Stock Market Valuation Concerns: BofA Offers Investors A Different View

Table of Contents

BofA's Bullish Stance on Stock Market Valuation

BofA's optimistic outlook on stock market valuation isn't based on blind faith; it's rooted in a detailed analysis of several key factors.

Focus on Earnings Growth

BofA highlights the crucial importance of focusing on future earnings growth rather than solely relying on current price-to-earnings (P/E) ratios. A short-term focus on P/E ratios alone can be misleading.

- Strong corporate earnings projections suggest sustained market strength. Many sectors are demonstrating robust revenue growth, indicating a positive outlook for future earnings.

- BofA analysts point to specific sectors showing robust earnings potential. For example, technology companies benefitting from AI advancements and healthcare companies leading innovation in pharmaceuticals are expected to show significant earnings growth. Detailed sector-specific analysis is key to understanding the current market valuations.

- Analysis of historical market data comparing P/E ratios to subsequent growth demonstrates that a high P/E ratio doesn't always precede a market crash. Context is crucial; historical data reveals instances where high P/E ratios were followed by sustained growth periods.

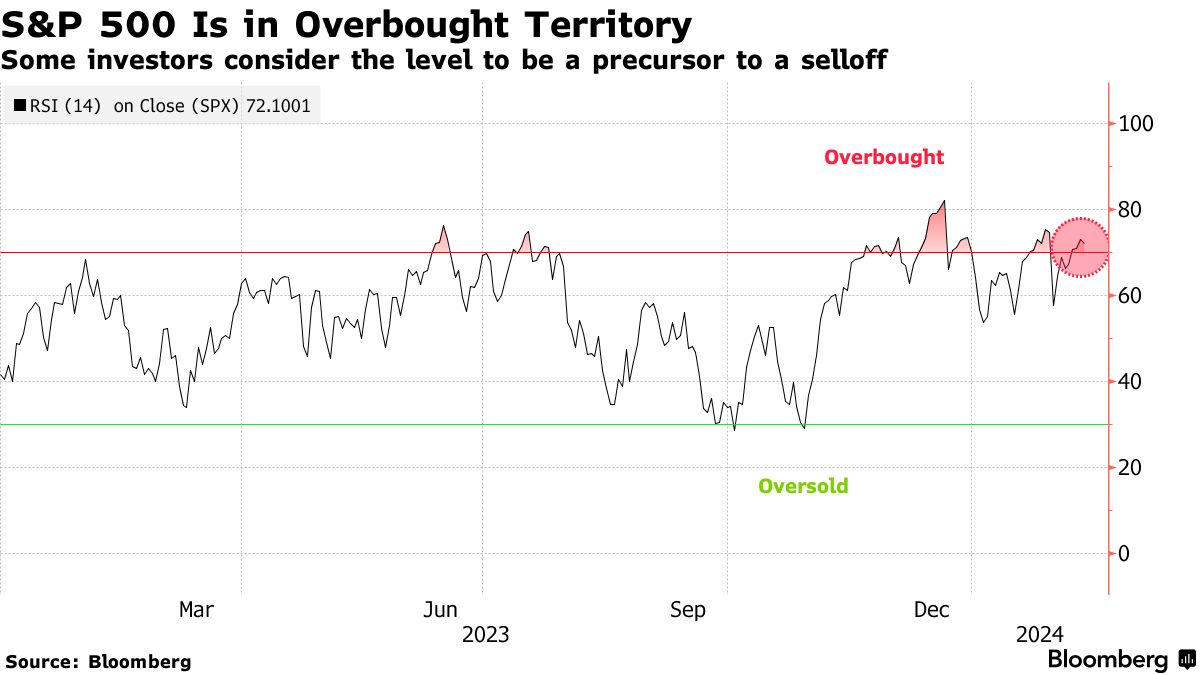

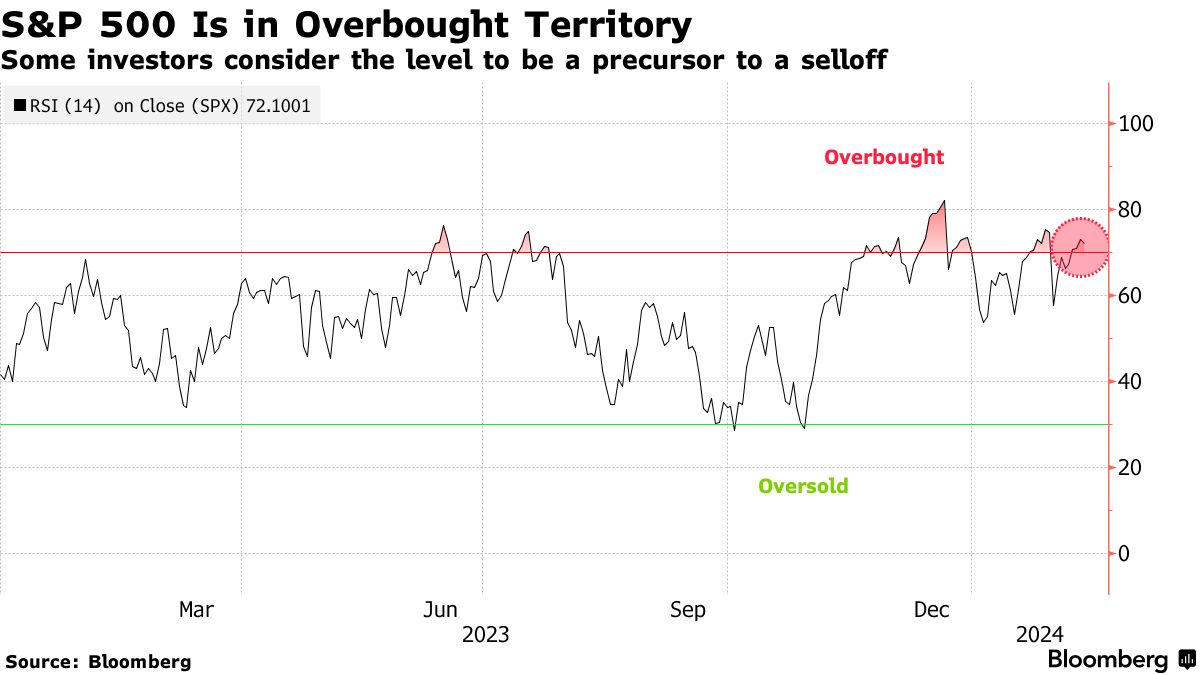

The Role of Interest Rates

BofA acknowledges the impact of rising interest rates, a significant concern impacting stock market valuation. However, they argue that their influence on valuations is overstated by some.

- Comparison of current interest rates to historical averages and their impact on market performance shows that while higher rates can impact valuations, they aren't always a harbinger of doom. Past data shows periods of higher interest rates alongside healthy market growth.

- Discussion of BofA's projections for future interest rate movements indicates a more moderate increase than some analysts predict. Their nuanced view suggests a less dramatic impact on market valuations than the prevailing bearish narrative suggests.

- Analysis of how specific sectors are affected differently by interest rate changes highlights opportunities. While some sectors may struggle, others, such as financial institutions, can even thrive in higher-rate environments.

Considering Alternative Valuation Metrics

BofA suggests a more holistic approach, moving beyond traditional P/E ratios. Relying solely on one metric provides an incomplete picture.

- Discussion of other relevant metrics like price-to-sales ratio, PEG ratio, and dividend yield offers a more comprehensive perspective on stock market valuation. Each metric provides unique insights into a company's financial health and growth potential.

- How these metrics paint a more nuanced picture of market valuation becomes evident when analyzing individual stocks and sectors. Combining different metrics allows for a more balanced and accurate assessment of value.

- Examples of companies where alternative metrics suggest undervaluation highlight opportunities for astute investors. While a high P/E ratio might be alarming, other metrics could indicate significant underlying value.

Counterarguments to the Bearish View on Stock Market Valuation

BofA directly addresses common bearish arguments, providing counterpoints to the prevailing negative sentiment concerning stock market valuation.

Addressing Inflation Concerns

Persistent inflation is a significant concern affecting stock market valuation. However, BofA provides a balanced perspective.

- Analysis of inflation's historical impact on stock market performance demonstrates that while inflation can be a challenge, it doesn't always lead to market crashes. Historically, markets have adapted and even thrived in inflationary periods.

- BofA's projections for future inflation and its potential impact suggest a more moderate and manageable scenario than some pessimistic forecasts. Their projections inform a more measured outlook.

- Discussion of how corporate strategies are adapting to the inflation environment highlights resilience and innovation. Companies are implementing strategies to mitigate inflationary pressures, such as increasing prices and improving efficiency.

Geopolitical Risks and Market Volatility

Geopolitical risks and market volatility are valid concerns impacting stock market valuation. BofA acknowledges these but tempers the alarmist tone.

- Analysis of how past geopolitical events have affected stock valuations shows that while disruptive, these events haven't always resulted in prolonged market declines. Markets often recover and even grow in the aftermath of geopolitical events.

- BofA's assessment of current geopolitical risks and their likelihood provides a realistic perspective, avoiding hyperbole. They assess the probability and potential impact of various geopolitical scenarios.

- Strategies for mitigating portfolio risk in a volatile market, such as diversification and hedging, are crucial for investors to consider. These strategies help manage risk and protect portfolios from significant losses.

Conclusion

While concerns about stock market valuation persist, BofA's analysis offers a compelling counter-narrative. By focusing on future earnings growth, considering alternative valuation metrics, and acknowledging but tempering concerns about inflation and geopolitical risks, BofA presents a more optimistic outlook. Understanding different perspectives on stock market valuation is crucial for informed investment decisions. Carefully consider BofA's arguments and conduct your own thorough research before making any investment decisions related to stock market valuation and broader market analysis.

Featured Posts

-

Den Helder Doop Van Damens Nieuwe Combat Support Schip Voor De Nederlandse Marine

Apr 26, 2025

Den Helder Doop Van Damens Nieuwe Combat Support Schip Voor De Nederlandse Marine

Apr 26, 2025 -

Green Transition In Africa Reshaping The Workforce In A Changing Climate

Apr 26, 2025

Green Transition In Africa Reshaping The Workforce In A Changing Climate

Apr 26, 2025 -

The China Market Analyzing The Difficulties Faced By Bmw Porsche And Other Auto Brands

Apr 26, 2025

The China Market Analyzing The Difficulties Faced By Bmw Porsche And Other Auto Brands

Apr 26, 2025 -

Climate Change And Africas Workforce Adapting To The Green Transition

Apr 26, 2025

Climate Change And Africas Workforce Adapting To The Green Transition

Apr 26, 2025 -

Oscars Afterparty Claims Of Drug Use Involving Chelsea Handler

Apr 26, 2025

Oscars Afterparty Claims Of Drug Use Involving Chelsea Handler

Apr 26, 2025