Revolut's Financial Success: 72% Revenue Growth And Future Global Strategy

Table of Contents

Revolut's 72% Revenue Growth: A Deep Dive

Revolut's remarkable 72% revenue growth isn't just a headline figure; it's a testament to a multifaceted strategy. Understanding the key drivers behind this success is crucial to comprehending Revolut's overall financial performance and profitability.

Key Drivers of Revenue Growth

Several factors contribute to Revolut's impressive revenue growth:

- Premium Subscriptions: Revolut's tiered subscription model, offering premium features like international travel insurance and higher withdrawal limits, generates significant recurring revenue. The percentage of revenue derived from premium subscriptions is steadily increasing, indicating strong customer adoption of these value-added services.

- International Money Transfers: Revolut's low-fee international money transfer service is a major revenue driver, capitalizing on the growing demand for efficient and cost-effective cross-border payments. This segment benefits from economies of scale and increasing transaction volumes.

- Crypto Trading: The integration of cryptocurrency trading features has attracted a significant user base and contributed substantially to Revolut's revenue streams. The volatility of the crypto market, while presenting some risks, also offers significant opportunities for profit.

- Business Accounts: Revolut's expansion into the business banking sector has opened a new avenue for revenue growth, attracting small and medium-sized enterprises (SMEs) with its streamlined and user-friendly platform. This segment represents a significant area for future expansion and profitability.

Market Analysis and Competitive Advantage

Revolut's success can be further understood by analyzing its position within the competitive landscape. Unlike traditional banks burdened by legacy systems and high overhead costs, Revolut leverages technology to offer superior user experience, lower fees, and global reach. This disruptive innovation allows Revolut to capture market share from both traditional banks and other fintech competitors. Key competitive advantages include:

- Ease of Use: Revolut's intuitive app and straightforward interface appeal to tech-savvy users who appreciate a seamless digital banking experience.

- Low Fees: Revolut's transparent and competitive pricing structure, significantly lower than many traditional banks, is a major draw for cost-conscious customers.

- Global Reach: Revolut's availability in numerous countries and its support for multiple currencies cater to the needs of international travelers and businesses.

Revolut's Global Expansion Strategy: Reaching New Markets

Revolut's ambitious global expansion strategy is a cornerstone of its financial success. The company has strategically targeted key markets worldwide, demonstrating a clear understanding of market dynamics and customer preferences.

Geographic Expansion and Market Penetration

Revolut's expansion has been methodical, focusing on regions with high growth potential and a receptive audience for digital financial services. The company faces various challenges in different markets, including navigating regulatory hurdles and adapting its services to local customs and preferences. However, its localization strategy – tailoring its offerings to specific regional needs – has facilitated successful market penetration.

Targeting Specific Customer Segments

Revolut effectively targets specific customer segments, focusing particularly on millennials and Gen Z, who are digitally native and receptive to innovative financial solutions. Its marketing strategy emphasizes convenience, transparency, and value, resonating strongly with these demographics. Furthermore, Revolut's focus on business accounts signals its intention to capture a growing market segment with specialized financial needs.

Future Outlook and Strategic Initiatives for Revolut

Revolut's future success hinges on its ability to continue innovating and adapting to the ever-evolving fintech landscape.

Planned Product Launches and Innovations

Revolut continues to invest heavily in research and development, with plans for new product launches and service enhancements. These innovations will likely focus on expanding its existing offerings and exploring new revenue streams such as advanced investment tools and enhanced business solutions.

Challenges and Risks Facing Revolut

Despite its considerable success, Revolut faces several challenges:

- Regulatory Compliance: Navigating the complex regulatory landscape in different countries is a constant challenge, requiring significant investment in compliance and legal expertise.

- Competition: The fintech sector is fiercely competitive, with established players and new entrants vying for market share. Maintaining a competitive edge requires continuous innovation and adaptation.

- Cybersecurity: Protecting customer data and maintaining robust security measures are paramount in the financial services industry. Any security breaches could severely damage Revolut's reputation and financial performance.

Conclusion: Revolut's Continued Financial Success: A Promising Future

Revolut's impressive 72% revenue growth is a testament to its innovative business model, aggressive global expansion, and effective targeting of specific customer segments. Its focus on technology, ease of use, and low fees has disrupted the traditional banking sector, capturing significant market share and establishing itself as a leading fintech player. While challenges remain, Revolut's strategic initiatives and planned innovations suggest a promising future. Stay informed about Revolut's continued financial success by following their updates and exploring their innovative financial products. Analyzing Revolut's success provides valuable insights into the future of the fintech industry.

Featured Posts

-

Cellnexs Uk Growth Strategy Ceo Confirms Year End Network Completion

Apr 25, 2025

Cellnexs Uk Growth Strategy Ceo Confirms Year End Network Completion

Apr 25, 2025 -

Linda Evangelistas Mastectomy Her First Reveal And Emotional Response

Apr 25, 2025

Linda Evangelistas Mastectomy Her First Reveal And Emotional Response

Apr 25, 2025 -

Kot Kellog V Kieve Vizit 20 Fevralya I Ego Znachenie

Apr 25, 2025

Kot Kellog V Kieve Vizit 20 Fevralya I Ego Znachenie

Apr 25, 2025 -

The Ubiquity Of You Tube Its Role In Modern Communication

Apr 25, 2025

The Ubiquity Of You Tube Its Role In Modern Communication

Apr 25, 2025 -

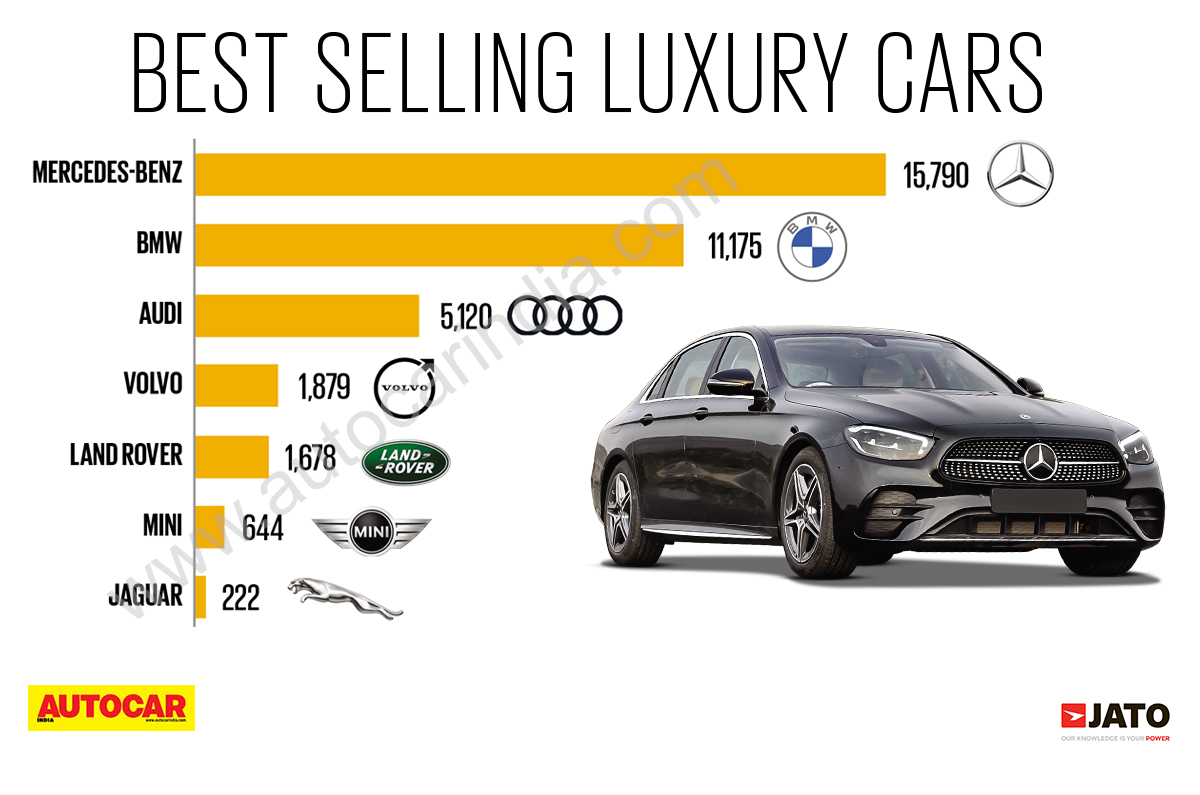

Luxury Car Sales In China A Difficult Landscape For Established Brands

Apr 25, 2025

Luxury Car Sales In China A Difficult Landscape For Established Brands

Apr 25, 2025