Stock Market Volatility: Investors Buy High, Prepare For Pain?

Table of Contents

Understanding Stock Market Volatility

Stock market volatility refers to the rate and extent of price fluctuations in the market. It essentially measures the degree of uncertainty and risk associated with investing. High volatility means prices are changing rapidly and unpredictably, while low volatility suggests more stable and predictable price movements. One common measure of volatility is standard deviation, which quantifies the dispersion of returns around the average. Beta, another key metric, compares a stock's volatility to the overall market.

- How is volatility measured? Volatility is measured using statistical tools like standard deviation and beta, examining historical price data to gauge the extent of price fluctuations. Various volatility indices, such as the VIX (Volatility Index), also provide real-time measures of market instability.

- Short-term vs. Long-term Volatility: Short-term volatility refers to price swings over shorter periods (days, weeks, or months), while long-term volatility reflects price fluctuations over years. Short-term volatility is often more dramatic and unpredictable.

- Historical Examples: The 2008 financial crisis and the COVID-19 market crash are prime examples of periods of extremely high stock market volatility, showcasing the significant price uncertainty and market instability these events created.

The Dangers of Buying High in a Volatile Market

Investing during periods of high stock market volatility carries substantial risks, particularly the danger of buying high and selling low. This is often exacerbated by emotional investing, a common pitfall for even experienced investors.

Emotional Investing: Fear and Greed

Market fluctuations trigger strong emotional responses. The "fear" of further losses can lead to panic selling at precisely the wrong time, locking in losses. Conversely, "greed," fueled by market rallies, can tempt investors to buy at inflated prices, setting the stage for significant losses when the market inevitably corrects.

- Fear and Greed Cycle: The fear and greed cycle often fuels irrational exuberance, leading to impulsive investment decisions driven by emotion rather than sound analysis.

- Impulsive Decisions: During periods of high price uncertainty, making rash decisions based on short-term market fluctuations can be detrimental to long-term investment goals.

- Potential for Significant Losses: Buying at market peaks and selling during downturns is a recipe for significant losses, especially during periods of high stock market volatility and market instability.

Strategies for Navigating Stock Market Volatility

While eliminating risk entirely is impossible, several strategies can help mitigate the impact of stock market volatility.

Diversification: Spreading Your Risk

Diversification is a cornerstone of sound investment strategy. By spreading your investments across various asset classes, you reduce your reliance on any single asset's performance, thereby lowering overall portfolio risk.

- Benefits of Diversification: A diversified portfolio cushions against losses in any one sector or asset class, enhancing resilience during periods of market instability.

- Asset Classes: Diversification encompasses a range of assets, including stocks, bonds, real estate, commodities, and alternative investments.

- Mutual Funds and ETFs: Mutual funds and exchange-traded funds (ETFs) offer convenient ways to achieve diversification by investing in a basket of different securities.

Dollar-Cost Averaging: A Steady Approach

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market price. This strategy reduces the risk of investing a large sum at a market peak.

- How it Works: Investing a consistent amount each month means you buy more shares when prices are low and fewer when prices are high.

- Advantages During Volatility: Dollar-cost averaging smooths out the impact of price swings, minimizing the risk of buying high.

- Example: Investing $100 per month consistently, regardless of market fluctuations, will result in a lower average cost per share over time compared to investing a lump sum at a single point in time.

Long-Term Investing: Ride Out the Waves

A long-term investment horizon is crucial for weathering short-term market fluctuations. The inherent volatility of the stock market is less impactful over extended periods.

- Minimizing Volatility's Impact: Focusing on long-term growth allows you to ride out short-term market corrections and capitalize on the market's long-term upward trend.

- Long-Term Growth Potential: History shows that despite periods of high stock market volatility and price uncertainty, markets tend to trend upwards over the long term.

- Realistic Goals: Setting realistic, long-term investment goals, aligned with your risk tolerance and financial objectives, is paramount.

Conclusion

Stock market volatility is an inherent characteristic of investing. Understanding its nature and the potential dangers of emotional investing, particularly the risk of buying high during periods of market instability, is crucial. By employing strategies like diversification, dollar-cost averaging, and adopting a long-term investment perspective, you can significantly mitigate risk and enhance your chances of achieving your financial goals. Don't let stock market volatility dictate your investment decisions. Learn more about mitigating risk and achieving your financial goals today! [Link to relevant resource, e.g., investment education website].

Featured Posts

-

Karen Read Murder Case Timeline Of Key Events And Legal Decisions

Apr 22, 2025

Karen Read Murder Case Timeline Of Key Events And Legal Decisions

Apr 22, 2025 -

Controversy Erupts Hegseths Signal Chat And Allegations Of Pentagon Dysfunction

Apr 22, 2025

Controversy Erupts Hegseths Signal Chat And Allegations Of Pentagon Dysfunction

Apr 22, 2025 -

Pan Nordic Military Cooperation Analyzing Swedens Armored Strength And Finlands Manpower

Apr 22, 2025

Pan Nordic Military Cooperation Analyzing Swedens Armored Strength And Finlands Manpower

Apr 22, 2025 -

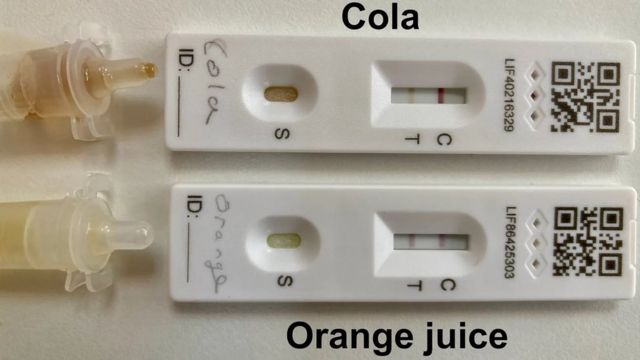

Pandemic Fraud Lab Owner Convicted For False Covid Test Reports

Apr 22, 2025

Pandemic Fraud Lab Owner Convicted For False Covid Test Reports

Apr 22, 2025 -

The Future Of Us Finance Navigating The Fallout From Trumps Trade Offensive

Apr 22, 2025

The Future Of Us Finance Navigating The Fallout From Trumps Trade Offensive

Apr 22, 2025