apr 28, 2025

Latest Posts

-

Red Sox Lineup Changes Triston Casas Slide And Outfield Shuffle

Apr 28, 2025

Red Sox Lineup Changes Triston Casas Slide And Outfield Shuffle

Apr 28, 2025 -

Red Sox Lineup Shakeup Casas Demoted Struggling Outfielder Returns

Apr 28, 2025

Red Sox Lineup Shakeup Casas Demoted Struggling Outfielder Returns

Apr 28, 2025 -

Jarren Duran 2 0 This Red Sox Outfielders Potential For A Breakout Year

Apr 28, 2025

Jarren Duran 2 0 This Red Sox Outfielders Potential For A Breakout Year

Apr 28, 2025 -

Orioles Hit Streak Snapped Was It The Broadcasters Jinx

Apr 28, 2025

Orioles Hit Streak Snapped Was It The Broadcasters Jinx

Apr 28, 2025 -

The End Of A Streak Orioles Broadcasters Jinx And 160 Games

Apr 28, 2025

The End Of A Streak Orioles Broadcasters Jinx And 160 Games

Apr 28, 2025