Retail Sales Slump: Economists Forecast Bank Of Canada Rate Cuts

Table of Contents

Declining Retail Sales Figures and Their Impact

Recent data reveals a concerning drop in Canadian retail sales. While precise figures fluctuate depending on the source and reporting period, a consistent downward trend is undeniable, impacting consumer confidence and various retail sectors. For example, preliminary estimates suggest a decline of X% in [Month, Year], following a Y% decrease in [Previous Month/Period]. This significant contraction signals a weakening Canadian economy and raises serious concerns about future economic growth.

- Impact on consumer confidence: The retail sales slump directly reflects waning consumer confidence. Falling sales translate to reduced business optimism, potentially leading to job losses and further dampening consumer spending. This creates a negative feedback loop, exacerbating the economic downturn.

- Effect on various retail sectors: The decline is not uniform across all retail sectors. While some sectors like grocery stores might experience relatively less impact, others, such as clothing, electronics, and automobiles, are experiencing substantial drops in sales, indicating a shift in consumer priorities towards essential goods.

- Geographical variations in sales decline: The severity of the retail sales slump varies across different regions of Canada. Provinces heavily reliant on specific industries or facing unique economic challenges might experience more pronounced declines compared to others. Analyzing these regional differences provides valuable insights into the overall economic health of the country.

- Comparison to previous economic downturns: Comparing the current retail sales slump to previous economic downturns reveals similarities and differences in its severity and underlying causes. Understanding historical trends helps economists forecast potential recovery timelines and formulate appropriate policy responses. This comparison also highlights the unique challenges posed by the current global economic landscape.

Factors Contributing to the Retail Sales Slump

Several macroeconomic factors are driving the decline in Canadian retail sales. The confluence of these factors creates a perfect storm impacting consumer spending and overall economic activity.

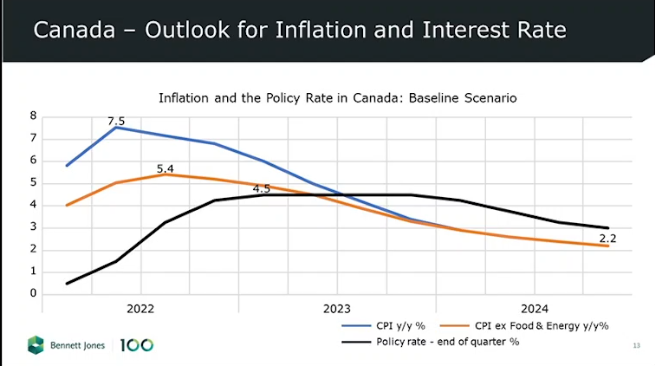

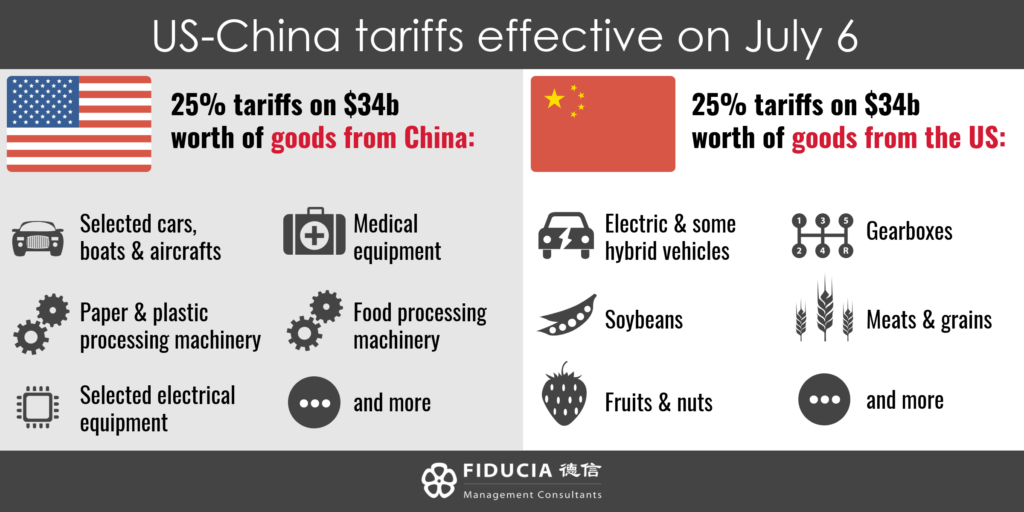

- High inflation and its impact on purchasing power: Persistent high inflation has significantly eroded the purchasing power of Canadian consumers. Rising prices for essential goods and services leave less disposable income for discretionary spending, directly impacting retail sales across various sectors. The current inflation rate, hovering around Z%, significantly surpasses the Bank of Canada's target range.

- Rising interest rates and their effect on borrowing and spending: The Bank of Canada's recent interest rate hikes, aimed at curbing inflation, have increased borrowing costs for consumers and businesses. Higher mortgage rates, for example, reduce the available funds for consumer spending, further contributing to the retail sales slump. This increased cost of borrowing affects both consumer purchases and business investments.

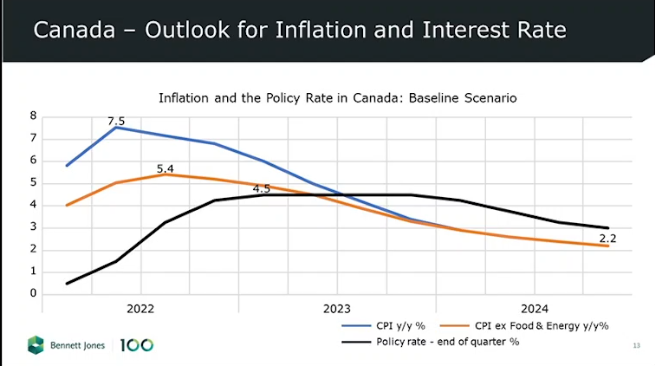

- Global economic uncertainty and its ripple effects: Global economic uncertainty, including geopolitical tensions and supply chain disruptions, significantly impacts the Canadian economy. This uncertainty affects consumer and business confidence, leading to reduced spending and investment. The interconnected nature of the global economy makes Canada vulnerable to external shocks.

- Supply chain disruptions and their ongoing consequences: Lingering supply chain disruptions continue to constrain the availability of goods and drive up prices. These disruptions affect both domestic production and imports, limiting consumer choice and increasing costs. This exacerbates inflationary pressures and further restricts consumer spending.

Economists' Predictions and the Bank of Canada's Response

Economists widely predict that the Bank of Canada will respond to the retail sales slump by implementing interest rate cuts. While there's some disagreement on the timing and magnitude of these cuts, the consensus points towards a shift in monetary policy.

- Likely timing of rate cuts: Many economists expect rate cuts to begin in [Timeframe, e.g., the next few months], depending on the release of upcoming economic indicators and inflation data.

- Magnitude of anticipated rate reductions: The extent of rate reductions remains uncertain, with predictions ranging from a modest decrease to a more significant reduction, depending on the evolving economic situation and the Bank of Canada's assessment of risks.

- Potential impact of rate cuts on inflation and economic growth: Rate cuts aim to stimulate economic growth by making borrowing cheaper and encouraging spending. However, there’s a risk that these cuts could also fuel inflation further if implemented prematurely or aggressively. The Bank of Canada faces a difficult balancing act.

- Alternative monetary policy options being considered: Besides interest rate cuts, the Bank of Canada might consider alternative monetary policy options, such as quantitative easing, to address the retail sales slump and stimulate economic recovery. These options will be evaluated based on their effectiveness and potential side effects.

Potential Implications of Rate Cuts

Interest rate cuts by the Bank of Canada, while intended to revitalize the economy, have both positive and negative implications:

- Stimulating consumer spending and business investment: Lower borrowing costs make it more attractive for consumers to take out loans and make purchases, boosting retail sales and overall economic activity. Similarly, businesses might be encouraged to invest in expansion and job creation.

- Risks of fueling inflation further: Reducing interest rates could exacerbate inflationary pressures if the economy is already experiencing significant demand-pull inflation. This makes carefully calibrated actions crucial.

- Impact on the Canadian dollar exchange rate: Rate cuts might weaken the Canadian dollar, making imports more expensive and potentially contributing to further inflation. This effect needs to be carefully monitored.

- Long-term effects on economic growth: The long-term effects of rate cuts on economic growth depend on their timing, magnitude, and the overall state of the economy. Well-timed and appropriately sized cuts can stimulate growth, whereas poorly managed cuts could lead to instability.

Conclusion

The significant retail sales slump in Canada is a serious concern, driven by a combination of high inflation, rising interest rates, global economic uncertainty, and persistent supply chain disruptions. Economists anticipate that the Bank of Canada will respond with interest rate cuts to stimulate the economy. However, these cuts carry both potential benefits and risks, requiring careful management to avoid further fueling inflation while promoting sustainable economic growth. The implications of this retail sales slump and the subsequent monetary policy adjustments will significantly impact the Canadian economy in the coming months and years.

Call to Action: Stay informed about the evolving economic situation and the Bank of Canada's response to the retail sales slump. Follow our blog for updates on the retail sales slump and its impact on the Canadian economy. Learn more about how the retail sales slump affects your investments by subscribing to our newsletter.

Featured Posts

-

New Lapd Video Details Events Before Shooting Of Weezer Bassists Wife

Apr 28, 2025

New Lapd Video Details Events Before Shooting Of Weezer Bassists Wife

Apr 28, 2025 -

Dows 9 B Alberta Project Delayed Collateral Damage From Tariffs

Apr 28, 2025

Dows 9 B Alberta Project Delayed Collateral Damage From Tariffs

Apr 28, 2025 -

Red Sox Lineup Shakeup Casas Demoted Struggling Outfielder Returns

Apr 28, 2025

Red Sox Lineup Shakeup Casas Demoted Struggling Outfielder Returns

Apr 28, 2025 -

Chinas Tariff Exemptions Some Us Products Get A Break

Apr 28, 2025

Chinas Tariff Exemptions Some Us Products Get A Break

Apr 28, 2025 -

Gpu Prices Out Of Control Whats Driving The Cost Increase

Apr 28, 2025

Gpu Prices Out Of Control Whats Driving The Cost Increase

Apr 28, 2025

Latest Posts

-

Boston Red Sox And Toronto Blue Jays Complete Lineups Buehler And Outfielder News

Apr 28, 2025

Boston Red Sox And Toronto Blue Jays Complete Lineups Buehler And Outfielder News

Apr 28, 2025 -

Todays Game Red Sox Vs Blue Jays Lineups Walker Buehler And Outfielder Update

Apr 28, 2025

Todays Game Red Sox Vs Blue Jays Lineups Walker Buehler And Outfielder Update

Apr 28, 2025 -

Red Sox Vs Blue Jays Buehlers First Start Updated Lineups And Outfielders Comeback

Apr 28, 2025

Red Sox Vs Blue Jays Buehlers First Start Updated Lineups And Outfielders Comeback

Apr 28, 2025 -

Walker Buehlers Start Highlights Red Sox Vs Blue Jays Game Full Lineups

Apr 28, 2025

Walker Buehlers Start Highlights Red Sox Vs Blue Jays Game Full Lineups

Apr 28, 2025 -

Red Sox Blue Jays Matchup Lineups Revealed Buehler Pitches Outfielder Returns

Apr 28, 2025

Red Sox Blue Jays Matchup Lineups Revealed Buehler Pitches Outfielder Returns

Apr 28, 2025